Just finished signup and ID checks on Binance and feeling ready to trade? Pause for a moment, because understanding every category of Binance fees can shape your outcomes far more than many newcomers expect.

Beyond the trading commission itself, you’ll also encounter costs tied to deposits and withdrawals, which should be factored into any plan or risk model you build.

We’ll unpack all of this step by step so you can budget effectively. Fees are periodically updated, so always verify the current schedule on the official resources before committing capital.

Binance Fees

People searching for Binance fees usually intend to operate on Binance, a venue many crypto users favor. Launched in 2017 by Changpeng Zhao, it rapidly became one of the largest cryptocurrency exchanges by volume, with a global audience running into the millions.

Both desktop and mobile apps emphasize ease of use, letting newcomers buy, sell, and swap numerous assets, while power users still find sophisticated tools for order types and analytics.

Security and reliability have become core talking points for the brand, with strong regulatory alignment and infrastructure that prioritizes safeguarding client assets and account access.

Before you place your first order, Know Your Customer verification is required. You’ll typically submit a government ID, documentation confirming your address, and a live photo or selfie to complete checks for a safer environment for everyone [1].

Once that step is done, you can explore all functionality in depth using a comprehensive platform guide, though our focus here remains squarely on Binance fees.

Binance Deposit Fees

Binance deposit charges differ based on whether you fund with cryptocurrency or fiat currency handled via payment rails and banking channels.

When you transfer coins directly, most networks incur no platform fee. One notable exception concerns Terra Classic and TerraUSD, where a 0.5% tax burn is automatically deducted during the on-chain transfer.

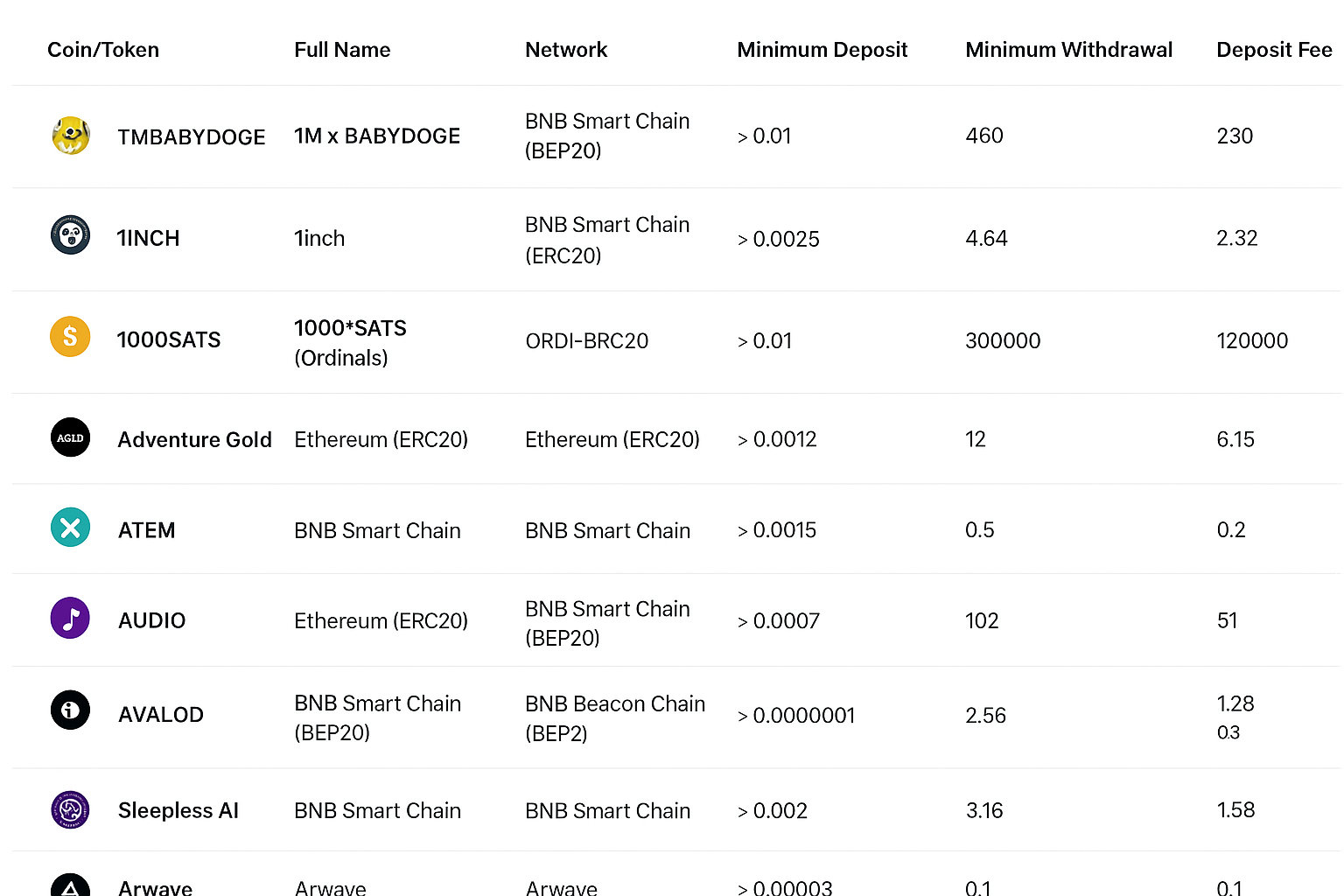

Minimums apply as well, and the threshold can vary depending on the selected blockchain or layer used for the inbound transaction.

Consider Bitcoin as an example: funding via BNB Smart Chain has a minimum of 0.00000002 BTC; using the native Bitcoin network requires at least 0.000006 BTC; the Lightning Network minimum lands at 0.00000001 BTC.

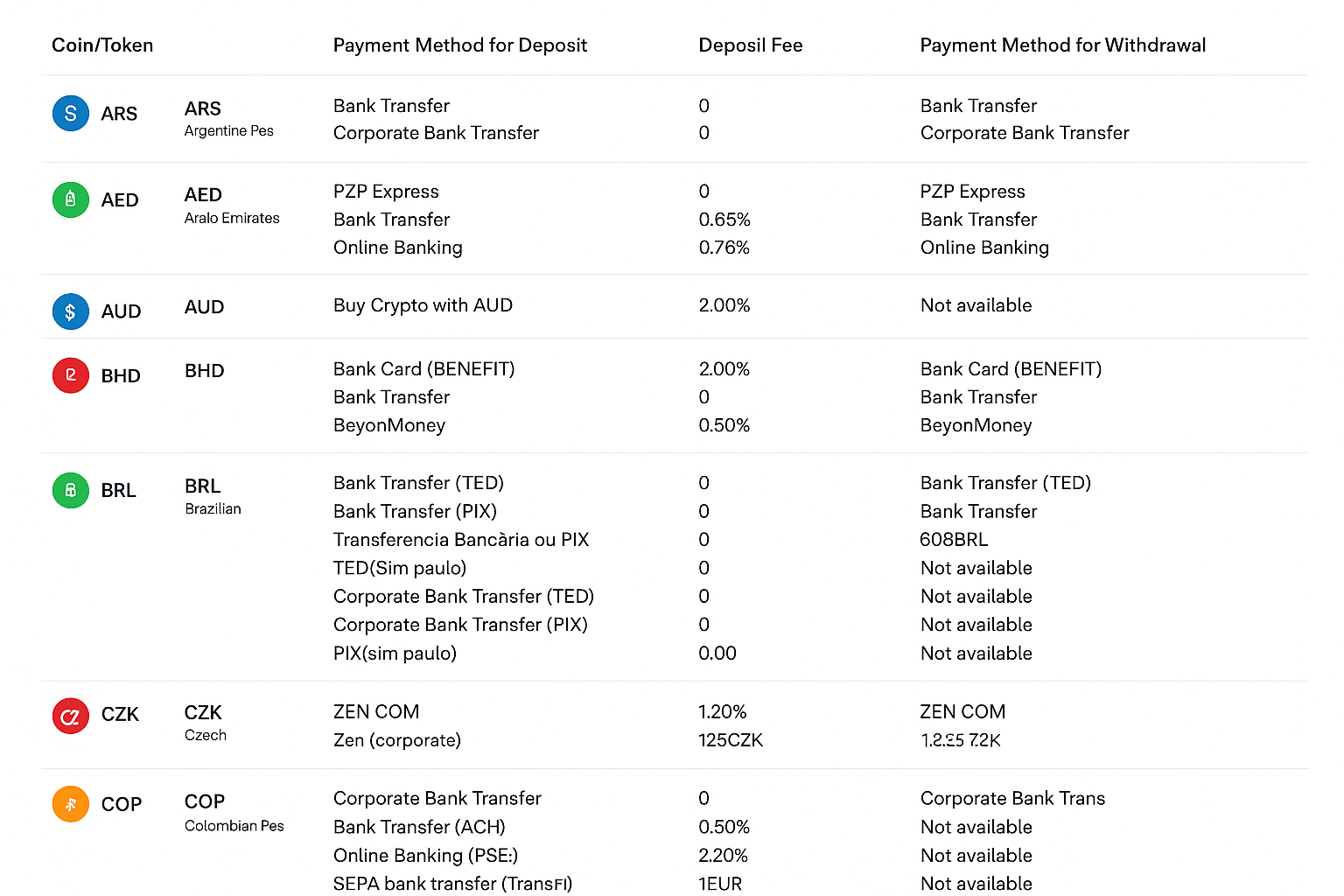

No crypto on hand yet? You can purchase with fiat. Over thirty currencies are supported, such as AUD, EUR, GBP, JPY, IDR, and USD. Some methods are free while others involve modest costs. Illustrative cases include:

- EUR: SEPA bank transfer charged at €1 flat; SEPA Open Banking priced at 0.12%.

