Hedge With Crypto strives to present material that is correct at the time it is written. For exchange- or platform-specific details, consult the relevant provider’s official site. The content below is broad in scope, intended for learning, and not tailored advice. Hedge With Crypto does not offer financial guidance and does not factor in your personal circumstances. Consider engaging an independent financial advisor where suitable and perform your own due diligence.

Because Internet Computer operates with a consensus that supports Proof-of-Stake-like participation, ICP can be placed in staking to receive incentives. Participants may lock tokens through the Network Nervous System App or allocate them to a crypto staking service. Many users find an exchange-based workflow simpler. Earnings change with the commitment window; in general, extending the lock boosts potential rewards.

Leading options to stake Internet Computer for passive rewards

1. Binance staking

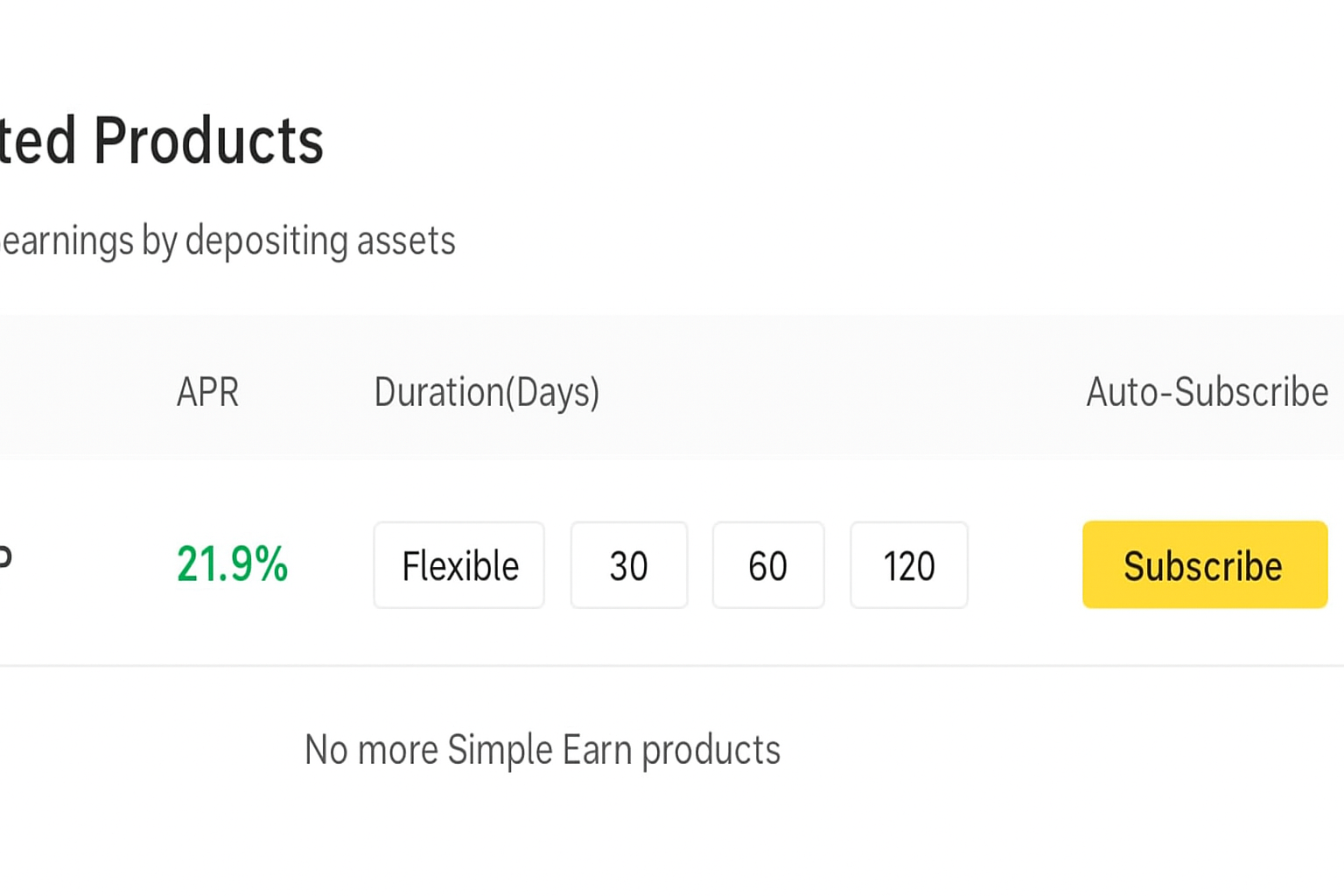

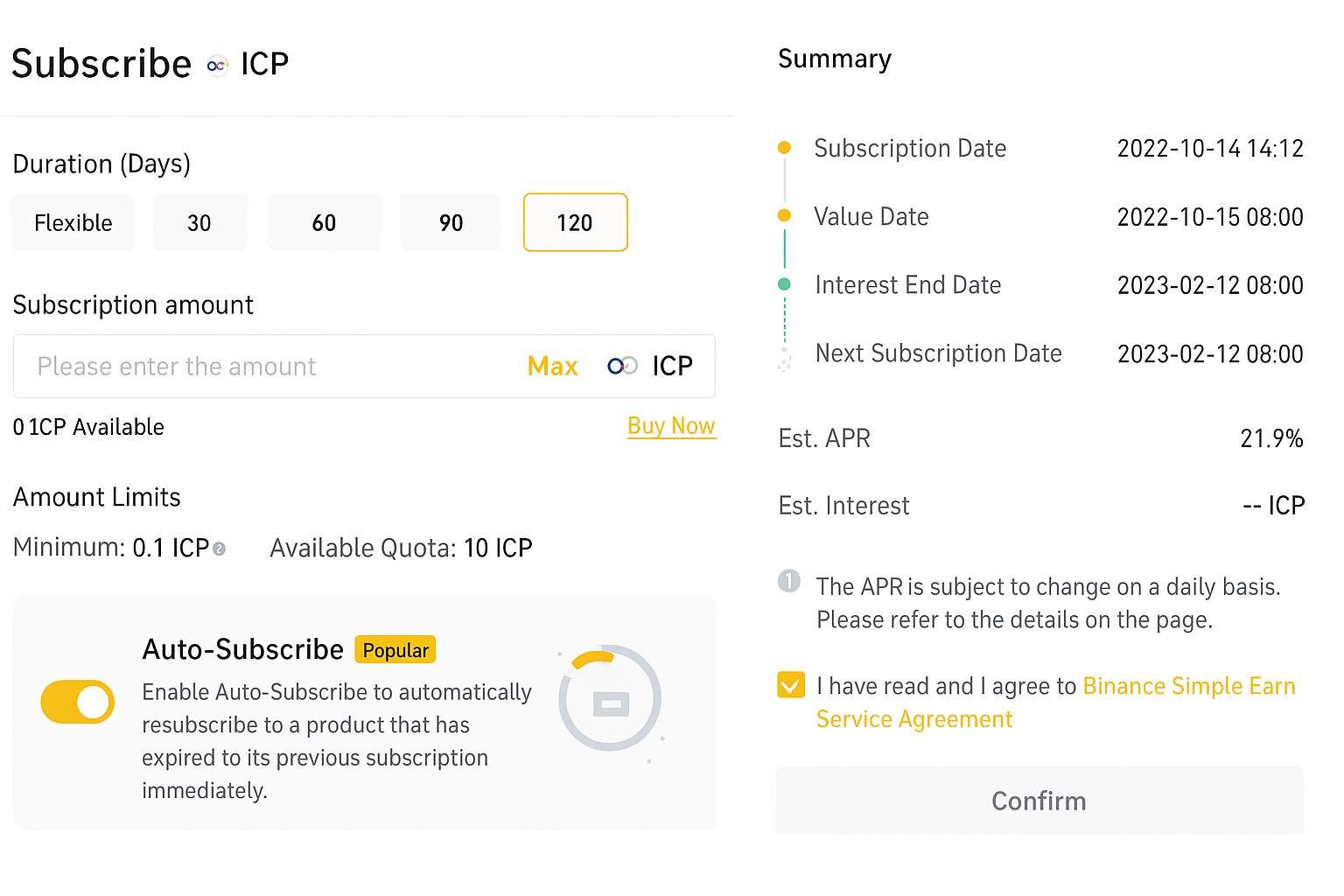

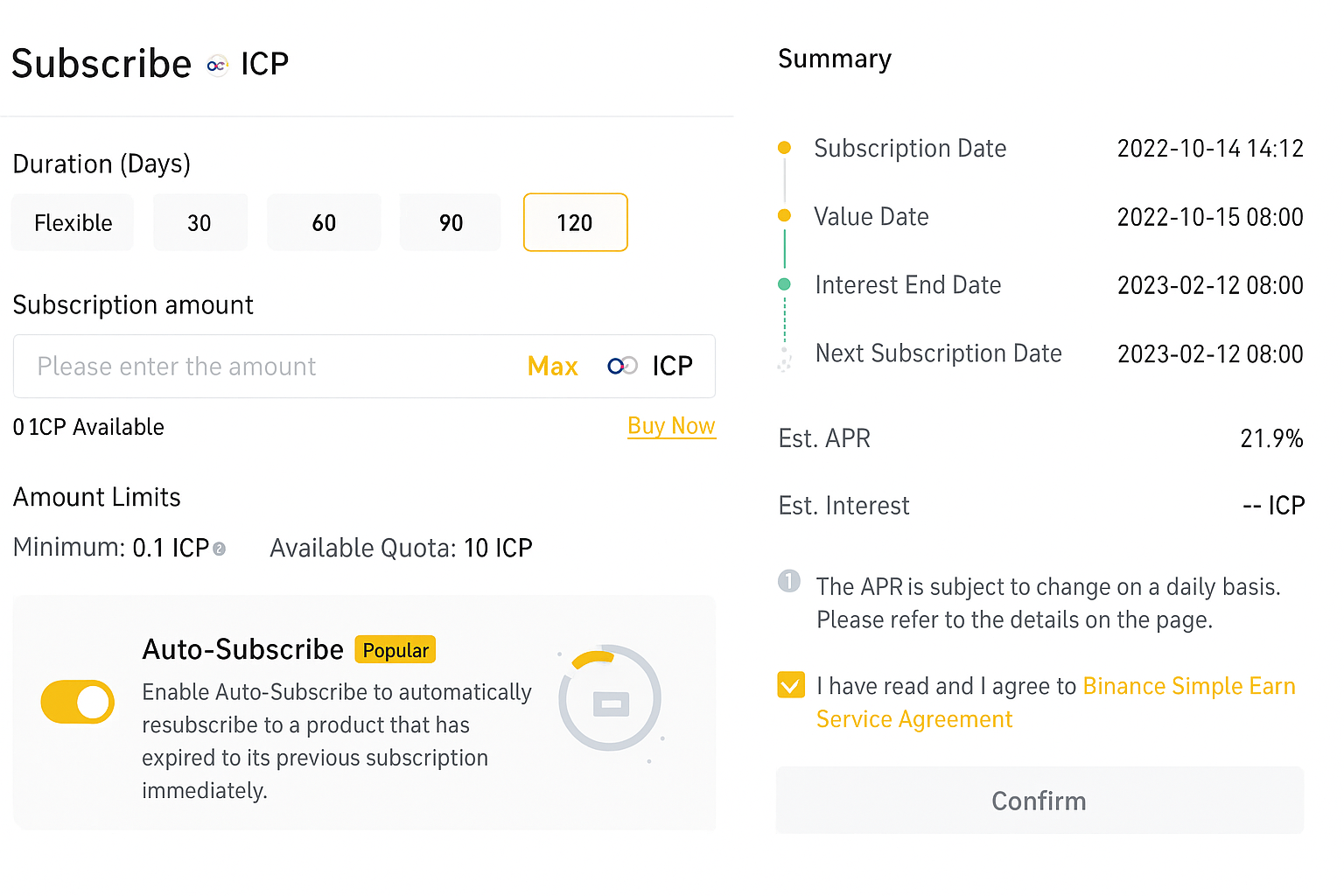

Binance activated ICP staking in April 2022 and rolled out fixed terms spanning roughly one, two, three, and four months (30/60/90/120 days). There is also a flexible product that lets users decide the holding duration. The smallest amount accepted to participate is 0.1 ICP.

Opting for the 30-day product generates about 4.95% APR, which lands on the lower side versus many assets. By contrast, the 120-day selection is far more attractive, delivering 21.90% APY at the time referenced—among the stronger returns seen relative to the best cryptocurrency staking coins.

The adaptable plan lets people choose a custom period, yet the rate there is modest—around 0.50% APY. Even so, it’s a handy on-ramp for moving ICP into Binance, a major venue for buying, trading, and selling ICP. Security practices are extensive, making it a comfortable place for storage while staking.

For exchange-based ICP staking, Binance ranks as our preferred choice because of its broad term selection and strong safety track record. You can also read an extended review on Binance for deeper context.

2. Bitrue staking

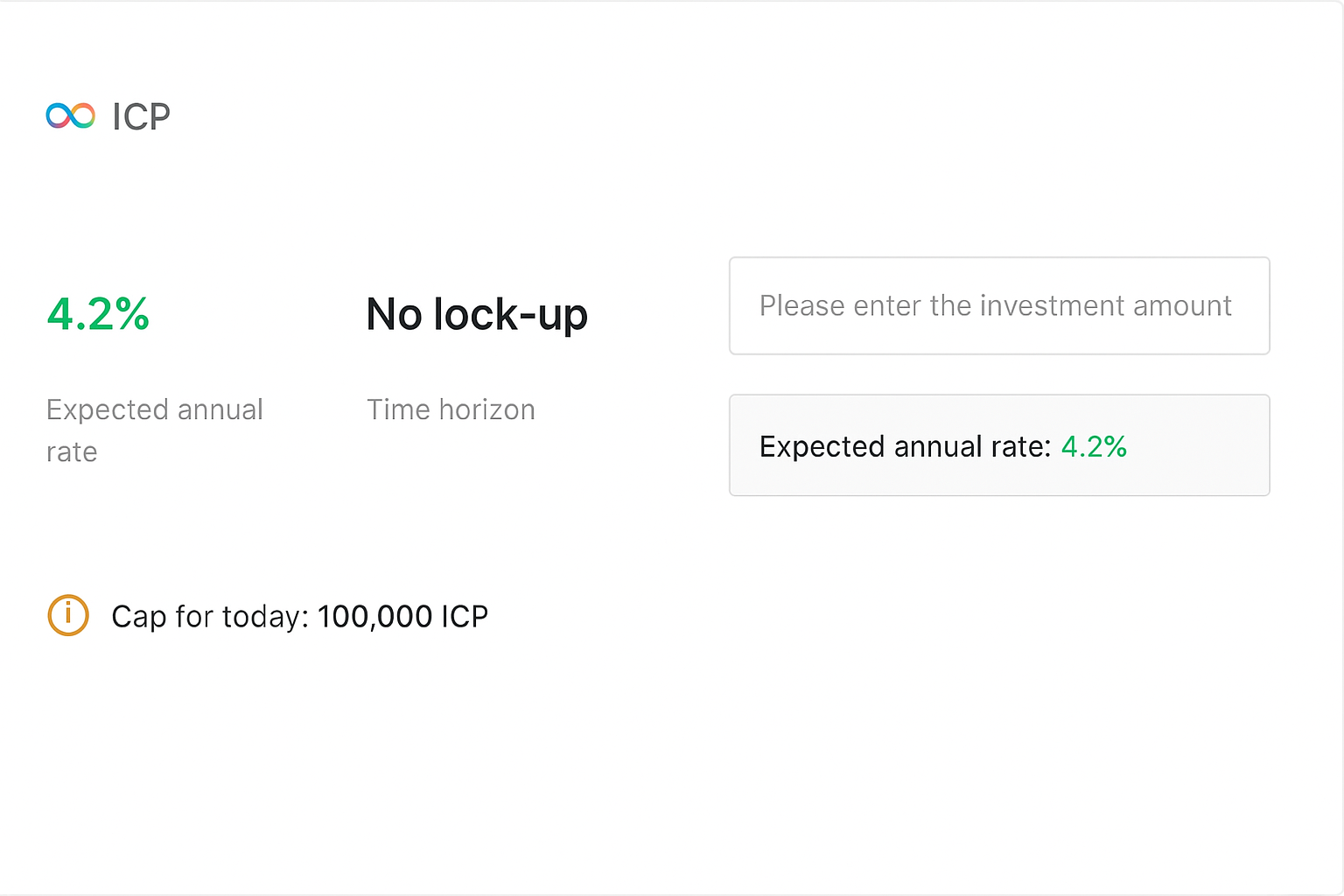

Bitrue’s simplest ICP earn product targets roughly 4.2% expected annual interest without any lock at all. The minimum to take part is 10 ICP, while a single position can go as high as 100,000 tokens. Versus Binance’s flexible rate, Bitrue’s no-lock option pays over eight times more, making it appealing for those who need immediate liquidity and still want a return.

Beyond that, Bitrue lists three fixed options—approximately 14, 30, and 90 days—advertising 13.66% APY, 9.11% APY, and 45.55% APY, respectively. While these payouts overshadow Binance’s offers, Bitrue’s overall liquidity is smaller; it doesn’t appear among the top 50 exchanges by trading volume, whereas Binance occupies the first spot.

Even with that caveat, yield-focused users may still pick Bitrue. The platform features many other earn products, and some show APYs north of 200% on different assets. A full review on Bitrue can provide additional insights.

3. Network Nervous System App guide

The Network Nervous System (NNS) coordinates Internet Computer governance by hosting community voting that directs the protocol. It also functions as a chain-level component with a public key system to verify transactions. Proposals—such as adding new subnets—are put forward, ICP holders vote, and participants receive ICP rewards tied to that on-chain decision-making.

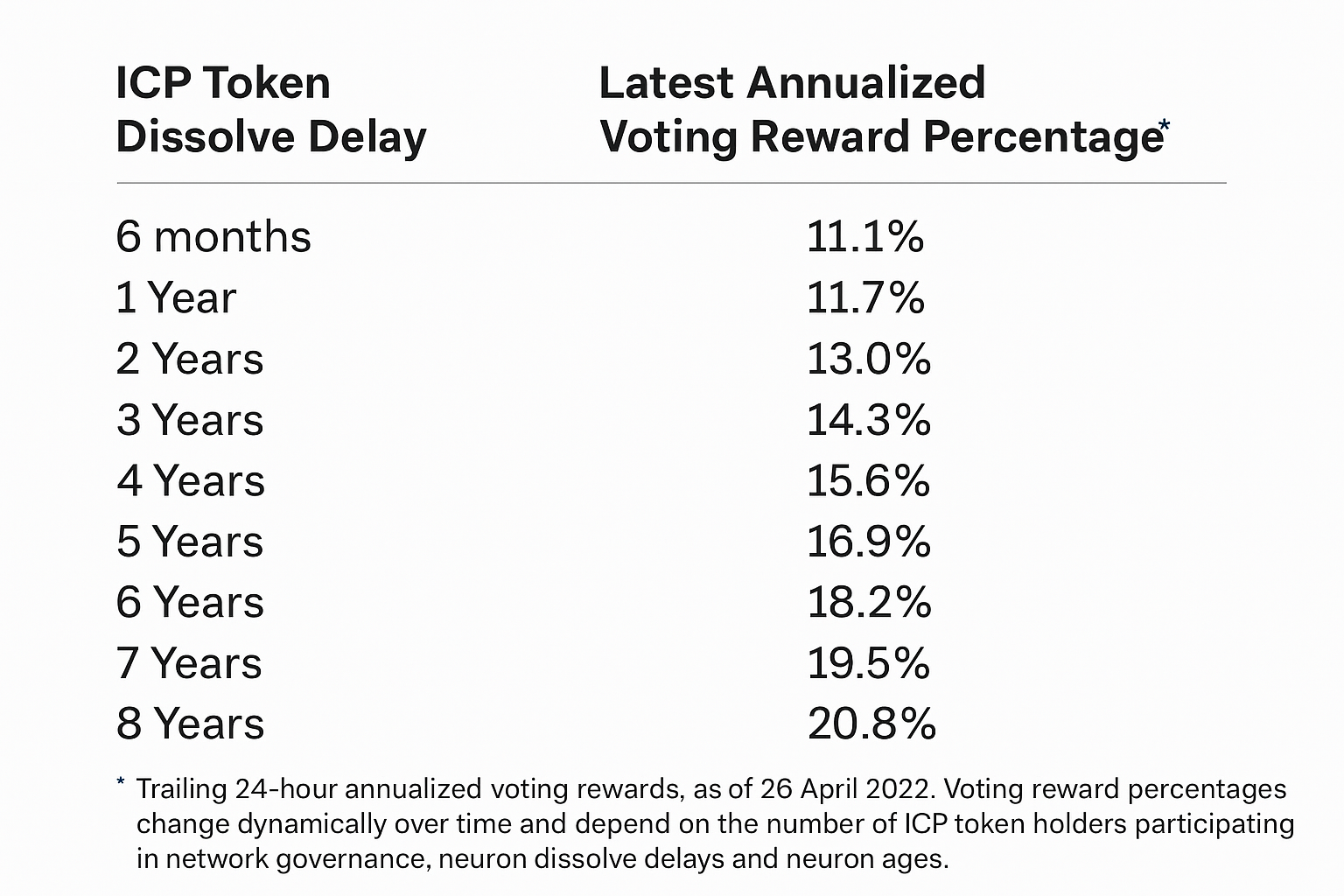

Reward rates scale with time. For instance, a six-month hold starts around 11.1% APY, a one-year commitment is near 11.7% APY, and staking for eight years can approach about 20.8% APY. These figures are indicative and can shift with market conditions and the total ICP engaged in governance.

Note: April 2022 rates are shown.

Although the NNS flow is straightforward, it is not always the smoothest path. ICP must be acquired on an exchange such as Binance and then transferred back to the NNS for staking. Compared with a single-platform experience, that extra step can be inconvenient, which is why many choose to stake directly where they buy or trade ICP.

Ways to stake Internet Computer

1. Staking ICP via the Network Nervous System App

Inside the NNS, proposals are continuously surfaced, and holders who lock ICP gain voting power and accrue rewards for participating in that process.

Follow these steps to place ICP in NNS staking:

- Buy ICP tokens. Start by sourcing ICP on a venue that lists the asset. As of writing, Binance and Coinbase record the most ICP volume among top crypto exchanges. You can deposit fiat via onramps or swap from another altcoin to obtain ICP.

- Create an account with the app. To take part in ICP governance, set up an account on the official NNS app that supports staking. You’ll need an Internet Identity to sign in—this can be created using biometrics (for example, a fingerprint or a face scan on a phone), a hardware security key, or by linking a compatible wallet.

- Transfer ICP tokens to the app. Send the ICP you purchased to the NNS “Main” wallet address shown in the app interface. The transfer typically finishes within a few minutes.

- Begin staking. After the funds arrive in the Main wallet, choose New Transaction to lock them. The minimum size is 1 ICP. Select a Dissolve Delay—anywhere from about half a year up to eight years—knowing that longer durations tend to produce higher rewards. Finally, pick which neurons to follow for voting delegation.

2. Staking ICP on an exchange platform

A number of staking platforms support ICP. Our top selection is Binance, and Bitrue is another viable alternative for those prioritizing flexible rates or high-yield terms.

To stake ICP on an exchange, complete these actions:

- Choose a staking platform. Pick one of the platforms mentioned earlier, open an account, and sign in using your credentials.

- Purchase ICP. Fund your account with either fiat or crypto. If you add traditional currency, expect a Know-Your-Customer process before trading. Buy ICP using those funds, or deposit pre-owned ICP if you already hold some.

- Navigate to the staking section. Visit the exchange’s staking area and scan the list of supported assets. Select ICP from the catalog.

- Choose a staking term and enter the amount. Decide whether to use a flexible arrangement or a fixed term, then specify an amount that meets the platform’s minimum.

- Review and start staking. Double-check the details and submit the request by pressing Stake Now (or its equivalent) to begin earning.

How staking Internet Computer works

Staking emerged with networks using a proof-of-stake consensus, which assigns validators to attest to transactions. While Internet Computer does not run a pure PoS design, it employs a four-layer mechanism centered on PoS principles, enabling staking-style participation and governance.

A neuron reward accrues daily. Neurons that vote claim rewards proportional to their stake weight, paid out in ICP. In practice, contributors help secure the system and steer governance, and are compensated accordingly.

How much could you earn staking Internet Computer

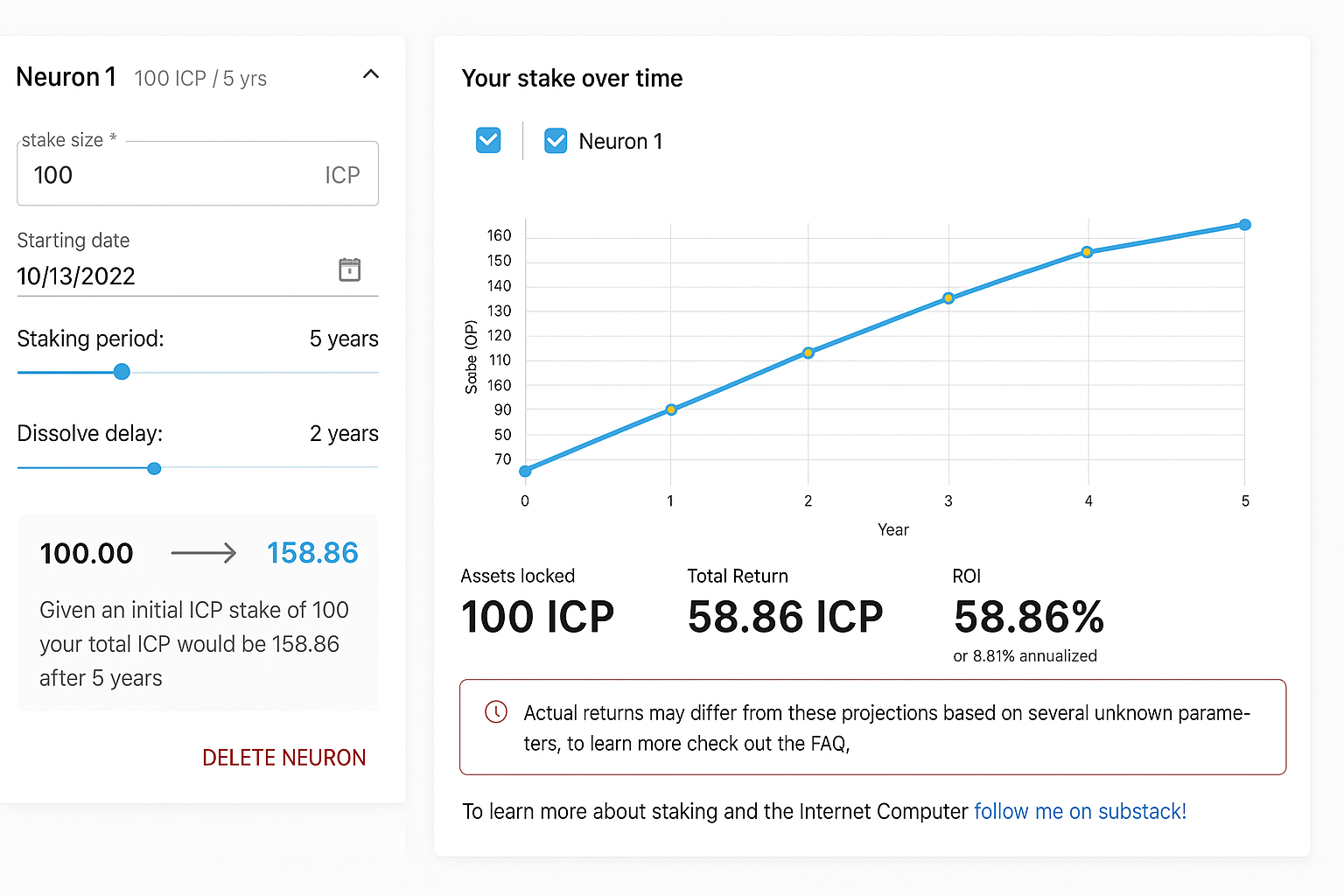

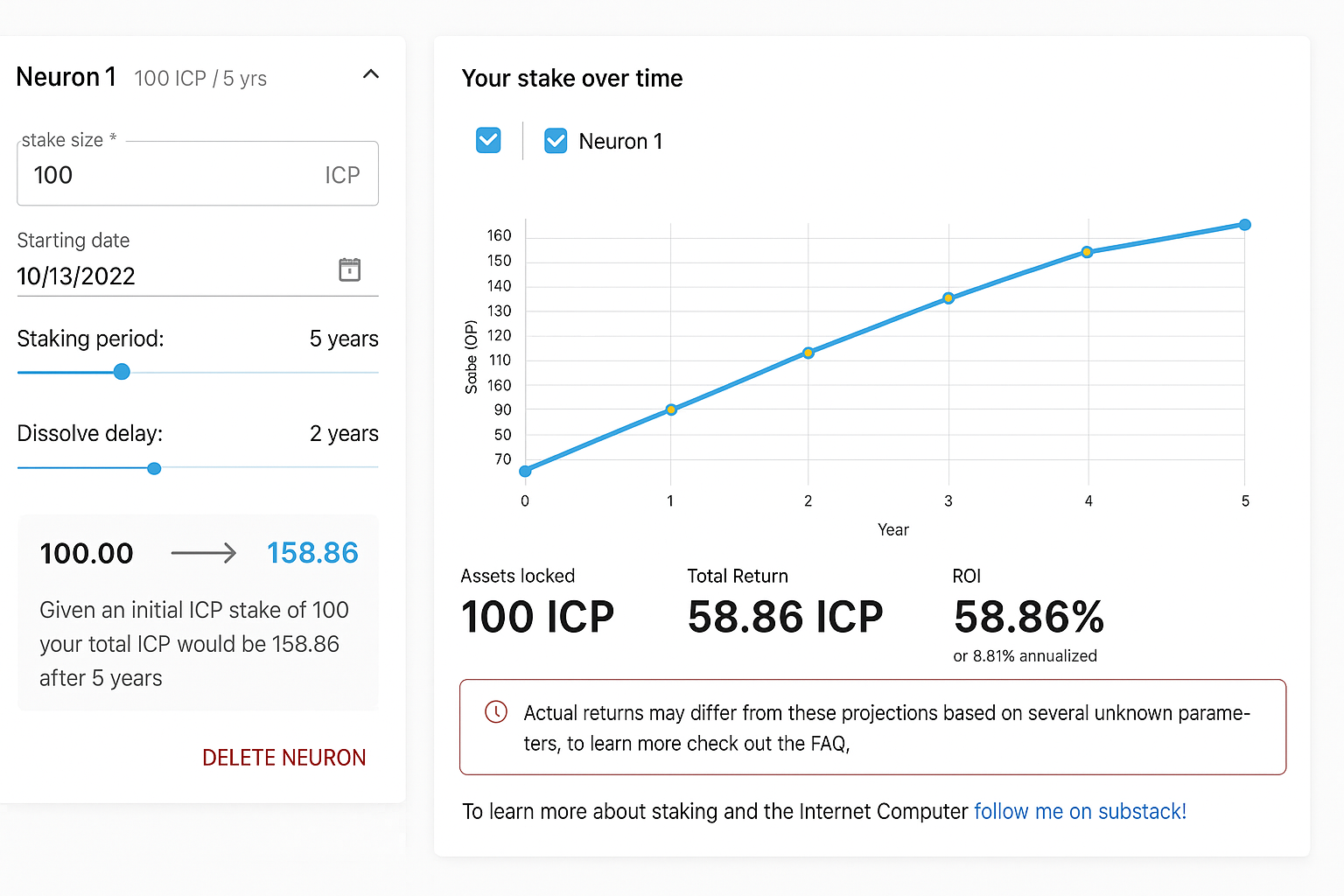

On exchanges, ICP frequently pays in the ballpark of 4.5% to 11% APY on fixed or locked terms. Some longer windows—like 120 days—have shown about 21.90% APY on Binance and roughly 45.55% APY on Bitrue. Outcomes also depend on factors beyond the lock length: Dissolve Delay selection, total ICP staked, neuron age within the NNS, how many proposals reach a vote, how many neurons participate each time, and the average age of all neurons. To estimate your potential rewards, you can reference the ICP Neuron calculator depicted below.

Pros and cons when staking Internet Computer

Before deciding to lock ICP, weigh the following positives and drawbacks.

Staking Internet Computer Pros:

- Choice of venue. You can commit ICP either through an exchange or by using the Network Nervous System App; both routes are accessible, with exchanges typically being more streamlined.

- Compelling yields. Across multiple platforms, ICP posts competitive APYs, which makes it a strong candidate for income-seeking participants.

- Vision and momentum. Internet Computer has an ambitious roadmap; although the chain launched recently relative to its five-year build, interest has expanded rapidly.

- Growth potential. The project’s long-term outlook suggests room for broader adoption and developer activity, which may support the ecosystem.

Staking Internet Computer Cons:

- Market swings. Crypto pricing is volatile, and both token value and quoted APYs can fluctuate significantly over time.

- Longer locks for peak returns. The most attractive reward tiers generally require committing funds for extended periods.

- Price history concerns. ICP’s valuation dropped sharply during the bear market, which can impact overall results despite earned rewards.

Risks to consider

Staking digital assets entails risks that also apply to ICP. Keep the following in mind.

- Changing APYs. Rates are variable. For example, at launch on Binance, the 120-day ICP term topped 25% APY, while the more recent figure referenced was 21.90% APY. Shifts like these can challenge a static plan during fast-moving markets.

- Security exposure. Wallets and users can be targeted by phishing or malware. Lack of security awareness may result in losses.

- Value volatility. Even staked ICP experiences price movement. In a severe downturn, the fiat value of your locked position can fall despite accumulating rewards.