Hedge With Crypto publishes educational material believed to be current on the date it goes live. For details on any particular exchange or trading venue, consult that provider’s official site. This information is general, intended for learning only. Hedge With Crypto does not offer financial advice or consider your personal circumstances. Seek guidance from an independent financial adviser where suitable and conduct your own research.

The Fantom (FTM) coin underpins the Fantom network, serving roles like payments, fee settlement, and governance. As a proof-of-stake asset, everyday participants help secure the chain by delegating FTM. Those preferring lower risk can lock tokens to receive periodic rewards from the staking pool.

Below is our finalized roundup of places to stake FTM:

- Binance– Overall best venue to stake FTM

- Bybit– Top choice for flexible FTM staking

- OKX– Platform targeting higher FTM returns

- Fantom– Best FTM staking wallet option

- KuCoin– Exchange with streamlined staking tools

- Uphold– Established FTM staking pick for US users

Where to stake FTM

1. Binance — why it leads for FTM staking

Binance frequently ranks first for Fantom staking. It is the world’s largest crypto marketplace by liquidity and trading turnover, welcoming users from a wide range of regions.

With Binance Earn, customers can stake more than sixty assets, including FTM, to collect rewards. Staking is accessible on both the web platform and the mobile application for convenience.

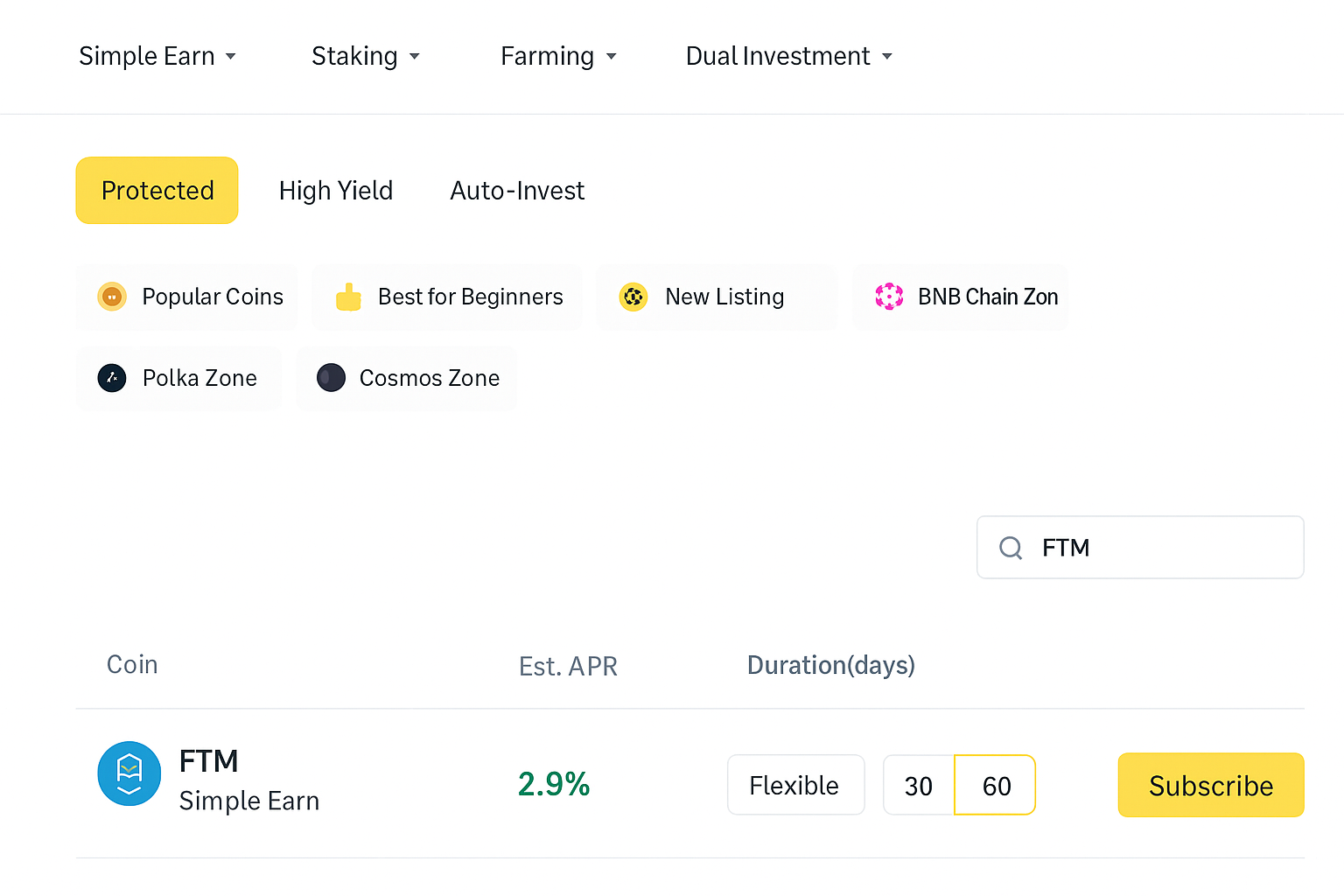

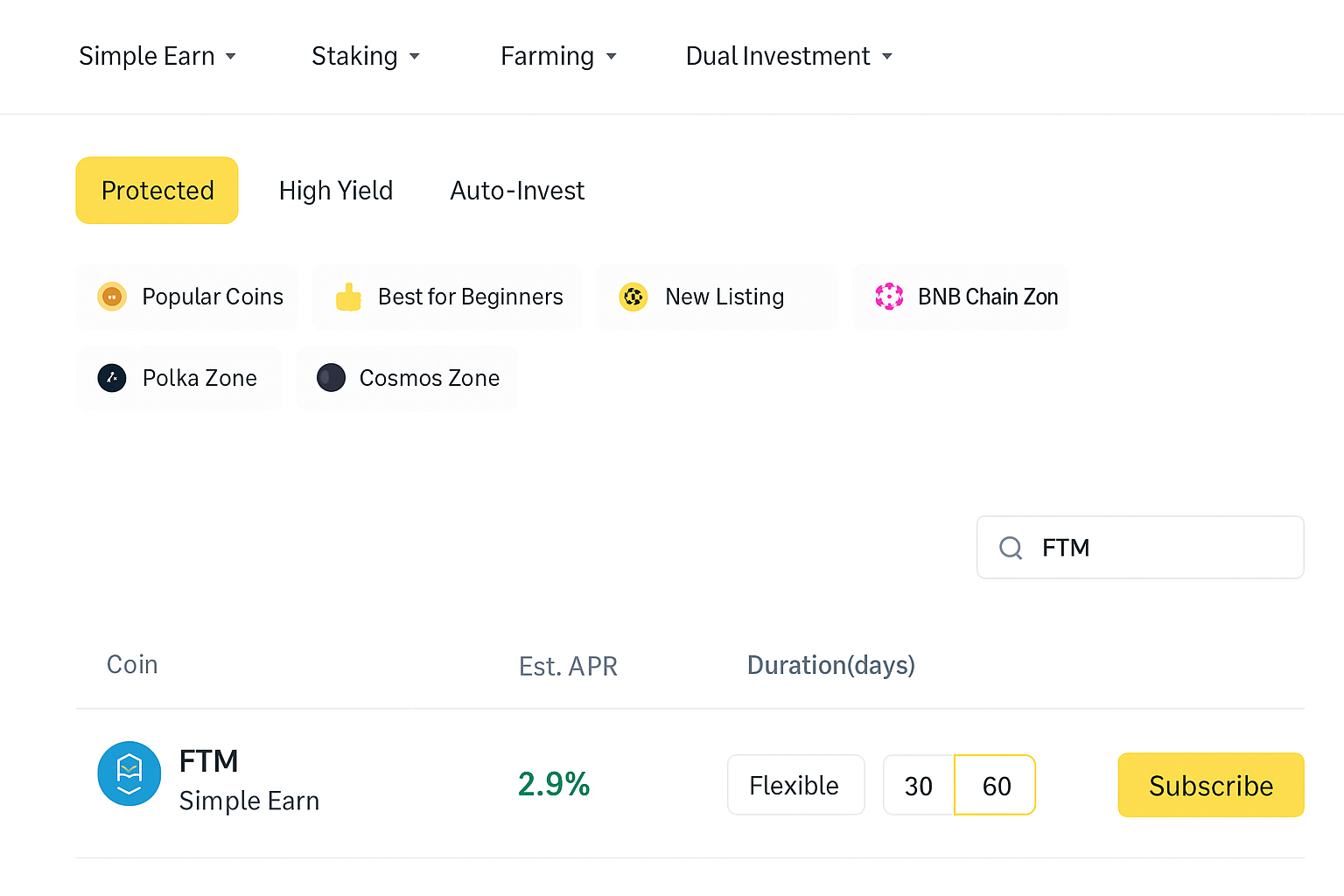

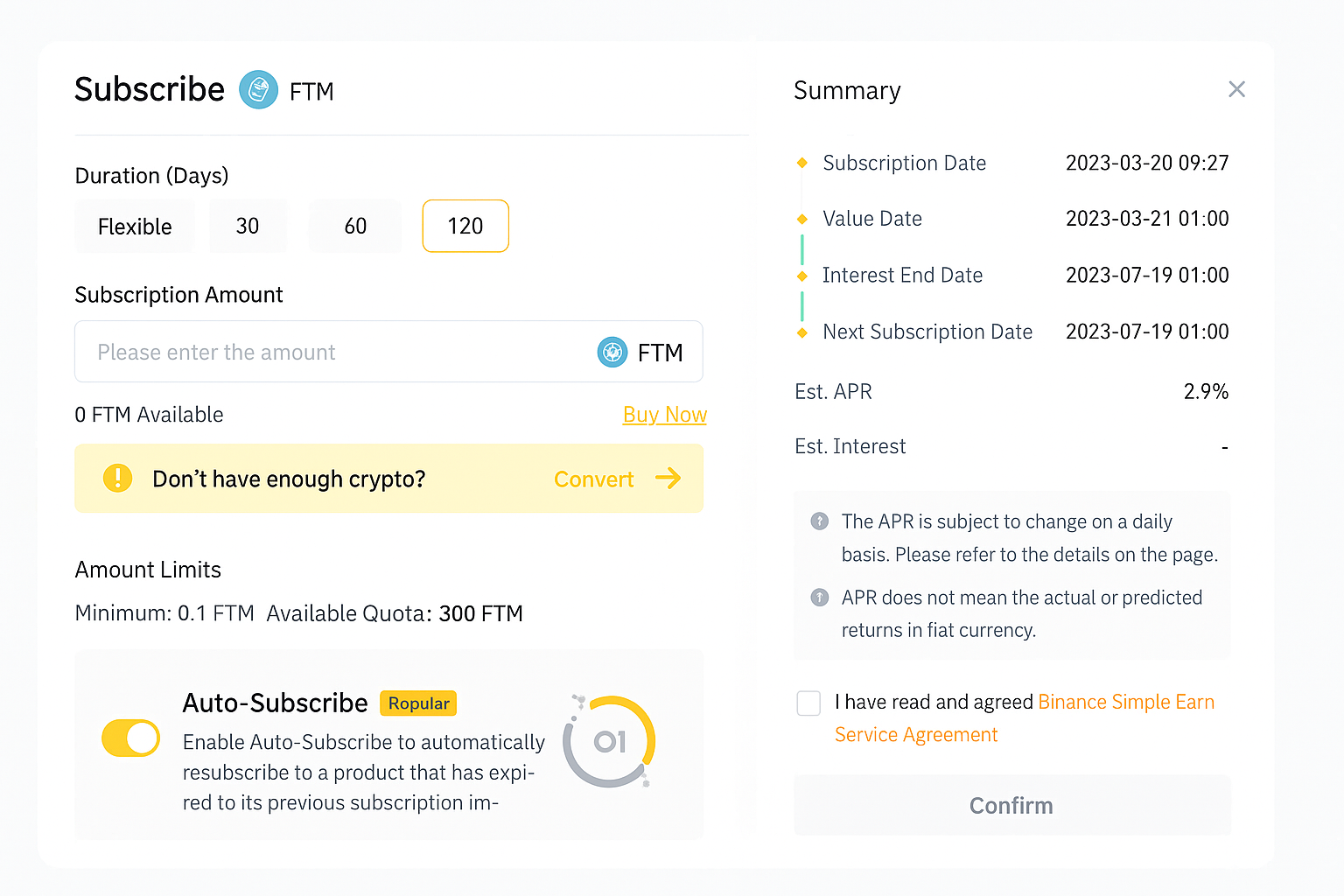

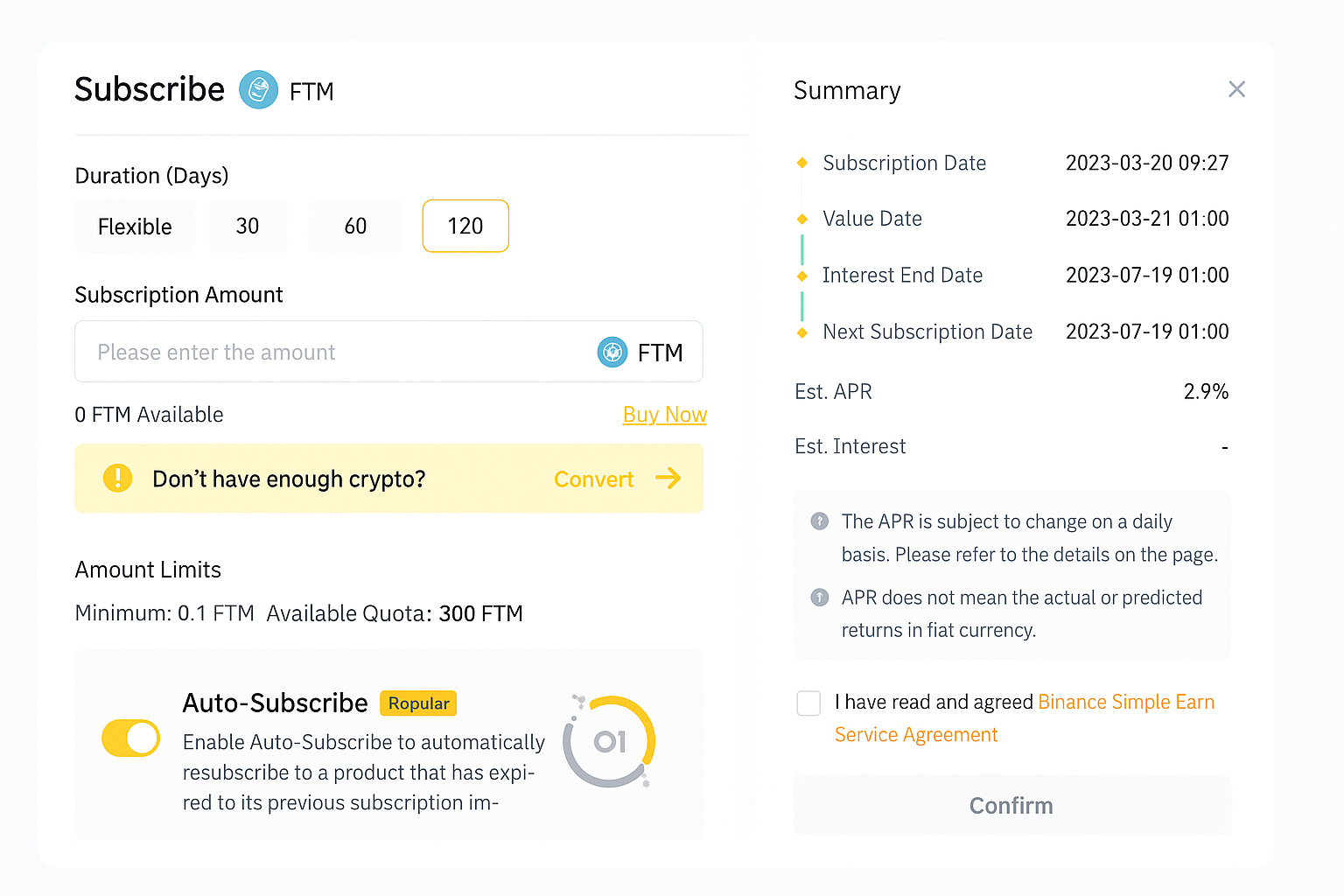

For FTM, Binance supports both locked and flexible options. Locked terms require committing coins for set durations—30, 60, or 120 days—during which redemptions are unavailable. Flexible staking lets holders un-stake whenever they choose, providing liquidity while still earning.

Indicative reward rates at the time of writing are about 1.49%, 2.39%, and 2.9% for 30, 60, and 120 days, respectively. The flexible product shows a real-time APR near 2.85%. Example: staking the cap of 300 FTM at 2.9% for 120 days would return roughly 2.86 FTM upon redemption.

Binance also sets minimums and maximums per plan for Fantom. Limits and expected returns include the following:

Flexible — minimum 1 FTM, maximum not specified, real-time APR ~2.85%

30 days — minimum 0.1 FTM, maximum 20,000 FTM, estimated 1.49%

60 days — minimum 0.1 FTM, maximum 1,500 FTM, estimated 2.39%

120 days — minimum 0.1 FTM, maximum 300 FTM, estimated 2.9%

One notable perk is zero staking commissions on Binance, unlike some competitors. The yields are competitive: Bybit sits near 1.8% while Uphold advertises around 3%. Availability is limited by subscription windows that operate first-come, first-served, so plans can sell out and must be joined promptly.

Explore our complete Binance review for more background.

