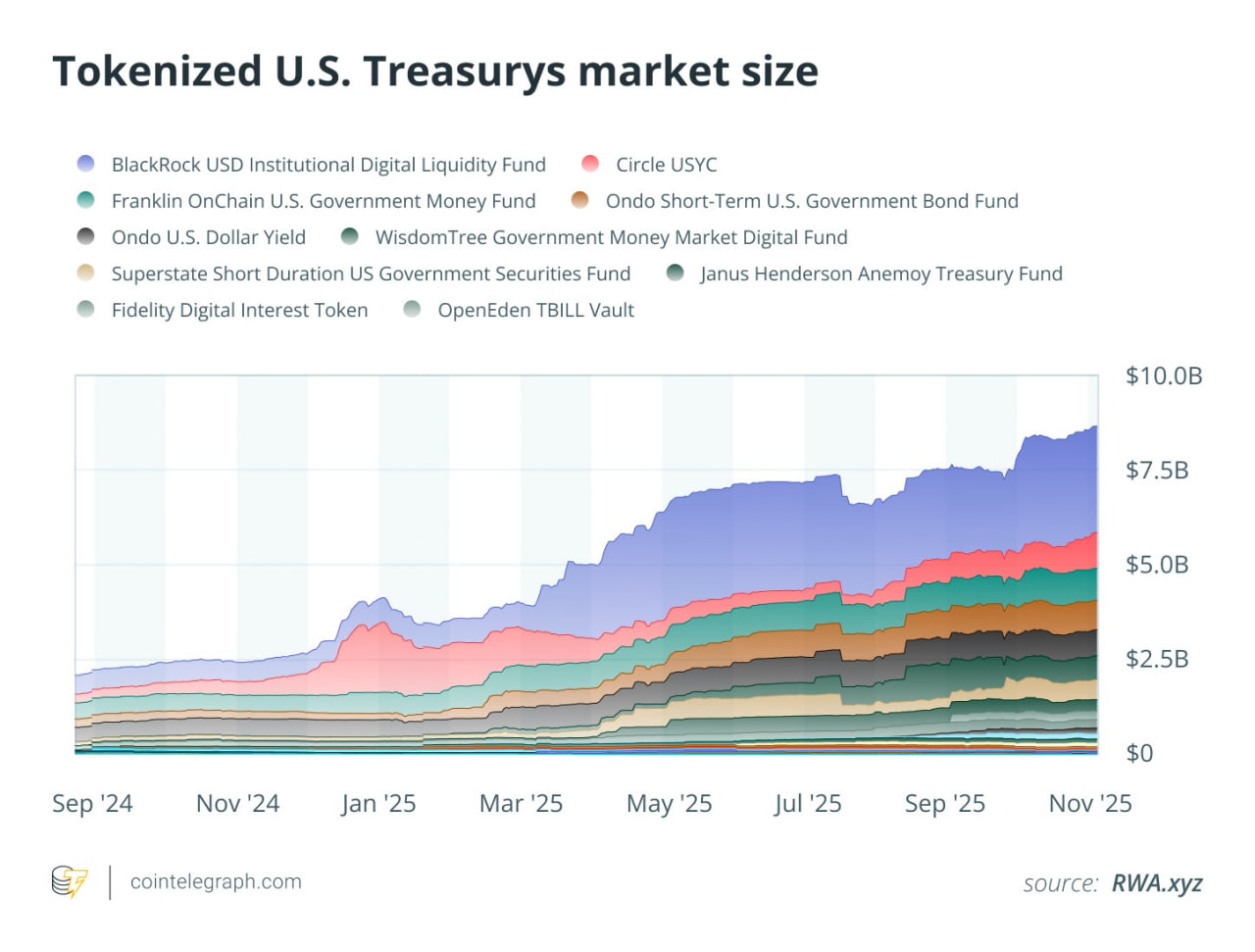

The market for tokenized US government bonds has entered a new stage of development. Their total capitalization exceeded $8.63 billion, and financial institutions began to use such assets not only for yield, but also as collateral in lending and repo operations.

