AI crypto signals are machine-generated trade prompts produced from price, volume, derivatives, order-book, on-chain and sentiment data. Traders like them because they scale, work 24/7, and can filter noise. In this guide you’ll learn how signals are built, how to judge providers, how to connect signals to bots safely, and how to paper-trade before risking capital—without the hype.

What Are AI Crypto Signals?

An AI crypto trading signals system ingests multiple data sources and outputs structured trade ideas (e.g., “Long BTC at 104,250, SL 103,520, TP 115,900”). Typical inputs:

- Price & volume (returns, volatility, momentum)

- Derivatives data (funding rates, open interest, liquidations)

- Order-book signals (depth, imbalance, iceberg detection)

- Labeled on-chain flows (exchange inflows/outflows, whale wallets)

- Text & sentiment (news headlines, Reddit/X chatter)

Some providers add market-regime filters to avoid choppy ranges; others push “AI” branding over simple rules, so inspect methodology. Neutral guides and roundups map the space but rarely prove efficacy—use them only to discover candidates.

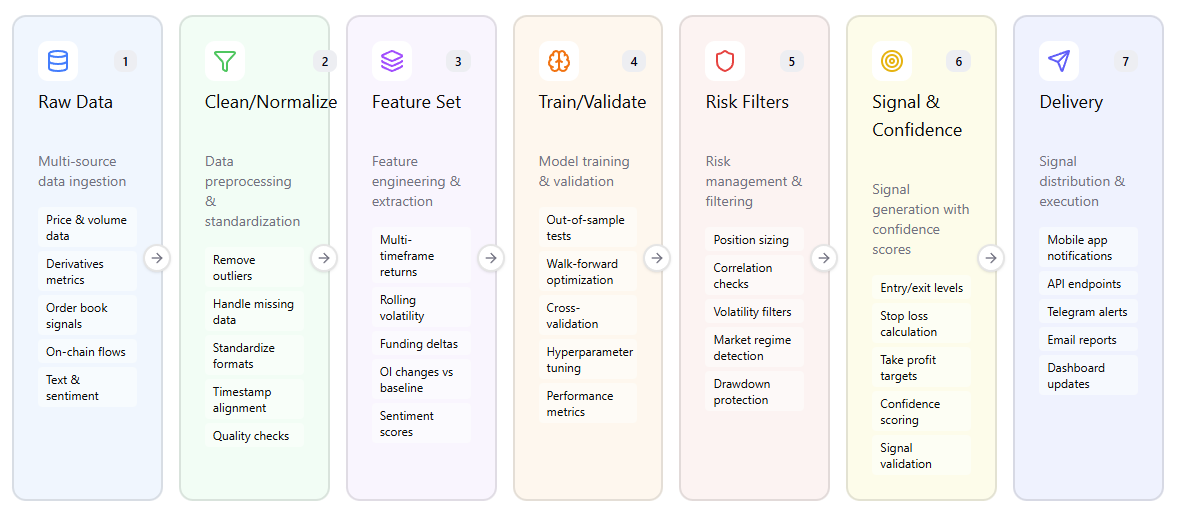

How Models Generate Signals

Do AI Signals Work? (Expectations vs. Reality)

Strengths vs. Limitations

AI helps with speed, scale, and consistency, but rules still apply.

| Risk/Property | Why it matters | Impact if ignored |

| Overfitting | Model learns noise, not signal | Equity curve collapses OOS |

| Market drift | Regimes change (vol, liquidity) | Edge decays, rising drawdowns |

| Latency & slippage | Delay from alert → fill | R:R worsens, PF drops |

| Data quality | Bad or delayed feeds | False signals, mis-labels |

| Black-box risk | No method transparency | Unverifiable performance |

| Position sizing | Edge < fees without sizing | Profitable model, unprofitable trader |

