The banking division of Sony has applied for a national license that will allow its subsidiary Connectia Trust to conduct a range of cryptocurrency operations. This is stated in official documents.

According to the application, Sony plans to issue stablecoins, create reserves, provide custodial services, and manage digital assets.

In recent months, more and more companies have been applying for a similar license from the U.S. Office of the Comptroller of the Currency (OCC). Among them are payment giant Stripe, crypto exchange Coinbase, and stablecoin issuers Paxos and Circle.

At the moment, the only player to have received full approval from the OCC remains Anchorage Digital Bank. However, even it had to go through issues: in 2022, the OCC issued an order to suspend operations, which was lifted only in August of this year. Since then, regulators’ attitude towards crypto assets has become noticeably softer, and the industry has gained more room to grow.

Sony chooses the right moment

After the adoption of the GENIUS law in the U.S., which established rules for the issuance and circulation of stablecoins, a wave of major players from the tech and finance world entered this field. Stablecoins have become a convenient digital equivalent of the dollar in countries where access to U.S. currency is limited or impossible. They allow for free crypto trading and sending money abroad — without the need to use dollars directly.

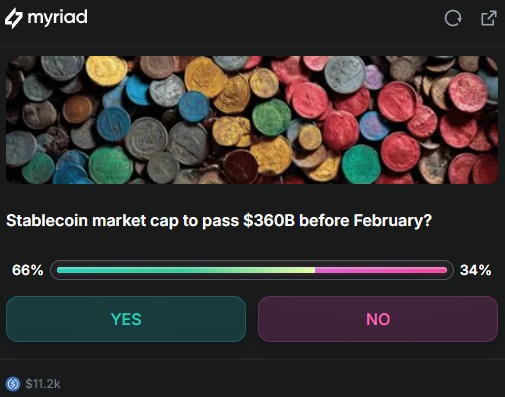

For issuers, this has turned into an extremely profitable business. Major players like Tether and Circle earn billions, and the total market capitalization now stands at $312 billion. According to the prediction platform Myriad, the chances of growth to $360 billion by February 2026 are estimated at 66%. For Sony, this is a very good time to enter the game.

User forecast for stablecoin market capitalization. Source: Myriad

Sony Bank belongs to Sony Group, whose portfolio also includes Sony Interactive Entertainment — the maker of PlayStation. However, the banking division operates independently and is not directly connected to the gaming business. The entire group manages hundreds of companies and subsidiaries around the world.

See also: Binance launched compensation for those affected by the ‘Black Friday’ crash

In the application, the company stated that at the initial stage, Trust Bank plans to focus on digital assets that OCC has already recognized as permissible under current law. These include issuing dollar-pegged stablecoins, holding corresponding reserves, custodial services without trust management, and asset management in the interests of affiliated structures.

Sony’s interest in crypto did not appear yesterday. Last year, the corporation already entered the blockchain market. In cooperation with Startale Group, it launched Soneiun — its own layer-2 network based on Ethereum. The project was announced back in 2023, and the full launch took place in January.