- TRY: Binance Transfer at no charge; bank transfer also free.

- USD: Al Salam Bank transfer free of charge.

- JPY: Corporate transfer via SBI free; standard bank transfer free.

- AED: Online banking at 0.65%; bank transfer free.

- IDR: Online banking to USDT set at 10,000 IDR flat; e-wallet to USDT at 2.20%.

If you opt for card funding with VISA or MasterCard, expect a 2% fee per swipe or transaction.

Card purchases also come with minimum size and weekly ceilings. With EUR, for instance, the smallest buy is €10, and the seven-day cap comes in at €5,000.

Availability of local payment methods can evolve due to policy or banking changes. For precise, current information, review the dedicated page that lists Binance deposit and withdrawal fees.

With funding covered, it’s time to look at how withdrawals are priced on the platform.

Binance Withdrawal Fees

Fiat withdrawals on Binance carry different costs and limits depending on the currency and the specific transfer rail utilized. Minimums and fees are region-dependent. Examples include:

- EUR: Minimums range from €1 through €10,000, with fees spanning free to 0.12%.

- IDR: Minimums extend from Rp250,000 to Rp25,000,000, and fees vary from Rp10,000 up to 1.80%.

- UAH: Minimums start at ₴550 and can reach ₴200,000, with charges from free to 5.50%.

Crypto withdrawals operate differently. Charges and thresholds shift with network congestion and conditions, so pricing can move up or down as on-chain traffic changes.

Each asset includes a minimum withdrawal and a fixed fee component. For Bitcoin, the minimum currently sits at 0.0004 BTC, and the flat network fee is 0.0002 BTC, unaffected by the size of the transfer.

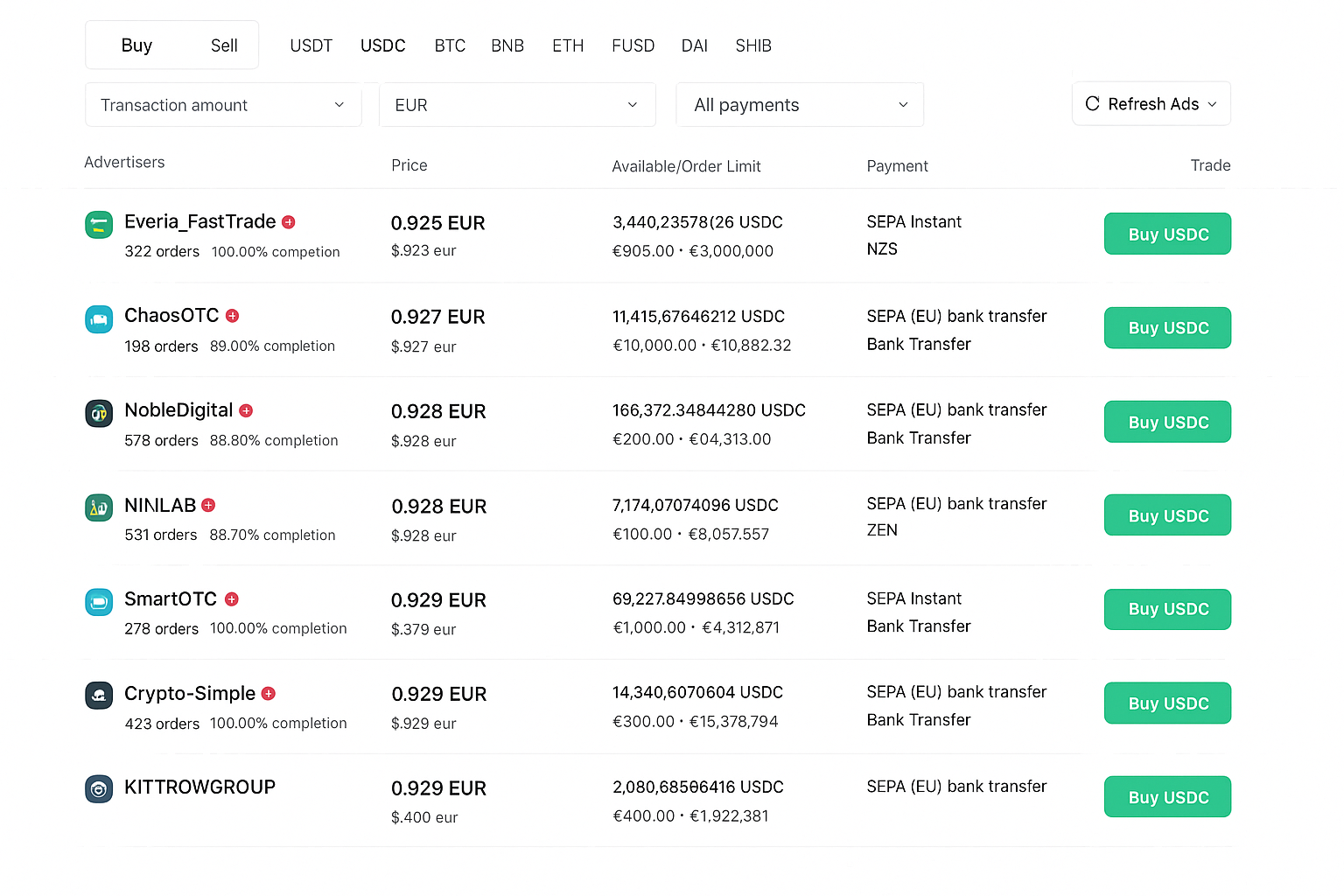

If your preferred fiat option isn’t listed for deposits or payouts, you can switch to Binance P2P, a peer-to-peer desk that lets you transact directly with another participant for greater flexibility.

At present, eight coins are supported there, including USDT, USDC, BTC, and ETH, and you’ll find 700+ settlement methods, even in-person cash exchanges in certain locales.

Many traders use Peer-to-Peer to reduce costs because some counterparties set their fee to zero, a rare perk in this niche. It may be slower than classic channels, but the adaptability and potential savings are compelling.

