The DeFi market in 2025 keeps expanding across multiple AMMs and networks, but along with growth comes a surge in rug pulls and liquidity-related scams. Investors now demand proof that a pool is safe before entering a new token, while responsible developers know that having liquidity locked is no longer optional — it is a credibility requirement. Because of this, the best liquidity lockers have become essential infrastructure for serious crypto projects on Uniswap, PancakeSwap, and other decentralized exchanges.

This guide gives a full breakdown of how liquidity lockers work, why they are crucial for investor protection, and which platforms rank among the most secure and trusted solutions in 2025 — especially for BNB Chain, Ethereum, Polygon, and upcoming L2 rollups.

What Is a Liquidity Locker and Why It Matters

A liquidity pool contains tokens used to facilitate swaps on AMMs like Uniswap or PancakeSwap. These tokens are supplied by either the founding team or community providers, and they ensure that traders can buy or sell instantly without waiting for a counterparty. The issue arises when a malicious developer controls the LP tokens — they can pull the entire pool, drain the project, and disappear, which is what we call a rug pull.

Liquidity lockers exist to solve this trust gap. They store the LP tokens inside a smart contract, making them inaccessible until a predefined unlock date. This creates:

-

Investor confidence – no surprise pool withdrawals

-

Authenticity – real, verifiable transparency on-chain

-

Protection from hacks – reduced attack vectors on liquidity

-

Legitimacy for new tokens – critical reputation boost during launch

Most lockers also allow teams to choose duration, lock extensions, vesting mechanics, and ownership management (sometimes via multisig). By locking liquidity, a DeFi team proves they are committed to the long game rather than short-term speculation.

Top 7 Best Liquidity Lockers 2025

Below are the top liquidity lockers ranked by usage, security, features, network coverage, and reliability.

Unicrypt (UNCX)

Unicrypt remains one of the most established liquidity-locking platforms in the ecosystem. It supports Ethereum, Binance Chain, Avalanche, Polygon, Arbitrum, and more — giving developers access to a multi-chain liquidity onboarding framework.

Features

- Token vesting, pools, staking, NFT utilities

- Strict audit history and transparency

- Liquidity locker dashboard with public proofs

Pros

- Trusted by large-scale launches

- Massive network support

- Strong community trust

Cons

-

Fees slightly higher compared to emerging players

Best for: professional DeFi teams aiming to attract larger investors.

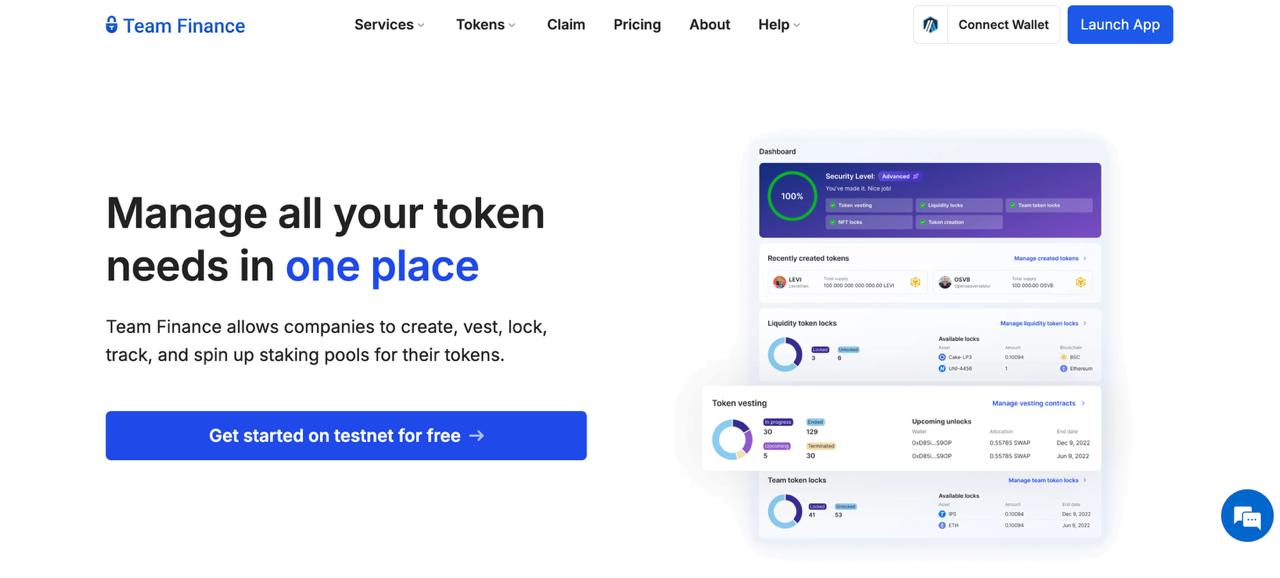

Team Finance

Team Finance has built a reputation for user safety and clarity. It appeals to developers seeking lightweight but secure smart contracts without overcomplication.

Highlights

- Smooth UI and instant analytics

- Good documentation for new project owners

- Decentralized, yet easy for beginners

Chains supported

Ethereum, BNB Chain, Polygon, Base

Drawback

-

Fewer advanced features than TrustSwap or Unicrypt

Ideal for: teams launching their first or second token that want credibility without a complex workflow.

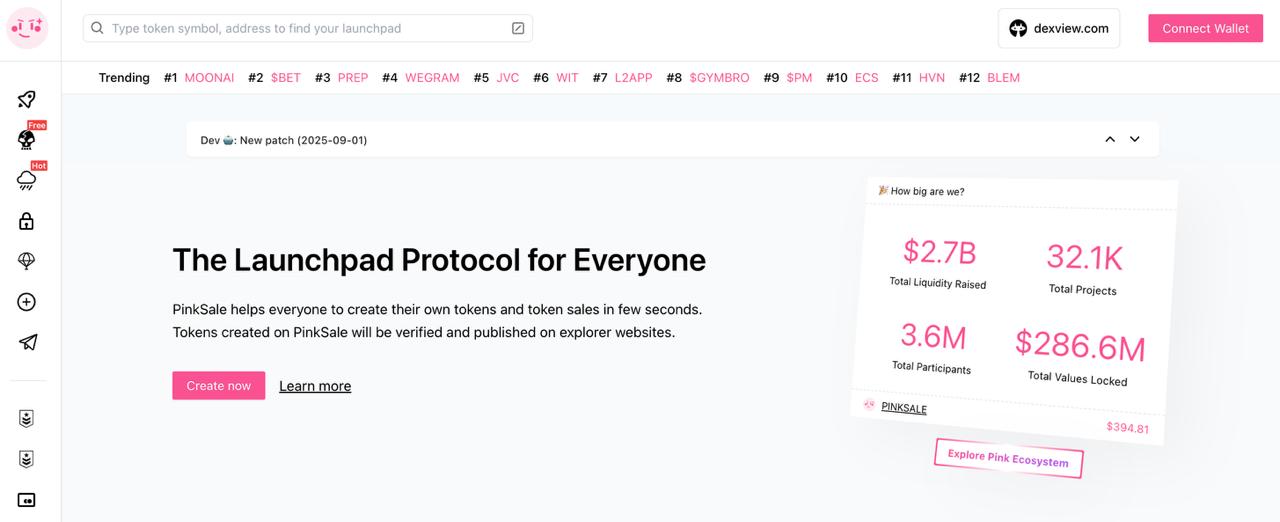

PinkLock (by PinkSale)

Designed natively for launchpad users, PinkLock integrates directly into the PinkSale ecosystem. This means liquidity can be locked instantly after token generation — reducing window risk.

Why it stands out

- Best onboarding for new BEP-20 tokens

- Built for BNB Chain-native communities

- Quick on-chain lock certificates

Limitations

-

Focused mainly on EVM launch tokens

Perfect for: projects using PinkSale launchpad or fundraising tools.

DxLock (by DxSale / DexTools)

DxLock offers deep developer tooling, making it attractive to technical founders and teams that prefer automation.

Key strengths

- Smart contract transparency

- Excellent integration with trading dashboards

- Flexible locking + token ownership management

Potential drawback

-

Interface is more technical than PinkLock or Mudra

Best suited for: teams that need DevOps-style control.

