In the fast-paced world of cryptocurrency, where market fluctuations can wipe out gains in minutes, ai crypto trading bots have emerged as essential tools for traders seeking an edge. This review dives into the landscape of automated systems that leverage artificial intelligence to execute trades, analyze data, and optimize strategies.

At their core, these bots are software programs powered by machine learning algorithms that learn from historical data to refine trading approaches. Benefits include enhanced efficiency, as they operate 24/7 without fatigue, and improved risk management through predefined parameters. For instance, they can implement dollar-cost averaging to mitigate volatility or scalping for quick profits in short-term price movements.

What Are AI Crypto Trading Bots and Why Use Them?

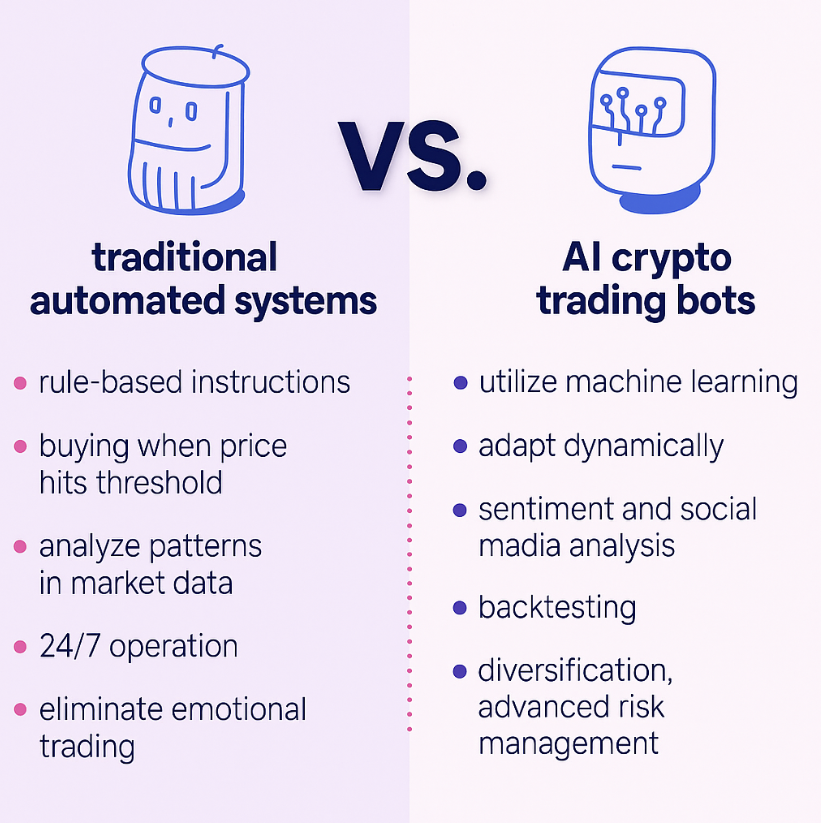

AI crypto trading bots represent a leap forward from traditional automated systems. While conventional bots follow rigid, rule-based instructions—such as buying when a price hits a certain threshold—AI versions incorporate machine learning to adapt dynamically. They analyze patterns in market data, sentiment from news sources, and even social media trends to make informed predictions, evolving their strategies over time for better win rates.

The appeal lies in their benefits. First, they enable 24/7 operation, capturing opportunities in a global market that never sleeps. Second, they eliminate emotional trading, sticking to logic amid volatility. Third, backtesting allows users to simulate strategies on historical data, refining approaches before real capital is at risk. Fourth, diversification across assets and exchanges becomes seamless, spreading exposure to minimize losses. Finally, advanced risk management features, like automatic stop-loss orders, protect investments.