Binance Trading Fees

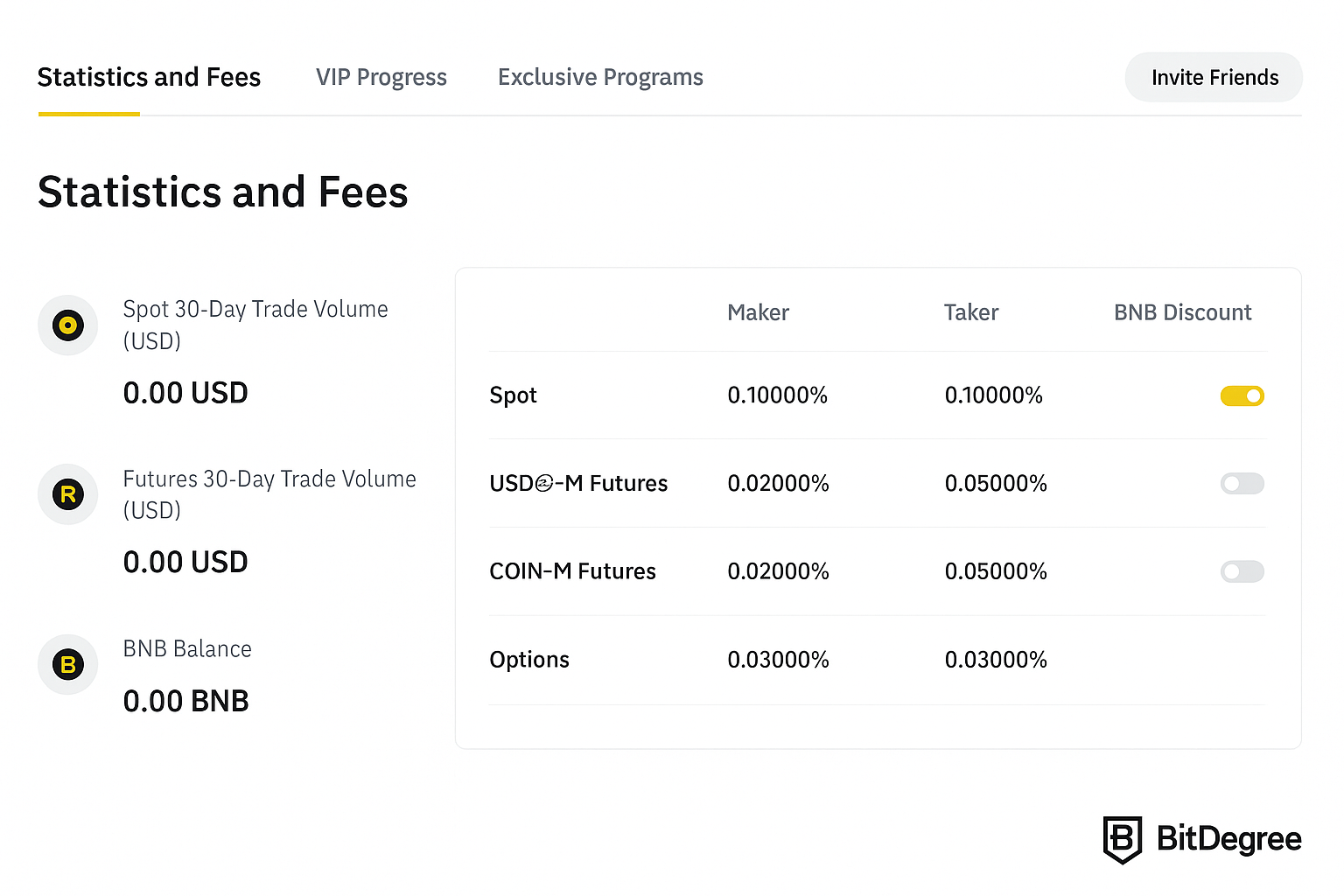

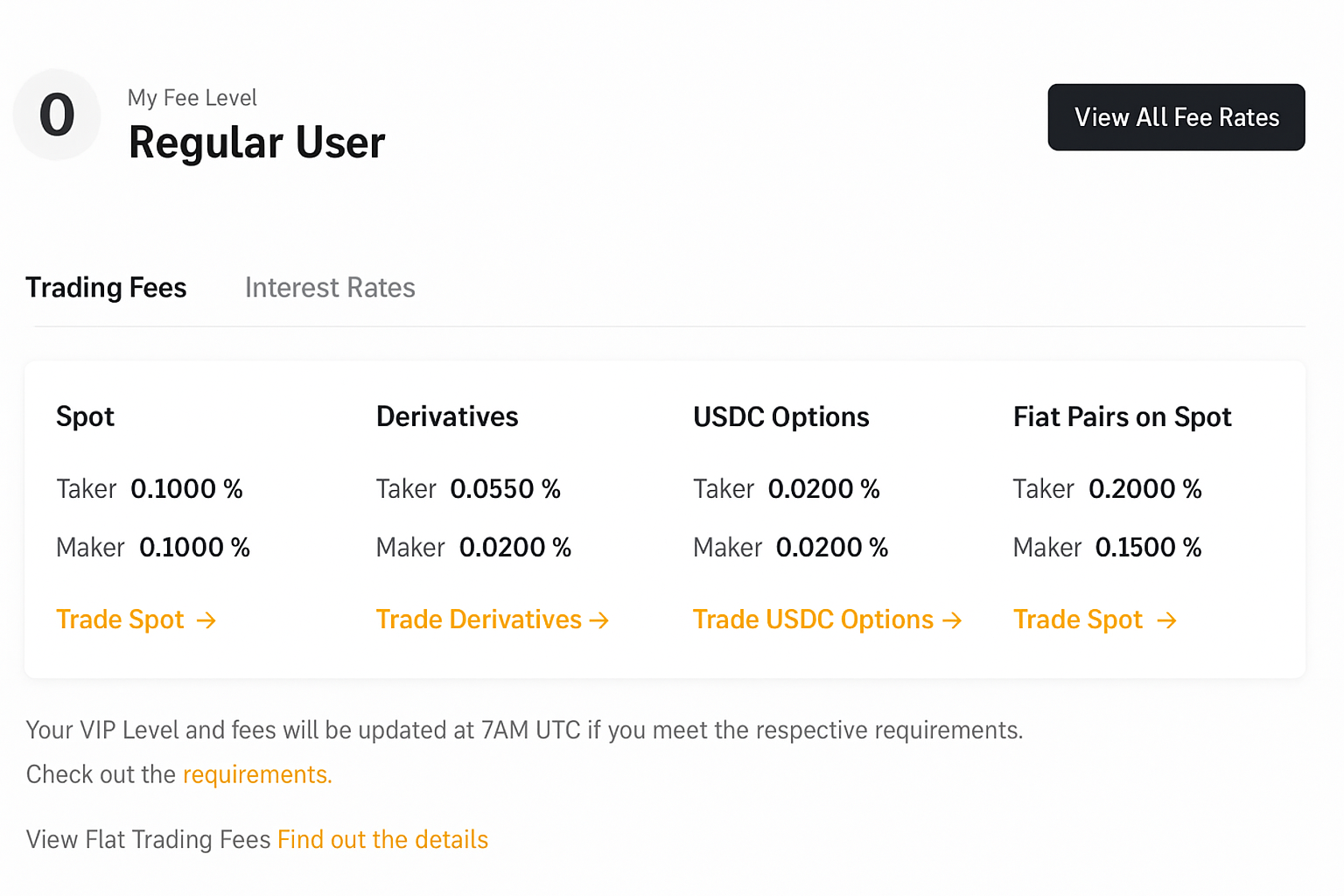

As with most crypto exchanges, Binance trading fees apply per order, calculated as a fraction of the notional value.

Charges differ by product line—spot, margin, futures, options, NFT marketplace, P2P, and fiat pairs—each with its own schedule and liquidity incentives.

Several factors generally influence what you pay: your rolling 30‑day volume, whether you’re a maker or taker, and any active promotions or rebates running at the time.

Makers who post limit orders that add liquidity typically see lower commissions, while takers—whose orders fill immediately and remove liquidity—tend to pay more [2].

Your fee tier is tied to 30‑day turnover. Growing volume can push you into higher VIP levels that come with progressively reduced maker/taker rates.

Promotional campaigns also appear frequently, lowering costs via discounts or cashback programs. Holding BNB can further cut charges—up to 25% off in some categories—benefiting frequent traders.

Let’s drill into the specifics by product so you can benchmark costs across the full suite of services.

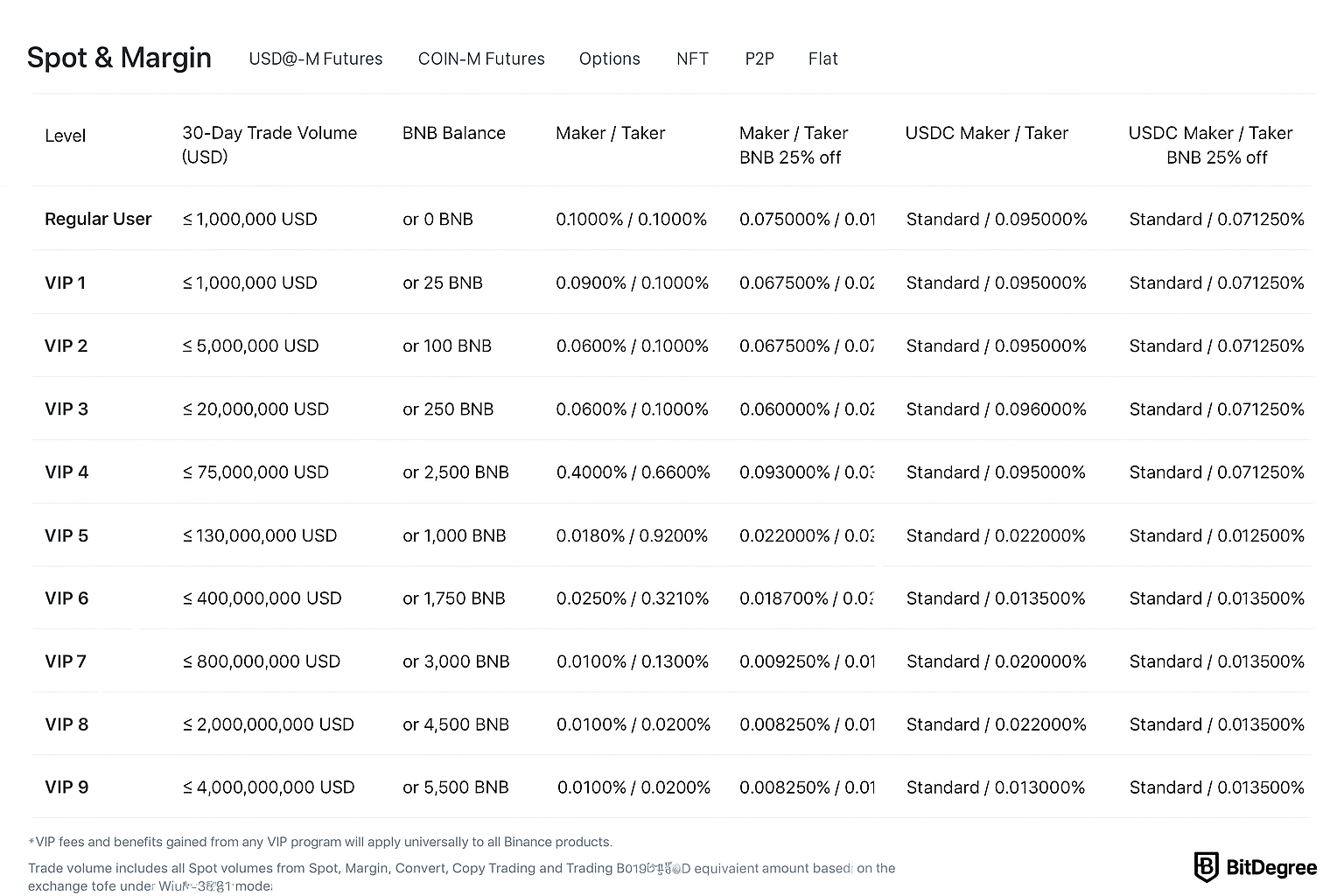

Binance Spot Trading Fees

For regular accounts, spot maker and taker rates start at 0.1%. If you’re trading USDC pairs, makers remain at the standard rate, while takers enjoy a slightly reduced 0.095%.

