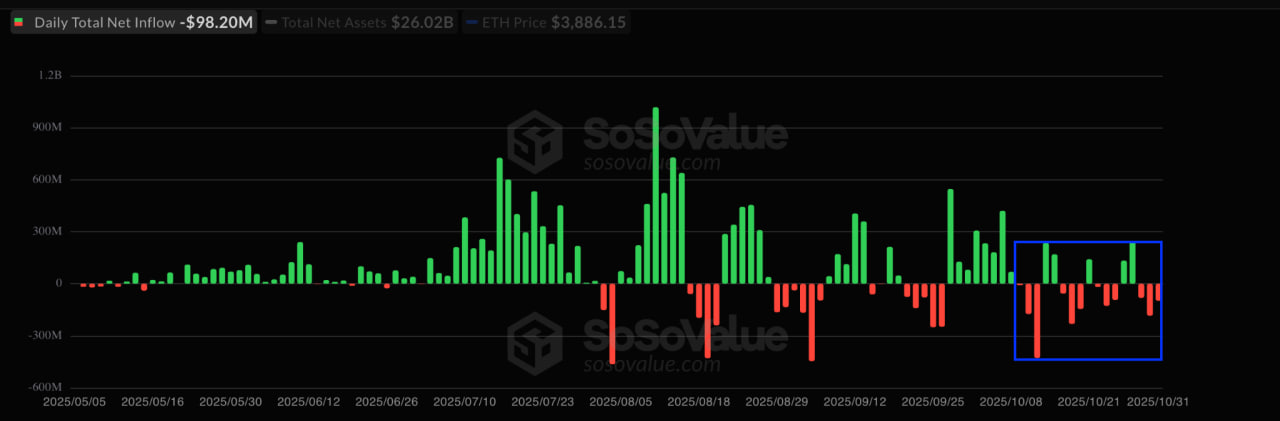

Ethereum remains under pressure — the asset’s price is approaching key support levels, and institutional investor interest in spot ETFs has noticeably decreased. Over the past three days, more than $364 million has been withdrawn from these products, increasing the risk of further decline.

Demand for ETH-ETF is falling

After record inflows at the beginning of autumn, spot Ethereum ETFs in the US have entered an outflow phase. According to SoSoValue, over three days, the funds recorded an outflow of $363.8 million — the largest figure in a month.

