Bitcoin dropped by more than 8% over the week, falling below $100,000 for the first time since June. The pressure intensified after long-term holders sold off BTC worth about $45 billion.

BTC/USD compared to Nasdaq, Dow Jones, and S&P 500 indices since the beginning of the year. Source: TradingView

The sharp sell-off coincided with a collapse in AI-related stocks — this triggered a wave of risk-off sentiment across the market.

According to analysts at The Kobeissei Letter, Bitcoin has “officially entered bear market territory,” correcting by about 20% from the all-time high on October 6.

Nevertheless, there are signals that BTC can still avoid a full-fledged bear scenario. But for this, several factors must align.

Bitcoin must stay above the key weekly moving average

At the moment, BTC is still trading above the 200-week exponential moving average (EMA), which is around $100,950. This is an important long-term support level that has held back all major corrections since the end of 2023.

After each strong rally, Bitcoin tested this level and bounced up, setting new highs. This confirms that the 200-week EMA acts as the structural “bottom” of the market.

Weekly BTC/USDT chart. Source: TradingView

The current drawdown of BTC/USD is 22%, but the pair is still holding at this support level.

Additionally, the weekly relative strength index (RSI) continues to hover near horizontal support around 45, an area from which strong bullish reversals often started in the past.

As long as Bitcoin stays above the 200-week EMA and RSI remains within support, the overall uptrend is intact. However, a break of both levels will sharply increase the risk of a deep correction and entry into a bear market.

“Hidden QE” from the Fed could save Bitcoin bulls

Former BitMEX CEO Arthur Hayes believes that ultimately US fiscal policy will force the Fed to expand its balance sheet again, but bypassing direct quantitative easing. He calls this process “hidden QE”.

According to the US Treasury’s report for Q3 2025, the country’s budget deficit is approaching $2 trillion per year — covered by issuing Treasury bonds.

Read also: Tokenized bonds exceeded $8.6 billion: banks start using them as collateral

At the same time, traditional buyers such as foreign central banks and US households are no longer absorbing this volume. As the Fed itself recently admitted in a report, hedge funds are becoming the main buyers.

They use overnight repos — short-term deals in which bonds are pledged overnight in exchange for liquidity. When market liquidity dries up, the standing repo facility (SRF) launched by the Fed quietly steps in. According to Hayes, this brings “new dollars” into the system, essentially an analogue of QE, just without an official announcement.

Hayes believes that as the US budget deficit grows, the use of SRF will also increase, covertly fueling the markets with liquidity and supporting demand for risky assets, including Bitcoin:

“If the Fed’s balance sheet starts to grow again — that means an inflow of dollar liquidity. And that means Bitcoin and crypto prices overall will get support.”

Until the shutdown ends, the rally won’t start

Nevertheless, as long as the US shutdown continues and liquidity remains tight, the market may remain under pressure, according to Arthur Hayes.