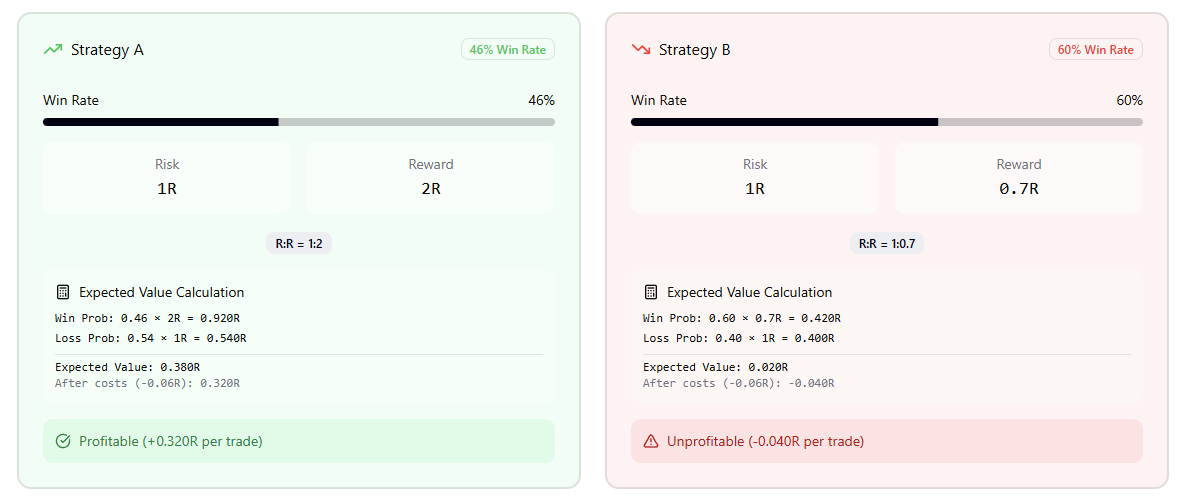

Why Win-Rate ≠ Profit

A system with 45% win-rate can outperform a 65% system if its average risk:reward is higher and costs are controlled. Always include fees and realistic slippage; a “paper edge” can vanish live.

Evaluating a Provider (Checklist)

Track Record & Reporting

Require an equity curve, sample size, max drawdown, and a benchmark (e.g., BTC buy-and-hold). Treat listicles as maps, not proof; most lack rigorous OOS and drawdown disclosure.

Methodology Transparency

Ask for: data sources, labeling scheme, validation splits, slippage assumptions, retraining cadence. Token/platform blogs are vendor-skewed—attribute and verify.

Security & Compliance

Look for minimal-scope API keys, storage practices, revocation and audit logs. Be skeptical of “guaranteed” returns; reputable media keep documenting scam ads and fake “AI trading” promotions—link a warning near any claims.

Pricing & Value

Compare tiers, refund policy, supported exchanges, and signal frequency/caps. Verify on the vendor page before paying.

Quick checklist

| Criterion | What to see |

| Archives | Public, immutable, time-stamped calls |

| Metrics | PF, max DD, CAGR vs BTC/ETH |

| Assumptions | Fees/slippage baked into stats |

| Security | API Read-only by default, IP allowlist |

| Support | Docs, webhook/API recipes |

| Price | Clear tiers; trial or paper feed |

Implementation: From Signal to Execution

Manual vs. Automated Flows

Manual: Signal → human review → order.

Automated: Signal → alert → webhook/API → bot executes with pre-set risk rules. Consumer explainers cover both; choose based on experience and capital at risk.

Connecting Signals to Bots (TradingView alerts, webhooks, API keys)

Use read-only keys for analytics, restricted trade keys for bots, IP/withdrawal whitelists, and rotate keys; leaks happen.

Risk Controls (position sizing, max DD, kill-switch, latency)

Set fixed risk per trade (0.5–1.0%), a global drawdown cap (e.g., −10–15%), enable a kill-switch on abnormal slippage/connectivity errors, and log signal time → route → fill to monitor latency.

Best AI Crypto Signals: Top Providers and Real-World Performance

Bot/Automation Platforms (overview)

3Commas / Bitsgap: AI grid/DCA bots, copy features, exchange integrations.

Coinrule / CryptoHopper: rule builders, template strategies, alerts.

Pionex / TradeSanta: AI exchange-linked bots, simple automation.

AI-Signal Providers

IntoTheBlock — Predictions & Actionable/On-Chain Signals: deep-learning hourly direction and daily on-chain signals; documented categories (on-chain, exchange, derivatives). Coverage is selective—verify asset list and accuracy disclosures.

Nansen — AI Signals Dashboard + Nansen AI agent: real-time AI signals and a new agent interface on top of labeled on-chain data; use as idea feed, then paper-trade.

