In the evolving world of cryptocurrency, the Bybit Card stands out as a versatile bridge between digital assets and everyday spending. This review covers features, fees, and real-world usability to help you decide if it’s the right crypto debit option. Issued by Bybit, one of the leading exchanges, the card converts assets like BTC, ETH, and USDT into fiat at checkout for use wherever Mastercard is accepted. Whether you prefer a virtual card for mobile wallets or a physical one for in-store purchases and ATMs, the guide below walks through application, activation, limits, and advanced tips—without the fluff.

Not financial advice. Always verify details in the official Help Center before you apply.

What Is the Bybit Card?

The Bybit Card is a Mastercard debit card (not a Bybit credit or prepaid card) that lets users spend crypto holdings directly. It supports major cryptocurrencies including BTC, ETH, XRP, USDT, USDC and TON, with automatic conversion to fiat at the point of sale. The card is primarily Mastercard-powered. It integrates with the Bybit ecosystem for trading, staking, and earning rewards. Users praise its global acceptance at over 90 million merchants and compatibility with digital wallets.

Key highlights include up to 10% cashback, no annual fees, and features like auto-savings for idle funds earning up to 8% APY. It’s designed for crypto enthusiasts who want to off-ramp assets effortlessly, with strong security via EMV 3D Secure and 2FA.

Bybit Card Supported Countries and Availability

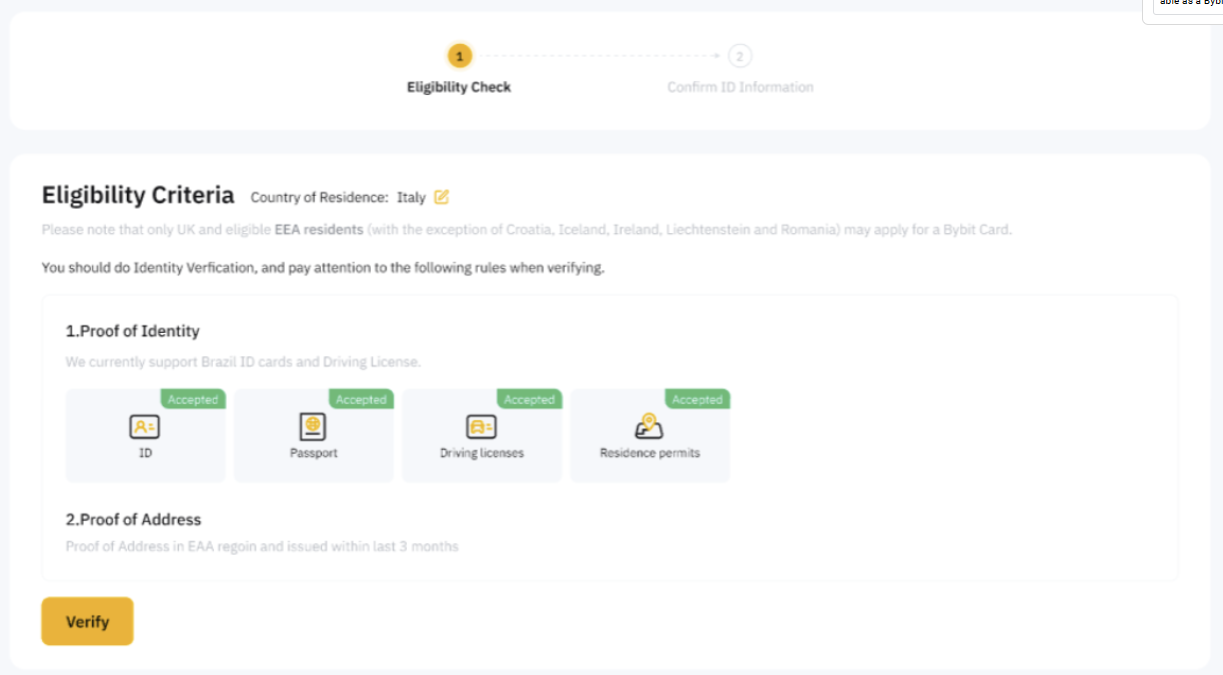

The Bybit Card is available in select regions, with primary coverage across Europe and additional rollouts. Supported markets include most EEA countries (excluding the UK, Croatia, Iceland, Ireland, Liechtenstein, Romania, and France), plus Switzerland, Australia, Argentina, Brazil, the AIFC jurisdiction, parts of Asia-Pacific, and Mexico. In Switzerland, residents aged 18+ can apply after completing KYC. In Europe, the product follows MiCA-aligned requirements to reinforce regulatory trust.