By increasing your 30‑day turnover and holding BNB, you can push fees much lower, with the top reductions dropping maker to 0.00825% and taker to 0.01725% at elevated VIP tiers.

Binance Margin Trading Fees

Margin trading costs include the trade commission plus borrowing interest. The commission follows a maker/taker structure; standard users start at 0.1%, or 0.075% if paying with BNB due to the 25% discount, while higher VIP levels grant even better rates.

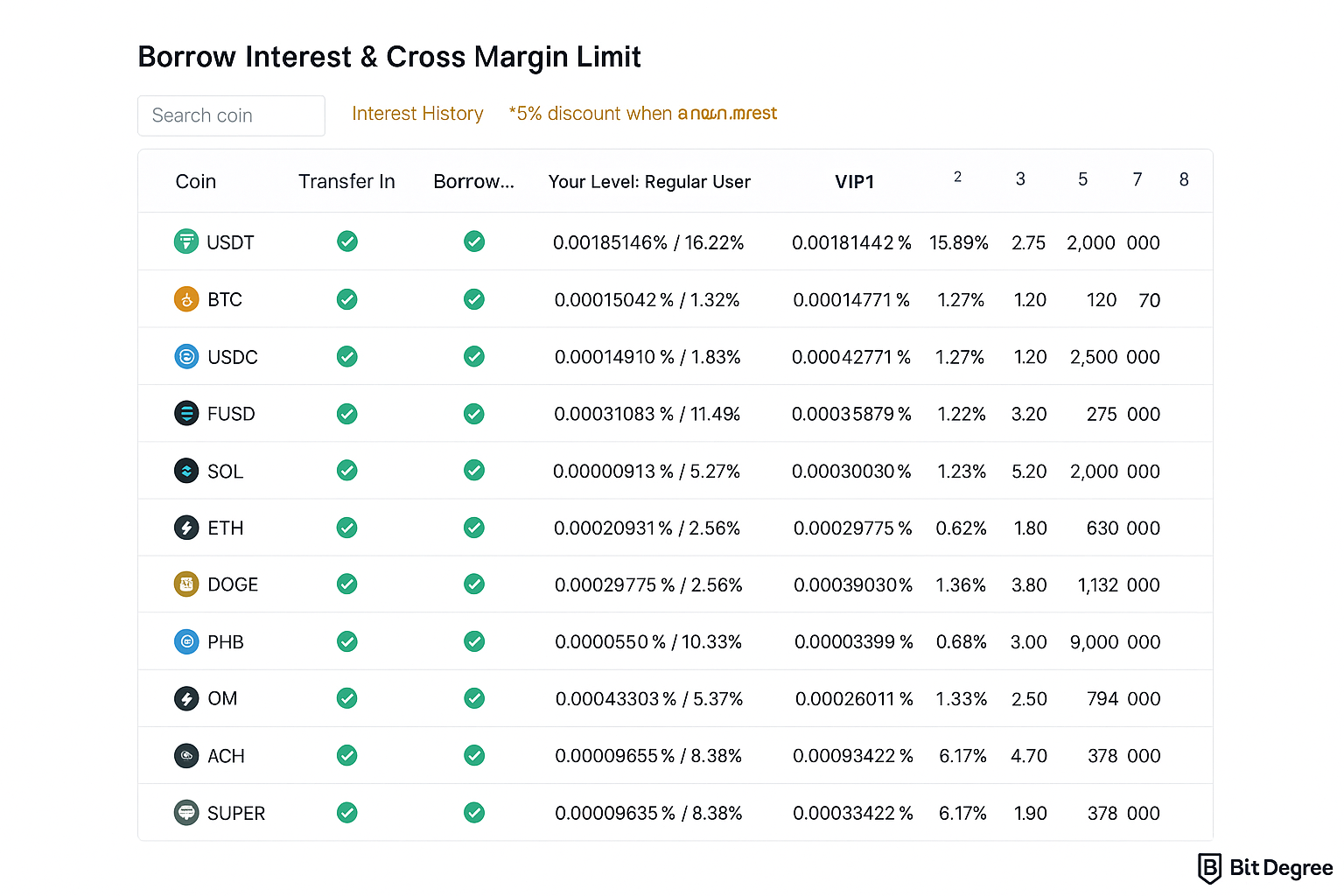

Interest on borrowed assets accrues hourly and depends on the coin. As a guidepost, BTC may carry around 0.00014629% per hour, with ETH a bit higher. Moving up VIP tiers reduces these interest rates, and paying interest in BNB unlocks an extra 5% reduction.

For asset‑by‑asset specifics, consult the margin fee overview where live rates are listed.

Binance Futures Trading Fees

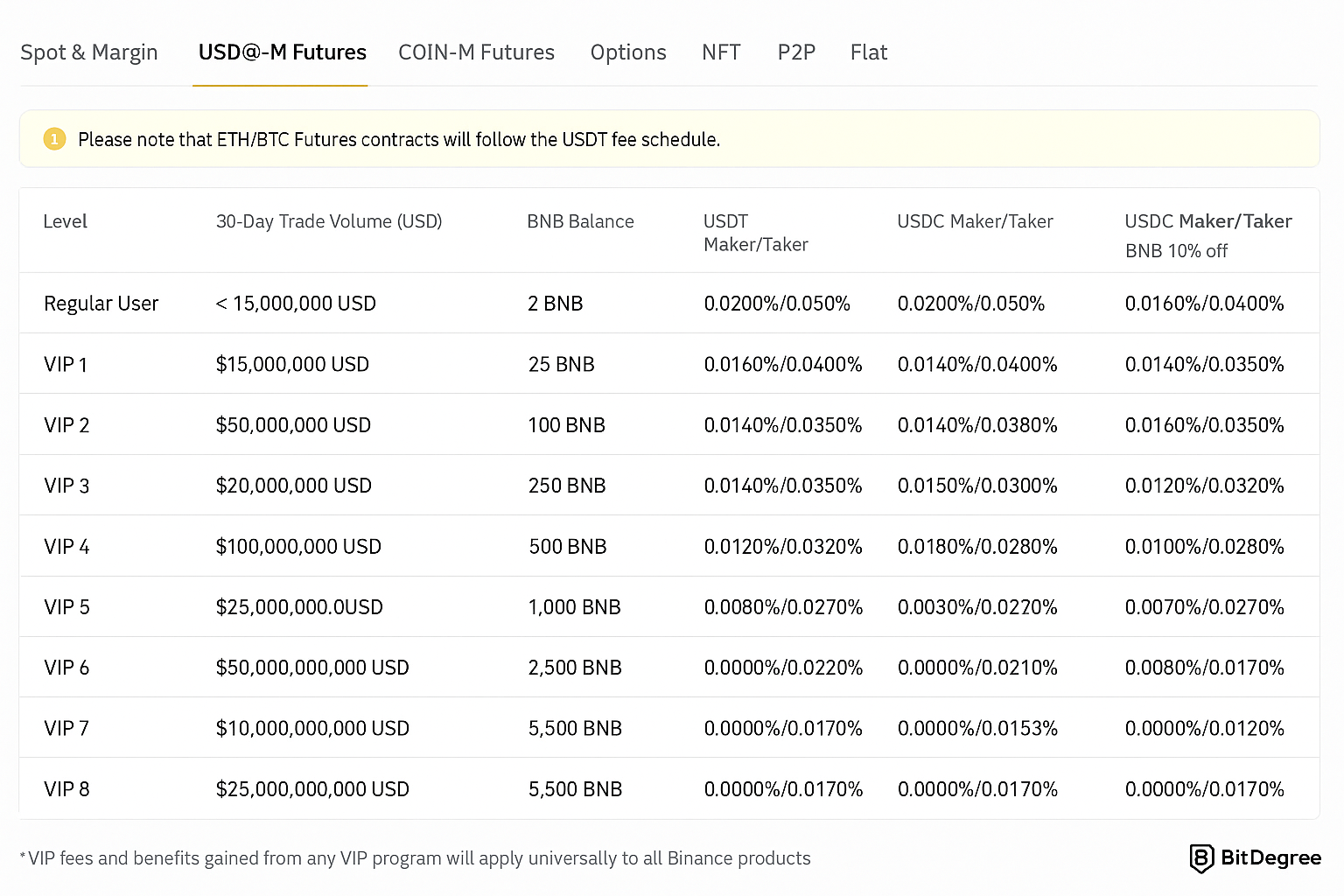

Futures also use maker/taker pricing that scales with your 30‑day volume and BNB holdings.

There are two contract families: USD‑Margined (USD‑M) and COIN‑Margined (COIN‑M), each with its own fee ladder and risk rules.

Base rates for both USD‑M and COIN‑M are 0.02% for makers and 0.05% for takers. At the top VIP level (VIP 9), maker can drop to 0% and taker to 0.017%.

Using BNB to pay fees on USDT‑M, ETH/BTC‑M, and USDC‑M contracts nets an additional 10% discount. Note that COIN‑M products don’t qualify for this particular BNB rebate.