How AI Crypto Trading Bots Work

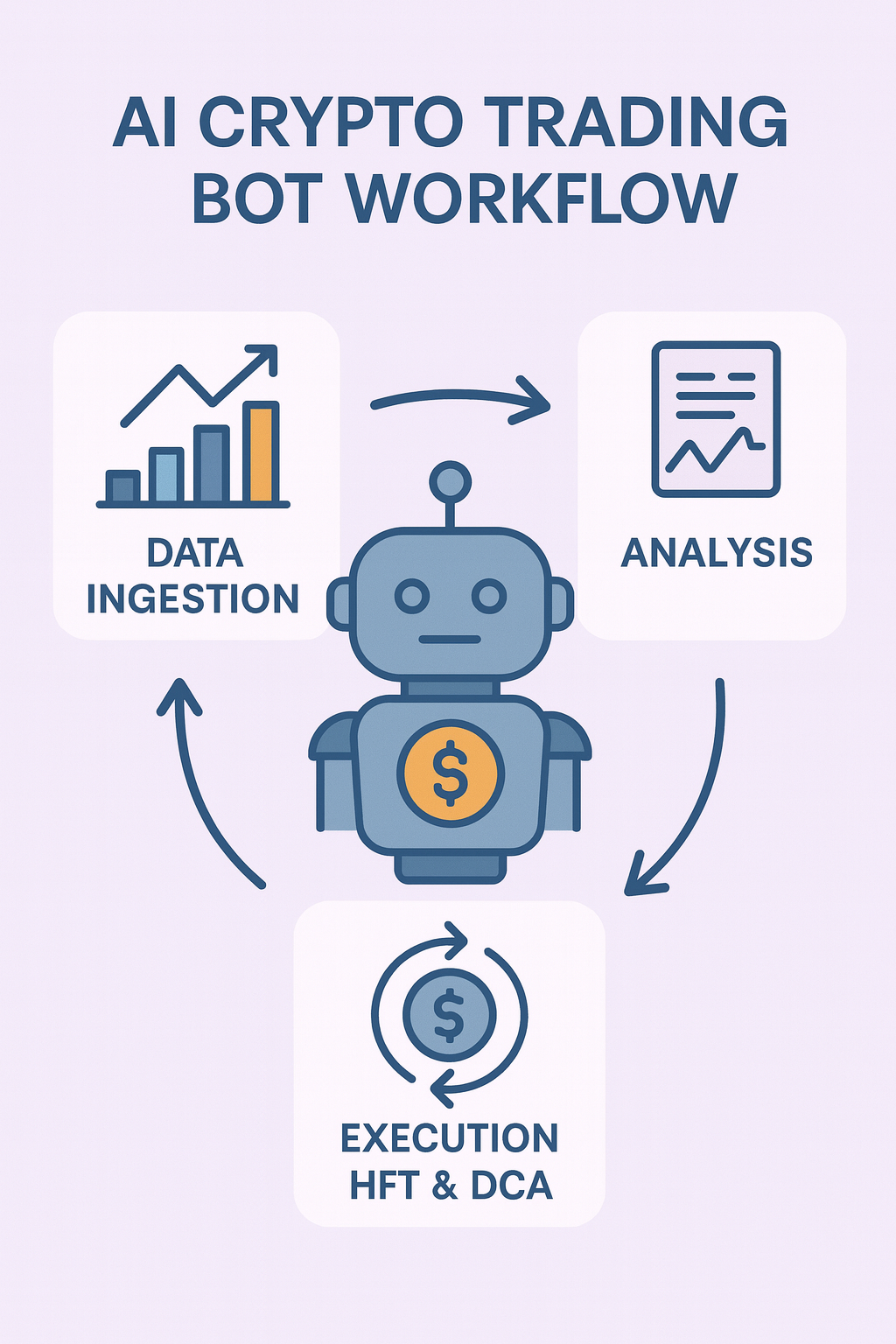

AI crypto trading bots function through a continuous loop of data ingestion, analysis, and execution. They start by pulling real-time information from exchanges via APIs, including price feeds, volume metrics, and order book details. Machine learning models then process this input, identifying patterns or anomalies—such as a sudden spike in trading volume signaling potential momentum.

For example, natural language processing might scan news articles for sentiment on Bitcoin, while technical indicators like moving averages guide entry points. Once a signal aligns with the user’s strategy, the bot executes trades automatically, buying or selling assets on platforms like Binance or Kraken.

Common strategies include DCA, where the bot invests fixed amounts periodically to average costs, or scalping, capitalizing on tiny price gaps in high-frequency trades. In 2025, advancements like predictive algorithms using neural networks enhance accuracy, allowing bots to forecast short-term movements with improved precision. This cycle repeats, with the bot learning from outcomes to refine future actions, making it a powerful ally in volatile markets.

Key Features to Look for in AI Crypto Trading Bot Platforms

When evaluating ai crypto trading bot platforms, prioritize features that align with your trading style.