If you’re in unsupported areas, Bybit allows interest registration for future expansions. Regional restrictions apply, such as varying crypto support and fees.

Note: Please refer to the Bybit Help Center for the current list of supported EEA markets and exclusions.

Bybit Card Types: Virtual, Physical, and Lite

All types share limits unless specified, and users can have one virtual and one physical active.

| Type | Description | Limits | Fees |

| Virtual Card | Issued instantly upon approval; ideal for online merchants, digital wallets (Apple Pay, Google Pay, Samsung Pay); supports 3D Secure for secure transactions; prerequisite for Physical Card; valid for 3 years with auto-renewal. | Shared with Physical Card; e.g., EEA & CH Tier 1: Daily 5,000 EUR, Monthly 10,000 EUR, Annual 60,000 EUR (higher tiers up to Daily 15,000 EUR); no ATM withdrawals. | Issuance: Free; Replacement: Free; Other: Regional FX (0.5% EEA) and crypto conversion (0.9%) fees apply. |

| Physical Card | For in-store purchases, ATM withdrawals, and contactless (NFC) payments; requires initial Virtual Card; valid for 3 years; delivery up to 30 days (free DHL for VIPs with tracking). | Shared with Virtual Card; same spending limits as Virtual; ATM: e.g., EEA & CH Tier 1: Daily 2,000 EUR, Monthly 2,000 EUR (higher tiers up to Monthly 10,000 EUR); max 10 daily withdrawals. | Issuance: 5 EUR/USD (EEA & CH), 29.99 USD (Australia); Replacement: Same as issuance; ATM: 2% after 100 EUR/month (EEA); Regional FX and conversion fees apply. |

| Virtual Card Lite | Virtual-only; no address verification required (only Identity KYC); upgradeable to Standard upon Address Verification; supports digital wallets. | Lifetime Spending: 150 EUR; lower daily/monthly limits than Standard (specifics shared in fees article). | Issuance: Free; Replacement: Free; Other: Same regional FX (0.5% EEA) and conversion (0.9%) fees as Virtual. |

Bybit Card Application and Activation Process

The Bybit Card application is straightforward via the Bybit app or website. Start by creating a verified Bybit account, then complete KYC requirements: identity proof (passport, ID) and address verification (issued within 3 months). Verification levels align with Bybit VIP tiers for higher limits.

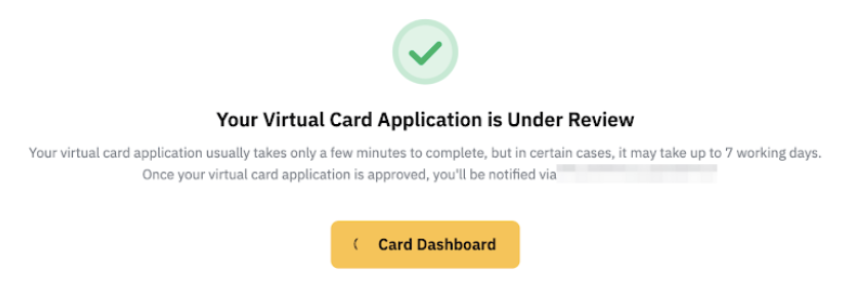

To apply for the Bybit Card, log in, open the Card Dashboard, submit identity and address documents, and wait for review (typically up to seven business days). For activation, set your billing address, mobile number, and security questions in the app. Virtual cards become active automatically once verification is complete; a physical card activates after delivery and PIN setup.

Fund your account with at least 100 EUR or equivalent crypto via deposits or buys.

Integration with Digital Wallets

The Bybit Card supports Apple Pay, Google Pay, and Samsung Pay, letting you add the virtual card to your preferred mobile wallet and start tap-to-pay in seconds. These integrations make contactless and online purchases fast and seamless.

Bybit Card Fees Explained

The Bybit charges no annual or inactivity fees.

Foreign transaction fees are 0.5% in the EEA and Switzerland, 1% in Australia, and up to 7% in Argentina, applied on top of Mastercard’s wholesale rate.

Crypto-to-fiat conversions incur a 0.9% conversion fee (minimum 1 EUR/USD).

