The term ethereum halving has become a major discussion point in the crypto market since Ethereum’s transition from Proof-of-Work to Proof-of-Stake. Investors are trying to understand whether Ethereum has its own version of halving similar to Bitcoin, when it could happen, and how it might affect long-term price performance. Interest in this topic has risen sharply because Ethereum is now structurally capable of becoming a deflationary asset, which means a supply shock can appear without a fixed, block-level halving schedule.

Unlike Bitcoin, Ethereum does not have a programmed reduction of block rewards at predetermined intervals. Instead, the network experiences economic supply compression through a combination of decreased issuance, staking mechanics, and permanent fee burning. This is why analysts refer to the process as a triple halving: several sources of supply reduction acting at the same time.

In practical terms, the most relevant ethereum halving date is projected for the 2025–2026 window. This is when analysts expect the next major decline in net ETH issuance combined with reduced selling pressure from validators and consistently high burn rates. These forces together can replicate the market impact typically associated with a Bitcoin halving cycle.

The following sections explain what the triple halving concept means, how it was formed through previous protocol upgrades, and why the next halving-like supply shock is expected during this timeframe.

What Is Ethereum Triple Halving?

Ethereum does not follow Bitcoin’s programmed block reward schedule. Instead, its supply model adjusts through structural economic mechanisms, not fixed calendar events. The triple halving concept refers to the combination of three parallel factors that reduce sell pressure and net issuance:

- The end of Proof-of-Work mining and removal of miner selling

- A sharp reduction in base issuance after The Merge

- The introduction of automatic fee burning via EIP-1559

Taken together, these effects resemble multiple Bitcoin halvings compressed into a shorter time period. This is why analysts refer to ethereum halving in a broader macroeconomic sense rather than a technical block reward event. The next ethereum halving is therefore understood as the next moment when market issuance is reduced enough to strengthen Ethereum’s deflationary trend.

To answer the question does ethereum have a halving: there is no single predefined block-based halving event. However, there is a recurring halving effect driven by network conditions and burn dynamics, which is why investors increasingly treat these cycles as halving-equivalents from a supply and pricing perspective.

Ethereum Halving Timeline and Key Events

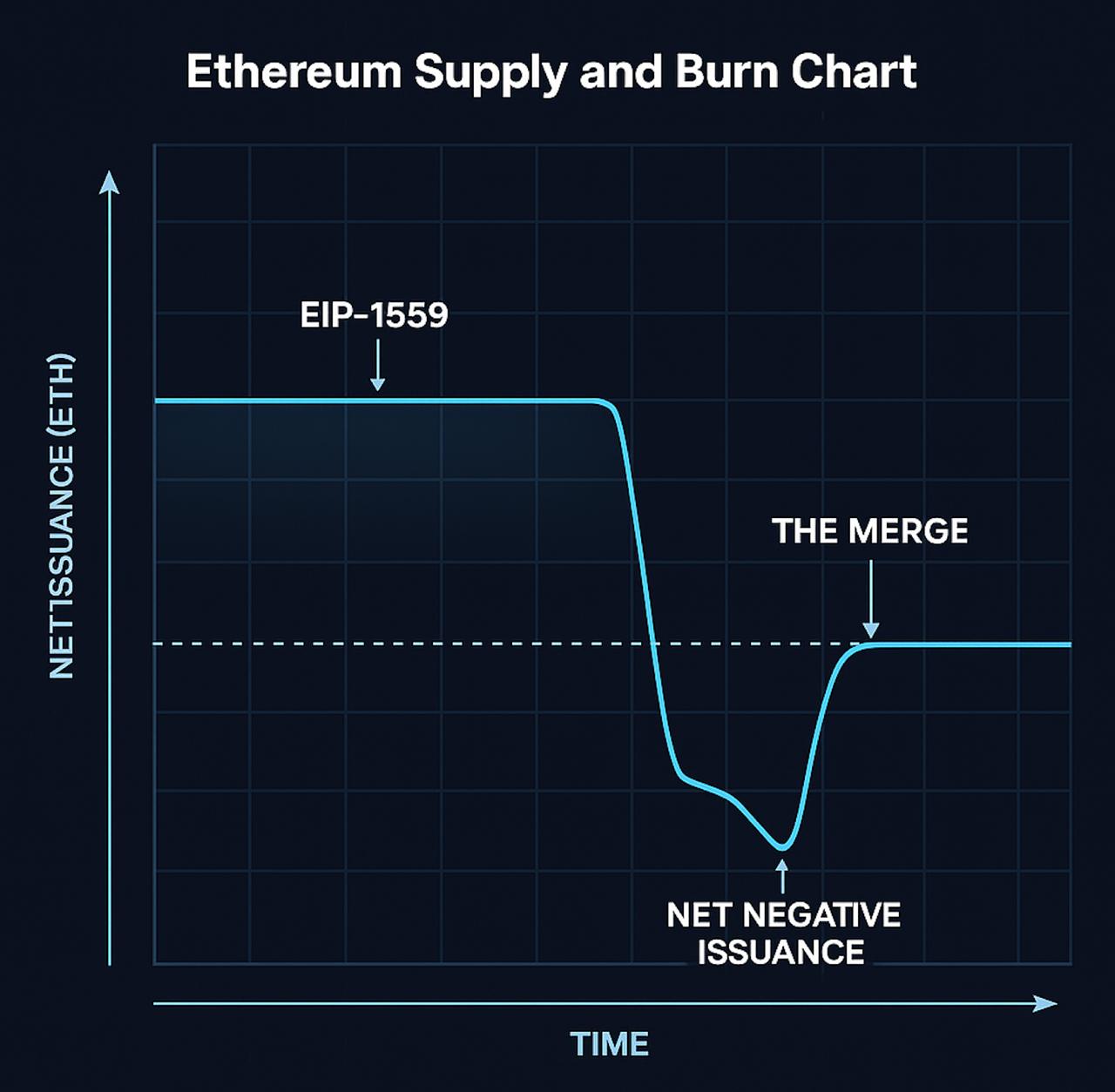

Ethereum’s shift toward a halving-like supply model did not occur all at once. It emerged through a sequence of upgrades and economic transitions that gradually reduced issuance and transformed ETH from an inflationary asset into a deflationary one. The key milestones below form the foundation of the ethereum halving schedule as it exists today.