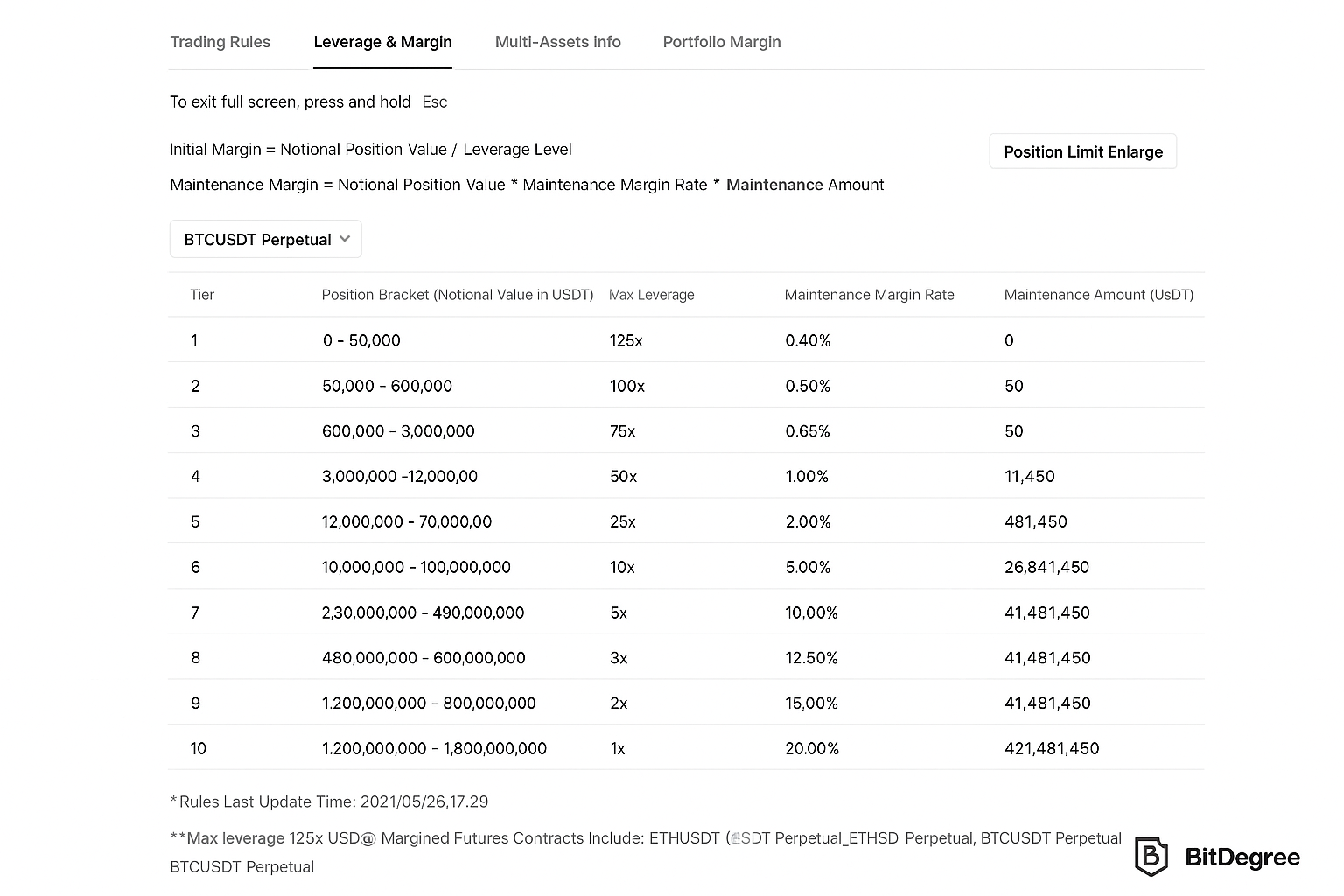

No separate leverage fee is charged. That said, the allowed leverage depends on position size, and the tiering adjusts as your notional grows.

Leverage spans from 1x up to 125x, with larger positions capped at lower multiples. Maintenance margin requirements vary widely, roughly from 0.40% up to 50.00%, depending on contract and size.

Because leverage interacts with liquidation thresholds, consider these boundaries before increasing exposure on derivatives.

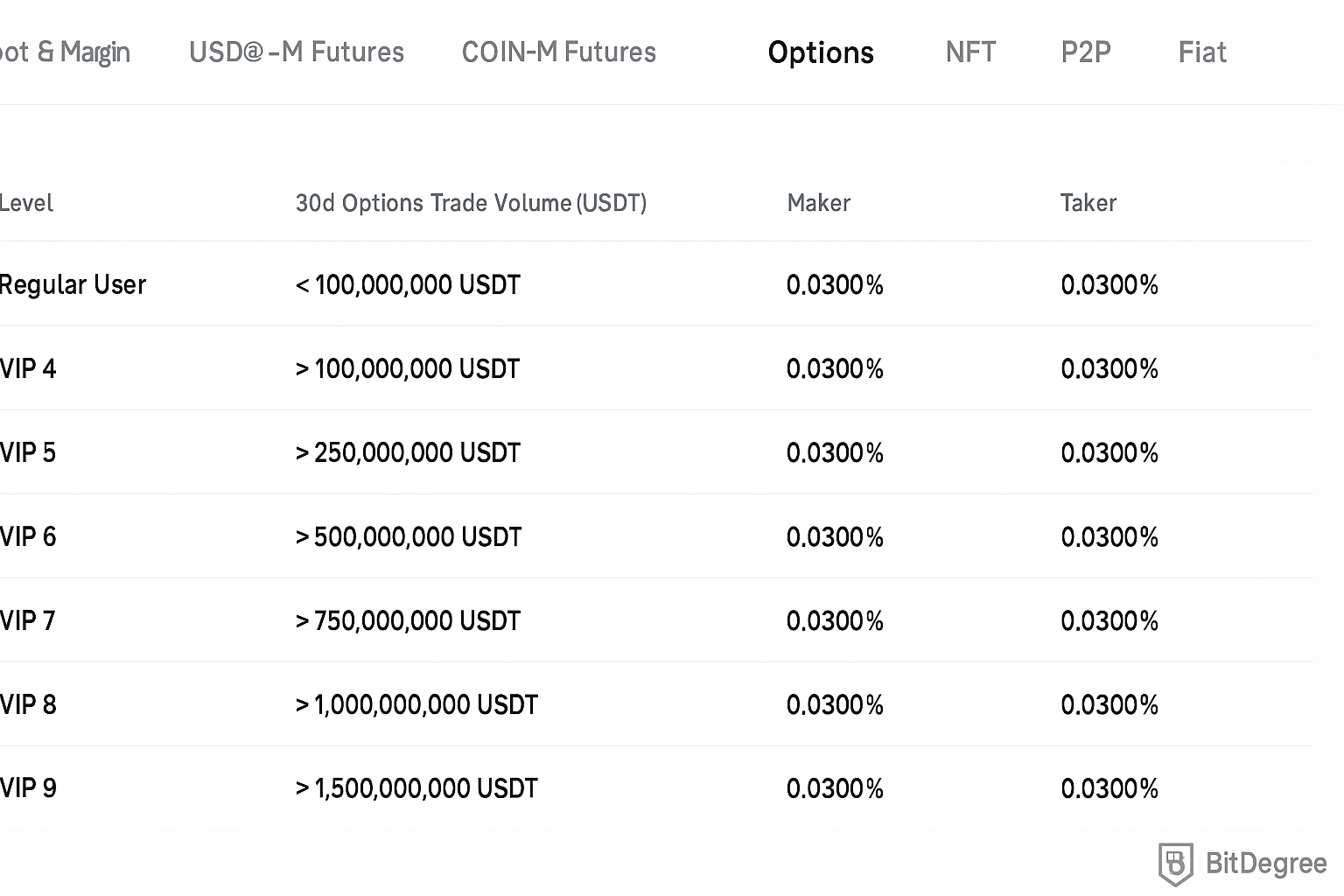

Binance Options Trading Fees

Options carry two cost types: a transaction fee when opening or closing, and an exercise fee if you choose to exercise.

The transaction fee is calculated from the Spot Index at trade time, capped at 10% of the option’s value; maker and taker rates are 0.03% for all users.

Exercising incurs an additional fee based on the settlement price, also capped at 10% of the option’s value, with a rate of 0.015%.

