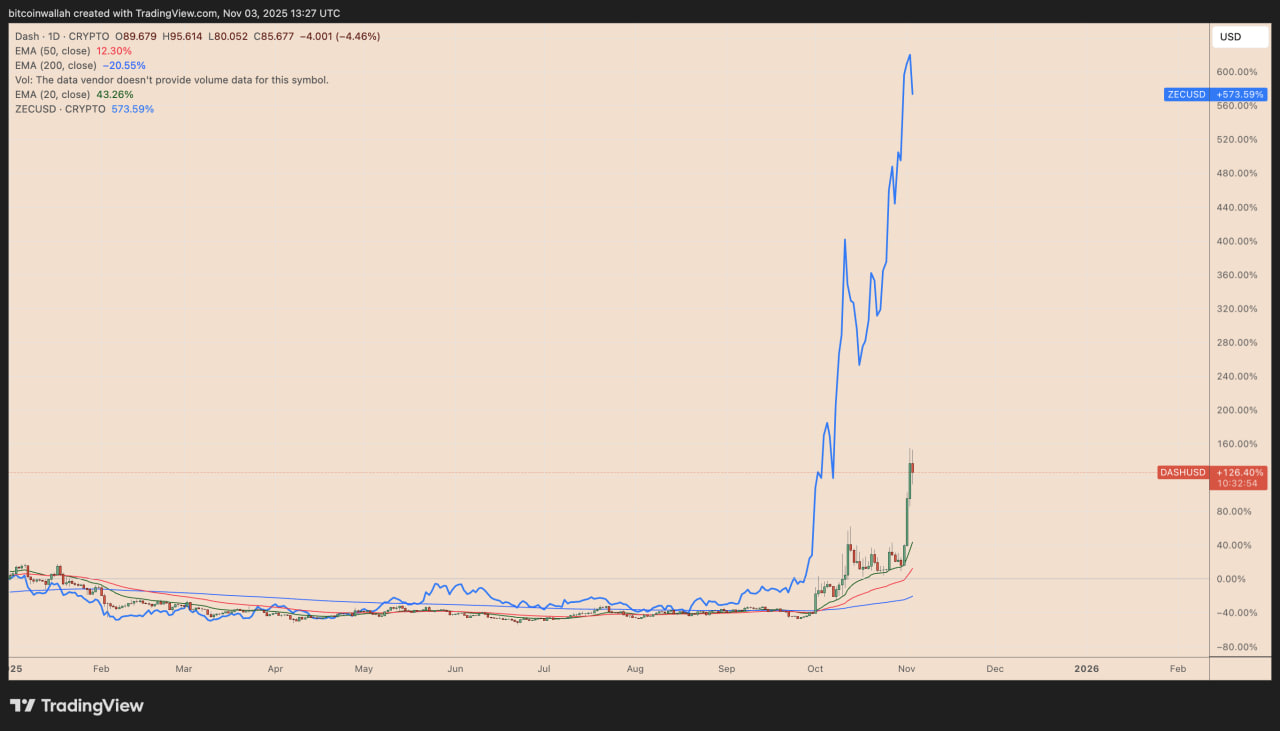

Dash has become one of the most dynamic coins of November. Its chart almost exactly copies the structure of Zcash before the breakout, which in September brought the token a growth of more than 600%. If history repeats itself, Dash could show a fourfold increase and break through the multi-year resistance zone.

Dash comes out of hibernation

Over the past month, Dash’s price has risen by 385%, reaching $126.7. This is one of the best results among major altcoins. The rally coincided with renewed interest in privacy tokens and a revival in the anonymous payments sector.

In terms of chart structure, Dash repeats the movement of Zcash (ZEC), which at the end of September broke out of a seven-year downward channel and in just a few weeks rose in price from $60 to $390. The ZEC breakout turned key resistance levels — including the 200-week moving average and the 0.236 and 0.382 Fibonacci zones — into support areas. This opened the way to the highest prices in eight years.

Dash is now in a very similar position: testing the upper boundary of its downward channel, which has held back the price since 2017. Analysts note that if the coin consolidates above the $98–$100 range, it could trigger a similar growth impulse as Zcash.

Growth potential up to 400%

Dash’s Relative Strength Index (RSI) remains at 78.7, indicating a strong bullish impulse, but not yet extreme overbought. For comparison, Zcash’s RSI before the breakout rose above 85, maintaining momentum up to the very peak.

If Dash breaks through the upper boundary of the channel, the next key target is the 0.236 Fibonacci level around $98. This could mean a growth of about 400% from current levels if buyers hold the initiative.

Analysts note that such a scenario is possible if interest in private assets remains and the outflow of liquidity from Bitcoin to altcoins continues.

What could hinder growth

However, Dash’s technical history is full of false breakouts. In 2018, 2021, and 2022, each approach to the upper boundary of the channel ended with a collapse of 85–97%.

If the impulse weakens, the first support zone will be at $69, where the 200-week exponential moving average (EMA) passes. Losing this level could send the price to $34–35 — the areas of the 50 and 20-week EMA.

In the worst-case scenario, Dash could return to the lower boundary of the channel in the $14–16 range, which would correspond to a complete repetition of the historical cycle and the end of the accumulation phase.

Why the scenario is repeating

The similarity of the Dash and Zcash charts is explained not only technically. Both coins are old privacy assets that appeared in the mid-2010s and have long been under pressure from regulators and low interest.

But in 2025, the situation began to change. Investors started looking for undervalued assets with limited supply and strong technical foundations. Against the backdrop of a revival in the DeFi sector and increased volumes on decentralized exchanges, it was the old coins with recognizable brands that got a second wind.

Dash also benefits from the overall trend toward “old projects” — those that have survived several cycles and retained their technological base. For many institutional players, this is a signal of reliability and resilience.

Macro background and demand for privacy

The rise in interest in privacy coins coincided with increased geopolitical tensions and regulatory risks in the US and EU. This brings attention back to assets that provide financial autonomy and confidentiality.

In addition, against the backdrop of declining activity in the Bitcoin market, investors are looking for opportunities in altcoins with “their own story.” Dash and Zcash fit this request — their movement since 2017 shows cyclicality, which may once again end with an expansion phase.

What’s next?

If Dash confirms the channel breakout and holds above $100, the next target will be the $140–150 zone, where the resistance levels of 2021 previously were. After consolidating there, the asset may aim for $200 and above.

But in an unsuccessful scenario, the ZEC story will not repeat — Dash may correct, retaining potential for long-term accumulation.

In any case, the asset is once again in the focus of traders and analysts, and its technical structure makes November one of the key months for the future trend.

Read more: 4 crypto events in November you can’t miss