The digital-asset arena often divides into two mindsets: thrill seekers orbiting hype cycles and pragmatists anchored in fundamentals. As meme coin heavyweight Pepecoin (PEPE) saturates social feeds, a fresh cohort is steering capital toward utility-first plays such as Mutuum Finance (MUTM), a DeFi altcoin. One camp runs on virality and momentum; the other emphasizes structure, tokenomics, and repeatable cash flows.

Many strategists expect the next market leg to reward measurable utility and steady revenue over short-lived memes. That naturally prompts a simple question for long-horizon investors: between PEPE and MUTM, which looks like the stronger bet for durable growth?

Pepecoin (PEPE)

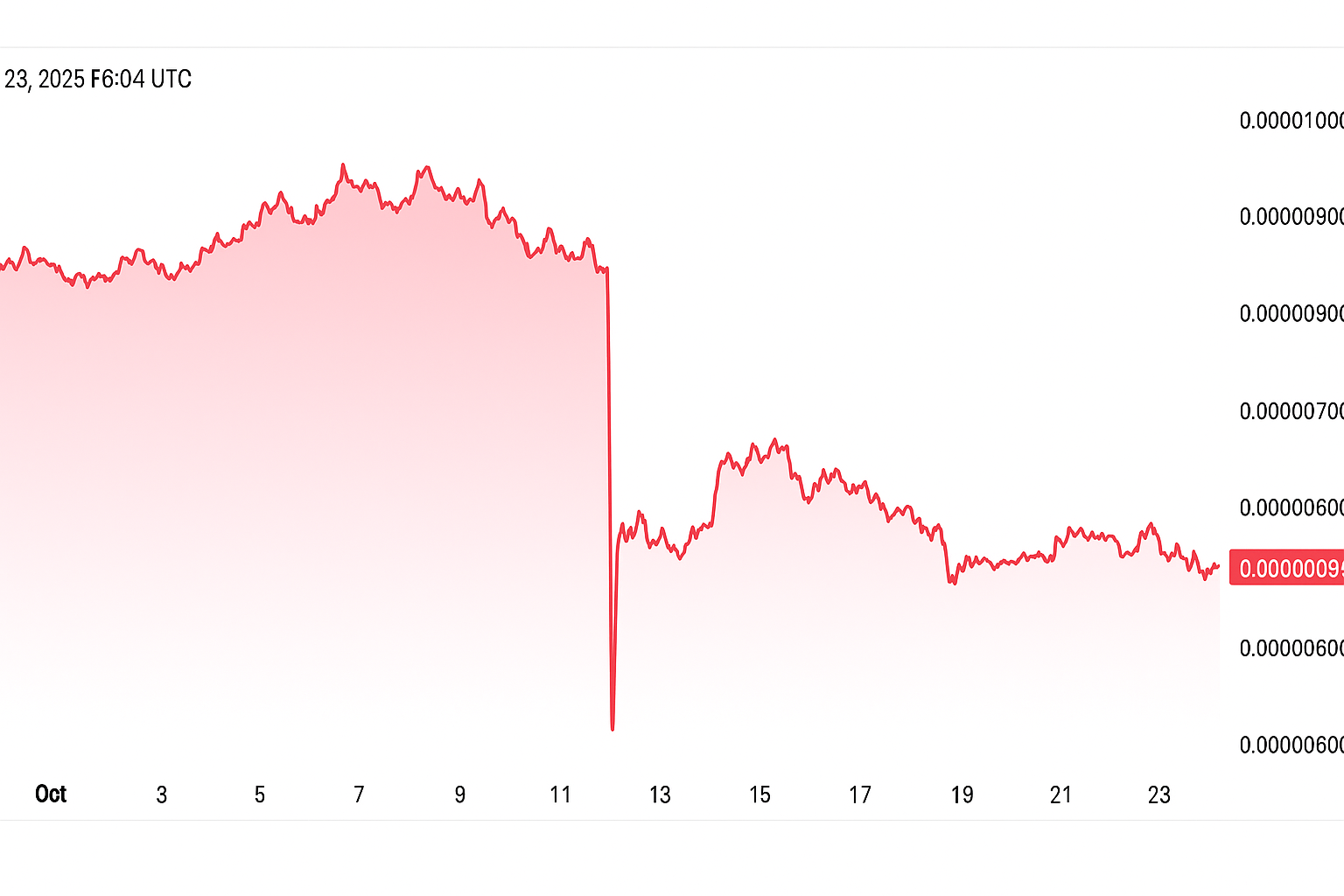

Over the past year, Pepecoin (PEPE) shocked speculators, with some early adopters realizing outsized windfalls. At present, pricing hovers near 0.000011 USD per unit, while market capitalization sits close to $4.7 billion. Circulation is roughly 420 trillion tokens, placing it among the biggest meme assets ever issued.