ATM withdrawals are free up to the monthly allowance (e.g., €100 in the EEA) and then 2%.

Issuance is free for virtual cards; physical issuance or replacement typically costs €5–€10. Exchange rates use Mastercard’s base rate, with regional FX padding that can range from 0% to 5%.

| Fee Type | EEA & CH | Australia | Argentina | Brazil | AIFC | Asia Pacific | Mexico |

| Foreign Exchange Fee | 0.5% (on Mastercard rate) | 1% | 7% | 1.5% | 2% | 2% | 0.5% |

| Crypto Conversion Fee | 0.9% (min 1 EUR/USD) | 0.5% | 0.9% (min 5,000 ARS) | 0.9% (min 10 BRL) | 0.9% (min 1 USD) | 0.9% | 0.9% |

| FX Padding | 0% | 5% | 3% | 0% | 0% | 2% | 0% |

| Annual Fee | None | None | None | None | None | None | None |

| Inactivity Fee | None | None | None | None | None | None | None |

| Card Cancellation Fee | None | None | None | None | None | None | None |

| Card Issuance/Replacement | Virtual: None; Physical: 5 EUR/USD | Virtual: None; Physical: 29.99 USD | Virtual: None | Virtual: None | Virtual: None | Virtual: None | Virtual: None |

| ATM Withdrawal Fee | 2% (after 100 EUR monthly free) | 2% (after 100 USD monthly free) | 2% (after 95k ARS monthly free) | 2% (after 550 BRL monthly free) | None | 2% (after 100 USD monthly free) | None |

Bybit Card Limits: Spending, Withdrawal, and Increases

Bybit Card limits vary by region and tier (1-3, based on VIP level).

| Region/Tier | Per Transaction | Daily Limit | Monthly Limit | Annual Limit | ATM Daily | ATM Monthly |

| EEA/CH Tier 1 | 5,000 EUR | 5,000 EUR | 10,000 EUR | 60,000 EUR | 2,000 EUR | 2,000 EUR |

| EEA/CH Tier 2 | 5,000 EUR | 10,000 EUR | 25,000 EUR | 125,000 EUR | 2,000 EUR | 5,000 EUR |

| EEA/CH Tier 3 | 5,000 EUR | 15,000 EUR | 50,000 EUR | 250,000 EUR | 2,000 EUR | 10,000 EUR |

| Australia | 13,500 USD | 13,500 USD | 27,000 USD | 270,000 USD | 600 USD | 1,800 USD |

| Argentina | 1,000 USD | 5,000 USD | 10,000 USD | 50,000 USD | N/A | N/A |

The Bybit shares daily and per-transaction limits across both virtual and physical cards. ATM withdrawal rules include a cap on the number of cashouts (e.g., up to 10 per day in the EEA). Contactless thresholds follow PSD2—€50 per tap and €150 cumulative before a PIN is required. To request a higher limit, submit a tier-upgrade application in the dashboard; reviews typically take up to seven business days. Otherwise, spending limits are fixed and cannot be adjusted.

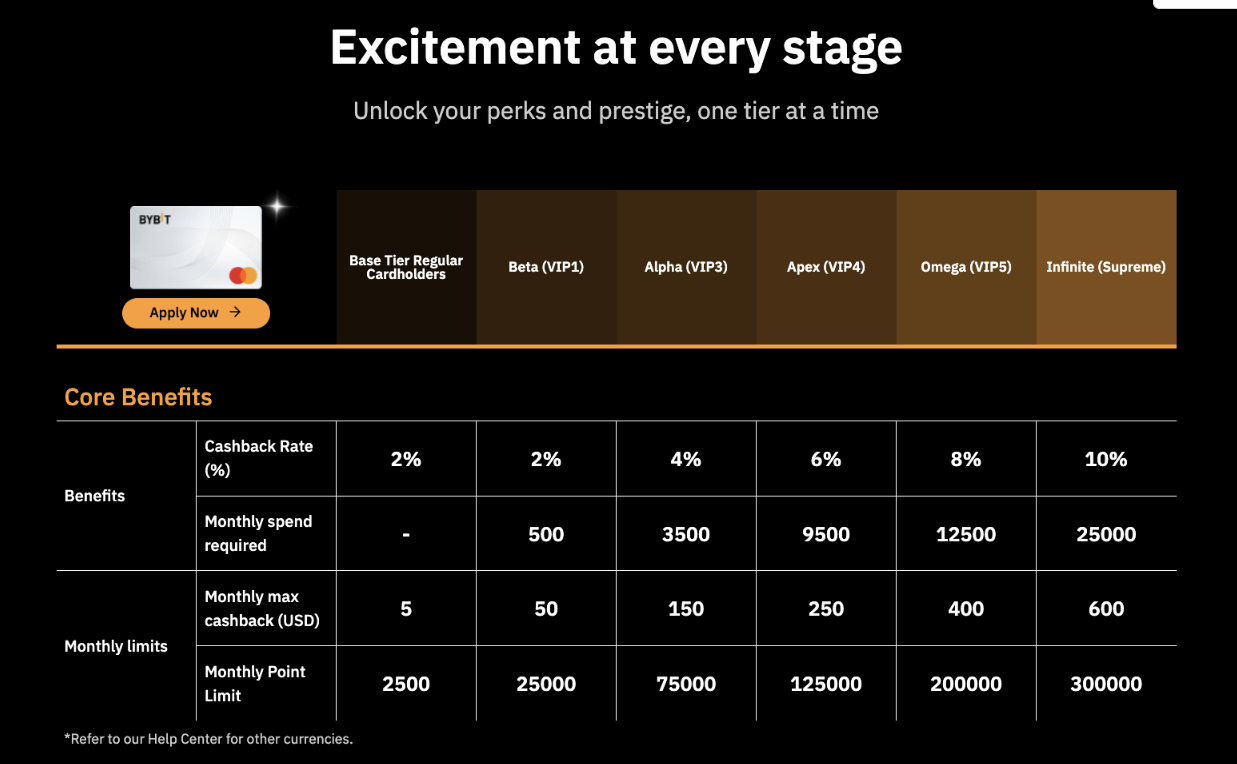

Bybit Card Cashback and Rewards

The Bybit offers tiered cashback of roughly 2–10%, paid in USDT or reward points redeemable for perks. Higher VIP tiers unlock extras such as up to 100% rebates on select subscriptions (e.g., Netflix, Spotify) and limited-time event boosts (e.g., 20–30% on Tomorrowland tickets). Reward points don’t expire, and category multipliers can reach up to 50× on eligible spends. Terms, rates, and availability vary by tier and region.

Using the Bybit Card: Top-ups, management, troubleshooting

The Bybit Card draws spending from your Funding Account, so first add funds by depositing or buying crypto in the app; no separate wallet is required. Top-ups are automatic—once the balance is available, the card can be used immediately.

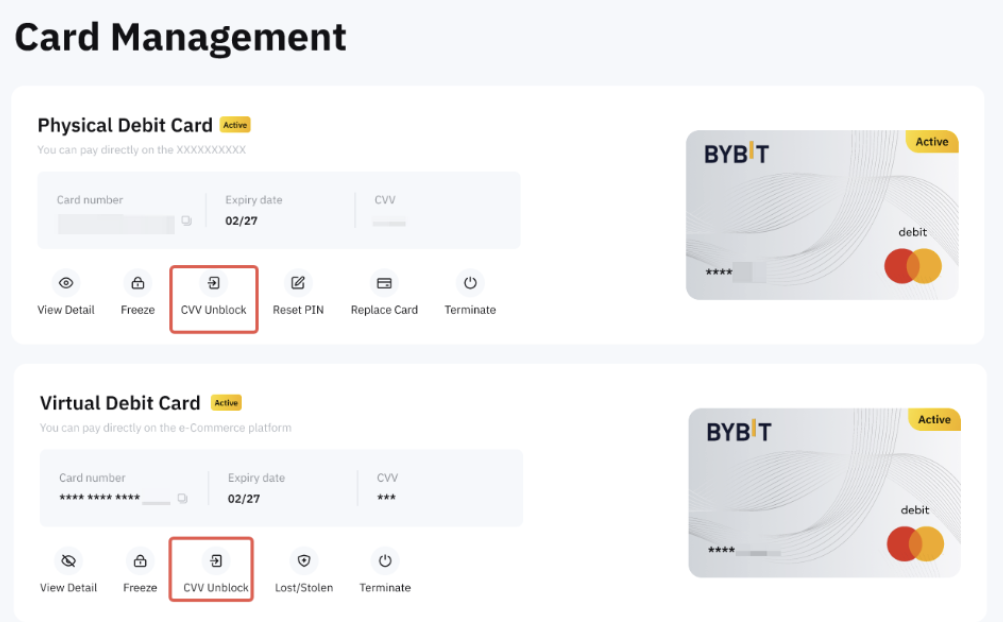

- Freeze / unfreeze: Instant via app for security.

- Cancel / close account: Via Card Management; reapply limits apply (3/day, 16/month).

- Lost or stolen: Report immediately for replacement (fee may apply).

- Delivery tracking: VIPs via DHL; standard up to 30 days.

If a transaction is declined, check available funds, limit usage, and activation status. To reset contactless after repeated offline taps, perform a chip-and-PIN transaction. Customer support is available via in-app chat, email, or the web form.

Pros and Cons of the Bybit Crypto Card

Pros:

- High cashback and rewards.

- Low fees and global acceptance.

- Strong security and MiCA compliance.

- User-friendly with auto-conversions.

Cons:

- Limited crypto support (only 6-8 assets).

- Geographic restrictions.

- Conversion fees add up for frequent crypto use.

Compared to competitors like Crypto.com or Nexo, Bybit excels in rewards but lags in altcoin variety. User experiences on X highlight smooth interfaces and reliable support, though some note FX fees.

| Card | Cashback/Rewards | Supported Cryptos (Number/Key Examples) | Fees (Conversion/FX/ATM/Issuance) | Limits (Daily/Monthly/Annual Example for Base Tier) | Availability (Key Regions) | Pros | Cons |

| Bybit Card | Up to 10% in USDT/points; VIP bonuses (e.g., 100% rebates on Netflix/Spotify) | 5-8 (BTC, ETH, XRP, USDT, USDC, TON) | 0.9% conversion; 0.5% FX (EEA); 2% ATM after €100/month; Physical: €5; No annual/inactivity | €5,000/€10,000/€60,000 (EEA Tier 1) | EEA (excl. some), Switzerland, Australia, Argentina, Brazil | High cashback; No staking required; Auto-savings interest; Apple/Google Pay integration; Low overall fees | Limited cryptos; Conversion/FX fees add up; Physical issuance cost; Regional restrictions |

| Crypto.com Visa Card | 0-3%+ (tier-based, e.g., 3% for mid-tiers); Perks like Spotify rebates | 100+ (BTC, ETH, CRO, many altcoins) | Variable conversion; No annual; Limited free ATM ($200-1,000/month); 0.1% Lightning fee | Varies by tier (e.g., $10,000 daily for mid-tier) | Global (Visa-accepted) | Tiered perks (lounge access); Broad crypto support; Global reach; No annual fees | Staking CRO required for rewards; Variable fees; No fiat back-transfer |

| Coinbase Card | Up to 4% in cryptos | 3+ (BTC, ETH, USDC) | Network transaction fees; No annual/spending; ATM operator fees | Not specified (flexible, linked to bank) | Europe, UK, US (rewards US-only) | No fees for basics; Flexible funding (bank/paycheck); Strong security (2FA) | Low rewards; Limited cryptos; Network fees; Rewards limited to US |

| Nexo Card | Up to 2% in NEXO or 0.5% BTC; Up to 14% interest on assets | 6+ (BTC, ETH, USDT, EUR/GBP/USD stablecoins) | Borrowing 2.9-18.9% (credit mode); ATM free up to €2,000/month, then 2%; Free issuance with min deposit; No annual | Not specified (high for Gold tier) | EEA, UK | Dual credit/debit modes; Earn interest on idle assets; Free ATM up to limit | Borrowing rates; Tier-based (needs NEXO tokens); Limited regions |

| Binance Card | Up to 8% in BNB (tier-based) | 100+ (BTC, ETH, BNB, many altcoins) | 0.9% conversion; No annual; ATM fees vary (free up to certain amount) | Up to €8,700 daily (base) | EEA, select global | High rewards; Vast crypto support; Binance ecosystem integration | Regulatory issues in some regions; Fees on high-volume; Less perks |

Final Verdict on Bybit Mastercard Card

Overall, the Bybit Card earns a solid 9/10 in 2025 reviews for its rewards, ease, and integration. It’s ideal for Bybit users in supported countries seeking a reliable crypto card. If you’re ready to apply, head to Bybit’s dashboard—just ensure you meet eligibility and understand regional fees.