Investors across more than fifty jurisdictions can open short positions on cryptocurrencies with Kraken. The venue supports over one hundred margin-enabled pairs with leverage available up to five times. Access to shorting on Kraken exists in both its margin capabilities and its dedicated Futures environment (a comprehensive Kraken review is available separately):

- Kraken margin trading interface. Margin on the spot market lets a trader employ borrowed capital to initiate a short setup. Depending on the specific asset, Kraken permits as much as 5× leverage, with limits varying per market. Using leverage expands position size and can amplify gains from a correctly timed short.

- Kraken Futures venue. Through Kraken’s futures contracts, participants speculate on forward price changes with up to 5× leverage. A futures contract is an agreement between counterparties to transact the asset at a set price on a future date, providing exposure without holding the underlying coin directly.

Short on Kraken with Margin: step-by-step

1. Sign in or create a Kraken account

Start by logging in to your profile or select the Create Account button to register. Provide a working email, set a strong unique password, and pick your country of residence. Confirm acceptance of the platform’s terms and conditions.

To enable fiat deposits and margin features, Kraken requires KYC verification. After access, choose Get Verified on the account prompt and complete the form. Upload a clear image of a government ID such as a driver’s license or passport; in some cases, a recent utility bill showing your address is requested. Account approval typically completes within a few hours.

2. Deposit funds

Next, add money to the new Kraken wallet. Supported fiat options include USD, EUR, GBP, RUB, and several others. Funding methods span bank wires, ACH transfers for U.S. users, crypto deposits, payment cards, and certain e-wallets. To place a short on Kraken, the minimum starting amount is $10.

3. Switch from Simple to Advanced

After your transfer lands, click Trade at the upper-left of the homepage. Under New Order, you will see Simple and Advanced modes; Simple is applied by default. Change the mode to Advanced to access the margin tools and order types designed for leveraged trading.

4. Choose a margin level

Pick the leverage multiple you intend to apply. Kraken allows as much as five-times on posted collateral. For new orders the leverage setting sits at None by default; use the selector near the order book to adjust. Monitor risk metrics like liquidation price and margin call thresholds before proceeding.

5. Borrow funds

Optionally request a loan from the exchange to expand your position. Select the asset you want to borrow, enter the desired quantity, and press Borrow to finalize. The borrowed balance is credited directly to your margin wallet for immediate use.

