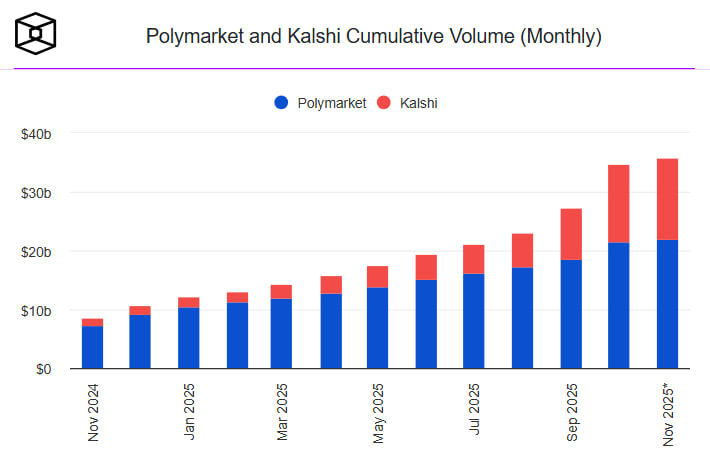

In October, the decentralized prediction market Polymarket experienced a powerful surge in activity. The platform recorded a record number of users, increased trading volumes, and the launch of thousands of new markets. However, in terms of total volume, it still lags behind its American competitor Kalshi, which continues to dominate the niche.

Record month for Polymarket

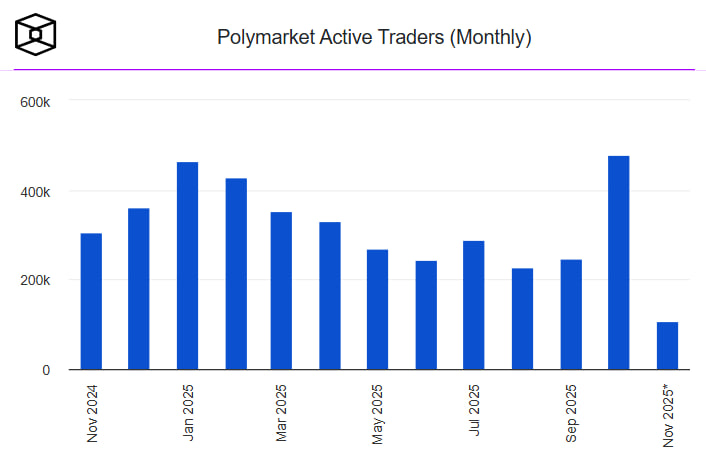

According to The Block, the number of active traders on Polymarket reached an all-time high of 477,850 people. This is higher than the previous record of 462.6 thousand, set in January, and almost twice as much as in August, when the figure dropped to 227 thousand.

Trading volume grew to $3.02 billion, exceeding the $3 billion mark for the first time after seven months of stagnation. The number of new markets reached 38,270 — almost three times more than in August.

LVRG Research director Nick Rak explained the surge in interest as a combination of factors:

“Traders have started using Polymarket as a tool for arbitrage, liquidity provision, and event trading. Thanks to decentralization and open access, the platform has become more like an options market tied to events.”

He noted that user sentiment is now completely different from a year ago, when Polymarket was mainly associated with political and sports betting.

The effect of the expected token

Interest in the platform was also boosted by the announcement of the upcoming launch of its own token, POLY. According to the marketing director, the token launch and airdrop are scheduled for the end of November.

The announcement became a catalyst for activity — users began to actively participate in trading, hoping for token distribution among early participants. A similar dynamic was previously observed with other DeFi projects, where the promise of an airdrop stimulated a massive influx of new accounts.

Return to the US market

Another growth factor is the upcoming return of Polymarket to the US. The company plans to complete the relaunch by the end of November.

Earlier, in 2022, the platform left the US market after a dispute with the Commodity Futures Trading Commission (CFTC), paying a $1.4 million fine. Now the regulator has taken a softer stance, viewing prediction markets as a “new form of information finance.”

If the relaunch is successful, it will be an important milestone in the project’s development and will strengthen its position in the competition with Kalshi.

Kalshi maintains leadership

Combined monthly volume of Polymarket and Kalshi

Despite Polymarket’s record, Kalshi remained the largest platform in the segment, recording a trading volume of $4.4 billion in October. The company strengthened the positions it had gained a month earlier.

According to Bloomberg, Kalshi is in talks with venture funds for new investments that could raise the company’s valuation to $12 billion. In October, the startup already raised $300 million at a $5 billion valuation.

What’s next?

The growing interest in prediction platforms shows that the market is moving from event betting to a full-fledged financial infrastructure, where information becomes an asset.

Polymarket is gaining momentum thanks to the token and its return to the US, but Kalshi still sets the pace. Experts believe that competition between them will intensify in 2025, when prediction markets finally become part of the financial mainstream.

Read more: DEX trading volume hit a record $613 billion in October