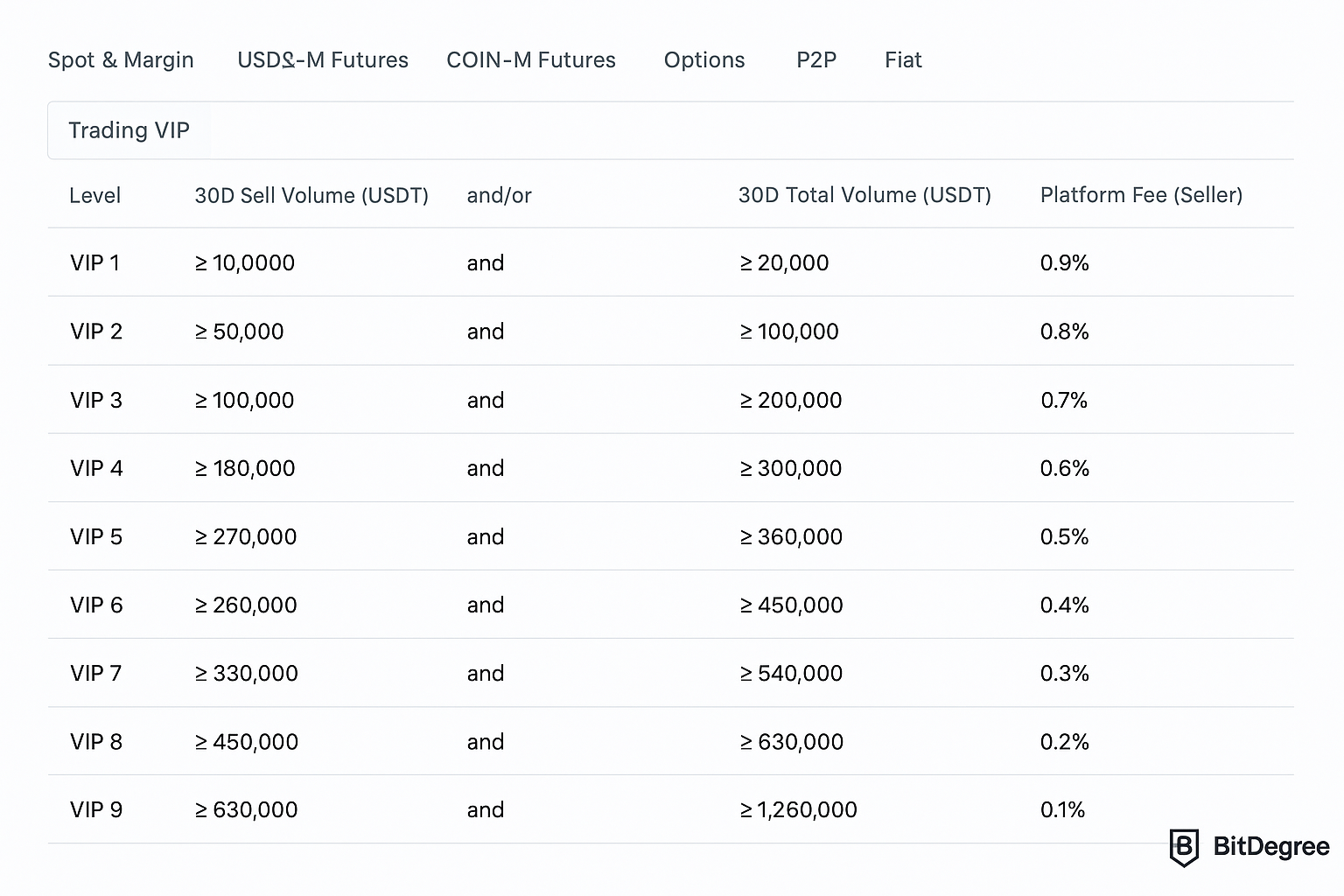

Binance NFT Trading Fees

The Binance NFT marketplace prices align with tiered fees similar to other products. For sellers, the platform fee begins at 0.9% and can shrink as your VIP level increases, potentially reaching 0.1% at the highest tiers.

If you’re primarily a holder of blue‑chip NFTs, a special holding tier applies. Starting at 0.9%, the rate can move down to about 0.6% as your 30‑day NFT valuation grows.

Binance Fiat Trading Fees

For fiat pairs, the tiered schedule starts at 0.1000% for makers and 0.1500% for takers. With higher VIP status, that can fall to 0.0110% and 0.0230%, respectively, and paying with BNB can unlock further discounts.

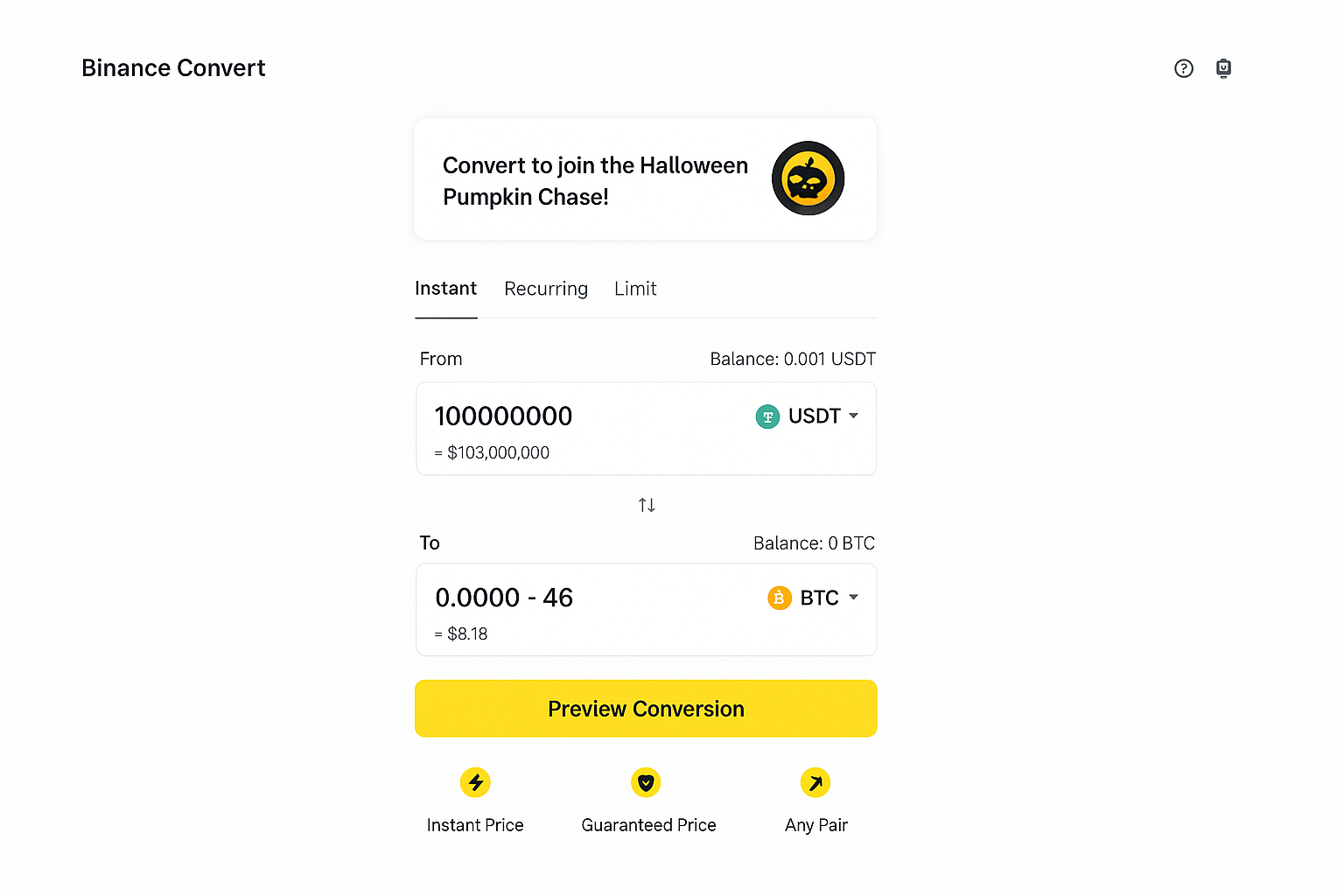

Binance Convert Fees

Those who prefer instant swaps will appreciate that Binance Convert charges no fee. You can exchange assets directly without worrying about extra commissions or order‑book slippage.

Coverage extends to more than 350 cryptocurrencies, enabling over 45,000 conversion routes. This breadth, combined with zero Convert fees, makes it a handy alternative to classic spot trades when rebalancing a portfolio.

Binance Fees Comparison

After mapping out the costs on Binance, comparing against other well‑known platforms can clarify whether Binance transaction fees match your style and volume.

We’ll contrast trading, deposit, and withdrawal pricing with Bybit and Kraken to provide useful context for decision‑making.

Binance Fees VS Bybit Fees

Both exchanges use tiered systems that grant discounts based on activity and balances, though their rules differ in meaningful ways.

On Bybit, you can qualify for a specific VIP tier by meeting either the required asset balance or the trailing 30‑day trading volume—satisfying one criterion is enough.

Imagine you hold $250,000 (VIP 1) but execute $6 million in volume (VIP 3). Bybit promotes you to VIP 3 and grants that tier’s benefits.

Binance, by contrast, requires you to hit both metrics for each VIP level. For example, VIP 3 on spot calls for at least $20 million in 30‑day volume alongside a holding of 250 BNB.

While the requirements run higher, the reward for top‑end activity is sharper. For instance, at VIP 5—$150 million in volume plus 1,000 BNB—maker/taker can reach 0.0250% and 0.0310%, with additional reductions if you pay in BNB.

For non‑VIP users, both stick close to a 0.1% rate on spot trades for makers and takers, keeping entry costs predictable.

Bybit’s perpetual and futures products price takers at 0.055% and makers at 0.02%. Versus Binance options, Bybit lists 0.02% for both maker and taker, which is a touch lower than Binance’s 0.03% transaction fee.

On the funding side, Bybit mirrors Binance by charging no fee for crypto deposits. Withdrawal costs vary by coin and chain, and fiat funding or payout methods can carry different charges depending on the provider selected.

In short, Bybit can be easier to climb initially, while Binance becomes compelling for those targeting minimal fees at very high trading volumes.