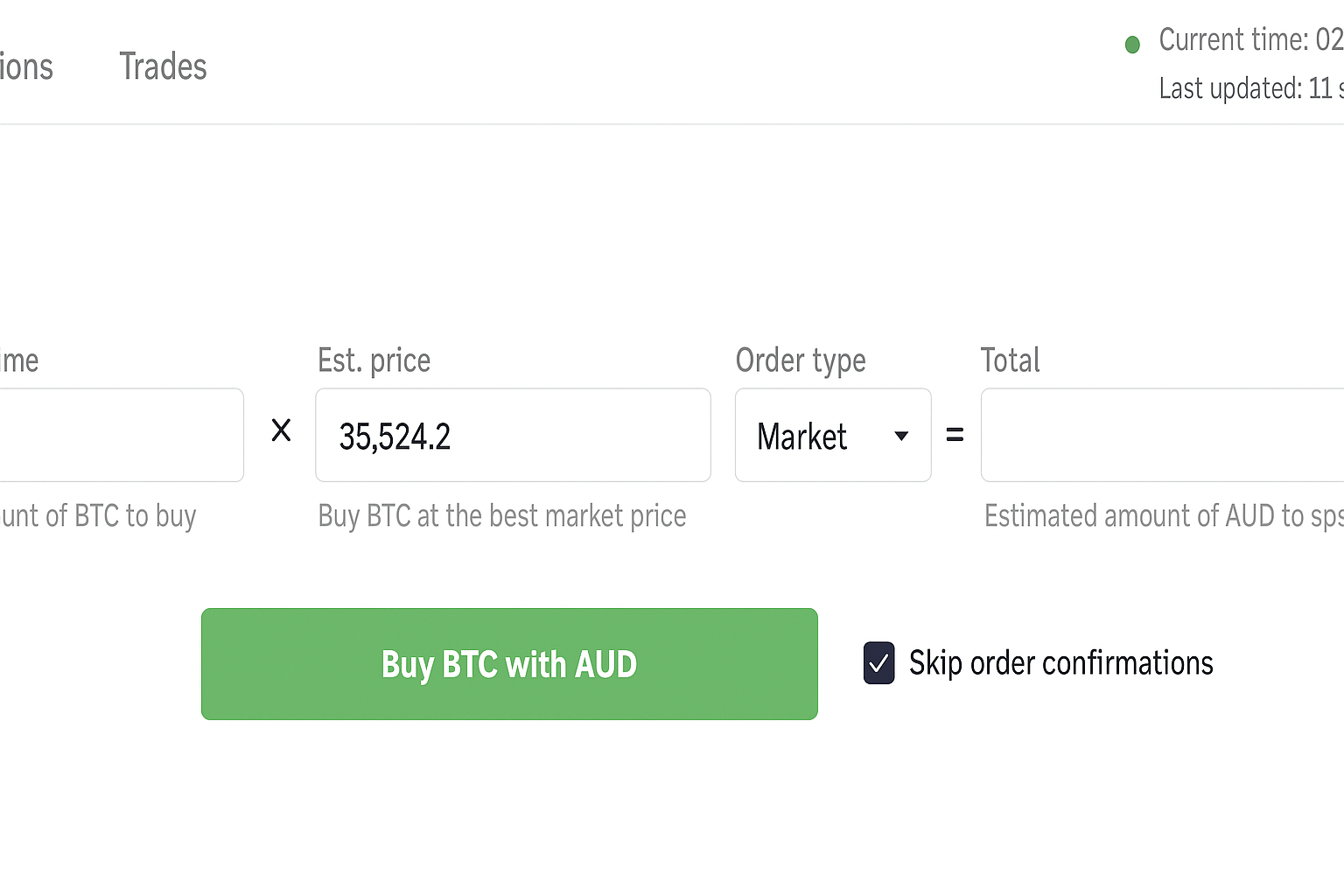

6. Open a short position

Set the price at which you’ll sell the asset. Kraken provides common order types to tailor execution. A limit order lets you define the exact price for your trade entry (e.g., for Bitcoin), while a market order fills instantly at the prevailing quote, subject to order book depth and possible slippage. Pick the order type and specify the amount you plan to trade.

7. Repay the borrowed amount

After closing the trade in profit, finalize the settlement and return the loan. Go back to Trade, choose Sell, and input the quantity to close. Pick either limit or market, then set the Order Type to Settle Position. Once executed, the platform reclaims the borrowed units and any remaining difference becomes your realized P&L.

Short on Kraken with Futures: quick guide

1. Log in to Kraken

To open an account for futures, head to the Futures portal, press Create Account, supply your email, and choose a robust password. Select your region and agree to the T&Cs to enable the button. Access to Kraken Futures requires completing identity verification before trading derivatives.

2. Add funds

When verification is complete, make a deposit. Choose your preferred payment route and fund at least $10. Funds initially credit to the Spot balance. Kraken accepts more than fifty fiat currencies, including USD, EUR, and GBP.

3. Switch to Kraken Futures

After depositing, click the four-square menu near your balance and pick Kraken Futures from the list. You’ll be redirected to the futures trading dashboard where leverage and hedging tools are available.

