The US Federal Reserve has officially confirmed: starting in December, it will end balance sheet reduction and begin reinvesting funds into Treasury bills. In essence, this marks the end of the quantitative tightening (QT) period—meaning liquidity is returning to the market.

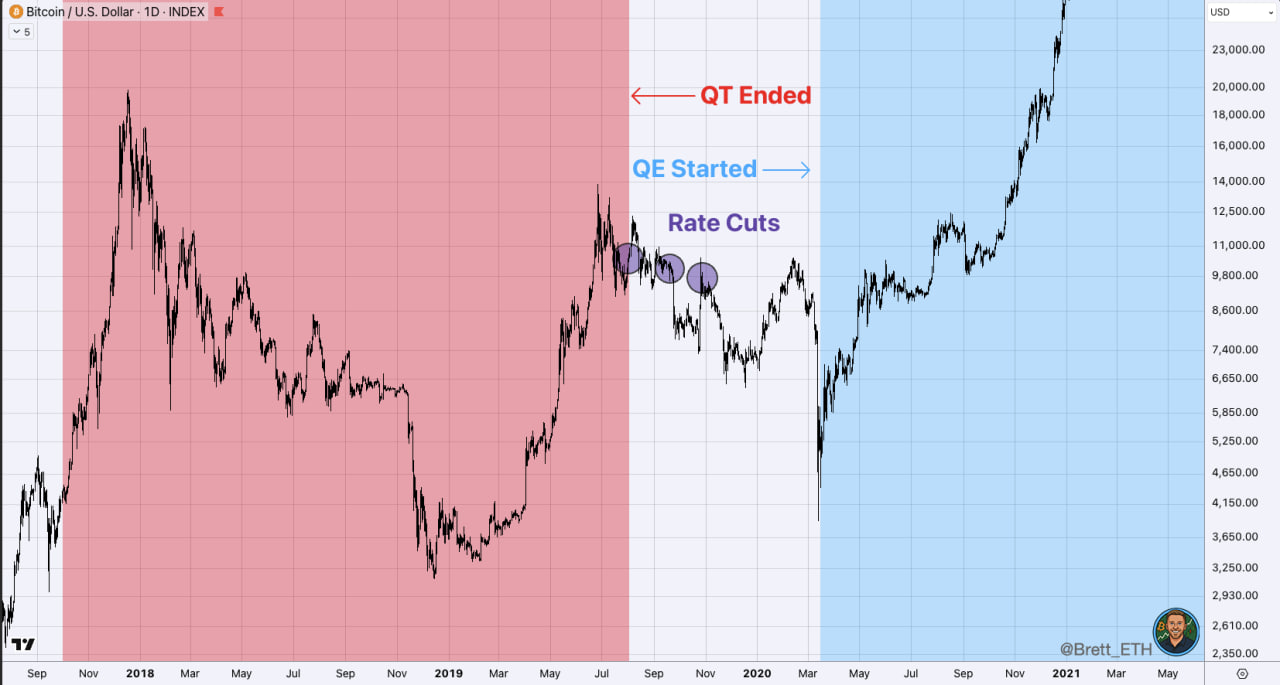

However, investors remember: the last time the Fed ended QT and started cutting rates, Bitcoin fell by 35%. Now traders are debating whether the market will see a repeat of that scenario.

What will change after December

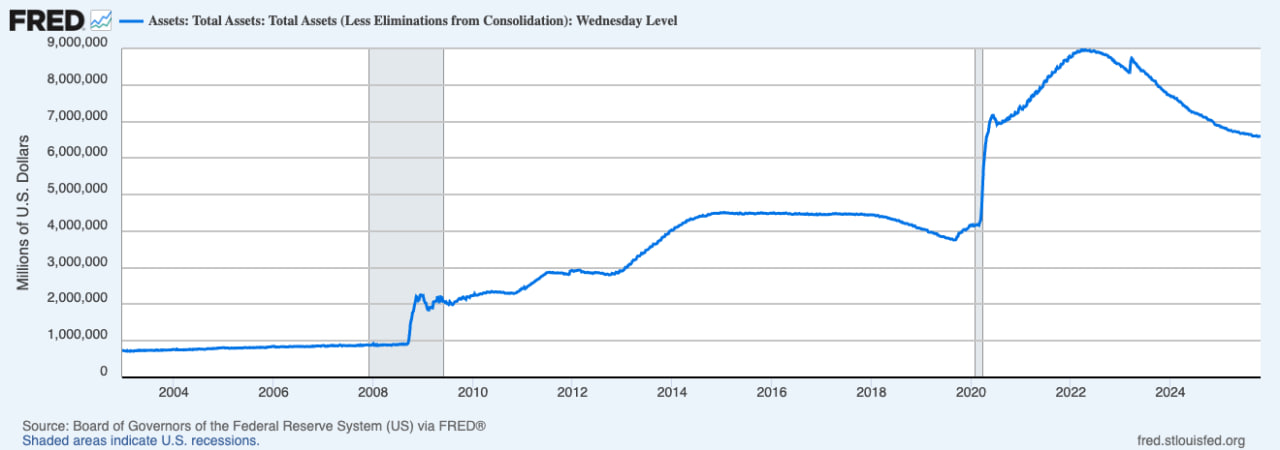

Fed balance sheet as of October 2025.

From December 1, the Fed will stop letting its bonds “roll off” and will start directing proceeds from maturing securities to buy short-term Treasury bills. Simply put, instead of withdrawing money from the system, the regulator will start “injecting” it again.