2. Bybit — flexible FTM staking made simple

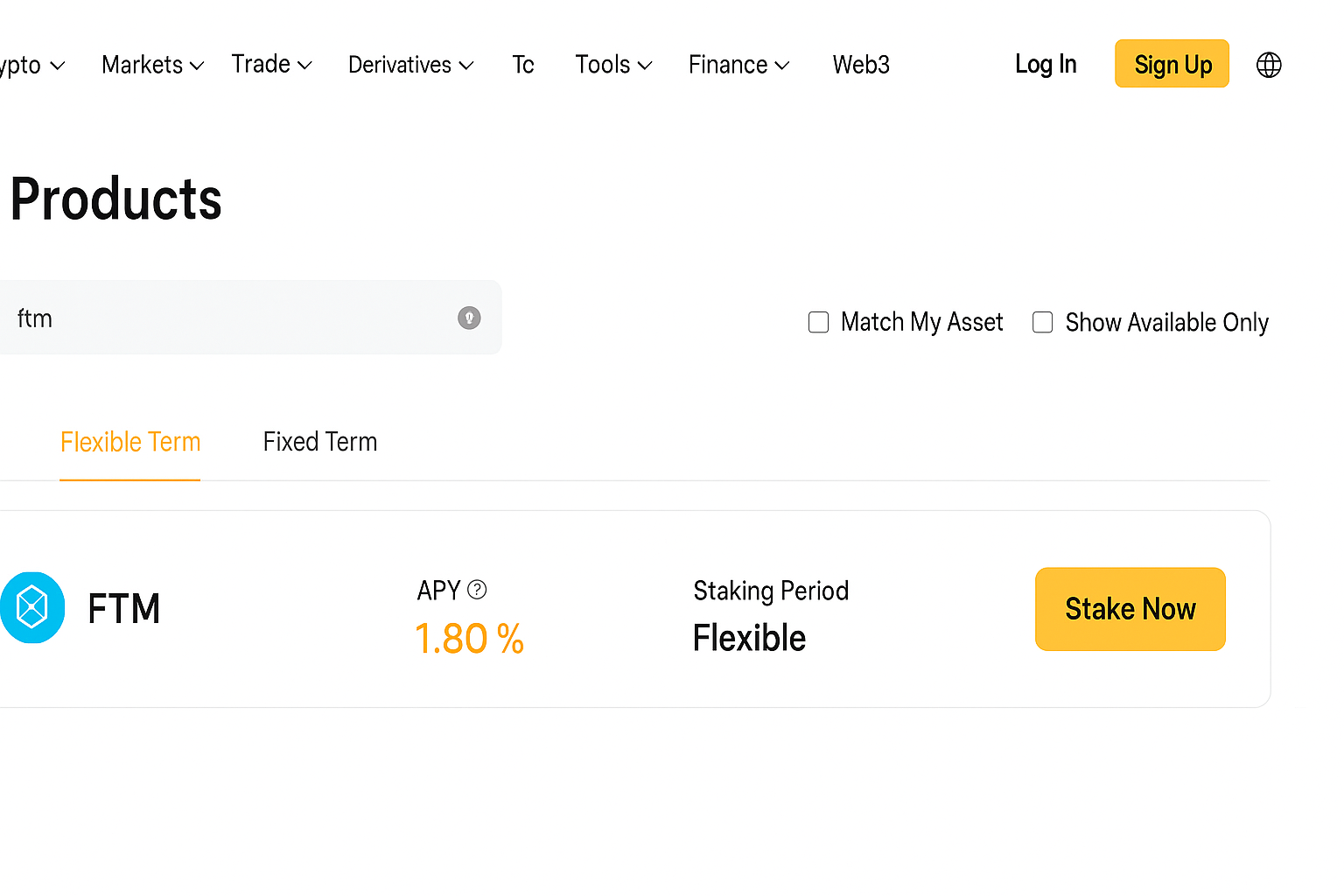

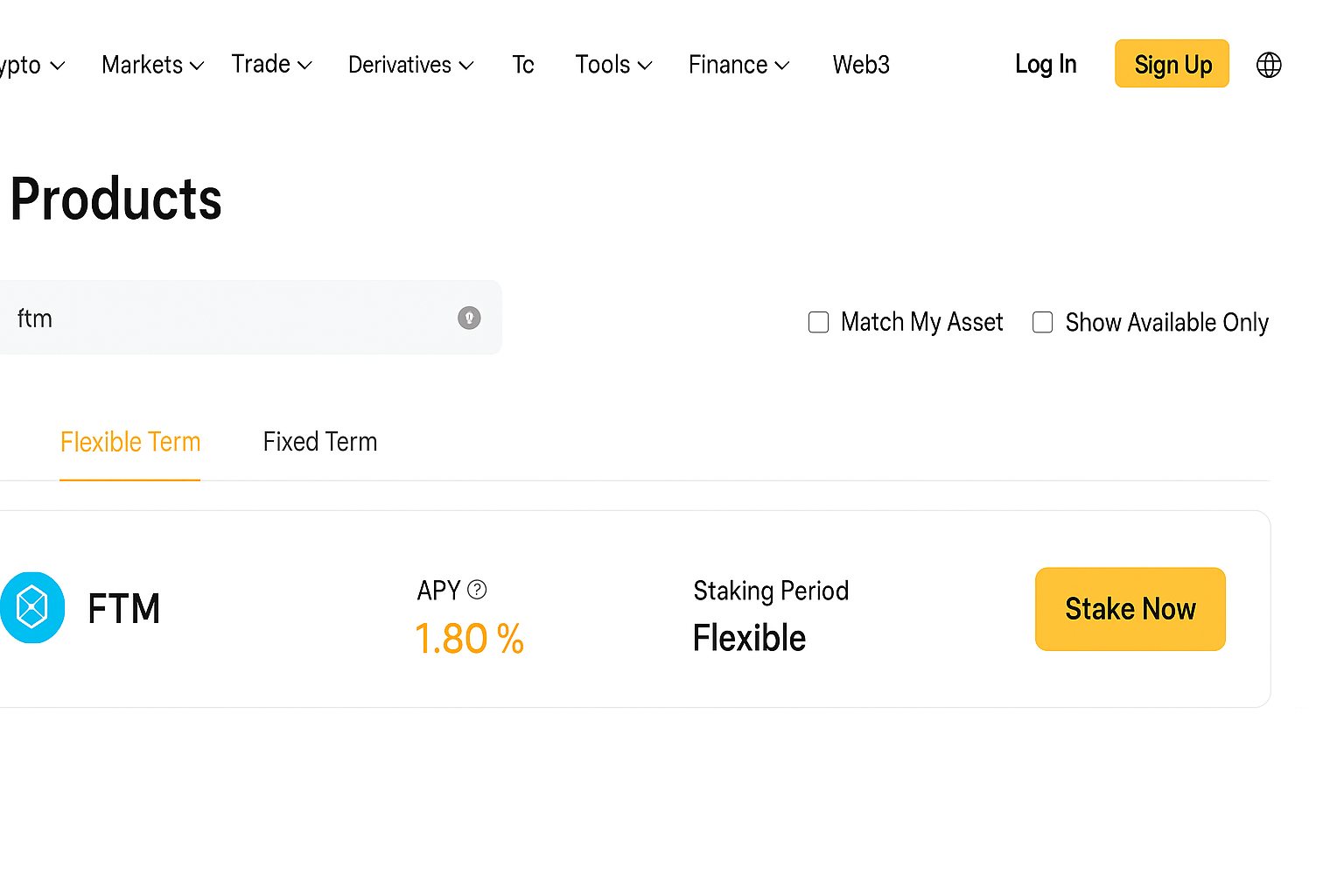

Bybit is a well-known centralized exchange for buying and trading crypto assets. The platform, headquartered in Singapore, also provides staking access. FTM holders can participate through Bybit Savings for passive income.

Bybit supports a flexible-only arrangement for FTM. There are no fixed lock durations, though the exchange enforces minimum and maximum amounts. The advertised annual yield is about 1.80%. Because funds aren’t locked, users can stake or un-stake frequently without penalties, maintaining liquidity.

Bybit’s FTM parameters at a glance: minimum 30 FTM, maximum 30,000 FTM, with roughly 1.80% APY.

Management fees apply, and Bybit notes these are reflected in the displayed APY, so separate charges aren’t added. Even so, the 1.80% rate is modest compared with alternatives such as OKX (up to roughly 9.07%) or Binance (up to about 2.9%).

See our in-depth Bybit review for additional insights.

3. OKX — fixed and flexible FTM yields

OKX ranks among the largest exchanges by market presence and supports buying, selling, and staking FTM. Its clean interface on desktop and mobile makes it approachable whether you’re a beginner or a seasoned trader.