From yield to collateral

Tokenized US bonds, which have become the largest class of real world assets (RWA) after stablecoins, are turning from a passive income instrument into a full-fledged element of financial infrastructure. Tokenized money market funds (MMF), which invest in short-term US government bonds, are now used in trading, lending, and settlements between banks.

.85 billion).” title=”photo_2025-11-05_08-50-46″>

.85 billion).” title=”photo_2025-11-05_08-50-46″>

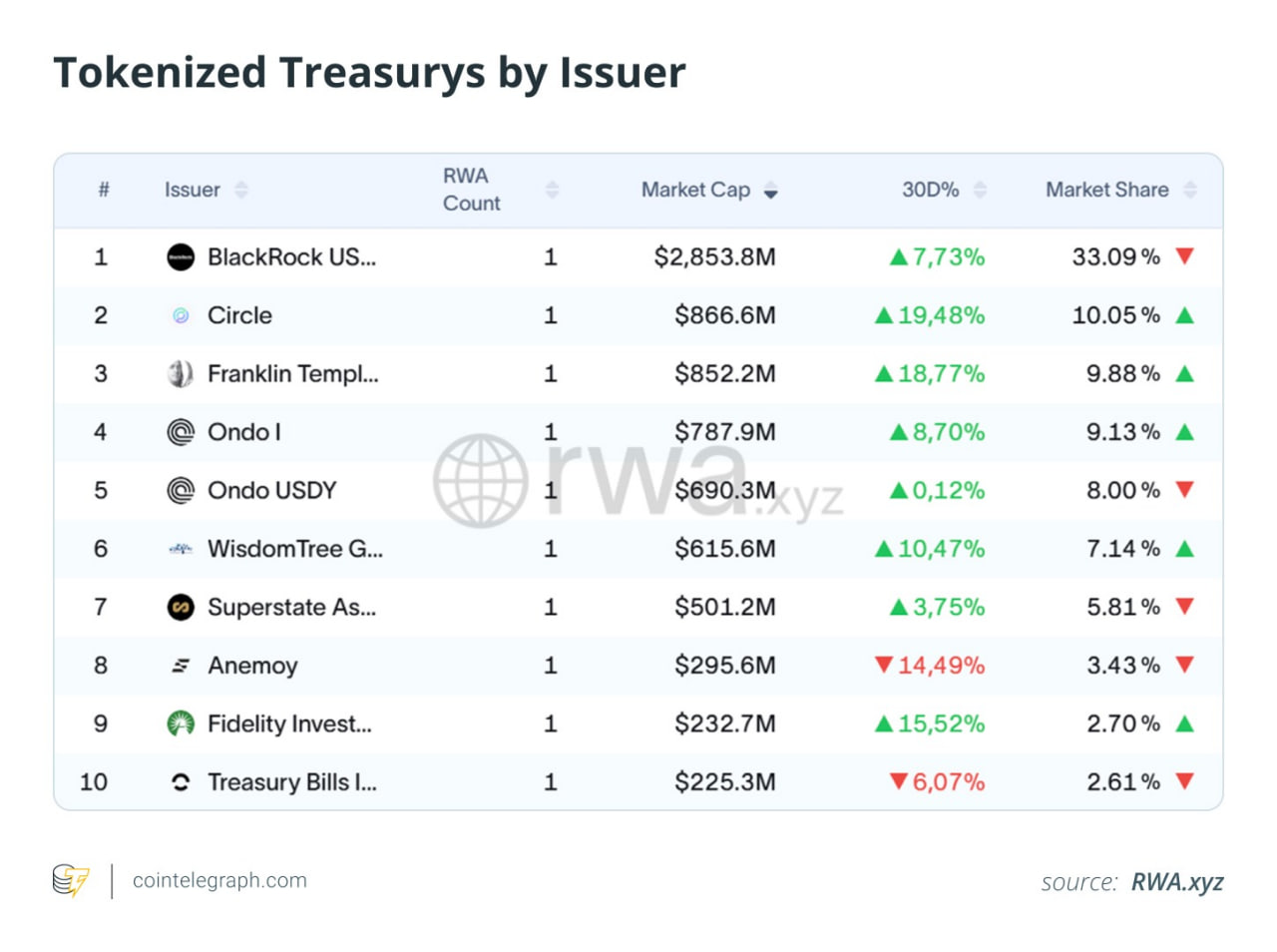

According to data at the end of October, the market capitalization of such assets grew from $7.4 billion in September to $8.6 billion, with the main growth provided by the BlackRock BUIDL fund (about $2.85 billion). In second place is Circle USYC ($866 million) and Franklin Templeton BENJI ($865 million). The new tokenized Fidelity fund also showed rapid growth, reaching $232 million.

Exchanges and banks join the market

Digital versions of treasury securities are beginning to go through the same settlement and margin systems as traditional securities. The first test of the “fund as collateral” concept was the launch of BUIDL on the Crypto.com and Deribit exchanges in June.

Later, in September, Bybit announced that it accepts the QCDT token, backed by US bonds, as collateral from professional clients. This allows traders to use the asset in trades while maintaining the yield from the underlying fund.

In the banking sector, DBS Bank took the lead. The Singaporean bank launched trading of the sgBENJI token — a digital version of the Franklin Templeton fund — on its own DBS Digital Exchange platform. The bank is also testing the use of sgBENJI as collateral in repo and lending transactions.

In fact, the project turns tokenized money market funds from an investment product into a working element of bank financing.

Infrastructure and compatibility

No less important changes are taking place at the infrastructure level. Chainlink and Swift, together with UBS Tokenize, conducted a pilot project where subscriptions and redemptions of tokenized funds were carried out via standard ISO 20022 messages.

In other words, the same message format that banks already use for settlements and payments can now trigger smart contracts on the blockchain. This enables interaction between the traditional financial system and on-chain assets without the need for intermediary bridges.