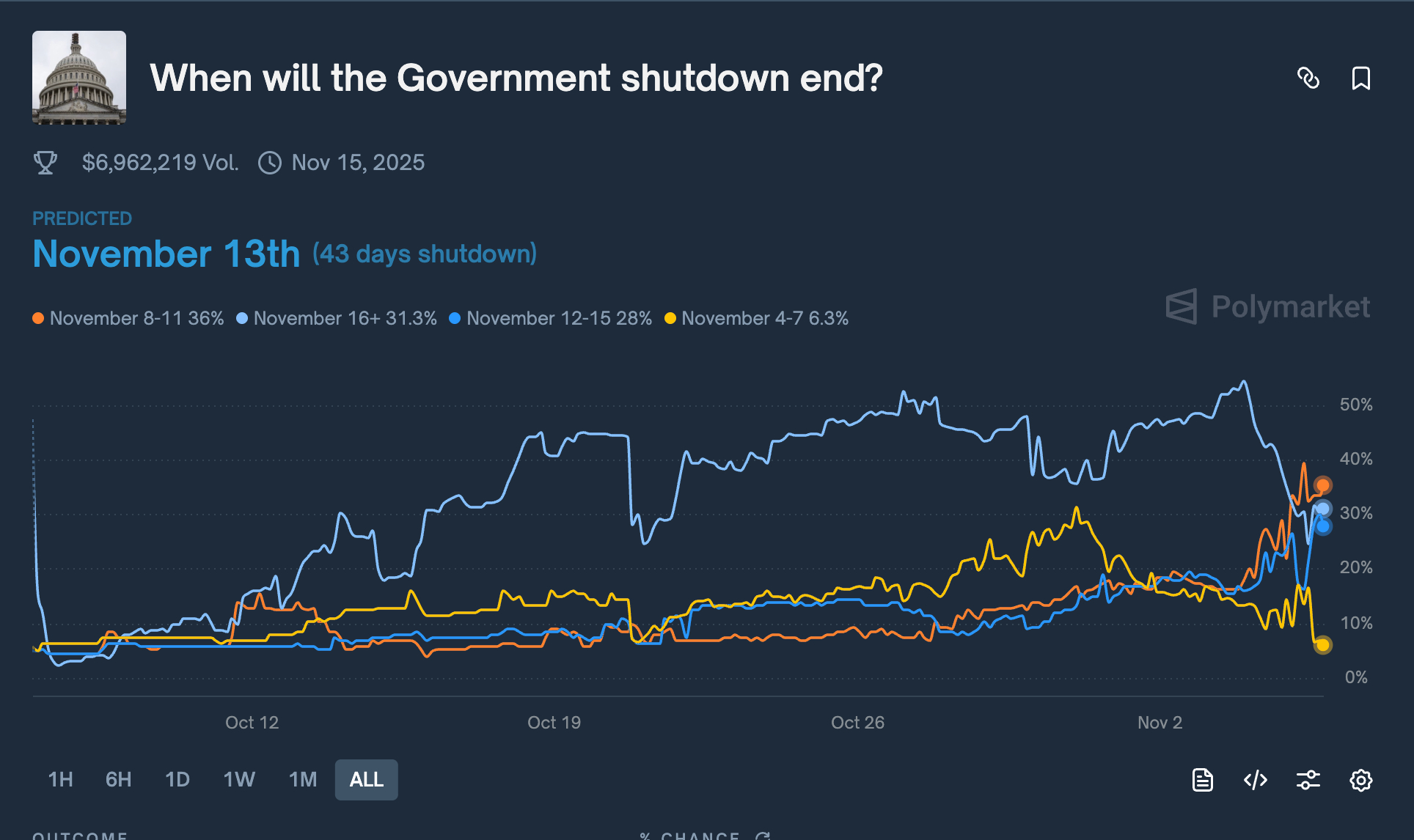

The good news for bulls is that a resolution to the crisis may come soon. According to Polymarket, more and more traders are betting that the shutdown will end as early as next week.

For example, the probability of the shutdown ending between November 8 and 11 (orange line) rose to 36%, up from 22% a week ago. The odds for November 12–15 also jumped, from 17% to 28%.

Probability of the US shutdown ending. Source: Polymarket

The situation remains tense. The US Treasury is actively issuing new bonds, thereby draining liquidity from the economy. At the same time, the balance of the main Treasury General Account (TGA) now exceeds the target level by $150 billion to $850 billion — meaning large sums are still not flowing back into the economy.

A temporary liquidity shortage is one of the key reasons for Bitcoin’s recent drop, Hayes believes.

Read also: Crypto market liquidations exceeded $2 billion: Bitcoin falls, ETH at 4-month low

He warns that many may mistakenly take the current stagnation for a market top, especially with the anniversary of BTC‘s all-time high set in 2021 approaching.

But in his opinion, fundamental signals say otherwise. As soon as the shutdown ends and money starts flowing back into the system, the market will get a new boost for growth.

“This system has only two modes: either print money or destroy it. Right now, the second is in effect. But it won’t last long,” Hayes summarized.