Ethereum Merge Date (Proof-of-Work End Date)

The Merge took place on September 15, 2022, marking the network’s final transition away from Proof-of-Work mining. This eliminated miner selling pressure and replaced hardware-based issuance with a staking-based reward model. As a result, total issuance dropped by approximately 90 percent.

This moment is often considered the first major anchor point of the ethereum triple halving date because it permanently removed the biggest historic source of ETH sell pressure from the market. It also laid the groundwork for Ethereum’s ability to become deflationary under sustained network activity.

The EIP-1559 Upgrade (Fee Burn Mechanism)

EIP-1559 introduced a fee burn system that permanently removes a portion of transaction fees from circulation. Instead of all fees going to validators, a part of each one is destroyed, reducing long-term supply. This mechanism created the structural foundation for deflation whenever burn volume exceeds issuance.

In practical terms, EIP-1559 is a core pillar of the current ethereum halving schedule because it directly limits circulating supply and strengthens the long-term scarcity of ETH.

Next Ethereum Halving Event

When investors ask when is ethereum halving, they are referring to the next period in which issuance decreases relative to burn rate and validator selling continues to decline. Based on current network conditions and staking participation levels, analysts expect the next halving-like event to occur between 2025 and 2026.

Unlike Bitcoin, this is not a single block milestone but a trend-driven event tied to economics: higher burn rates, lower validator issuance, and decreasing rewards over time as staking participation increases. This is why the market refers to the upcoming point of deflationary acceleration as the next ethereum halving.

Ethereum Halving Price Prediction (2025–2030)

The pricing impact of the next ethereum halving depends on the relationship between issuance, staking dynamics, network demand, and macroeconomic liquidity. Since The Merge, Ethereum already shifted from net inflation to periods of net deflation during high activity. As burn volume grows and validator rewards decline, long-term circulating supply is expected to tighten further, creating a supply shock similar to Bitcoin’s halvings.

Below is a structured view of how this process may affect the market in the coming years.

Short-Term Outlook (2025–2026)

The short-term period aligns with the projected halving window. As staking continues to expand, validator yields gradually compress, which lowers incentive to sell ETH on the open market. At the same time, network usage related to on-chain payments, DeFi flows, and Layer 2 activity increases the rate at which ETH is burned.

Many analysts expect that ethereum halving price prediction for this period may reflect the effects of reduced supply pressure, especially if network congestion remains high. Historically, supply compression phases tend to coincide with rising interest from institutional participants seeking predictable store-of-value assets within the crypto market.

Long-Term Outlook (2030 and Beyond)

By 2030, the triple halving framework positions Ethereum as a programmable deflationary asset rather than a purely transactional one. As Layer 2 solutions expand and real-world tokenization continues to migrate to Ethereum infrastructure, demand-side pressure could compound against diminishing issuance. In this scenario, store-of-value characteristics may strengthen over time.

Here it is useful to contrast Ethereum with ethereum classic halving, which still follows a Proof-of-Work model more similar to Bitcoin. Unlike Ethereum Classic, the ETH supply curve is not tied to hardware emission cycles but to economic activity driving burn volume. This creates a more flexible, demand-responsive halving effect that scales with usage rather than block timing.

How to Prepare for the Next Ethereum Halving

Investors anticipating the next supply contraction typically focus on positioning before the deflationary window fully reflects in market pricing. Preparation is not limited to accumulation but also to strategic storage and monitoring of network conditions.

Some key steps include:

• Tracking issuance, burn rate, and staking participation, as these determine when is the next ethereum halving from an economic standpoint

• Using regulated exchanges to acquire ETH ahead of major deflationary shifts

• Transferring holdings to non-custodial wallets for long-term self-custody

• Diversifying across portfolios to limit volatility shocks even during bull cycles

Under deflationary conditions, ethereum price after halving tends historically to reflect the relationship between declining issuance and increasing demand. The timing of positioning is therefore as important as the holding period.

FAQ

Does Ethereum Have a Halving Like Bitcoin?

Ethereum does not have a block-based halving schedule. Instead, the network experiences a halving-like effect through decreased issuance, increased burn rate, and reduced validator selling. These shifts are driven by protocol economics rather than a fixed block interval.

When Is the Next Ethereum Halving Date?

There is no predetermined calendar date. However, based on current burn rate trends and staking dynamics, analysts estimate that the next major reduction in net supply will occur during the 2025–2026 period. This is why market observers refer to this window as the practical ethereum halving 2025 cycle.

How Will the Ethereum Halving Affect ETH Price?

By reducing net issuance and accelerating the burn effect, the halving framework can increase scarcity and decrease sell pressure over time. This is the foundation of the eth triple halving model often cited in macro forecasts describing what is triple halving ethereum in broader market terms.