Prediction market operator Polymarket is preparing to return to the US market as early as the end of November, Bloomberg reports, citing sources familiar with the company’s plans.

Return after regulatory conflict

For Polymarket, this will be the first official launch in the US after being forced to leave in 2022. At that time, the Commodity Futures Trading Commission (CFTC) imposed a $1.4 million fine and required the company to cease operations in the country.

Since then, the firm has built a new legal foundation by acquiring QCX — a licensed derivatives trading and clearing platform. This allowed Polymarket to obtain a regulated structure and prepare for a legal return to the domestic market.

Intersection with the sports betting industry

The Polymarket restart coincided with a time when the prediction and sports betting markets began to rapidly converge. Federal licensing has given platforms like Polymarket an advantage over traditional bookmakers, who are limited by individual state laws.

Against this backdrop, the company signed multi-year agreements with the National Hockey League (NHL) and its competitor Kalshi, becoming the first prediction platform to officially partner with a major US sports league.

This event intensified competition with traditional players like DraftKings and FanDuel, who now face regulated exchanges offering event contracts instead of conventional bets.

Explosive growth of the prediction market

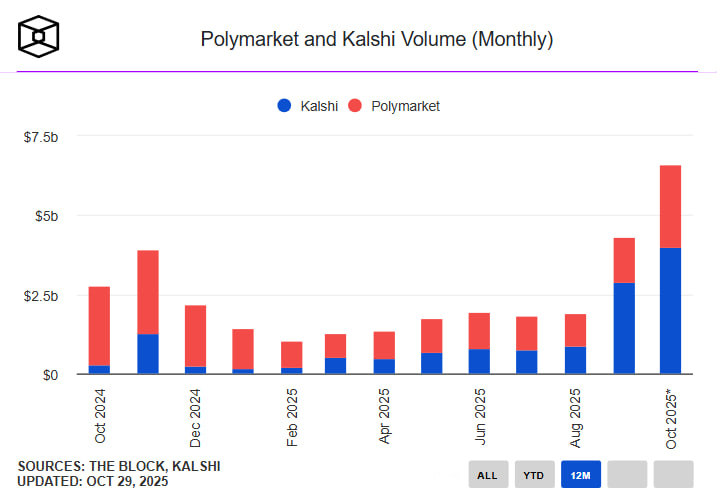

The prediction markets sector is experiencing a real boom. According to The Block, in October alone, the trading volume of Polymarket and Kalshi exceeded $6.3 billion, a record for this category of products.

Institutional interest in the platforms is growing. Polymarket has already received investments from Intercontinental Exchange (ICE) — the owner of the New York Stock Exchange. The company’s latest valuation was about $9 billion. Competitor Kalshi recently raised $300 million and is valued at $5 billion, and according to Bloomberg, is negotiating with investors to sell a stake at a valuation of up to $12 billion.

POLY token launch and upcoming airdrop

Along with its return to the market, Polymarket announced the launch of its own POLY token and an airdrop for the most active users. According to marketing director Matthew Modabber, token distribution will begin after the official US launch.

‘The token will appear, and there will be an airdrop. We are creating an asset with real utility and longevity,’ he emphasized in an interview.

Prediction markets are already estimating the probability of launching the American version of Polymarket. According to on-chain statistics, traders estimate an 89% chance that the platform will open by the end of 2025.

A new era of betting

The return of Polymarket comes amid a rapid rise in interest in prediction markets and sports contracts, which are becoming one of the key segments of the Web3 industry.

Earlier this week, Trump Media — owner of Truth Social — announced a partnership with Crypto.com to launch its own product called Truth Predict. Crypto.com CEO Kris Marszalek noted that the prediction market could grow to tens of billions of dollars in the coming years.

Polymarket, Kalshi, and new players are effectively creating a new format for financial markets, where users bet not on stocks or currencies, but on the outcome of real events — from sports matches to elections and economic decisions.

What’s next?

The return of Polymarket to the US could become a defining moment for the entire industry. If regulators continue to allow such platforms, the prediction market could move beyond a niche product and become a full-fledged element of financial infrastructure.

And for users, the launch of Polymarket in the US is an opportunity not just to place bets, but to participate in a new form of collective future analysis, where each contract reflects the market’s expectations.

Read more: Western Union prepares to launch a stablecoin on Solana in 2026