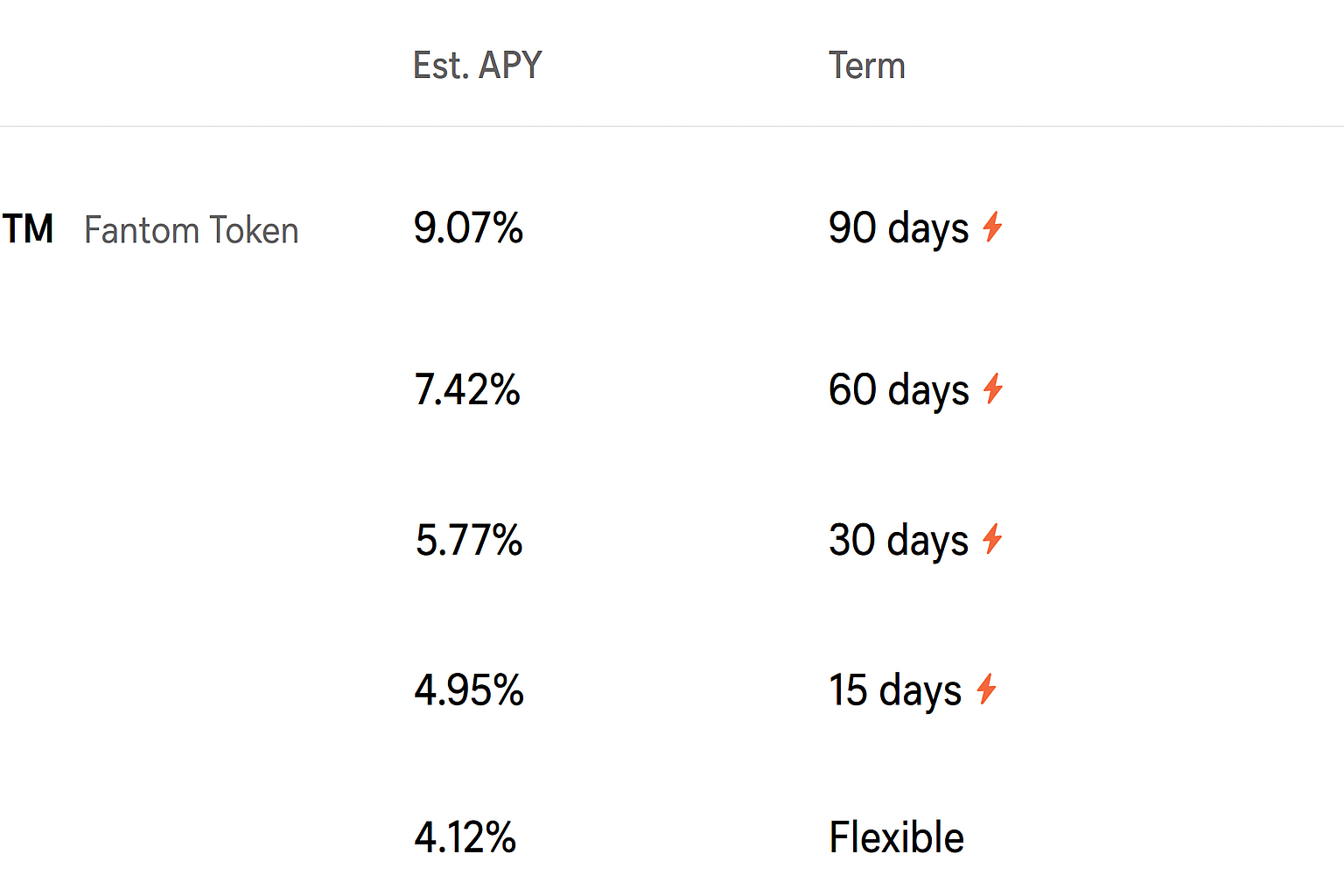

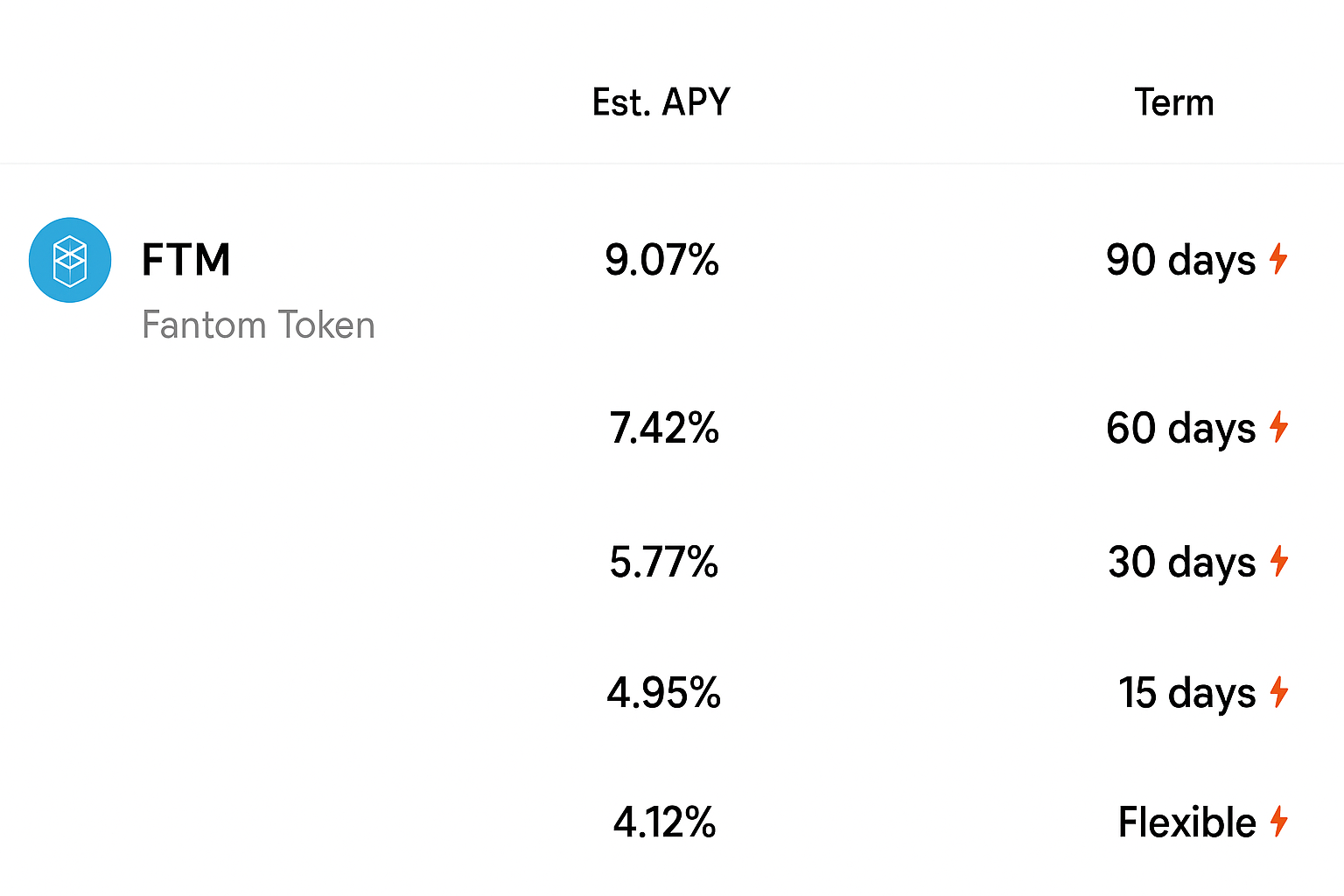

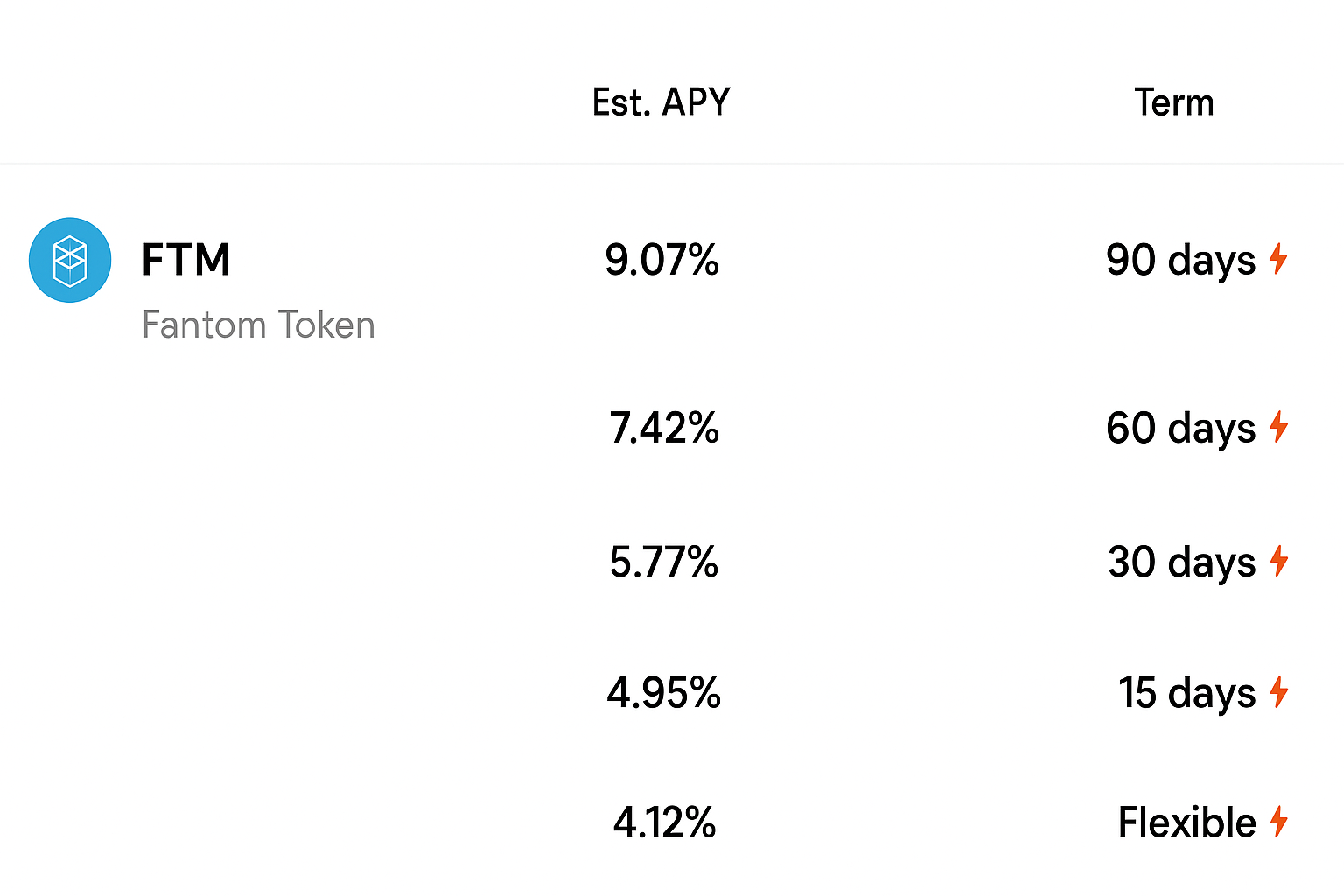

As with Binance, OKX offers both locked and flexible products for FTM. Fixed terms include approximately 15, 30, 60, and 90 days with limited quotas that can sell out. Depending on the period, the estimated range is roughly 4.11% to 9.07% APY.

Minimum staking amounts vary by chosen term, and OKX does not set explicit maximum caps—unlike Binance and Bybit. Refer to OKX’s staking panel for current durations, minimums, and rates on Fantom.

Read our full OKX review for the complete breakdown.

4. Fantom — staking via the native wallet

Fantom Wallet enables direct participation in the network’s own staking pool. Unlike a centralized exchange, this is the project’s proprietary wallet (fWallet), so users generally buy FTM elsewhere and transfer it in. No special validator hardware is required to delegate.