Binance Fees VS Kraken Fees

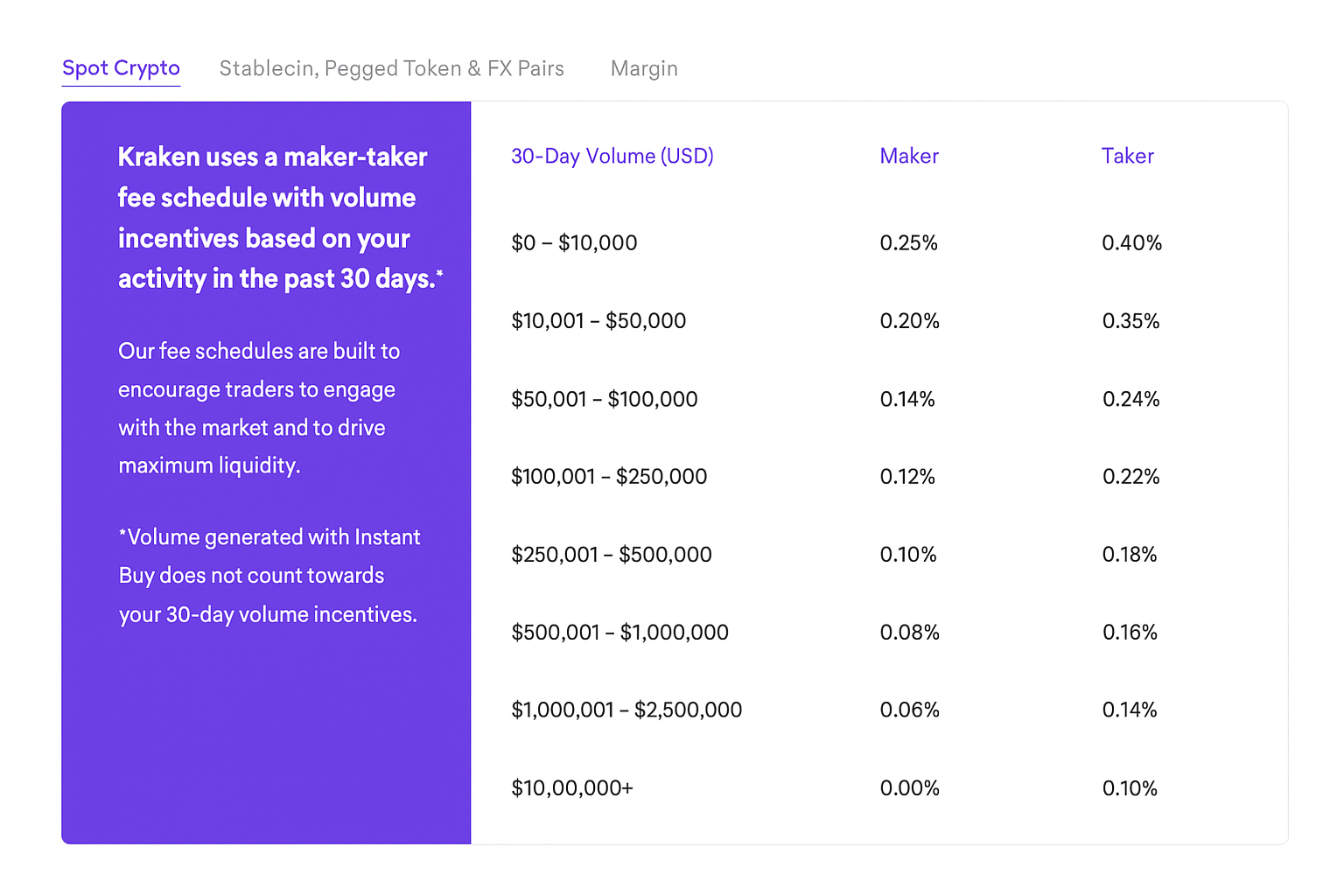

When you compare Binance with Kraken, you’ll see distinct tier ladders meant for different profiles.

Binance spot fees start comparatively low, and you can shave more off by holding BNB or earning higher VIP ranks—though the thresholds to enter those ranks are stiffer.

Kraken opens discounted tiers at relatively modest levels: once your monthly spot volume reaches $500,000, maker fees dip to 0.08%, and at the summit, maker can fall to 0% for the most active traders.

For casual activity, Binance may feel more wallet‑friendly. Kraken’s baseline for regular users sits at 0.25% maker and 0.4% taker on spot markets.

Regarding deposits and withdrawals, Kraken’s fees shift by currency and method; they’re periodically revised based on cost and demand. Always check the current schedules before moving funds.

Broadly, Binance appeals to both newcomers and whales with competitive pricing, while Kraken can suit mid‑tier participants who want faster access to low maker fees.

How to reduce Binance Fees: Tips & Tricks

With the landscape in view, you might ask how to reduce Binance fees—or whether avoiding the charges entirely is possible. Skirting the rules isn’t advisable, but there are legitimate tactics that trim costs nicely for smaller and larger accounts alike.

Below you’ll find practical techniques that respect the platform’s terms while saving on commissions and network‑related expenses.

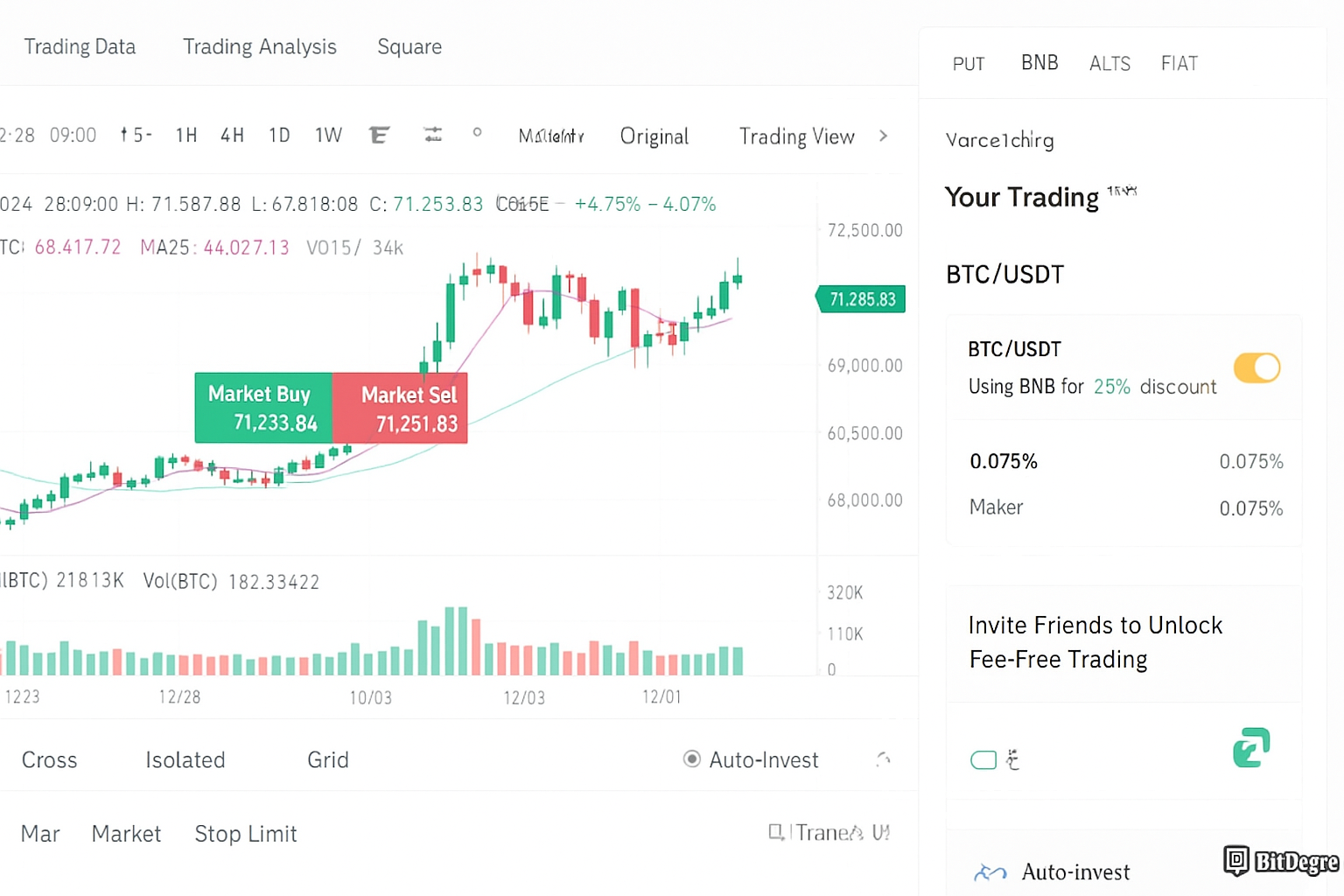

Using BNB for Transactions

One of the easiest wins is paying fees with BNB. Doing so gives a 25% reduction on standard trading commissions and 10% off on eligible futures, which compounds nicely over time as trade count rises.

To use this, keep some BNB in your Spot wallet and enable the BNB deduction feature. You can toggle it in two places:

- Option One: On the Spot Trading page, open Fee Level and switch the BNB/USDT deduction on or off.

- Option Two: In the Fees & Transactions Overview, toggle the BNB Discount setting on or off.

After activation, Binance will automatically draw fees from your BNB balance whenever possible so you receive the discounted rates.

Quick illustration: suppose a regular user places a buy for 10 ETH at 25,000 USDT each. The usual fee works out to 0.01 ETH (0.1%). Paying in BNB cuts it to 0.0075 ETH instantly.

Maintaining a small BNB cushion ensures ongoing savings across your trading flow.

