Across several market eras, the price of Ethereum set the rhythm for smart-contract ecosystems and token economies. Winds are changing, though. As global money networks inch toward blockchain-native rails, some strategists argue the coming upswing may not be steered only by Ethereum. Attention is steadily pivoting to a SWIFT challenger preparing the groundwork for a redesigned financial stack in Web3.

Even if the Ethereum price were to double, the headline many may remember could involve Paydax Protocol (PDP) — a hybrid liquidity design that commentators describe as a banking-style rails upgrade built on-chain.

ETH price aiming at $9,000: bold target or realistic scenario?

Momentum for ETH is building into a powerful advance. Forthcoming upgrades are engineered to compress fees, accelerate confirmation times, and improve the staking experience, turning the network more streamlined than before. Parallel to that, activity from DeFi and NFTs keeps injecting capital into ETH markets, sustaining tailwinds across the ecosystem and Layer-2 scaling solutions.

Source: TradingView

Chart structures are flashing strength, and with institutions deepening exposure while Layer-2s widen throughput, ETH is not simply resilient — it’s evolving into a core infrastructure candidate for the next upswing. Alongside that rise, a SWIFT rival is quietly taking shape as on-chain settlements push toward mainstream finance.

SWIFT rival narrative: why payments are the new frontier

Each business day, SWIFT coordinates trillions in transfers, yet end users still face sluggish speed, high costs, and reliance on dated intermediaries. Years of blockchain experimentation promised to repair these frictions, but practical convergence between Ethereum’s deep liquidity and real-world transaction flows has been elusive in cross-border payments.

Paydax Protocol is emerging as that SWIFT rival. It fuses Ethereum programmability with an institutional-grade liquidity spine, moving beyond programmable money to programmable payments. The PDP token underpins near-instant settlement finality without banking middlemen, positioning Paydax (PDP) to propel a parallel rally as tokenized assets see broader adoption.

Inside the Paydax (PDP) project analysts believe could soar 25,000%

Several forecasters map a path for ETH toward $9,000 by 2026 — a twofold climb supported by spot ETF demand, compounding stake growth, and enterprise integrations. Beneath that headline, the more asymmetric setup often appears where large liquidity meets protocols engineered for capital efficiency, enabling outsized multiples during an advancing market.

Asset | Current price | Target price | ROI potentialEthereum (ETH) | $4,500 | $9,000 | 100%Paydax (PDP) | $0.015 | $3.75 | 25,000%

Asset | Current price | Target price | ROI potential

Ethereum (ETH) | $4,500 | $9,000 | 100%

Paydax (PDP) | $0.015 | $3.75 | 25,000%

Paydax taps that dynamic early as a micro-cap. Operating as a liquidity conduit, PDP routes institutional order flow into cross-chain settlement activity, magnifying upside when cycles expand. Initial figures show more than 64 million tokens placed and $965,000 gathered; projections outline a path toward $3.75 per token, implying a 25,000% appreciation if conditions align.

Paydax Protocol: SWIFT rival built for a mission

Paydax Protocol targets one of decentralized finance’s most stubborn frictions: immobilized capital. Legacy SWIFT transfers rely on an intermediary chain for reconciliation; many lending platforms in DeFi keep funds locked for extended periods. Acting as a SWIFT rival, Paydax removes both chokepoints through a liquidity-unlocking engine powered by PDP — a model tailored for the coming cycle.

Why Paydax stands out as a SWIFT rival:

- Deflationary PDP mechanism: a slice of PDP is burned per transaction, reducing circulating supply as network usage scales.

- Immediate settlement engine: near-instant, multi-chain clearing that avoids multi-day SWIFT queues.

- Tokenized collateral credit: borrow, lend, and earn yields without liquidating the underlying position.

This design blends practical utility with scalability — a pair of attributes many so-called “DeFi 2.0” attempts struggled to deliver at production scale.

