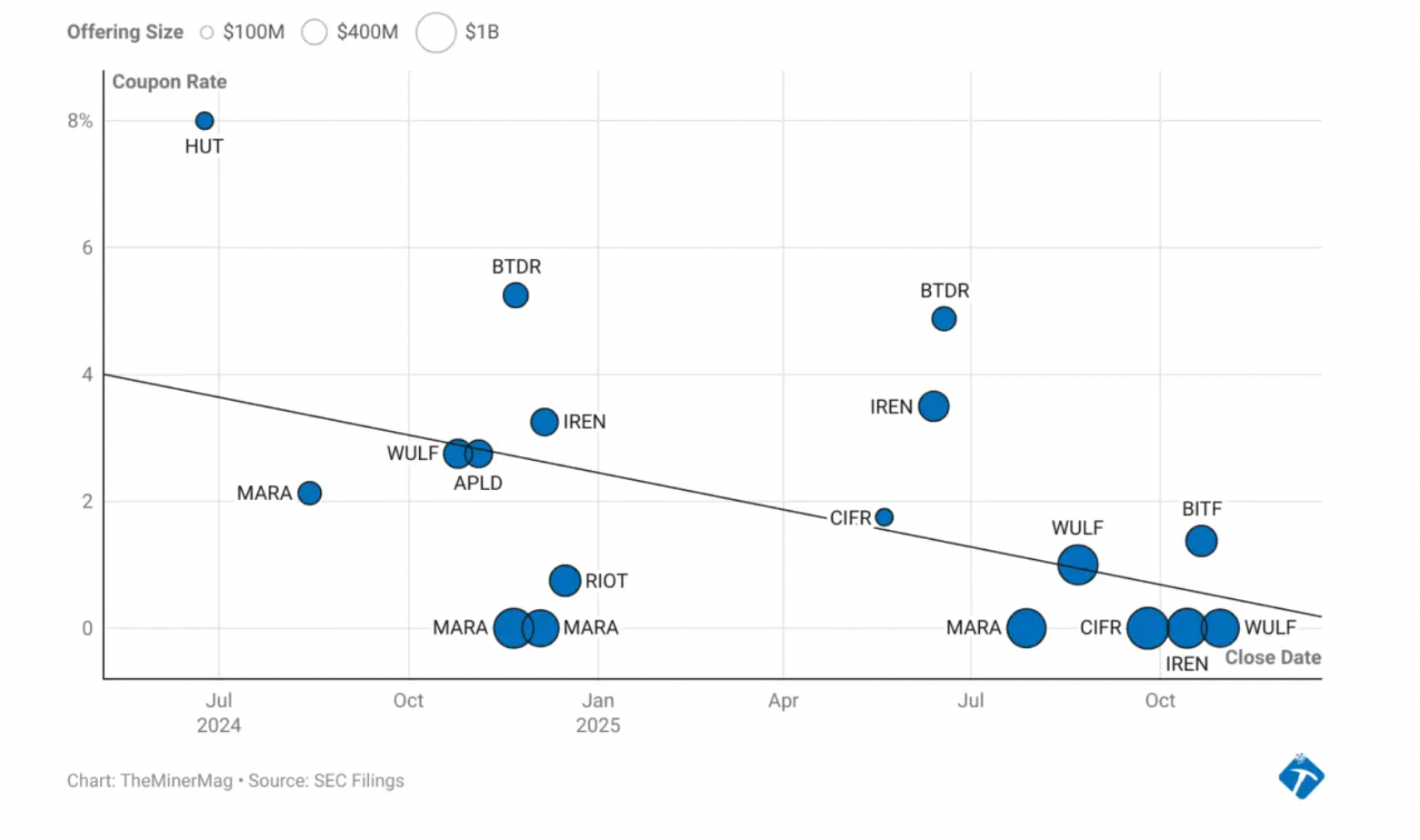

Over the past year, mining companies have raised $11 billion through the issuance of convertible bonds — corporate debt that can later be exchanged for shares. All this is happening amid an active pivot towards data centers for artificial intelligence.

After the halving in April 2024, when the block reward was halved, 18 deals for such bonds were closed. This was reported by TheMinerMag.

Issuance volumes have grown significantly. Companies MARA, Cipher Mining, IREN and TeraWulf each raised $1 billion in a single deal. Some bonds had coupons of 0% — investors agreed not to receive interest, betting on the future growth of share prices.

Convertible bond issuance volumes. Source: TheMinerMag

For comparison, a year earlier, most bonds from miners were in the range of from $200 to $400 million.

After the halving in April, miners began actively looking towards AI data centers — they needed to somehow make up for the drop in income. But even with this direction, the situation remains difficult. The industry is under pressure from everything: from volatile tokenomics to equipment supply issues and high electricity prices. And also — trade restrictions, which throw surprises at the worst possible moment.

Miners face a battle for hashrate and AI resources

According to investment company VanEck, over the past year, miners’ debt burden has increased fivefold and now amounts to $12.7 billion.