- Backtesting tools are crucial, allowing simulation of strategies on past data to gauge effectiveness.

- Security measures, such as encrypted API keys and IP whitelisting, protect against hacks—essential given past incidents like the 2023 3Commas breach.

- Integrations with exchanges like Binance or OKX enable seamless operation, while no-code builders let beginners create bots via drag-and-drop interfaces without programming knowledge.

- Telegram notifications provide real-time alerts on trades, and mobile apps ensure accessibility on the go.

- TradingView compatibility adds value, incorporating advanced charting for signal generation.

- Look for free trials to test platforms, and consider pricing structures—many offer tiered plans starting free, scaling to premium for unlimited bots. Ultimately, choose based on user reviews and demo performance to match your needs.

Top AI Crypto Trading Bots: Reviews and Comparison

Selecting the top ai crypto trading bots involved assessing 2025 performance metrics, user feedback, and feature sets. Criteria included adaptability, security, ease of use, and integration depth. Here, we review 10 standout options, followed by a comparison table.

3Commas

This platform excels in versatility, offering DCA, grid, and signal bots with machine learning for adaptive strategies. Pricing in 2025: Pro at $49/month, Expert $79/month.

- Pros: Multi-exchange support (20+), SmartTrade terminal;

- Сons: Requires tuning for optimal results. Best for seasoned traders seeking customization.

Pionex

As an exchange-integrated bot, it provides 16 free pre-built options like grid and arbitrage, with AI for historical optimization. Pricing: 0.05% trading fee, no subscription.

- Pros: Beginner-friendly, low cost

- Сons: Limited to Pionex exchange. Best for starters testing automation.

Bitsgap

Features AI Assistant for personalized bots, supporting COMBO and GRID strategies across 15+ exchanges. Pricing: Basic $22/month, Pro $111/month.

- Pros: All-in-one portfolio management;

- Сons: Higher fees for advanced tiers. Best for diversified trading.

Cryptohopper

Offers AI trend detection and social trading, with backtesting and arbitrage tools. Pricing: Pioneer free, Hero $107.50/month.

- Pros: Marketplace for strategies;

- Сons: Overwhelming for novices. Best for creative users.

HaasOnline

Advanced scripting with HaasScript for custom AI algorithms, supporting market-making and scalping. Pricing: Lite+ $7.50/month, Pro $82.50/month.

- Pros: High customization;

- Сons: Steep learning curve. Best for developers.

TradeSanta

Cloud-based with templates for DCA and grid, focusing on simplicity. Pricing: Basic $18/month, Maximum $45/month.

- Pros: Quick setup;

- Сons: Limited advanced features. Best for casual traders.

Shrimpy

Specializes in portfolio rebalancing with AI for allocation optimization. Pricing: Standard $15/month, Plus $39/month.

- Pros: Long-term focus;

- Сons: Fewer short-term strategies. Best for investors.

Mudrex

Provides curated strategies with AI backtesting, emphasizing security. Pricing: Free plan, paid up to $39.99/month.

- Pros: User-friendly;

- Сons: Limited exchanges. Best for balanced approaches.

Coinrule

Drag-and-drop rules with 250+ templates, AI for market adaptation. Pricing: Starter free, Pro $449.99/month.

- Pros: No coding needed;

- Сons: Rule-based limits. Best for quick setups.

Kryll

Visual builder for custom strategies, with Smartfolio for AI portfolio management. Pricing: Tiered based on usage.

- Pros: Backtesting;

- Сons: Strategy deployment fees. Best for intermediates.

Additional mentions: Zignaly for copy trading, Trality for code-based bots, Gunbot for NLP integration, NapBots and Stoic for autonomous operation, WunderTrading for spread trading, Cornix and RevenueBot for Telegram-focused automation.