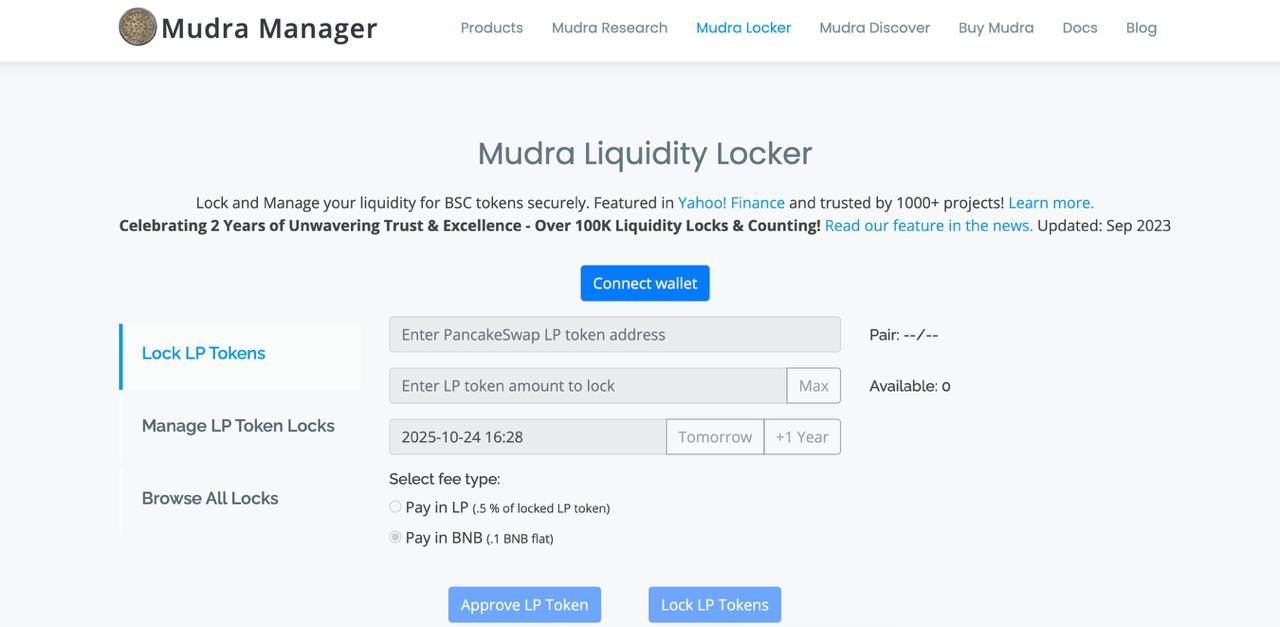

Mudra Locker

Mudra is extremely popular across the BNB Chain ecosystem because of its simplicity and affordability. Many BEP-20 token launches rely on it for first-phase credibility.

Benefits

- Very low cost

- Real-time blockchain verifications

- Great UX for small or mid-size teams

Limitation

-

Primarily optimized for BSC

Best for: low-budget or early-stage token launches.

TrustSwap Locker

TrustSwap supports liquidity and token vesting, staking, and milestone-based unlocks. It’s ideal for projects seeking broad institutional trust.

Top features

- Advanced tokenomics control

- Multi-chain support (ETH, BNB, Polygon, Avalanche, Base, more)

- Extra utilities like smart locks and launchpads

Safety: Among the highest in the industry due to years of audits and transparency.

Ideal for: teams planning multi-year roadmaps and deeper investor involvement.