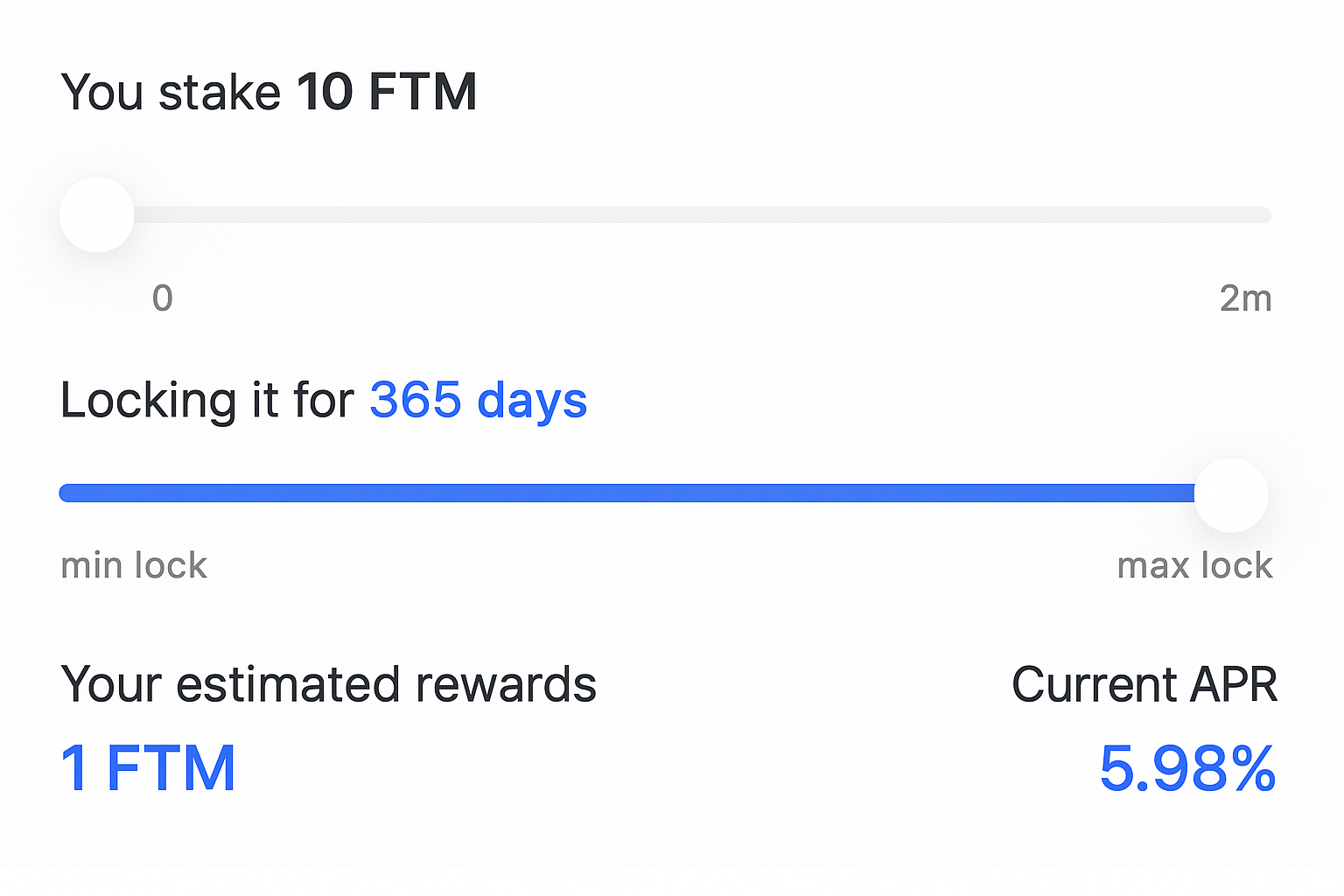

The minimum to stake is 10 FTM, while the upper bound is 2,000,000 FTM. Lockups can be chosen from roughly 14 days up to 365 days—the longest max term among the options compared. APY depends on duration, generally from about 1.80% up to around 6%. Those preferring no lockup can opt for a flexible base rate near 1.80% APY.

Another standout is liquid staking. Delegators can mint a 1:1 representation of staked tokens for use across Fantom Finance in DeFi—such as borrowing or collateral—while accruing rewards. Minting and loan repayment are fee-free features.

5. KuCoin — straightforward Fantom staking

KuCoin is a major altcoin hub with deep liquidity and competitive trading costs. Its staking interface for FTM offers both fixed and flexible paths and works on desktop and mobile apps.