| Bot | Features | Pricing (2025) | Pros | Cons | Best For | Rating |

| 3Commas | DCA, grid, signals | $49–$79/month | Versatile, multi-exchange | Needs adjustment | Seasoned | 4.8/5 |

| Pionex | 16 free bots, arbitrage | 0.05% fee | Free, integrated | Limited exchange | Beginners | 4.7/5 |

| Bitsgap | AI Assistant, COMBO | $22–$111/month | All-in-one | Costly pro | Diversified | 4.6/5 |

| Cryptohopper | Trend detection, marketplace | Free–$107.50/month | Creative tools | Complex | Tinkerers | 4.5/5 |

| HaasOnline | Scripting, scalping | $7.50–$82.50/month | Customizable | Steep curve | Developers | 4.4/5 |

| TradeSanta | Templates, cloud | $18–$45/month | Simple | Basic | Casual | 4.3/5 |

| Shrimpy | Rebalancing | $15–$39/month | Long-term | Fewer strategies | Investors | 4.2/5 |

| Mudrex | Curated strategies | Free–$39.99/month | Secure | Limited | Balanced | 4.1/5 |

| Coinrule | Rules, templates | Free–$449.99/month | Easy | Rule-limited | Quick | 4.0/5 |

| Kryll | Builder, Smartfolio | Usage-based | Backtesting | Fees | Intermediates | 3.9/5 |

| Zignaly | Copy trading, profit sharing (no monthly fee), Binance custody | Profit share only; start from ~$10 capital | Hands-off, same fills as pro trader | Depends on trader performance | Copy trading | 4.4/5 |

| Trality | Code-based bots (Python editor) + Rule Builder | Free tier; paid from ~€9.99/mo | Powerful for coders | Geared to Python users | Developers | 4.3/5 |

| Gunbot | Local install, lifetime license, AutoConfig; AI/ChatGPT-assisted strategy gen (NLP-style prompts) | Lifetime from ~$59–$149 (tiers) | Runs on your VPS/PC; very flexible | Setup/maintenance burden | Power users | 4.2/5 |

| NapBots (HAL) | Autonomous strategies by CoinShares (NapBots → HAL) | From ~€19.90/mo (HAL) | Set-and-forget | Less customization | Autopilot | 3.9/5 |

| Stoic | AI-managed portfolios (Starter/Plus/Pro) | ~$9–$199/mo (annual billing options) | Very low effort | Strategy transparency limits | Passive investors | 4.1/5 |

| WunderTrading | Spread/arbitrage, copy-trading, TradingView/webhooks | Free; Basic $19.95; Pro $39.95 (annual −30%) | Native spread tools | Learning curve | Spread/arbitrage fans | 4.2/5 |

| Cornix | Telegram-focused automation, signal marketplace | Free plan; Premium ≈ $25/mo | Deep Telegram workflow | Ties you to TG UX | Signal-channel users | 4.0/5 |

| RevenueBot | Telegram-centric bots, profit-share fee model | 20% of profit, capped at $50/mo per trade type | No upfront subscription | Ongoing profit fee | Budget/experimental | 3.8/5 |

AI Crypto Trading Bots on Major Exchanges

AI bots thrive through integrations with major exchanges, offering built-in or third-party options. Built-in tools provide convenience but limited flexibility, while third-party bots allow customization across platforms.

Binance

Features AI-powered signals in its futures bots, with third-party support like 3Commas for grid strategies. Pricing: Exchange fees apply; bots vary.

- Pros: High liquidity;

- Сons: Regulatory restrictions in some regions.

Bybit

Offers Aurora AI bot for parameter optimization, integrating with WunderTrading for advanced automation. Pricing: Free basic, premium tiers.

- Pros: User-friendly;

- Сons: Asset-limited.

OKX

Spot grid bots with automation, compatible with Pionex for DCA. Pricing: Low fees.

- Pros: Versatile;

- Сons: Complex for new users.

KuCoin

Built-in bots for spot and futures, works with Hinvest AI for smart trading. Pricing: Tiered.

- Pros: Wide pairs;

- Сons: Variable performance.

Coinbase

Advanced Trade API for bots like Stoic, focusing on compliance. Pricing: Subscription-based.

- Pros: Secure;

- Сons: Higher fees.

Bitfinex

Supports algorithmic trading, integrates with HaasOnline. Pricing: Usage fees.

- Pros: Lending features;

- Сons: Less intuitive.

Bitget

AI strategies in bots, compatible with OctoBot for DCA. Pricing: Competitive.

- Pros: Bonuses;

- Сons: Newer platform.

Kraken

Low-risk index bots, pairs with Cryptohopper. Pricing: Free trials.

- Pros: Reliable;

- Сons: Fewer assets.

