SharpLink Gaming, a company listed on Nasdaq, has announced a large-scale strategy to allocate $200 million in Ethereum on Consensys’ Linea blockchain. This move will be one of the largest corporate deployments in decentralized finance and highlights the growing interest of traditional companies in DeFi yields.

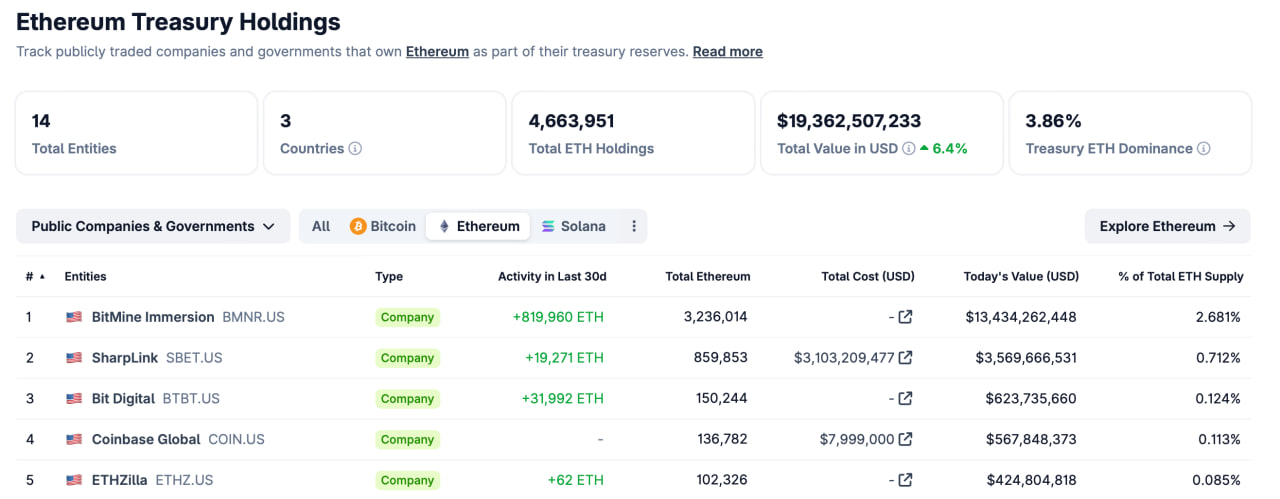

The company manages a treasury of $3.57 billion in Ethereum (859,853 ETH) and ranks second among the largest corporate ETH holders, behind only giants like MicroStrategy in the Bitcoin segment.

Now SharpLink plans to allocate 5.6% of its portfolio to DeFi operations. The funds will be placed on Linea’s second layer using zkEVM technologies — solutions that provide scalability and lower fees without sacrificing security.

Asset management will be carried out under the supervision of Anchorage Digital Bank, a certified custodian for institutional investors.

Focus on Staking and Restaking

The core of SharpLink’s strategy is participation in staking and restaking, that is, reusing staked assets to secure and operate decentralized services.

The main partner will be ether.fi — a liquid staking and restaking protocol that allows investors to earn yield without locking up liquidity. In addition, SharpLink will use EigenCloud — a decentralized data and computation verification platform that provides additional rewards for supporting infrastructure.

The company emphasizes that the goal is not just yield growth, but the creation of a sustainable asset management model where risks are minimized and income is generated through real blockchain mechanisms, not speculation.

Transition to Active Capital Management

SharpLink is making this move as part of a broader trend: corporate investors are beginning to move away from passive crypto asset holding. Previously, the Ethereum Foundation allocated 45,000 ETH to Compound and Spark protocols, and ETHZilla allocated $100 million to ether.fi for similar purposes.

This approach allows companies to earn “on-chain yield” — i.e., profit directly within the blockchain, without intermediaries and traditional financial fees.

‘If the strategy demonstrates stable yield while maintaining a high level of security and compliance, we are ready to consider increasing the program’s volume,’ a SharpLink representative said.

Linea Strengthens Its Position Among Corporate Clients

Linea is a second-layer solution from Consensys, developed based on zkEVM. This technology combines Ethereum’s security with high speed and low costs.

In recent months, Linea has been actively developing its ecosystem, providing infrastructure for institutional investments and DeFi protocols. According to Consensys, the network processes hundreds of thousands of transactions daily and is attracting more and more corporate participants.

SharpLink’s integration into the Linea ecosystem could become an important signal for other institutional players, showing that corporate funds now see DeFi not as an experiment but as a strategic direction for yield growth.

Institutions Enter DeFi

Traditional market participants are increasingly using DeFi products as a supplement to treasury management. Coinbase recently launched a partnership with the Morpho protocol, offering clients yields of up to 10.8% on USDC stablecoins. Crypto.com announced plans to integrate Morpho into its Cronos blockchain, so users can earn on ETH and other asset deposits.

These steps signal a gradual shift of financial capital into “smart” decentralized strategies, where yield is provided by real network mechanisms, not just market volatility.

What’s Next?

For SharpLink, this project could become a precedent and model for other public companies seeking to increase capital efficiency. If staking and restaking yields on Linea prove stable, we can expect the program to expand and institutional interest in ETH yields to grow.

Wider adoption of corporate DeFi strategies could become a key trend in 2025, accelerating blockchain integration into traditional financial systems and increasing capital management transparency.

Read more: Polymarket Returns to the US: Sports Betting Becomes a New Battleground