The price of Bitcoin has collapsed again, breaking through an important support level. In the past 24 hours, quotes dropped to $103,700, increasing traders’ fears that the market is preparing for a deeper correction. Now, the key target is the $92,000 area—where an unfilled price gap on CME futures is located.

Break of $104,000 increased pressure

On Tuesday, Bitcoin lost about 2% and for the first time in several weeks fell below $104,000. During the Asian session, selling intensified, and buyers failed to hold the $105,000 level. Traders note: now the market’s attention is fully focused on the $100,000 zone, which is called the last line of defense before a new round of decline.

Investor and entrepreneur Ted Pillows called what is happening a ‘free fall’ for Bitcoin:

‘The asset has no stable support up to $100,000. If this level does not hold, the next target is the $92,000 area, where the CME gap is located.’

He added that a recovery above $105,000 would be a signal of stabilization, but so far this is not happening—the market looks exhausted, and selling volumes remain high.

Technical picture worsens

Trader Daan Crypto Trades believes that Bitcoin has lost the main support range that held the price in recent weeks. Now, quotes are approaching the lower boundary of the channel formed after the mass liquidations on October 10.

According to him, a combination of factors—large sales by ‘whales’, decreased activity in the US stock market, and a strengthening dollar—creates an extremely unfavorable background for risk assets.

‘All together, this is not the best recipe for a short-term recovery,’ the analyst noted.

On the chart, the $102,000 level remains key. This is where in October the lower shadow of the daily candle on Binance passed, coinciding with the 50-week EMA—an area Bitcoin has not tested for more than seven months. Losing this support could be the starting point for a prolonged decline.

Investors move to lock in losses

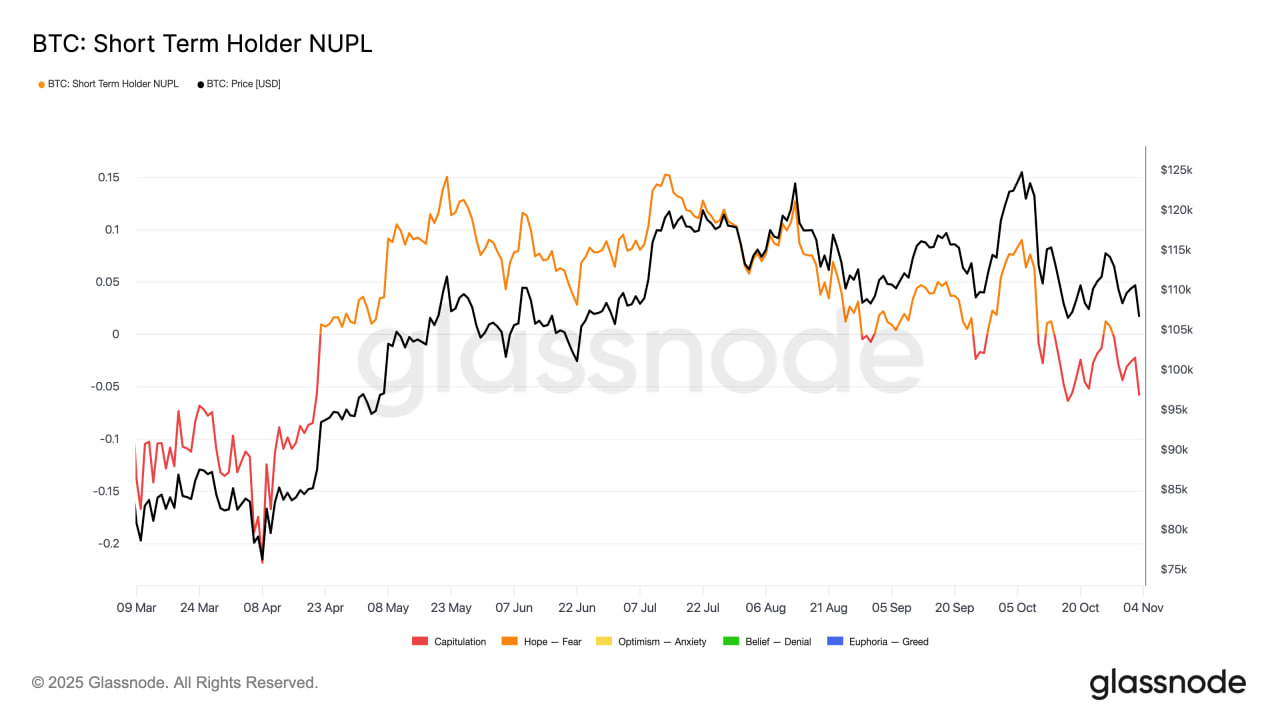

The drop increased stress among short-term holders. According to Glassnode, the NUPL (Net Unrealized Profit/Loss) metric for investors holding assets up to 155 days has returned to the capitulation zone—for the first time since April.

The current NUPL value is -0.058, indicating a predominance of unrealized losses among new buyers. Historically, such phases have coincided with moments of emotional pressure, when weak market participants lock in losses, and long-term players begin to accumulate positions.

‘Periods of capitulation among short-term holders often become accumulation points for more patient investors,’ Glassnode analysts emphasized.

Macro factors increase pressure

In addition to technical signals, the market is pressured by the macro environment. The Fed’s tougher rhetoric, rising bond yields, and a strengthening dollar reduce risk appetite. US stock indices are losing momentum, and the correlation between the S&P 500 and Bitcoin is increasing again—this means that pressure on traditional markets directly affects cryptocurrencies as well.

Traders also note an increase in open shorts and a decline in open interest in futures. On CME, it dropped by almost 9% in a day, indicating the exit of some institutional participants. This indirectly confirms a decrease in liquidity and a reduced willingness of large players to take risks in the current environment.

Possible scenario

If Bitcoin fails to stay above $105,000, the next target is $100,000, and if it breaks through—then the $92,000 area, where the unfilled CME gap is located. Historically, such zones have often acted as magnets for the price.

Recovery is possible only if trading volumes stabilize and liquidations slow down. Otherwise, the market may enter a sideways phase and then update yearly lows.

Nevertheless, some analysts see a positive side in what is happening. Retail investor capitulation often precedes new phases of growth—these are the periods when professional market participants begin to accumulate positions.

‘The market is under heavy pressure, but for long-term investors this may be a chance to repeat the scenarios of 2020 and 2022, when capitulation turned into the start of a new cycle,’ Glassnode’s analytical report notes.

What’s next?

While Bitcoin balances on the edge of $100,000, the market looks overheated on the selling side. If a local rebound appears, the next target will be the $107,000–$109,000 range. Breaking through it will open the way to recovery above $110,000, but this will require increased volumes and a weakening dollar.

If the pressure persists, Bitcoin may test the $92,000 zone as early as November, which will be a key test for investors.

Read more: Berachain launches emergency hard fork after Balancer V2 hack