Analysts Nathan Frankovitz and Matthew Sigel believe that it is not about greed or adventurism, but about the very logic of the industry. To stay afloat, companies have to spend huge sums on equipment.

“Previously, miners covered these expenses with shares, not debt. But now it’s different,” they write.

At the same time, experts call the value of equipment a “melting block of ice.” It quickly loses relevance, but without it you can’t withstand the competition.

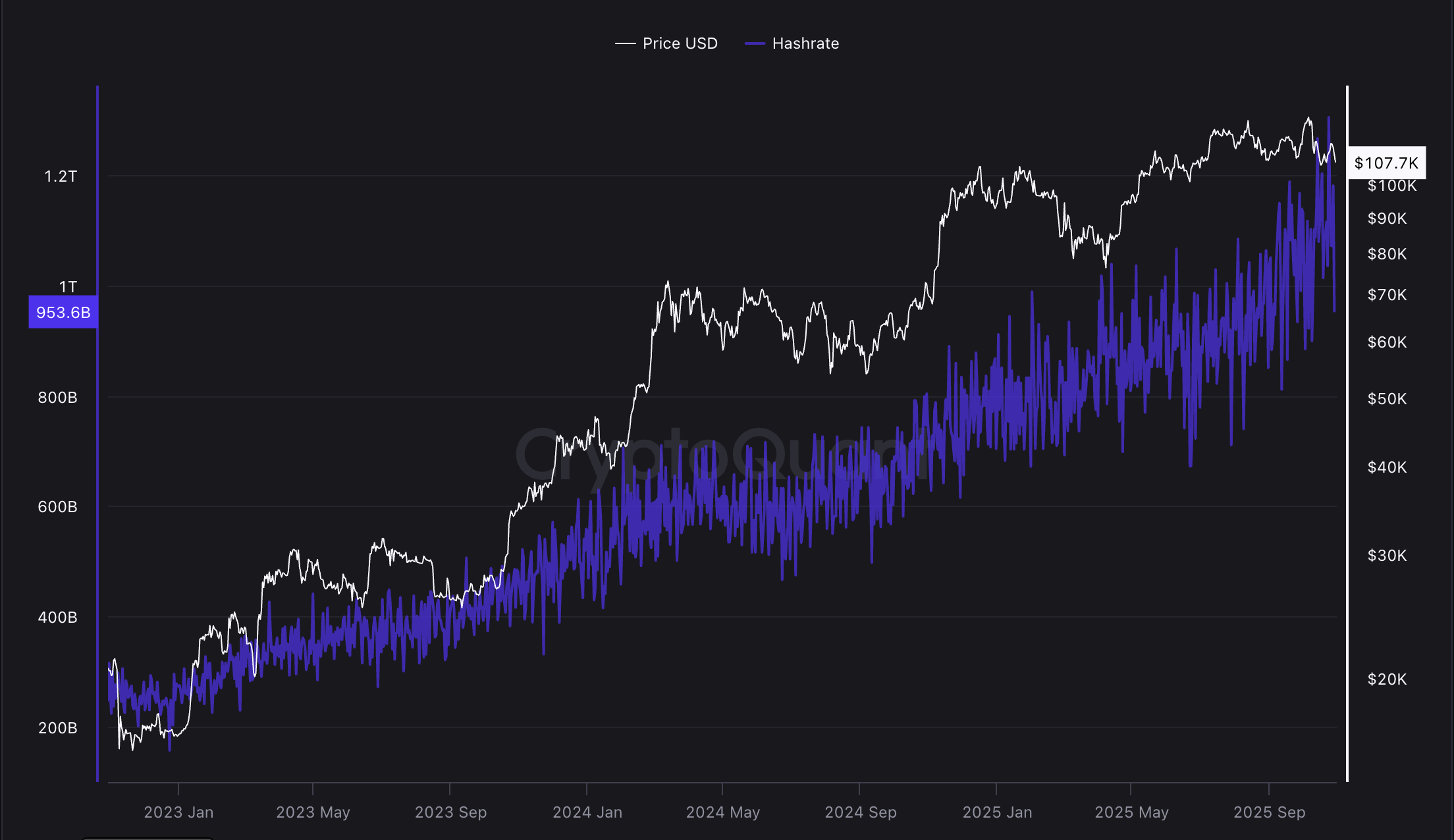

Bitcoin network hashrate continues to rise. Source: CryptoQuant

Bitcoin’s hashrate continues to grow, and miners have to invest more and more, both in equipment and electricity. The higher the competition, the more expensive it becomes to participate in the race.

In October, US Energy Secretary Chris Wright proposed to simplify the connection of data centers and mining farms directly to power grids. This scheme would allow them to receive electricity without intermediaries and in the required volumes.

In addition, miners will be able to help the energy system itself. For example, reduce the load during off-peak hours and, on the contrary, take excess energy when there is nowhere else for it to go. This could make them an important part of the infrastructure, not just resource consumers.