Enhanced yields for Ethereum users

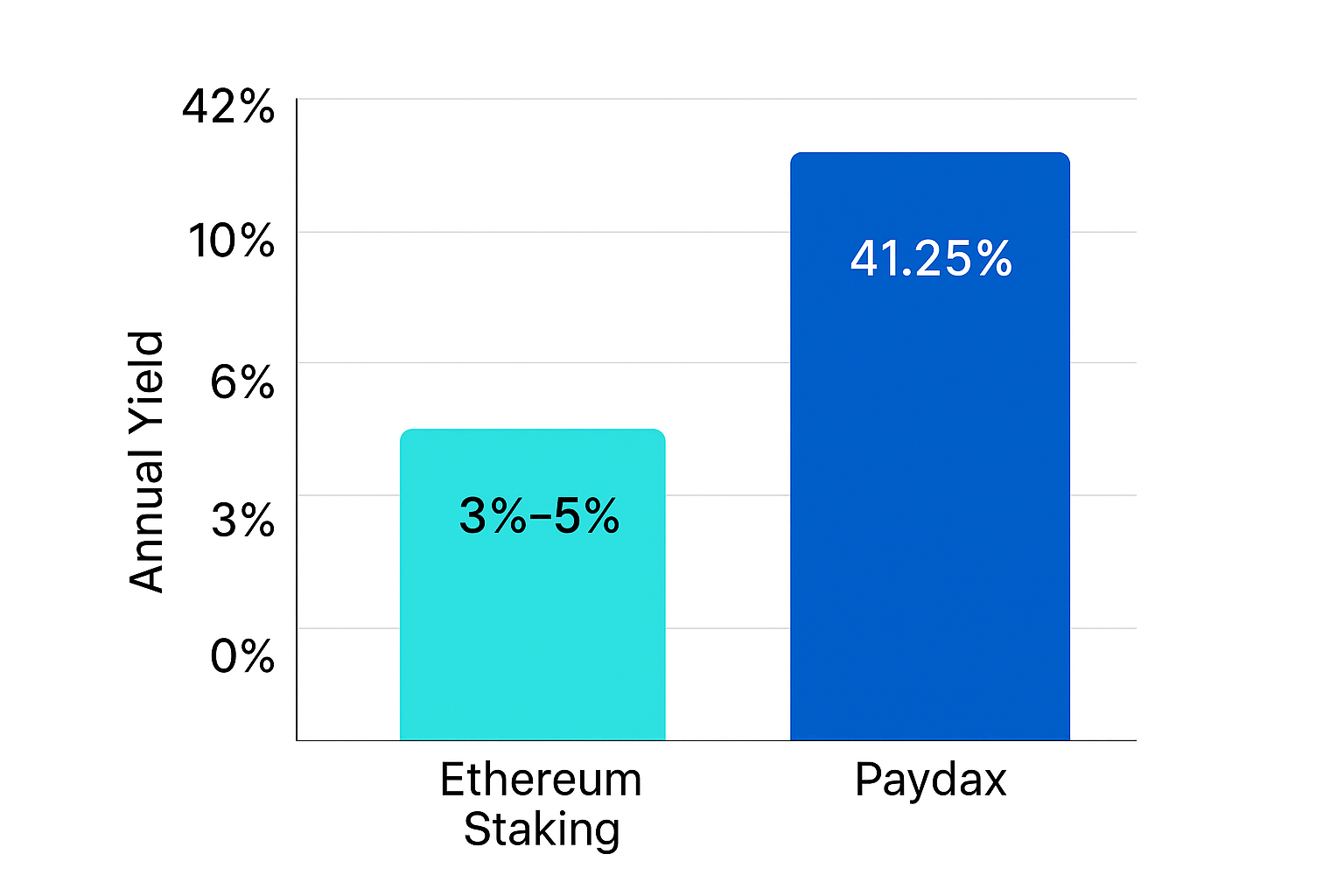

Typical staking returns for ETH hover roughly between 3% and 5% annually, yet capital can be put to work more aggressively. With Paydax acting as a SWIFT rival, idle assets become active liquidity: deposit ETH, BTC, or LP positions to target around 5%–7% annualized, with tiers reaching up to 41.25%; liquidity providers can capture additional variable returns tied to network throughput.

Source: Paydax Protocol

Instead of merely staking for ETH-denominated rewards, participants engage a system where capital moves across networks and compounds, creating broader earning avenues. Paydax converts dormant balances into productive liquidity, giving users a clear motive to bridge assets and harvest more value from each digital dollar in capital markets.

Presale window and dual momentum

While the Ethereum price consolidates, capital rotation increasingly spotlights upcoming platforms like Paydax. Early entrants are accumulating PDP close to its presale band. The sale remains open and features a 25% bonus with code PD25BONUS, paired with independent audit coverage for added confidence.

Source: Paydax Protocol

ETH headlines may dominate as new highs approach, yet Paydax is where liquidity turns into executable payments and real-world delivery. Together, these tracks introduce the next stage of finance: blockchain capability meeting tangible outcomes. Ethereum spotlights the opportunity; Paydax could be the engine that drives the coming run, with room for a 25,000% move if adoption accelerates.