The use of ISO 20022 creates a “common language” for banks, custodians, and management companies, allowing tokenized assets to move through standard settlement and reporting processes. Thus, tokenized bonds are beginning to integrate into traditional financial flows, going beyond experiments.

Concentration and limitations

Capitalization of tokenized bonds by issuer.

The market is still concentrated in the hands of a few large players. BlackRock BUIDL occupies about 33% of the market, while the shares of Franklin Templeton BENJI, Ondo OUSG, and Circle USYC are 9–10% each. However, the market structure is gradually diversifying: new managers are appearing, and liquidity is distributed among several regulated funds.

This makes the assets more convenient for banks, exchanges, and custodians, who prefer diversified collateral, reducing concentration risks. Nevertheless, barriers remain: most funds are open only to Qualified Purchasers — professional investors and high-net-worth individuals.

In addition, redemption and subscription operations are only possible at certain times, as in traditional MMFs. This limits the speed of withdrawals in stressful situations and distinguishes such assets from 24/7 crypto instruments.

Difference in valuation and risks

Tokenized funds are still trading at an additional discount compared to traditional bonds. Exchanges such as Deribit apply margin reductions of up to 10%, whereas in traditional repo operations the “haircut” rarely exceeds 2%.

The difference is explained not by credit, but by operational risks: possible delays in redemption, blockchain confirmation speed, and lower liquidity on the secondary market. However, as the infrastructure strengthens and reporting becomes more transparent, this gap will narrow.

From tests to industrial use

The next stage of market development is the transition from pilot programs to everyday use. DBS repo tests, Bybit initiatives, and Swift x Chainlink integration form the basis for the introduction of tokenized bonds into daily operations.

At the regulatory level, the process is also shifting. In the US, the CFTC in September launched the Tokenized Collateral and Stablecoins Initiative, aimed at regulating the use of tokenized assets in secured transactions.

If the projects advance, tokenized bonds will cease to be a niche instrument and will become an active element of the global collateral system, connecting bank balance sheets, stablecoin liquidity, and on-chain finance.

Read more: Wintermute head denied rumors of a lawsuit against Binance after ‘Black Friday’