Best AI Crypto Trading Bot for Beginners and Free Options

For newcomers, Pionex stands out with its 16 free bots and intuitive interface, ideal for learning DCA without costs. TradeSanta offers templates and a free plan for basic automation, easing entry into grid strategies. CryptoHero provides paper trading on its free tier, allowing risk-free practice.

Free trials are common: 3Commas and Cryptohopper let users test premium features. Bitsgap’s demo mode simulates trades. These options build confidence, with LSI elements like win rates improving through backtesting.

- Start with pre-built strategies.

- Use mobile apps for monitoring.

- Begin small to understand mechanics.

Popular AI Crypto Trading Bot Strategies

AI bots excel in various strategies, tailored to market conditions.

- DCA involves regular investments to average prices, reducing volatility impact—ideal for long-term holds like Bitcoin.

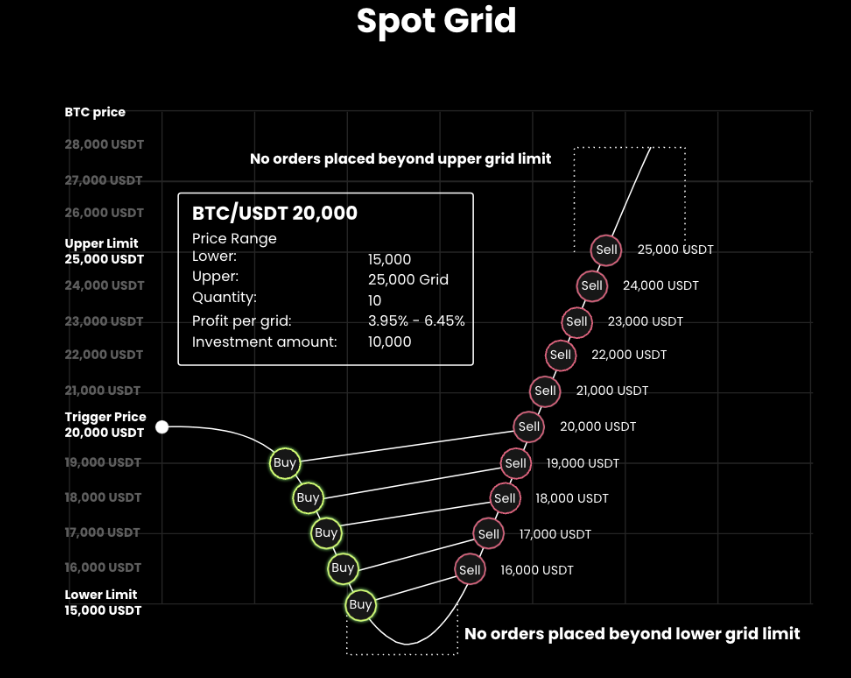

- Grid trading sets buy/sell orders in a range, profiting from oscillations; bots automate this for efficiency.

- Scalping targets small, frequent gains from minor price changes, using high-frequency execution.

Futures trading amplifies positions with leverage, but requires strong risk controls. Spot trading focuses on immediate asset exchanges.

Tips: Backtest strategies on historical data, diversify across assets, and incorporate stop-losses. In 2025, AI enhancements like sentiment analysis refine these, boosting potential returns.

AI Crypto Trading Bot Tutorial: How to Set Up

Setting up an AI bot involves straightforward steps.

- Choose a platform like Pionex or 3Commas and sign up for an account.

- Connect your exchange via API keys—generate them on Binance or Kraken, ensuring read/trade permissions only.

- Select a strategy, such as DCA, and configure parameters like investment amount and intervals.

- Backtest on historical data to verify performance.

- Fund your bot and activate it for live trading.

- Monitor via dashboard and adjust as needed.

For example, on Cryptohopper, use the strategy designer to build rules, then deploy. Always start with small amounts.

Security and Risks in AI Crypto Trading Bots

While powerful, AI bots carry risks like hacking, as seen in past exploits. In 2025, regulations emphasize API security and data privacy. Measures include using 2FA, encrypted connections, and limiting permissions to trade-only.

Risks: Overfitting strategies to historical data fails in live markets; scams promise unrealistic returns.

Bullet tips: Regularly update software, monitor for unusual activity, diversify bots, and avoid sharing keys.

