The sharp decline in Bitcoin triggered the largest wave of liquidations in recent months. Over the past day, more than $1.3 billion in traders’ positions was wiped out from the market, and participants’ attention focused on the $100,000 level as the last line of defense for BTC.

The market loses its footing

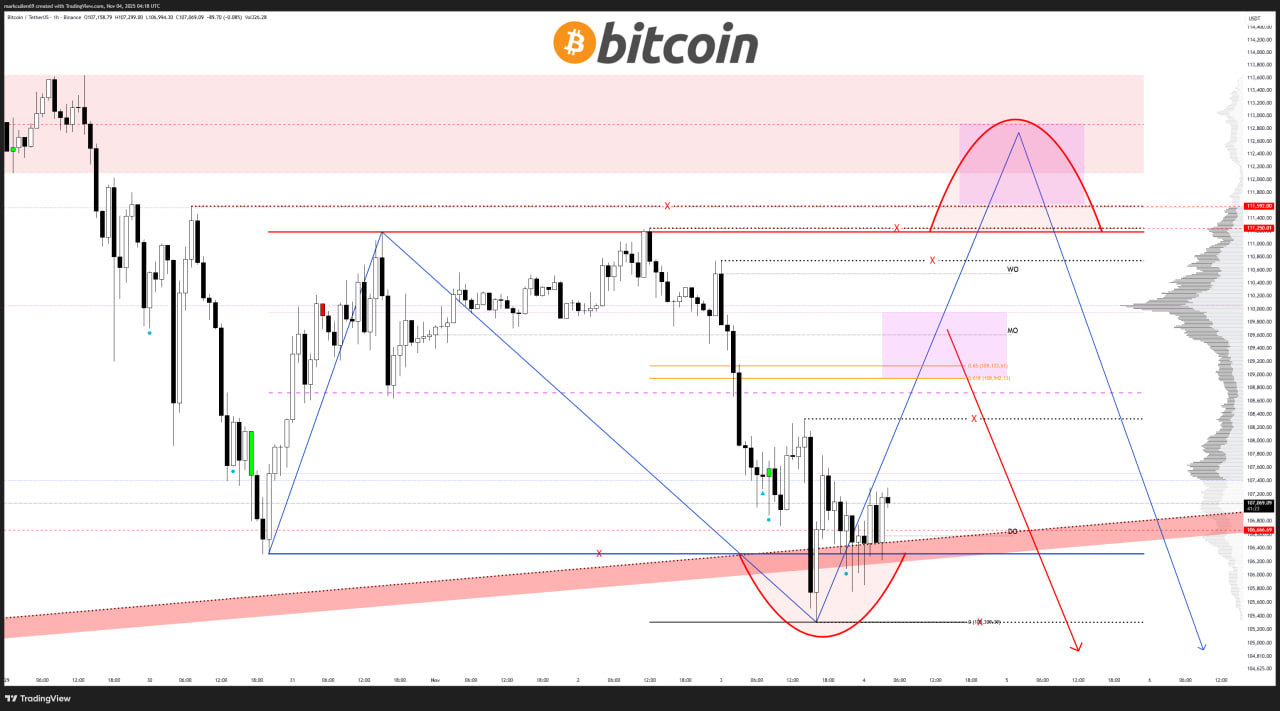

On Tuesday, the price of Bitcoin fell to $104,000, losing 17% from the all-time high of $126,000 set on October 6. The correction caused a large-scale closing of leveraged positions and forced traders to switch to capital protection mode.

According to CoinGlass, over the past 24 hours, long liquidations amounted to $1.21 billion, of which $377 million were in Bitcoin. In second place is Ethereum, where the liquidation volume reached $316.6 million.

The total liquidation volume in the market amounted to $1.36 billion, including both short and long positions. The largest closure occurred on HTX, where a BTC/USDT long worth $47.9 million was forcibly liquidated.

Pressure is increasing

The drop below $104,000 continued the decline that began after Sunday’s surge to $111,000. Futures traders sharply reduced risk, locking in losses and closing positions.

According to CoinGlass, open interest (OI) in Bitcoin across all exchanges decreased by 4% in a day, and on CME — by 9% at once, indicating a decline in institutional participation.

A decrease in OI usually reflects a drop in leveraged volume and weakening bullish sentiment. Previously, in September, a 10% drop in open interest was accompanied by about an 8% drop in Bitcoin’s price.

$100,000 becomes key support

Analysts warn that current levels are close to a tipping point. According to trader Jelle, the bears have finally ‘pushed’ the market after several failed attempts, and now for Bitcoin to recover, it needs to regain the $105,000–$107,000 zone.

If this does not happen, the next target will be the psychologically important $100,000 level, which market participants call the last barrier before a new downward cycle.

Trader AlphaBTC noted that a daily close below $105,300 could trigger a new wave of sell-offs and send the price below $100,000.

Capitulation or the start of a reversal?

Mass long liquidations often become a signal of capitulation — and a possible local bottom. After such events, the market often shows a short rebound, especially if the liquidation volume reaches extreme levels, as it does now.

However, if $100,000 is broken, the pressure may intensify: this level is seen as the last point where ‘bulls’ are ready to defend positions. Losing this mark will open the way for a deep correction and a potential reversal of the medium-term trend.

At the same time, some analysts expect aggressive defense of the $100,000 level, believing that the current volatility is part of a broad consolidation before the next impulse.

What’s next?

Amid a sharp drop in liquidity and open interest, the market has entered a phase of caution. Investors are waiting for confirmation of a local bottom and possible recovery to $107,000.

If Bitcoin holds the $100,000 zone and the liquidation volume starts to decrease, this could be the first sign of stabilization. Otherwise, the market risks entering a new downward cycle — with new yearly lows.

Read more: Investors withdrew $360 million after Powell’s statement, but Solana maintained demand