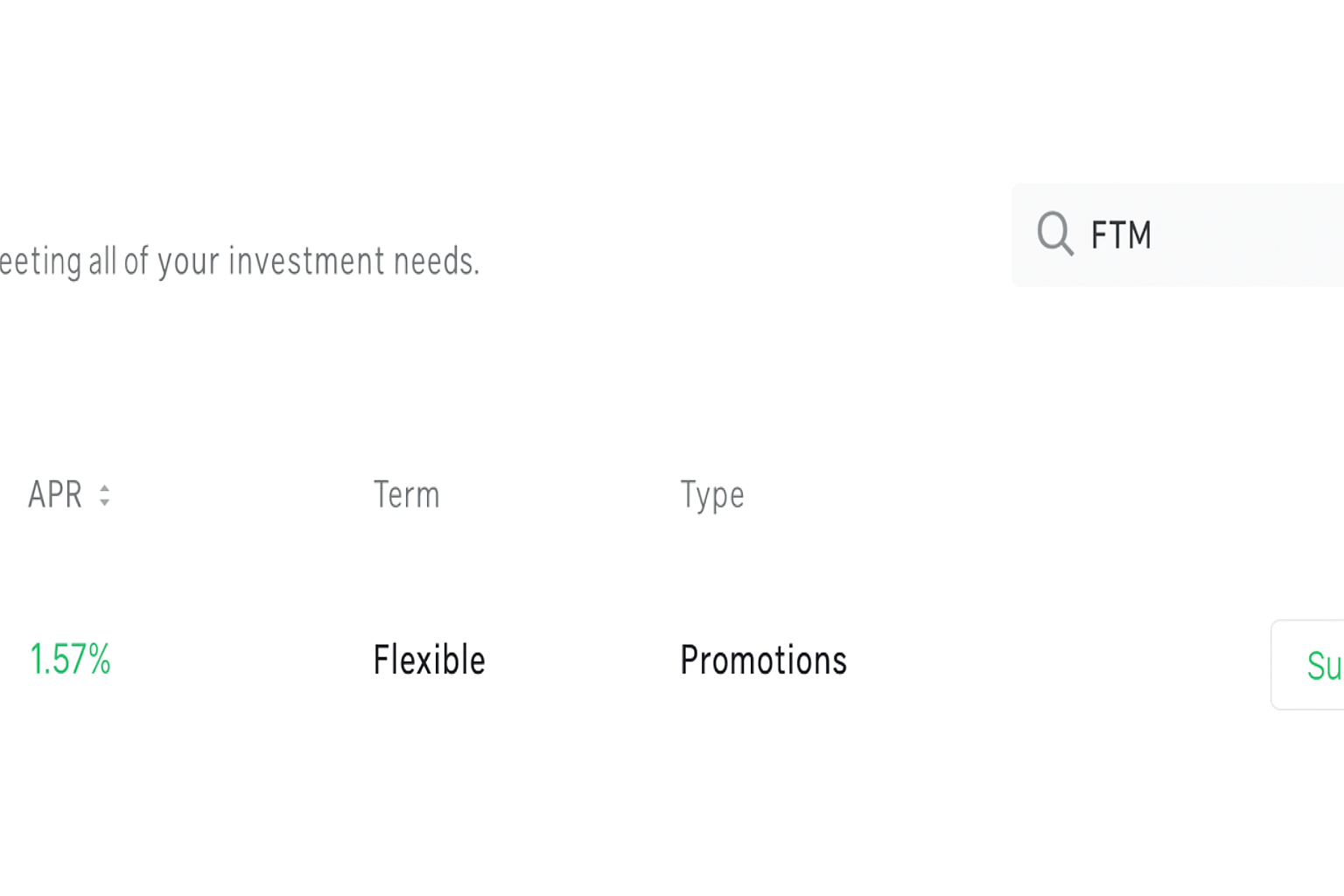

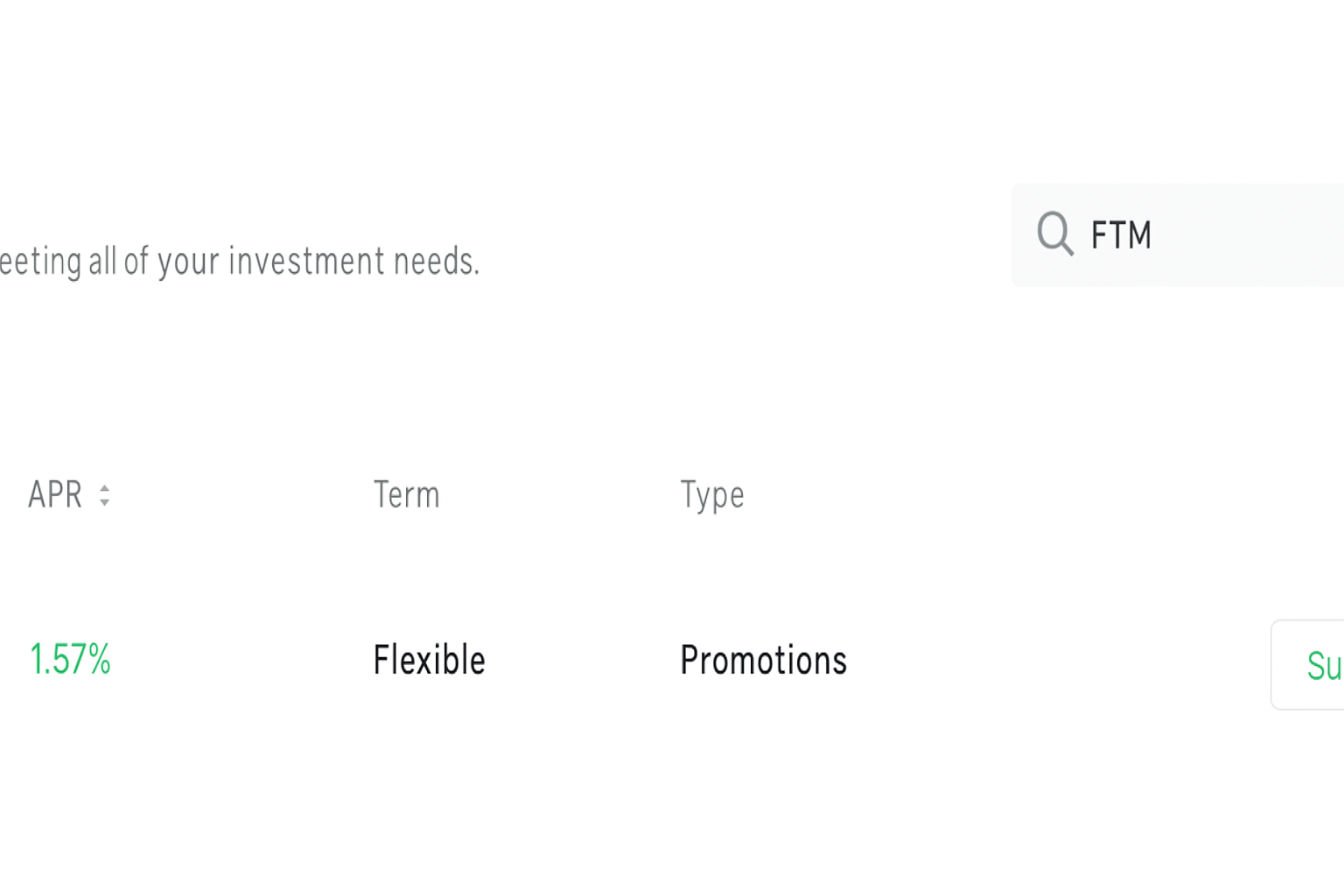

Estimated Fantom returns on KuCoin sit around 1.57% APR. The minimum to participate is 50 FTM, and the maximum is 500,000 FTM. Participation is possible on both the mobile and desktop clients.

A key advantage is the absence of explicit staking fees, allowing users to capture the full quoted yield. While the APR is on the low side, fee-free staking may appeal to some. Those prioritizing higher yield potential might compare against Binance or OKX.