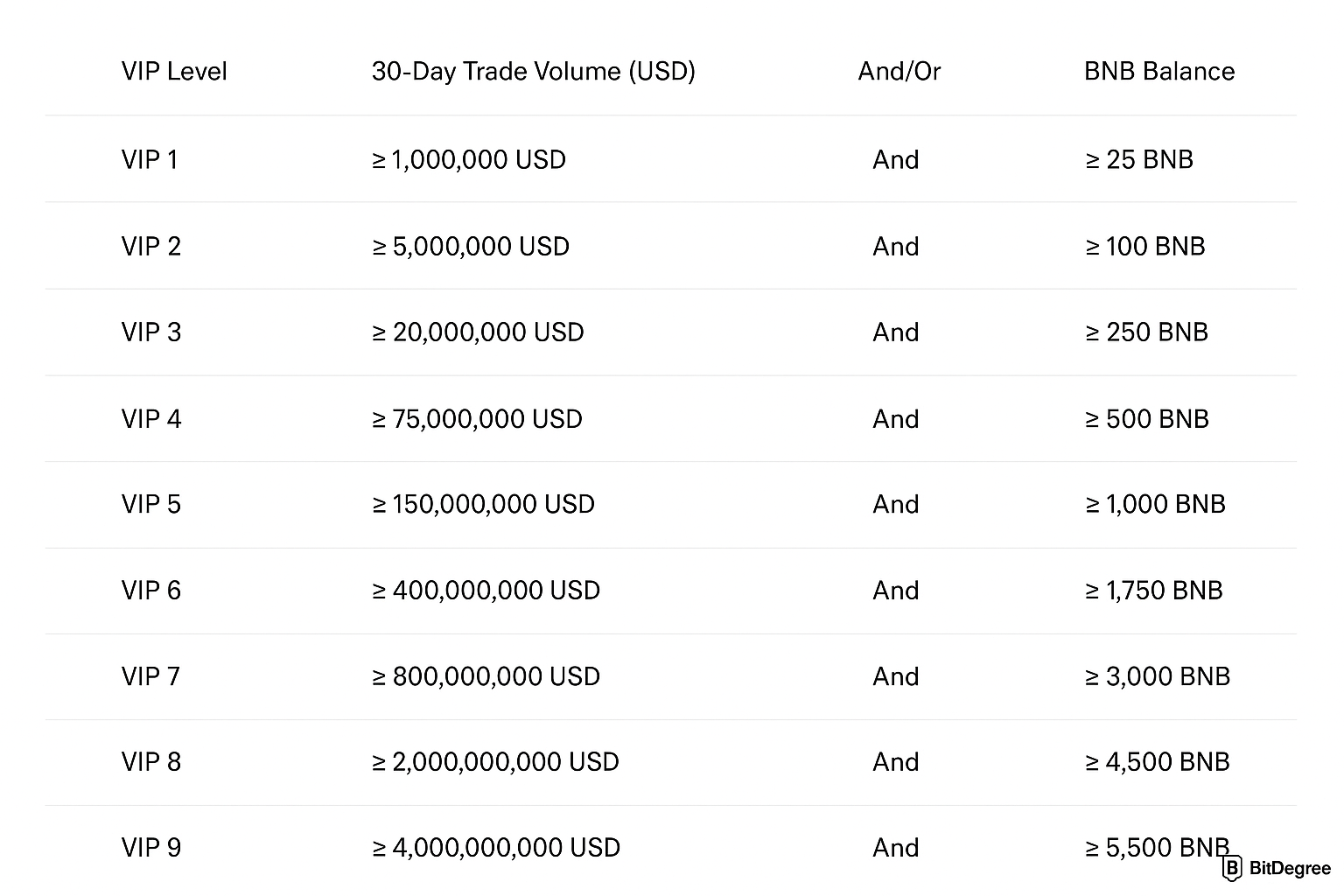

Advance Through Binance Fee Tiers

Climbing the VIP ladder is another powerful way to reduce Binance fees, although it requires both sustained activity and a BNB position.

There are nine levels. To move up, you must meet the 30‑day volume requirement and hold the specified BNB balance for the target tier.

VIP 1, for instance, needs at least $1,000,000 in trailing 30‑day spot volume and a daily balance of 25 BNB, which trims standard spot rates from 0.1% to 0.09%.

At the top end (VIP 9), maker/taker can fall to 0.011% and 0.0230%, and paying in BNB can push those even lower—to 0.00825% and 0.01725%—which is substantial for high‑volume strategies.

Your VIP status updates daily at 00:00 UTC, based on the last 30 days of trading and your BNB holdings.

Additional benefits accompany higher ranks beyond fee relief:

- Lower borrow rates on margin and larger credit lines.

- Raised withdrawal ceilings and improved settlement flexibility.

- More frequent API order allowances for systematic trading.

- Priority account assistance and entry to the Binance VIP Portal.

Active market participants who transact frequently may find the tier program especially valuable for optimizing net performance.

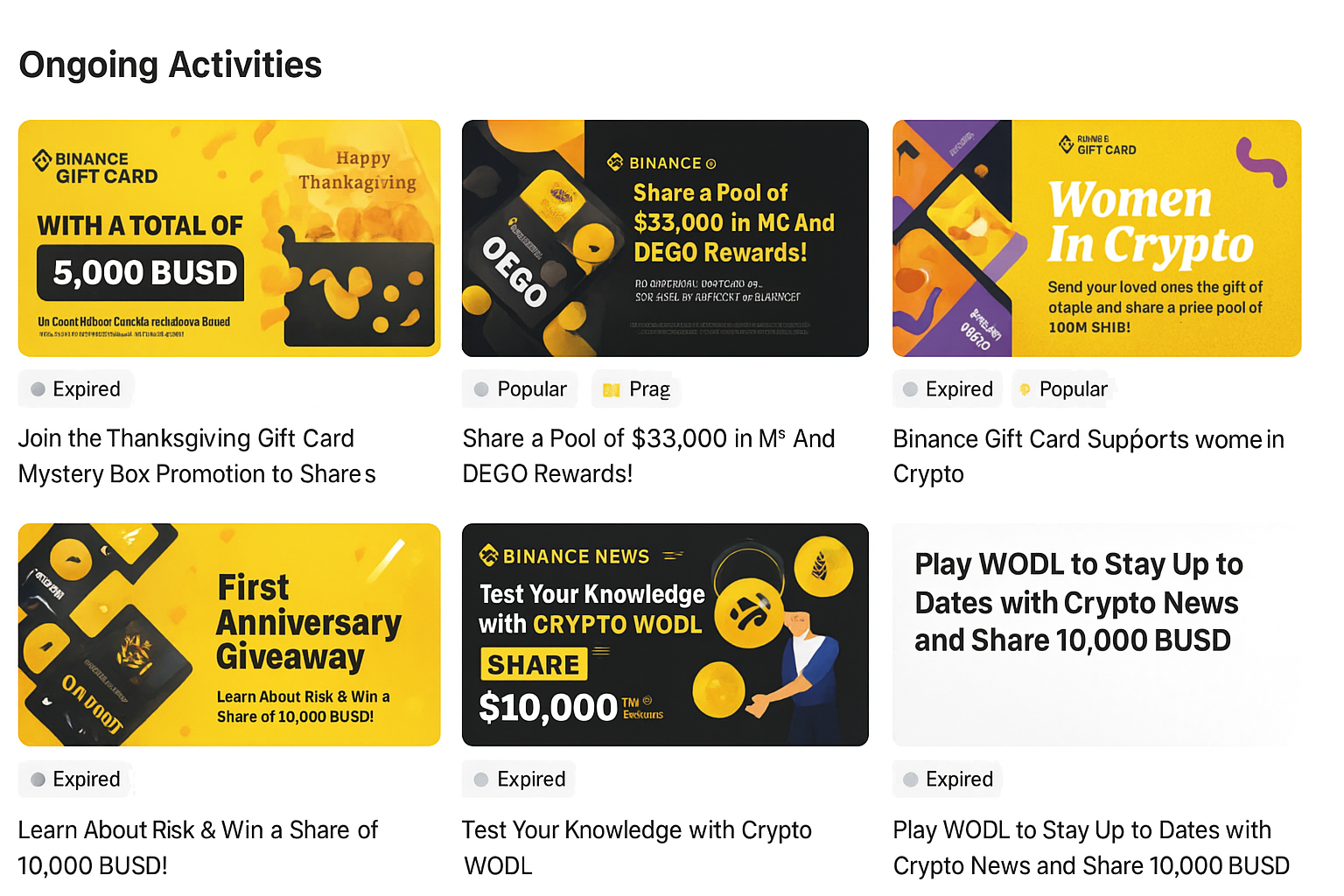

Make the Most of Limited-Time Offers

From time to time, Binance runs promotions that lower costs—discounted fees for certain pairs, or even zero fees on specific deposit or withdrawal methods for a limited window.

Keep an eye on official announcements and a dedicated promotions page so you can time trades or payments when specials surface and maximize savings.

This approach is especially useful if you’re already active. Aligning larger actions with a promotional period can reduce friction and improve your average cost over time.

While totally eliminating the fees Binance applies isn’t realistic, these tactics can bring them down substantially without adding complexity.

Conclusions

To sum up, Binance fees are among the most competitive globally, comparable to peers such as Kraken and Bybit. The tiered design rewards volume and BNB holdings, making the cost structure attractive for frequent traders and market makers.

Even without VIP status, base rates remain approachable for casual users. This blend of accessibility and depth makes Binance a flexible choice for many, from first purchases to high‑frequency strategies seeking lower friction.

The information here is educational and not financial advice. does not recommend buying, selling, or holding any digital asset. Always consult a qualified advisor before making investment decisions.