Pump.fun, known as one of the largest token launch platforms in the Solana ecosystem, is reaching a new level of development.

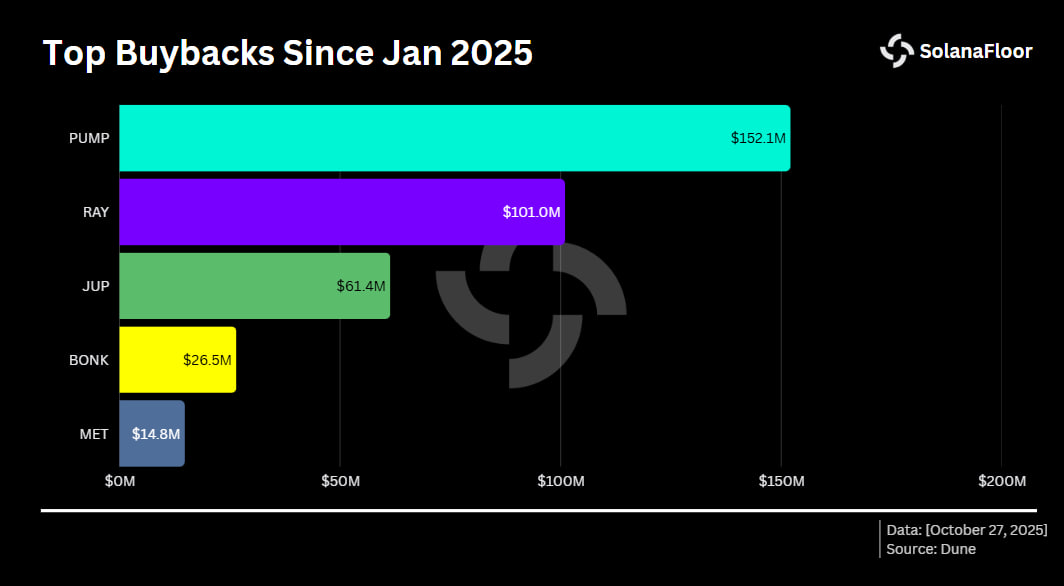

A comparative chart shows the largest token buybacks in the Solana ecosystem since January 2025.

In just three months, the company has allocated over $150 million for the buyback of $PUMP tokens, demonstrating unprecedented support for its own asset and a commitment to sustainable growth even amid a cooling market.

Scale of Buybacks and Economic Strategy

According to analytics, Pump.fun has already removed nearly 10% of the total $PUMP supply from circulation, making the token one of the most actively supported in the ecosystem. This is the second highest among all Solana projects, second only to Raydium, whose total buybacks have exceeded $200 million.