Read our comprehensive KuCoin review for a full feature overview.

6. Uphold — US-friendly FTM staking

Uphold is a regulated exchange popular with US-based users. It supports more than 250 cryptocurrencies, letting customers buy, sell, and invest in assets such as FTM to earn staking rewards. The service is available across the United States and over a hundred additional jurisdictions.

Uphold quotes around 3% APY for FTM staking. Specifics about their programs are less granular than rivals, though fixed terms appear to start from roughly 30 days.

One trade-off is fees: while some exchanges like Binance and KuCoin do not add staking commissions, Uphold takes an estimated cut of about 3% to 34% depending on asset and chain. Combined with its mobile-only access, this may reduce overall net rewards for FTM stakers.

For a complete perspective, see our Uphold platform review.

What is FTM?

Fantom is an open-source smart contract blockchain supporting DApps and digital assets. Positioned as a scalable alternative, it targets lower costs and strong throughput compared with Ethereum while maintaining decentralization and security. Its consensus engine, Lachesis, is a proof-of-stake variant designed for fast finality and reliable performance.

FTM functions as the utility and governance token of the ecosystem. It pays for transactions, secures the network through validator incentives, and can be delegated for staking rewards. Beyond staking, FTM is widely tradable on exchanges for spot and investment activity.

Staking FTM basics

FTM is a proof-of-stake asset that can be delegated across exchanges such as Binance, Bybit, KuCoin, Uphold, and OKX, or staked directly on the Fantom network for rewards. Compared with more ubiquitous staking coins, FTM has fewer supported venues, though the core options cover major platforms.

How much can you earn staking FTM

Your rewards depend on where you delegate and for how long. On Binance locked plans, the available terms are about 30, 60, or 120 days. Committing 300 FTM for the 120-day plan targets roughly 2.8–2.86 FTM by redemption, based on the quoted rates.

Using a sample FTM price of $0.457, the above payout would be near $1.2 on an initial allocation around $137.1. If you want to allocate more capital, consider platforms with no stated maximums like OKX to potentially scale returns.

How to stake FTM

Our top recommendation for staking Fantom is Binance. Follow these steps to start earning FTM rewards.

Step 1. Sign in to Binance

Open your Binance account from the website or mobile app. Tap “Log In” from the homepage on web, or use the sign-in option in the app, to access your dashboard.

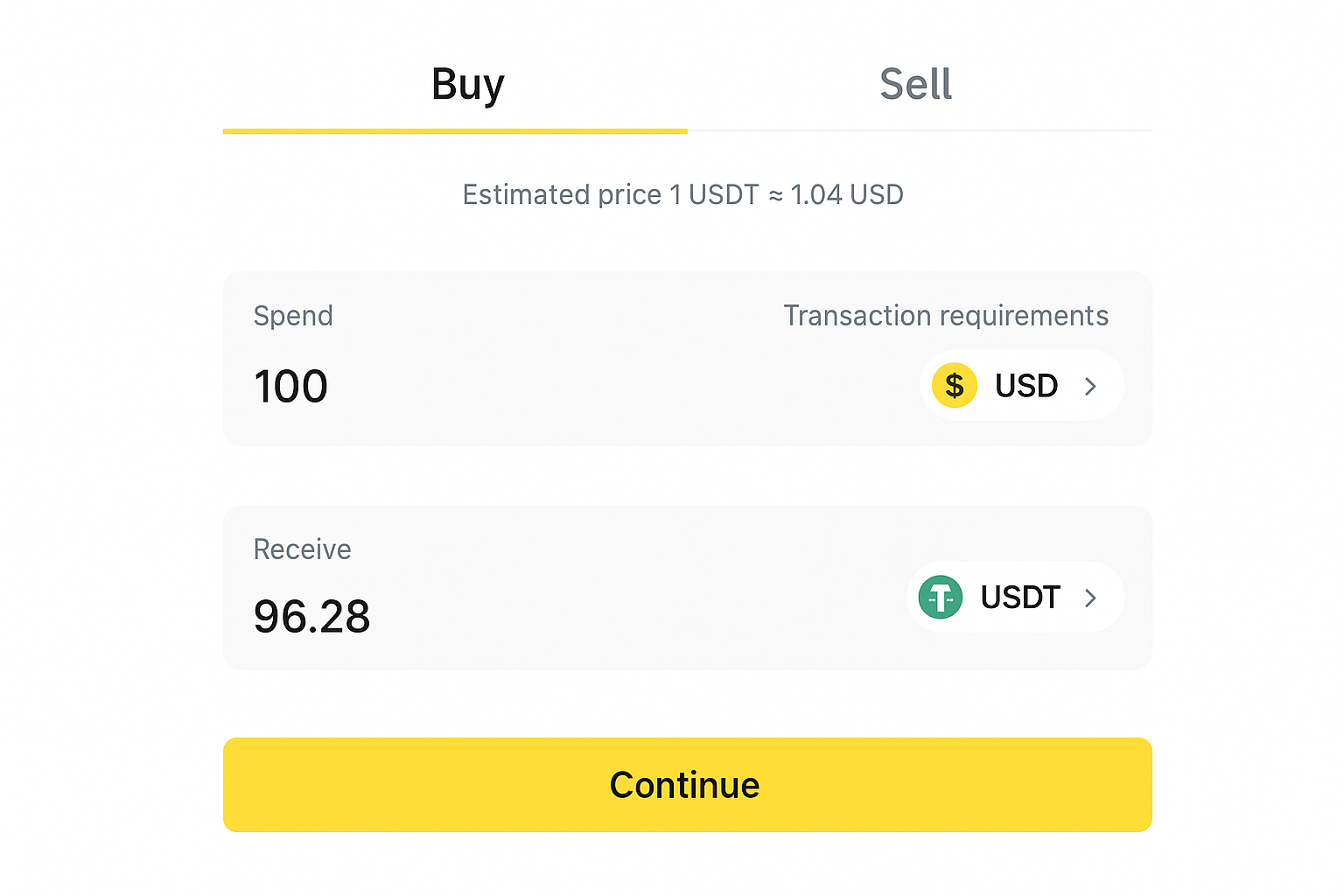

Step 2. Buy USDT

Binance may not offer direct fiat purchases of FTM. If you don’t already hold the token, acquire Tether (USDT), which you can then swap to Fantom. Select “Buy Crypto” from the main menu and choose your payment option.

Supported payment methods can vary by country and typically include:

- Credit or debit card payments

- Bank transfers and deposits

- Peer-to-peer (P2P) marketplace

- Apple Pay, Google Pay, and similar options

Enter how much fiat (USD, EUR, etc.) you wish to spend in the “Spend” field, and choose USDT as the asset to receive. Provide payment details and finalize the purchase.

Step 3. Convert USDT to FTM

Swap the USDT in your Binance wallet for FTM. The Convert feature lets you exchange a set amount of USDT to FTM with no trading fee and minimal slippage. After conversion, the corresponding FTM balance will appear in your spot wallet.

Step 4. Start staking FTM

Navigate to Binance Earn by selecting “Earn” on the top menu and choosing “DeFi Staking.” Search for FTM, hit “Subscribe,” pick your preferred duration, and input the amount to stake. Review the summary, accept the terms, and confirm to complete the subscription.

Remember, Binance staking capacity is offered via limited subscriptions on a first-come, first-served basis. If allocations are full, check back regularly for availability.