SYGNAL.ai — Signal Packages & audit tooling: aggregates quant strategies; offers blockchain-logged track-record and signal packages—still demand equity curves and OOS.

CoinScreener.ai — AI signals & “Top Trader” tracking: web/app product providing AI signals and whale/top-trader alerts; verify methodology and live stats.

AlgosOne — AI crypto signals explainer/vendor POV: useful for definitions and positioning; treat performance claims as marketing unless verified.

CryptoRobotics — “AI Alpha” signals (inside platform): provides pricing/features; bold returns claims require paper-trading first and data checks.

Exchanges with Built-In AI Signals (not bots)

Bybit — TradeGPT (incl. Telegram bot): “real-time market analysis and timely trading signals” via bot and terminal features—ask for performance reporting before automating.

BingX — AI Agent / AI Master: exchange-native AI with recommended strategies and backtest views (per BingX content); still validate live vs. backtest.

Binance — Wallet Trading Signals (Smart Money / KOL / Sentiment): AI/on-chain-powered signal notifications inside the wallet. Useful for discovery; not a full entry/SL/TP system.

OKX — Signal Trading & Signal Marketplace: subscribe/publish signals and wire them to a Signal Bot for execution—demand per-signal equity curves and fee assumptions.

Bitget — Onchain AI Signals (multichain module): AI-powered on-chain signals across ETH/SOL/BSC/Base in the Bitget Onchain product. Validate liquidity/latency on small caps.

LLM-Powered Routes (build your own signals)

OpenAI (Assistants/Actions): function-calling + Actions let you fetch data, engineer features, score a trade, then post a webhook to your bot. Keep risk logic outside the model.

xAI Grok API: Grok models with API compatibility; useful for reasoning over multi-source inputs and live sentiment from x.com — still add hard execution guards.

Specialized crypto LLM—ASCN.AI: crypto AI assistant claiming real-time on-chain + sentiment ingestion, “signal cards,” and automation; treat media/write-ups as context, not proof.

Snapshot table

| Provider/Stack | Signal types | Delivery |

| IntoTheBlock | Momentum, on-chain confluence | App/API |

| Nansen | Wallet/on-chain AI alerts | App/API |

| SYGNAL.ai | Trend, mean-revert, breakout | App/Telegram/API |

| CoinScreener.ai | Screeners → alerts | App/API |

| AlgosOne | Trend/volume models | App/Telegram |

| CryptoRobotics | AI Alpha bundles | App/Telegram |

| Bybit (TradeGPT / Signals) | AI market analysis & signals | App/Telegram |

| OKX (Signal Trading / Marketplace) | Expert/algorithmic signal feeds, signal bots | In-app bots/API |

| Binance (Wallet Signals) | Smart Money / KOL / Sentiment AI signals | In-wallet |

| Bitget (Onchain AI Signals) | AI on-chain “smart money” alerts, copy | App/Onchain |

| BingX (AI Agent) | AI assistant & signal helpers | App |

| 3Commas/Bitsgap/Coinrule/etc. | Execution & risk bots | API/Webhooks |

Note: “ai crypto signals telegram” delivery is common; verify archive links. Some offer ai crypto signals free tiers with limited pairs or delays.

FAQs

Are AI crypto signals profitable?

Sometimes—under certain regimes, with costs included, and with strict risk controls. Past results don’t guarantee future returns; mainstream explainers underline this.

What’s a realistic win rate?

There is no universal number. Profitability depends more on risk-reward, position sizing, and execution costs than raw win-rate.

How do I backtest signals?

Use out-of-sample and walk-forward tests; include fees and slippage; then paper-trade before risking capital.

Can I use AI signals on futures?

Yes, but leverage amplifies losses. Use liquidation buffers, hard stops, and smaller risk per trade.

Are Telegram AI signals safe?

Some are legitimate; many are not. Verify track records, avoid guarantees, and trial via paper-trading.

Conclusion & Key Takeaways

- Evaluate methodology, not slogans: demand OOS tests, drawdowns, slippage assumptions, and latency distributions.

- Paper-trade first, then scale cautiously with tight risk caps.

- Automate carefully: alerts → webhook → bot; keep risk logic outside the LLM or vendor black box.

- Verify exchange “AI” features the same way you would any vendor; a wallet or agent UI doesn’t replace audited stats.