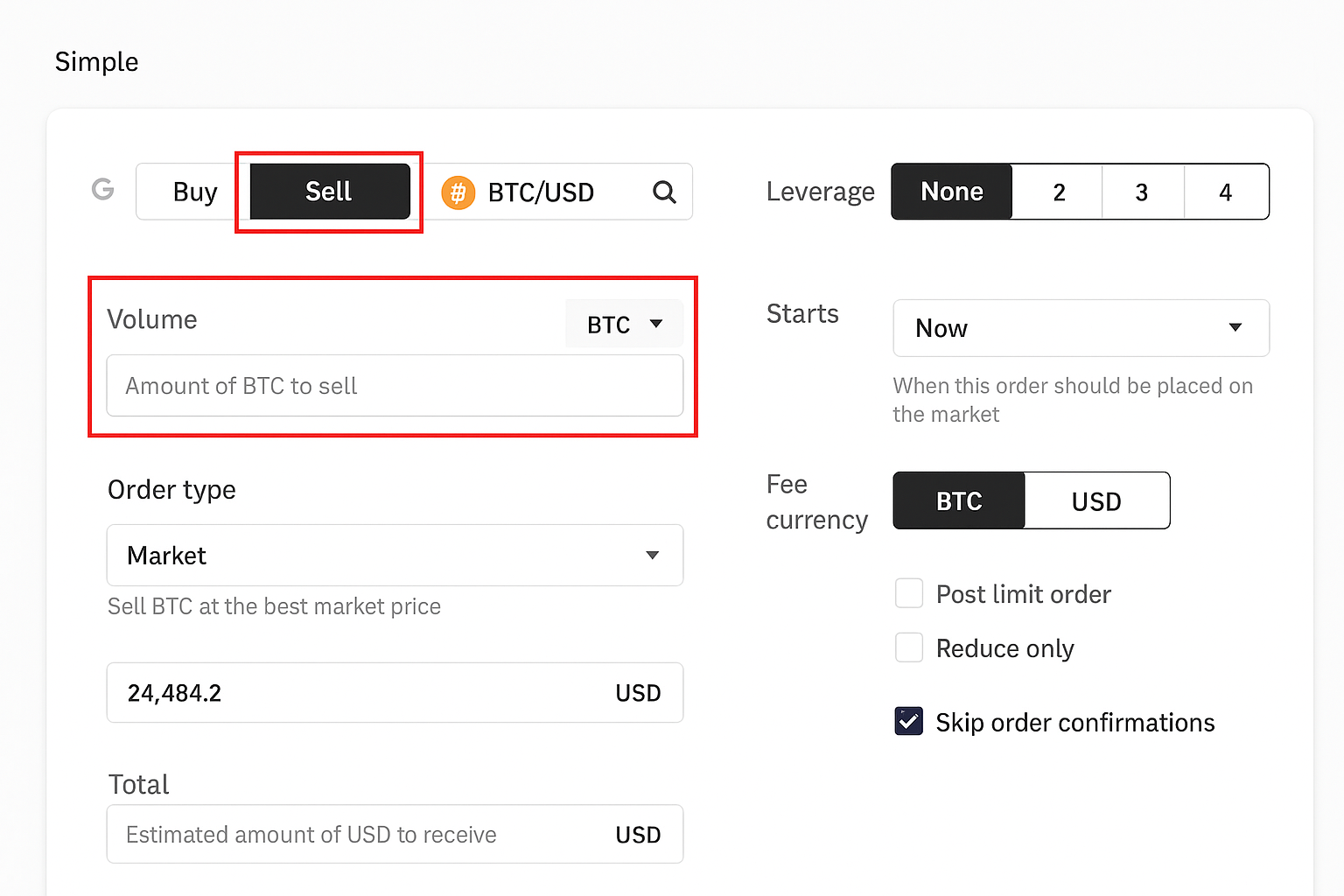

4. Place a short order

On the Trading panel at the far right, flip from Buy to Sell. Set your chosen Leverage, select Limit under Order Type, and input the price you want for the short entry. Hit Review Sell to verify details, then Confirm Sell to send the order for execution.

Who can short on Kraken?

Kraken operates globally, yet product availability depends on where a customer lives. Most users in Europe can access the full suite, including shorting crypto. In contrast, U.S. customers have restrictions: the dedicated Futures product is unavailable, and margin access is constrained to qualified users who meet Eligible Contract Participant (ECP) requirements.

What are the fees to short on Kraken?

Margin shorting fees on Kraken depend on the specific market being sold. As an illustration, BTC (Bitcoin) carries a 0.01% short fee plus a 0.01% rollover every four hours. On Kraken Futures, baseline fees start at 0.02% for makers and 0.05% for takers, with discounts that scale down as 30‑day trading volume increases. Consider funding rates, volatility, and risk management when calculating total costs.