The value of Toncoin decreased amid pressure from investors and regulators, dropping below the $2.17 mark. The sharp decline coincided with a statement from Nasdaq addressed to TON Strategy, the company holding the largest treasury reserve of Toncoin.

According to the exchange, the company issued additional shares without shareholder approval to finance the purchase of tokens worth about $272.7 million, which violates listing requirements.

Nasdaq pointed out errors in the transaction

Information about the violation appeared after the publication of an SEC report on October 28, which noted that TON Strategy did not formally seek shareholder approval before issuing new shares. The funds raised from the deal were attracted in the format of Private Investment in Public Equity (PIPE) — a private placement of shares among institutional investors.

Out of the total capital raised, almost $273 million was directed to purchase Toncoin, allowing TON Strategy to increase its ownership stake and secure its status as one of the largest institutional holders of the asset.

Nasdaq regarded the company’s actions as non-compliance with corporate standards but did not initiate a delisting procedure. In its clarification, the exchange emphasized that it does not see signs of intentional rule evasion, but noted that the incident raises questions about the quality of corporate governance at TON Strategy.

Experts note that such remarks from Nasdaq put strong pressure on public crypto funds seeking institutional recognition. At the moment, TON Strategy controls about 217.5 million Toncoin tokens, remaining the largest public holder of the coin.

Increasing market pressure

The market instantly reacted to the news. The Toncoin rate fell by 5% in a day, dropping to $2.165, with a minimum value of $2.162. Trading volumes rose to 5.76 million tokens, which is almost one and a half times higher than average levels. This indicates increased seller activity and heightened short-term pressure.

Analysts link the decline not only to the corporate conflict but also to the general cooling of the market. The CoinDesk 20 Index (CD20), which tracks the dynamics of the largest crypto assets, fell by 3.7% over the past 24 hours, reflecting a decline in interest in risky assets and increased investor caution.

What does the incident mean for Toncoin

TON Strategy was seen as a key driver of institutional interest in Toncoin, and the Nasdaq warning calls into question the pace of legalization of its treasury model. Procedural violations may complicate the company’s relationship with regulators and slow the inflow of new investments.

Despite the fact that Nasdaq limited itself to a warning, the situation caused reputational risks for TON Strategy and pressure on the TON token itself. According to analysts, the current correction may turn into a prolonged phase if the price does not hold above the $2.17–$2.20 zone.