From a charting lens, nearby barriers appear around 0.00001075–0.00001100, followed by additional ceilings at roughly 0.000013–0.000014. A convincing push above those bands likely needs a resurgence in risk appetite, as traded volumes have cooled relative to earlier months. On the downside, notable cushions cluster near 0.00000750–0.00000900, so a broad-market pullback could lean on that structure.

The central headwind is sentiment dependence. With minimal direct utility and a vast float, upside asymmetry is naturally constrained. At about $4.7B in value, repeating early multiples would require many tens of billions in fresh demand. Researchers tracking meme-coin cycles estimate a restrained 30–50% advance by late 2025; beyond that, the base case skews toward consolidation rather than runaway trend continuation—common among large-cap memes once the initial mania ebbs.

Mutuum Finance (MUTM)

By contrast, Mutuum Finance (MUTM) aims for durability. The protocol runs on Ethereum as a money market, combining two complementary venues: a pooled-liquidity segment backing blue-chip assets and risk-isolated lending where custom terms apply. Participants can supply ETH, USDT, and similar tokens, receiving mtTokens that auto-accrue yield as borrowers repay—akin to passive staking rewards.

The architecture addresses a frequent DeFi puzzle: aligning usage with token demand. A portion of fees collected by the protocol and operating income is directed to repurchase MUTM on the open market, then redistributed to mtToken stakers. This purchase-and-distribute loop creates reflexive demand, turning on-chain activity into persistent buy pressure.

Fundraising momentum signals growing conviction. Mutuum Finance has gathered more than $17.8 million from upward of 17,400 holders. Phase 6 currently prices MUTM at $0.035 and is roughly 72% filled; after this tranche, the price steps to $0.04, with an official launch marked at $0.06.

PEPE vs MUTM: projected performance

When forward potential is compared, the contrast sharpens. For PEPE, several desks outline a constrained 40–60% advance in 2026 if conditions remain favorable. Its already sizable capitalization and limited on-chain utility reduce the odds of exponential moves. The viral phase has largely played out, and sustaining further rallies would require catalysts that transcend community enthusiasm.

Mutuum Finance (MUTM), by comparison, remains early in its trajectory. With an entry near $0.035 and a slated launch at $0.06, analysts tracking new DeFi listings anticipate initial price discovery around $0.15–$0.20—translating to about a 328–471% lift from current pricing. Should mainnet adoption hit expectations, longer-range projections extend toward $0.40–$0.50.

A quick illustration clarifies the gap. If PEPE simply maintains its current rhythm, a $1,000 allocation could grow to roughly $1,500–$1,600 over time, assuming sentiment and the market backdrop remain supportive.

Using the same $1,000 at a $0.035 entry in MUTM, reaching the $0.15–$0.20 band would value the position at approximately $4,300–$5,700—around 330% to 470% higher.

Security, openness, and whale confidence

On trust indicators, Mutuum Finance scores well. A CertiK audit has been completed, with a Token Scan rating of 90/100—among the stronger outcomes for an active DeFi presale. The team also runs a $50,000 bug-bounty, rewarding white-hat contributors for surfacing vulnerabilities.

Community dynamics stay lively. A 24-hour leaderboard resets at 00:00 UTC, granting $500 in MUTM to the day’s top participant. This mechanism boosts transparency and encourages continual participation throughout the presale.

Large-holder inflows have added conviction. Several sizable wallets accumulated during the past week ahead of Mutuum Finance’s V1 testnet launch, scheduled for Q4 2025 on Sepolia. The initial rollout will ship the Liquidity Pool, mtToken logic, a Debt Token, and a Liquidator Bot, with ETH and USDT available for supplying, borrowing, and collateralization.

For further details on Mutuum Finance (MUTM), consult the resources below: