Trump Media and Technology Group, which is behind the Truth Social platform, announced a partnership with Crypto․com. As part of the agreement, the social network will launch its own prediction markets.

The collaboration is being implemented through the American division of Crypto․com, the company CDNA (Crypto․com Derivatives North America). Thanks to the partnership, Truth Social users will be able to bet on the outcomes of real events, from elections and economic indicators to sports matches and commodities.

The new feature, called Truth Predict, will integrate CDNA contracts directly into the Truth Social app. Users will have access to real-time prediction markets. They will be able to follow and bet on topics such as inflation rates, political elections, and sports results.

Trump’s Truth Social could redefine the prediction market

As stated in the announcement, prices on the platform will be updated in real time, allowing users to instantly react to ongoing events.

“We are the first among public social networks to offer prediction markets directly to users,” said Trump Media CEO Devin Nunes.

He called the launch a way to “put information in the hands of ordinary Americans” and promised that Truth Predict will combine user activity with market signals, turning data into “a forecast you can rely on.”

Contracts will be based on CDNA, a platform registered with the CFTC , which gives the project a legal basis for operating in the US. For Truth Social this is an opportunity to connect to regulated infrastructure amid rapidly growing interest in such platforms.

According to Crypto․com CEO Kris Marszalek, the partnership fully fits into the company’s strategy: to promote legal fintech tools in the Web3 world.

“Prediction markets are about to become a multi-billion dollar segment. We are excited to launch them together with Truth Social, right inside the social network,” he said.

Crypto․com strengthens in the US: futures, banking license, and partnership with Truth Social

The partnership with Truth Social coincided with both companies actively strengthening their positions in the US financial market. In September, Crypto․com received the green light from the CFTC. Now its subsidiary CDNA can offer margin derivatives.

At the same time, the American division of Crypto․com received the status of a registered futures broker. This gives the company the right to operate with leverage, both with retail and institutional clients.

And last week Crypto․com applied for a banking license from the OCC. If approved, the company will become one of the few crypto companies with federal status. This will open the way for scaling up custodial and staking services, including in its own Cronos network.

It also became known about integration with Morpho, the second largest DeFi lending protocol. Thanks to the partnership, the Cronos network will offer stablecoin loans and the ability to deposit wrapped assets.

See also: MetaMask prepares airdrop — mysterious site fuels rumors about MASK token

As part of the integration with Truth Social , users earning Truth gems (in-platform activity bonuses) will be able to exchange them for CRO, the native token of Cronos, and use them to purchase contracts on the Truth Predict platform.

This integration continues the strategy started earlier, when the companies announced the creation of a joint venture Trump Media Group CRO Strategy, Inc. This entity will manage the digital treasury with a focus on the CRO token.

Beta testing of the Truth Predict feature will begin soon, and the full launch in the US is planned for the end of the year. Trump Media noted that after obtaining all permits, the service is planned to be expanded to the international market.

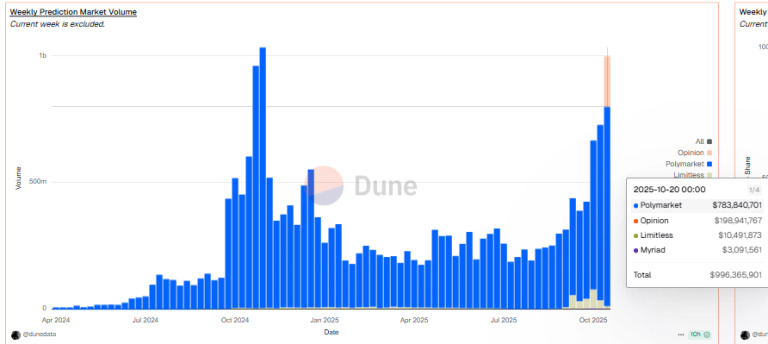

Prediction market trading volume approaches $1 billion per week

This was announced amid a new surge in the prediction markets industry.

According to Dune Analytics, in mid-October, the total weekly trading volume on leading platforms approached $1 billion.

The market leaders remain Polymarket and Kalshi. Polymarket accounts for about 79% of the total weekly volume, more than $780 million per week. During this period, the platform was used by more than 220,000 active users.

Institutional investment in the sector has also accelerated. The owner of the New York Stock Exchange, Intercontinental Exchange, invested $2 billion in Polymarket, valuing the project at $9 billion.

The Kalshi platform also attracted attention, with a Series D funding round of $300 million raising its valuation to $5 billion. Among the investors are major venture funds, including Sequoia Capital and Andreessen Horowitz.

The rapidly growing market has begun to attract both crypto projects and players from traditional finance. For example, the American sports betting giant DraftKings entered the sector by acquiring the regulated CFTC platform Railbird and choosing Polymarket as a partner.

Against this backdrop, new players are also growing rapidly. The Limitless Exchange platform, after raising $10 million , has already exceeded $500 million in total trading volume.