Formally, this is not called quantitative easing (QE), but in essence the effect is similar—liquidity available to banks and funds increases.

Economist Lyn Alden explains:

‘When the Fed buys T-bills, it is essentially creating new reserves in the system. This is an unofficial form of QE, even if the regulator avoids using that term.’

Analysts have already dubbed what is happening “stealth QE”—a process that is not advertised but affects the flow of money into financial markets.

Historical parallels: Bitcoin versus Fed policy

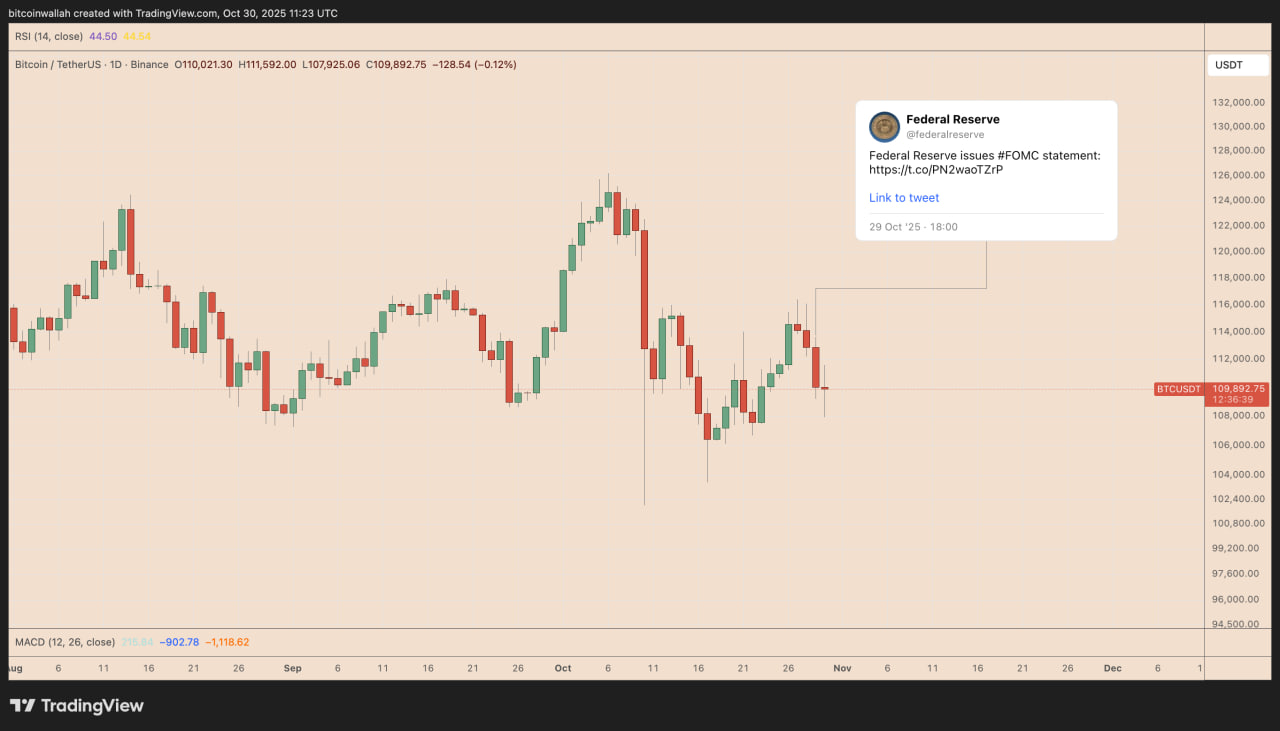

Daily BTC/USD chart.

The last time the Fed ended QT in 2019, Bitcoin came under pressure. Despite the stock market’s growth, the cryptocurrency fell by a third. Recovery only began after the regulator launched full-scale QE in the spring of 2020—already against the backdrop of the pandemic.

Analyst Brett notes:

‘We are probably at the peak of the four-year Bitcoin cycle. If QE really starts, it will most likely not be before the end of next year.’

Some experts are already noting worrying signals. Analyst Jesse Olson points to a developing bearish MACD crossover on Bitcoin’s three-week chart. The same crossover was observed before the 69% market drop in 2021–2022. If history repeats itself, Bitcoin could face a correction before a new wave of liquidity pushes it higher.

How much liquidity is needed for new growth

Paradoxically, even the Fed’s “stealth” program could become a driver for BTC. An increase in system liquidity usually leads to higher prices for risk assets.

According to analyst Bedouin, inflows from new Fed investments could help Bitcoin rise to the $130,000–$180,000 range by 2026. He believes that the impact of liquidity already outweighs the usual crypto market cycles, making the “four-year peak” model less accurate.

This forecast matches the targets previously announced by leading Wall Street banks—JPMorgan and Standard Chartered. Both financial giants believe that growing institutional interest and Fed policy could create favorable conditions for a new bull cycle.

What this means for the market

The end of QT is a turning point. Over the past two years, Fed tightening has been the main pressure factor on all markets, including cryptocurrencies. Now this cycle is coming to an end, and money flows are gradually returning.

But the market does not grow in a straight line. If the 2019 scenario repeats, there may first be a decline, followed by strong growth. In fact, the Fed is launching a new phase where liquidity once again becomes the main driver of prices.

Bitcoin no longer just reacts to the regulator’s decisions—it is embedded in the overall financial system. And that is why the question is not whether BTC will rise, but when the next liquidity impulse will begin.

Read more: Mastercard prepares to buy Zerohash for $2 billion to strengthen its position in the world of stablecoins