After the Fed’s rate cut, Bitcoin once again dipped to the lower boundary of the local range. Buyers who were counting on growth lost out: the volume of long position liquidations approached $1 billion. If the stock market decline intensifies, BTC could lose up to 30% of its value.

BTC/USD on the hourly chart. Source: TradingView

BTC balances on the edge of $107,000

According to TradingView, Bitcoin dropped close to $107,000 — this is the lower boundary of the current range, which is extremely important for the bulls to hold.

The crypto market, like the US stock indices, fell amid another Fed rate cut of 0.25% the day before.

The main macro hope of the week remained a possible trade deal between the US and China, which could cancel new tariffs from November 1. But despite optimistic statements from Donald Trump, there is still no confidence in an agreement.

In a post on Truth Social after meeting with Chinese President Xi Jinping, Donald Trump said that the parties “agreed on many issues”.

“I had a really great meeting with President Xi. There is mutual respect between our countries, and the events of the last few hours have only strengthened this feeling. We reached an agreement on a number of topics, including key ones, and we are already close to the finish line on the rest,” Trump wrote.

XAU/USD on the daily chart. Source: TradingView

Against this backdrop, the stock market opened in the red: both S&P 500 and Nasdaq fell. Gold, on the contrary, went up and once again exceeded $4000 per ounce.

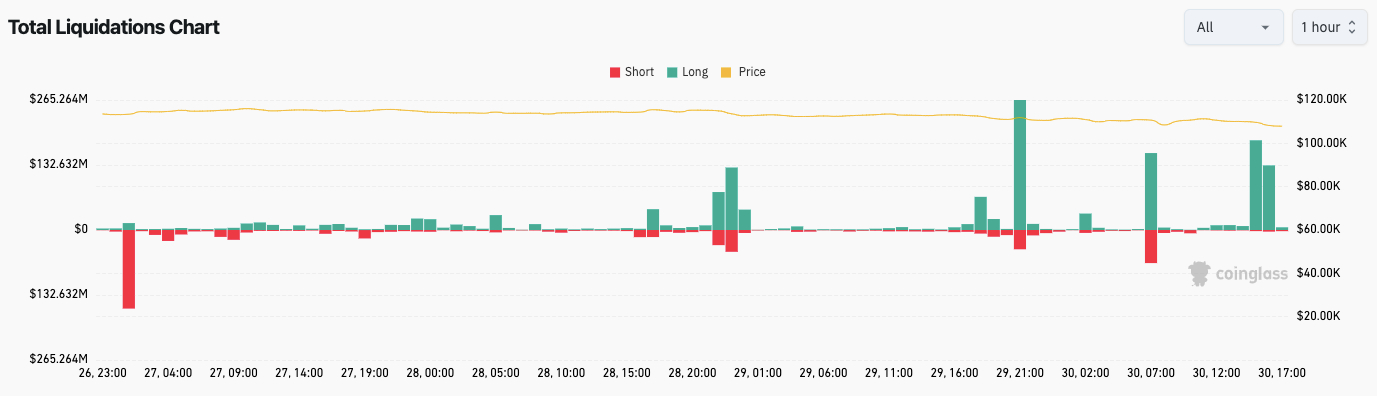

Crypto also couldn’t withstand the pressure: traders who bet on macro optimism were hit by a wave of liquidations. According to CoinGlass, over the past 24 hours, more than $1.1 billion was wiped out from the market.

Crypto market liquidation volumes. Source: CoinGlass

A reversal in stocks is near — and this could hit BTC

Market participants assessed Bitcoin’s current behavior differently.

Some, like trader CrypNuevo, believe that BTC is acting quite normally in the context of the Fed’s decisions.

“No threat to the market structure or trend. The price is simply closing imbalances that appeared this evening,” he wrote on X.

He also noted that Bitcoin closed another “gap” on CME futures that remained after the weekend.

CME Bitcoin futures on the hourly chart. Source: CrypNuevo/X

However, not everyone was so calm. A trader under the nickname Roman warned that BTC is not keeping up with the stock market even during its growth. This means that if stocks reverse downwards, Bitcoin may collapse even more.

See also: CZ sees new risks for the market after Powell’s speech

According to CoinGlass, October may close in the red for the first time since 2018. Bitcoin has only one trading day left to change the situation.

The average growth of BTC in October since 2013 is about 20%, so the current decline clearly stands out from the historical norm.

BTC/USD monthly returns. Source: CoinGlass