Binance founder Changpeng Zhao (CZ) stated that the market has not yet completed the decline phase. After the speech by Fed Chairman Jerome Powell, Bitcoin fell below $107,000, and total position liquidations exceeded $300 million in a day. Against this backdrop, CZ noted:

‘the drops are still ahead.’

Powell scared the markets again

Jerome Powell’s speech at the Federal Open Market Committee meeting triggered a chain reaction in global markets. The Fed lowered the key rate by 0.25 percentage points—to a range of 3.75–4%, the lowest in the past three years.

The decision was accompanied by disagreements within the committee itself: Kansas City Fed President Jeffrey Schmid voted to keep the rate unchanged, while White House economic adviser Steven Miran supported a deeper cut of 0.5 percentage points.

Although the rate cut was supposed to support risk assets, the effect was the opposite. According to Cryptopolitan, investors lost $377 million in liquidations in a day, and the prices of most cryptocurrencies fell sharply.

Bitcoin shows the worst ‘Uptober’ in seven years

Bitcoin became the main catalyst for the sell-off. The price of the largest cryptocurrency fell to $106,993, updating the month’s lows, and only by Friday morning managed to rebound above $109,000.

According to analyst Immortal Crypto, October 2025 was the worst ‘Uptober’ in the past seven years—Bitcoin lost 6.8% of its value. Ethereum fell by 1.7% to $3,850, and the total crypto market capitalization decreased by 0.46% to $3.69 trillion, according to CoinMarketCap.

Short-term traders are dumping assets

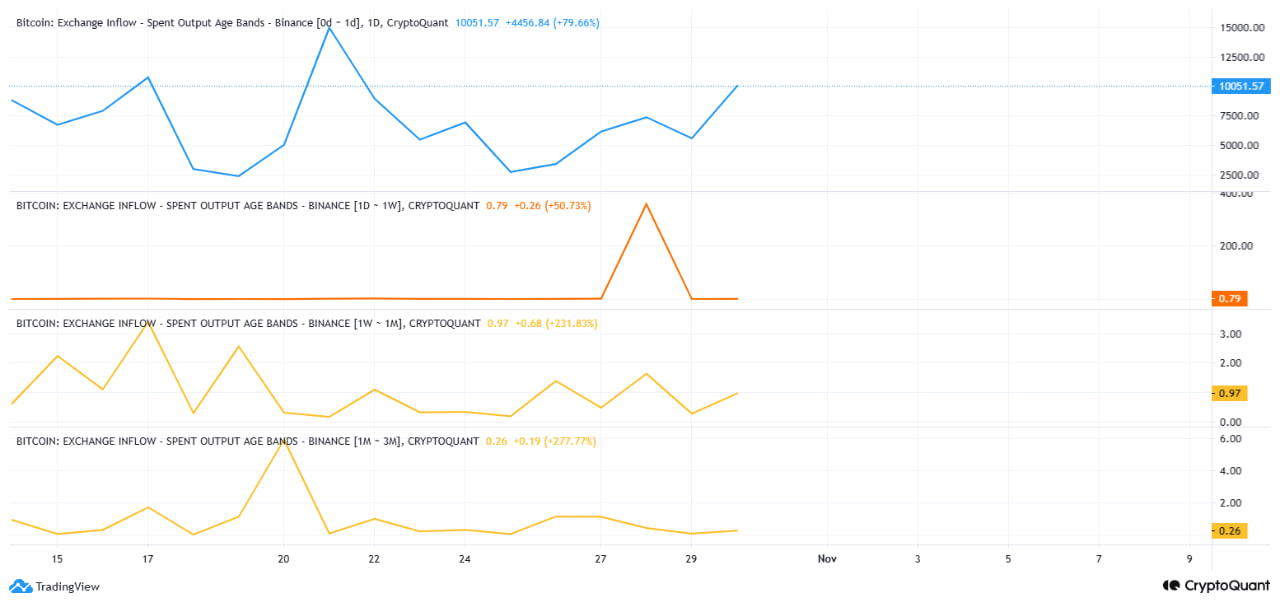

Binance data shows that the main pressure on the market comes from short-term investors. During the decline, over 10,000 BTC were sent to the exchange, most of which belonged to coins that had been in circulation for less than 24 hours.

CryptoQuant analyst under the pseudonym CryptoOnChain called this a classic example of ‘hot money’ activity—speculative capital that reacts instantly to news and causes sharp price swings.

At the same time, long-term holders, or ‘diamond hands’, remained calm. Coins held for more than six months barely moved, indicating a shakeout of weak hands rather than the start of a bear trend.

‘The data is clear: this is not the start of winter. We are seeing a regular cleansing of short-term players, the market structure remains solid,’ the analyst noted.

From Trump to the Fed: a turbulent autumn for the market

The late October drop continued a volatile month. Earlier, on October 10, the crypto market had already experienced the largest liquidation in history—over $19 billion in open positions, according to CoinGlass. At that time, the crash coincided with Donald Trump’s statement about possible 100% tariffs on Chinese goods, which triggered sell-offs across all platforms.

According to CryptoQuant, on the eve of the latest Fed meeting, retail traders sold about 9,200 BTC, equivalent to $1 billion. This indicates an increase in panic selling by retail investors.

The Retail Traders Daily Buy/Sell chart on Binance shows regular spikes in sales in October, coinciding with intraday BTC price drops.

Whales use the dip to accumulate

Despite the chaotic market moves, the activity of large holders shows the opposite picture. The Scarcity Index rose, which, according to Arab Chain, indicates that bitcoins are being withdrawn from exchanges to personal wallets.

This behavior by large investors usually reduces selling pressure and creates the conditions for recovery. If the trend continues, the market may stabilize closer to November.

‘Retail is selling, while whales are buying. This is the classic stage where panic creates opportunities,’ analysts note.

What’s next?

CZ warns that the market may experience several more waves of decline before a new growth cycle begins. However, on-chain dynamics show the opposite: large players are using dips to accumulate, which usually precedes a recovery.

The key question is whether the Fed will remain cautious or soften its rhetoric again in December. If the regulator returns to a policy of increasing liquidity, the market may quickly recover its losses.

Read more: Investors are withdrawing funds from US Bitcoin and Ethereum ETFs: all funds showed zero inflow