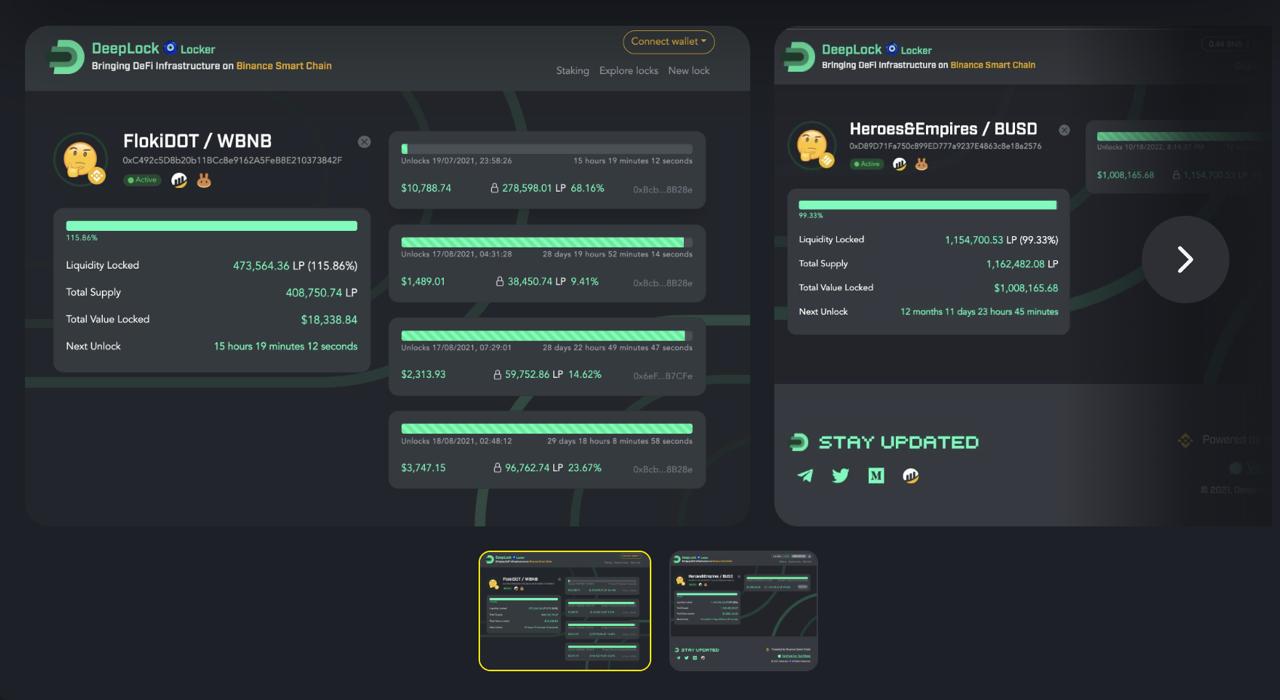

Deeplock

Deeplock offers a simplified approach that appeals to startups or indie developers. It focuses on fast deployment and clean, readable verification pages for investors.

Benefits

- Intuitive UI

- Quick deployment

- Affordable on-chain fees

Tradeoff

-

Fewer ecosystem add-ons

Good for: small projects that need trust fast, without dev complexity.

Risks and Limitations

Even with a liquidity locker in place, no DeFi project becomes “risk-free.” Locking liquidity mostly protects users from rug pulls by preventing the developer from withdrawing the pool funds, but other attack vectors and mistakes can still undermine investor safety. The security of a project also depends on the locker’s smart contract, the team’s technical competence, and how ownership settings were configured during the lock process.

The main risks include:

- Smart contract vulnerabilities – if the locker’s code has a flaw, hackers can exploit it even with funds locked.

- Centralized admin keys – some services hold emergency privileges, which introduces a partial trust element.

- Misconfiguration during setup – locking to the wrong wallet or address can permanently trap liquidity.

- Early access loopholes – in rare designs, multisig or emergency functions may allow early withdrawals.

- Regulatory uncertainty – lockers operate across borders with no unified regulation, so users rely on audits instead of formal compliance.

FAQ

What is the safest liquidity locker?

In 2025, Unicrypt and TrustSwap remain top-tier for transparency, decentralization, and ongoing security audits. They are widely recognized by serious investors.

How long should liquidity be locked?

Most legitimate projects choose 6–12 months. Some opt for multi-year locks or staged extensions to create higher confidence for bigger pools.

Can liquidity be unlocked early?

Usually no. The locker holds LP tokens until the expiration date. Only contracts configured with multisig overrides or emergency provisions have early withdrawal options.

Are liquidity lockers regulated?

Not directly. They operate through smart contracts visible on-chain. Audits act as credibility insurance in place of traditional regulations.