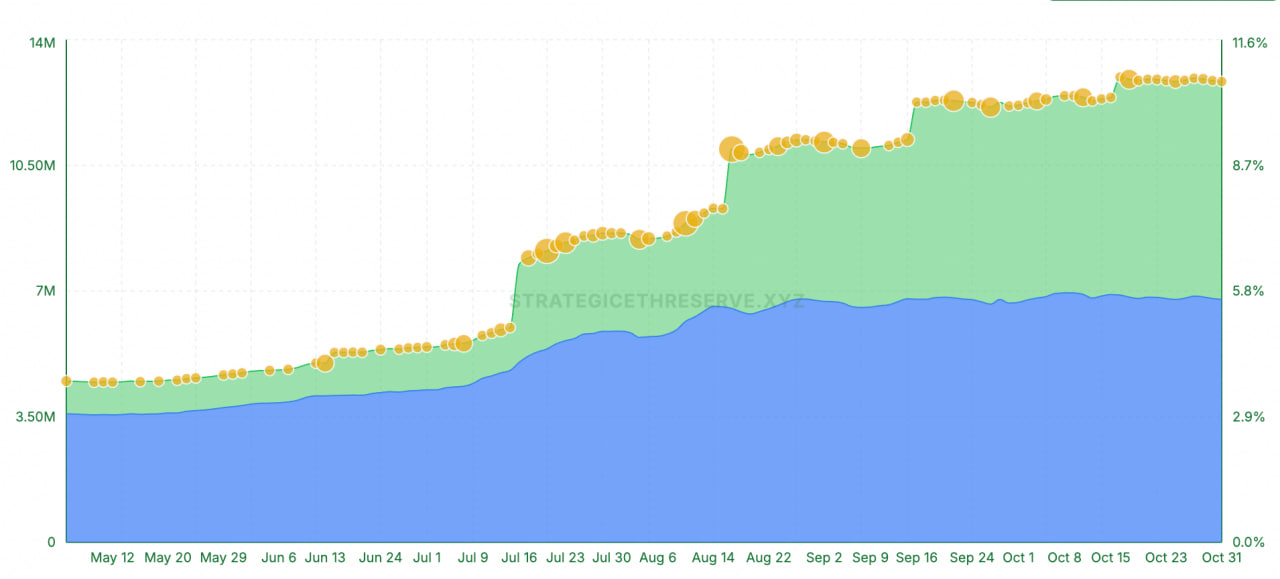

Treasury reserves and ETH holdings in ETF

At the same time, the combined strategic reserves of ETH and ETF positions have decreased by 124,060 ETH since mid-October, according to StrategicETHreserve.xyz. This indicates a decline in interest from large corporate investors and treasury companies, who previously actively replenished their ether reserves.

Analyst Ted Pillows noted on X (formerly Twitter):

‘Treasury companies continue to reduce their ETH share, and there are almost no new large buyers left. The only active buyer now is BitMine, but that won’t last long.’

According to him, at current prices and with the weakening of shares of companies holding ether on their balance sheets, ‘a new buying cycle should not be expected until corporate portfolios recover.’

Technical signal points to possible reversal

Since October 7, a ‘descending triangle’ pattern has formed on the ETH chart, which is traditionally considered a trend reversal signal. On the 8-hour timeframe, a flat support level and a descending resistance line narrowing the price range are clearly visible.

Analyst CryptoBull_360 believes that ETH has already broken through the lower boundary of the triangle and is testing the breakout level:

‘If the retest is successful, this will confirm the continuation of the downtrend. The target according to the pattern is about $2,870, which implies a drop of about 22% from the current price.’

This scenario is also supported by the SuperTrend indicator, which recently changed color from green to red, moving above the price line. The last similar signal in October preceded ether’s decline from $4,750 to $3,700 — a drop of the same 22%.

ETH is losing ground faster than the market

In the past 30 days, Ethereum has lost about 14% of its value, falling from $3,850 to $3,327. At the time of publication, ETH was trading near $3,320–3,350, with short-term support remaining at $3,700 and the resistance zone around $4,000.

If the price fails to stay above $3,700, analysts expect a move first to $3,500 and then to $2,800–2,870 — depending on the strength of the momentum.

Technical signals confirm the weakening of the uptrend. SuperTrend, RSI, and EMA50 simultaneously point to a continued correction.

‘Ethereum is in a critical zone. Without a quick recovery above $4,000, the price could fall to $3,500 in the coming weeks,’ warns Ted Pillows.

Institutional cooling

Amid growing interest in new instruments like the Solana ETF, some capital has been redistributed from Ethereum and Bitcoin to alternative assets. Over the past week, funds investing in Solana have recorded inflows for four consecutive days, while Ethereum continued to lose ground.

This capital shift increases pressure on ETH, making recovery more difficult. Institutional investors, who previously viewed ether as the ‘second flagship’ of the market after Bitcoin, are now showing caution, focusing on more flexible and volatile altcoins.

Forecast and key levels

For the coming weeks, analysts highlight several key levels:

- Support: $3,500 → $2,870 → $2,800

- Resistance: $3,700 → $4,000 → $4,250

If the price does not hold above $3,500, Ethereum may test the $2,870 area, which coincides with the technical target of the descending triangle. At the same time, short-term rebounds to $3,600–3,700 will not change the overall picture.

To return to a confident upward momentum, renewed ETF inflows and increased interest from corporate buyers are necessary. Without this, ETH risks consolidating below $3,000 and ending the year under pressure.

Read more: Animoca Brands plans to go public on Nasdaq via merger with AI-fintech Currenc Group