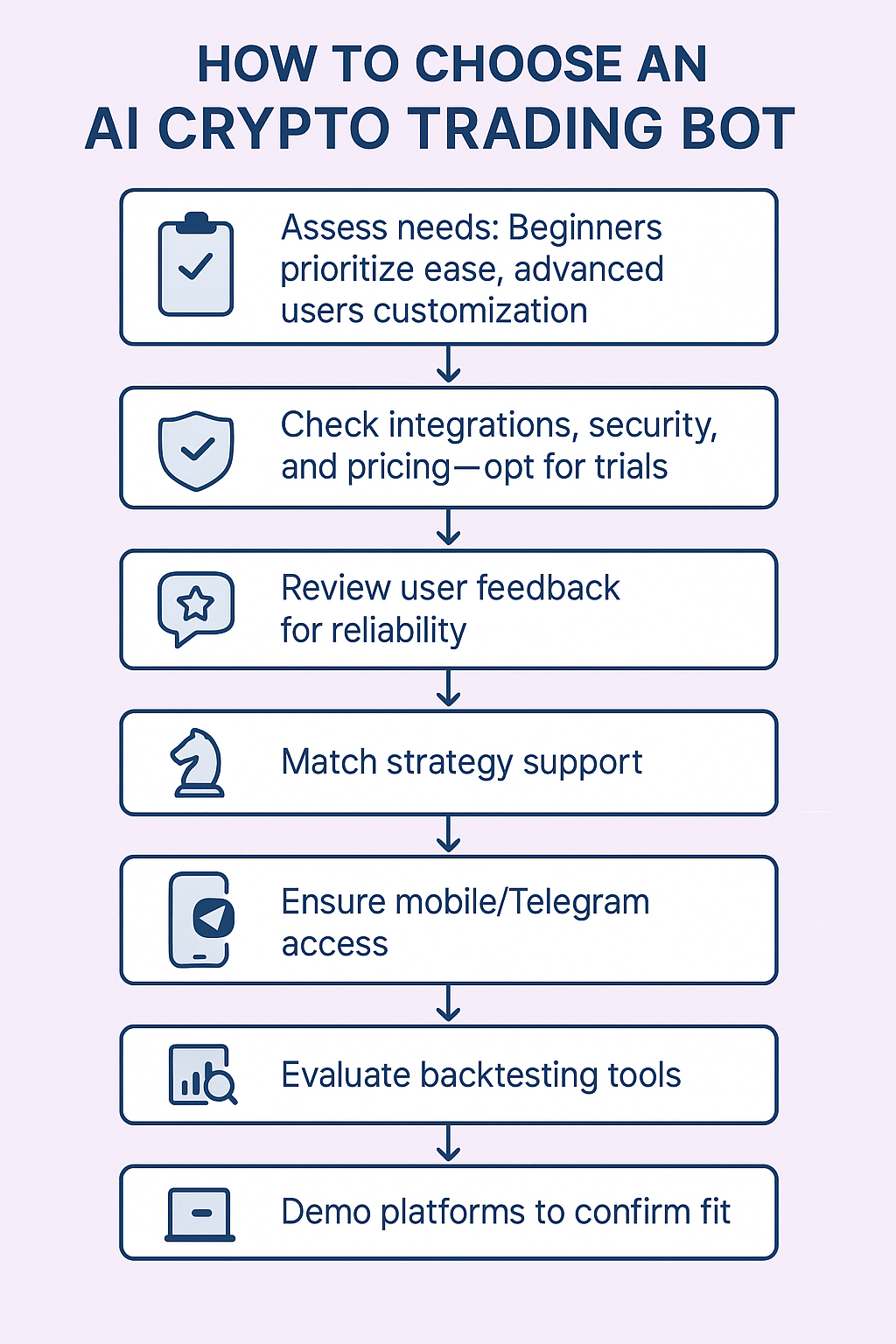

How to Choose an AI Crypto Trading Bot

Assess needs: Beginners prioritize ease, advanced users customization. Check integrations, security, and pricing—opt for trials. Review user feedback for reliability.

- Match strategy support.

- Ensure mobile/telegram access.

- Evaluate backtesting tools.

Demo platforms to confirm fit.

Conclusion

In summary, the best ai crypto trading bot depends on your goals—Pionex for free entry, 3Commas for versatility. Top ai crypto trading bots like these automate effectively, but remember risks and monitor actively. Explore options to boost your trading today.