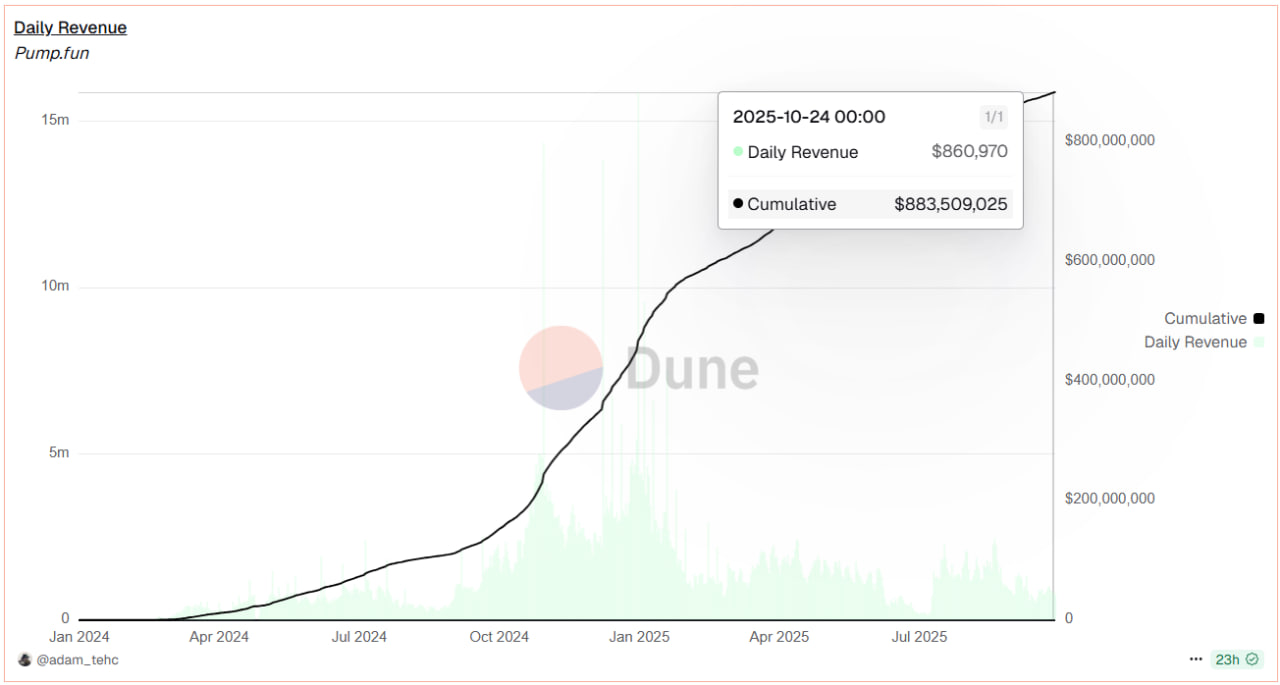

Charts show that Pump.fun’s total revenue reached $883.5 million, and $PUMP buybacks exceeded $150 million — a record for the Solana ecosystem.

This strategy helps the platform maintain liquidity and reduce price volatility, which is especially important during periods of declining interest in memecoins. According to Dune Analytics, Pump.fun’s total revenue exceeded $883 million, with daily income approaching $861,000, allowing the company not only to fund buybacks but also to allocate part of the funds to infrastructure development.

Essentially, Pump.fun uses a capital redistribution model, where revenues from fees and trading of integrated services are partially returned to the ecosystem through token buybacks and increasing their market value.

Padre Integration: Expanding Beyond Memecoins

In addition to its aggressive buyback program, Pump.fun is focusing on developing its own infrastructure. In October, the company announced the acquisition of the multichain terminal Padre, which supports trading on Solana, Ethereum, BNB Chain, and Base.

Padre became a logical continuation of the course towards diversification and deeper control over all stages of the token lifecycle — from creation to trading. The new terminal is already integrated into the Pump.fun ecosystem and is used for automatic profit redistribution, enhancing the tokenomics of $PUMP.

The company noted that Padre features a user-friendly interface, cashback model, and competitive fees, making it an attractive tool for traders and new projects. After integration, the terminal quickly rose to the top and became the second largest trading bot on Solana, second only to the ecosystem leader.

Padre Token Scandal and Community Reaction

The acquisition of Padre was accompanied by a wave of discontent in the community. After the official announcement on X, users noticed that the $PADRE token had lost its functionality, which meant a loss of value.

In response, the Pump.fun team offered a solution: holders recorded in the snapshot as of October 24 will receive compensation in $PUMP. The distribution process is open until December 30, 2025, and users become part of the updated ecosystem. Thus, the Padre asset has effectively transformed into a new level of access to the Pump.fun platform.

This solution helped avoid escalation of the conflict and at the same time expanded the project’s user base, ensuring a smooth transition of the audience from one ecosystem to another.

Evolution of Pump.fun’s Business Model

Pump.fun started as a simple tool for launching memecoins but is gradually transforming into a multi-level infrastructure covering trading, analytics, and liquidity management.

The company has already launched PumpSwap — its own AMM pool, Pump Screener — an analytics platform competing with Dexscreener, and the Kolscan monitoring service focused on analyzing new tokens.

Together, these products form an ecosystem in which each element generates income, part of which is returned to the $PUMP economy through buybacks. Thus, Pump.fun is effectively building a closed economic model with internal profit redistribution, which is rare for crypto projects of this scale.

Confident Leadership in Solana

Today, Pump.fun holds over 90% of the token launch market share on the Solana network. According to Dune, all successful listings in the last 24 hours took place on the platform — competitors recorded none.

Previously, Pump.fun’s leadership was briefly challenged by a project from the Binance Smart Chain network, but the Solana platform quickly regained dominance, once again topping weekly revenue charts.

This advantage is explained not only by aggressive marketing but also by a well-thought-out economy: Pump.fun managed to combine memecoin platform functionality with professional liquidity and analytics tools, giving it a sustainable edge over niche projects.

Transition to a New Phase of Development

Amid declining interest in speculative assets, Pump.fun continues to build infrastructure and expand its product line. The integration of Padre and the strengthening of the buyback model signal a shift from short-term hype to a long-term capital management strategy.

Experts note that the company is gradually turning $PUMP from a meme token into a full-fledged economic instrument, supported by stable revenue and a technological base.

What’s Next?

If current growth rates continue, Pump.fun could become the central Solana platform, connecting token creation, trading, and analytics in a single space. In a market seeking stable projects with real economics, this model could set a new standard for the Web3 industry.

Read more: The MegaETH token sale raised $450 million and exceeded the limit by almost nine times