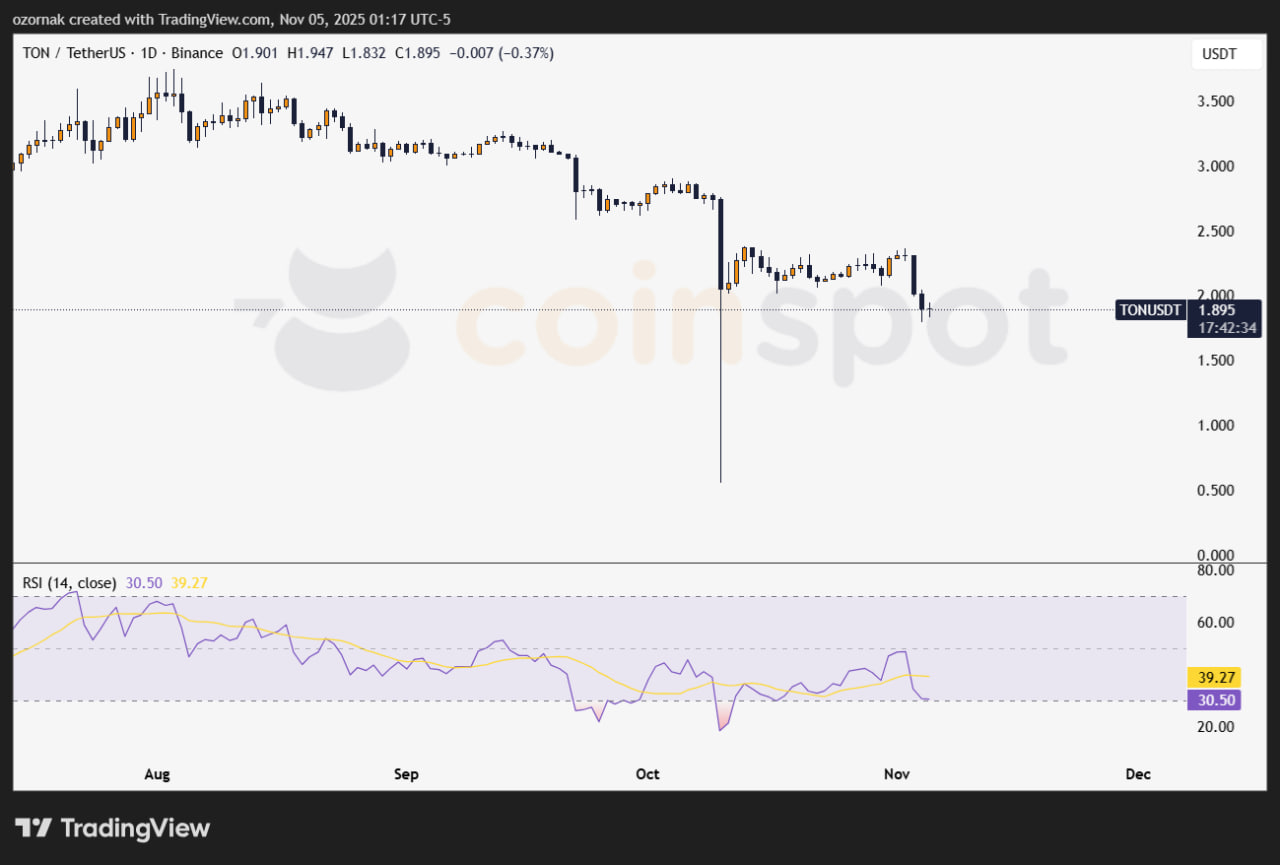

<img loading="lazy" decoding="async" class="aligncenter size-full wp-image-149810" title="photo_2025-11-05_09-17-31" src="https://coinspot.io/wp-content/uploads/2025/11/photo_2025-11-05_09-17-31.jpg" alt="The technical picture remains weak — Toncoin is already trading at $1.89, having broken support at $2.16. The resistance zone remains around $2.19, and selling pressure is still high." width="1280" height="865" srcset="https://coinspot.io/wp-content/uploads/2025/11/photo_2025-11-05_09-17-31.jpg 1280w, https://coinspot.io/wp-content/uploads/2025/11/photo_2025-11-05_09-17-31-266×180.jpg 266w, https://coinspot.io/wp-content/uploads/2025/11/photo_2025-11-05_09-17-31-400×270.jpg 400w, https://coinspot.io/wp-content/uploads/2025/11/photo_2025-11-05_09-17-31-768×519.jpg 768w" sizes="(max-width: 1280px) 100vw, 1280px" / alt="The technical picture remains weak — Toncoin is already trading at  .16. The resistance zone remains around >.19, and selling pressure is still high.” title=”photo_2025-11-05_09-17-31″>

.16. The resistance zone remains around >.19, and selling pressure is still high.” title=”photo_2025-11-05_09-17-31″>

The technical picture remains weak — Toncoin is already trading at $1.89, having broken support at $2.16. The resistance zone remains around $2.19, and selling pressure is still high.

What’s next?

The incident with TON Strategy became the first major corporate challenge for the Toncoin ecosystem, which over the past year has actively promoted the idea of integrating crypto-assets into public capital markets. Now, investors’ attention will be focused not only on the price chart but also on how the company will address the violations and restore regulator trust.

Read more: Tokenized bonds exceeded $8.6 billion: banks are starting to use them as collateral