Hedge With Crypto publishes educational material believed to be correct at the time it’s written. For details specific to any exchange or trading venue, check that company’s official site. This article is general information, not investment guidance, and doesn’t consider your personal circumstances. Seek independent financial advice where suitable and do your own research.

RUNE can be put to work, but the direct route is demanding: there’s no simple delegation, so to earn validator rewards you must run a node yourself, which calls for more than $1.5M USD in bonded capital. People who don’t want to operate infrastructure often choose other paths: stake-like products on Binance, swapping RUNE for a native THORChain asset, or placing RUNE into a pool to earn swap fees.

Roughly one in two RUNE is effectively “locked” earning yield, with an average return near 13.54% APY at the time of writing. That said, node staking is impractical for most because it needs seven-figure funds. There are still several ways to capture returns on RUNE and other THORChain coins. Below is a fast roundup of places to stake or deploy Rune for competitive rewards:

- Binance (Top exchange pick for Rune staking)

- THORSwap Staking (Best overall approach to boost Rune yield)

- THORSwap (Add liquidity to pursue Thor incentives)

Rune staking on supported exchanges and services

1. Binance

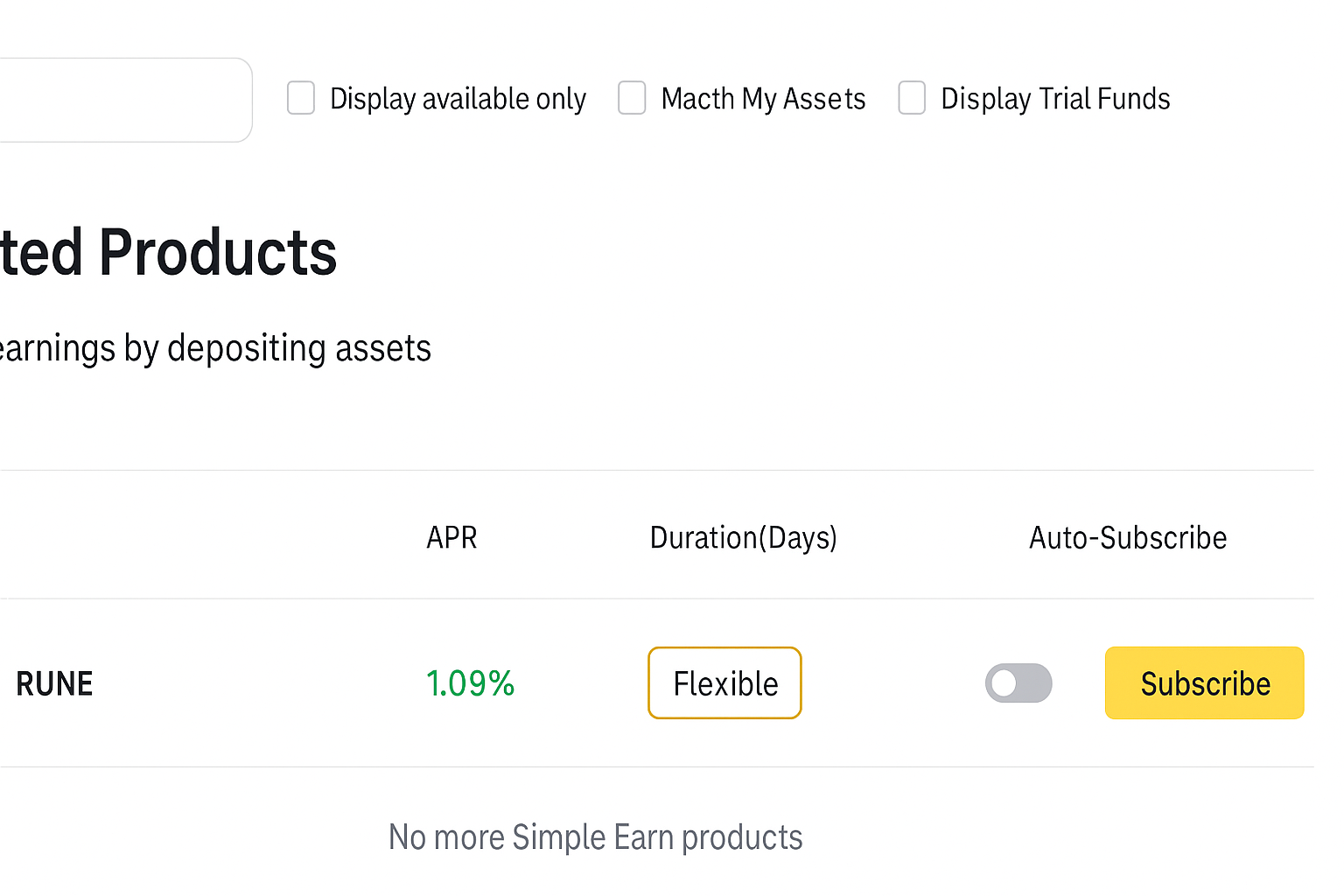

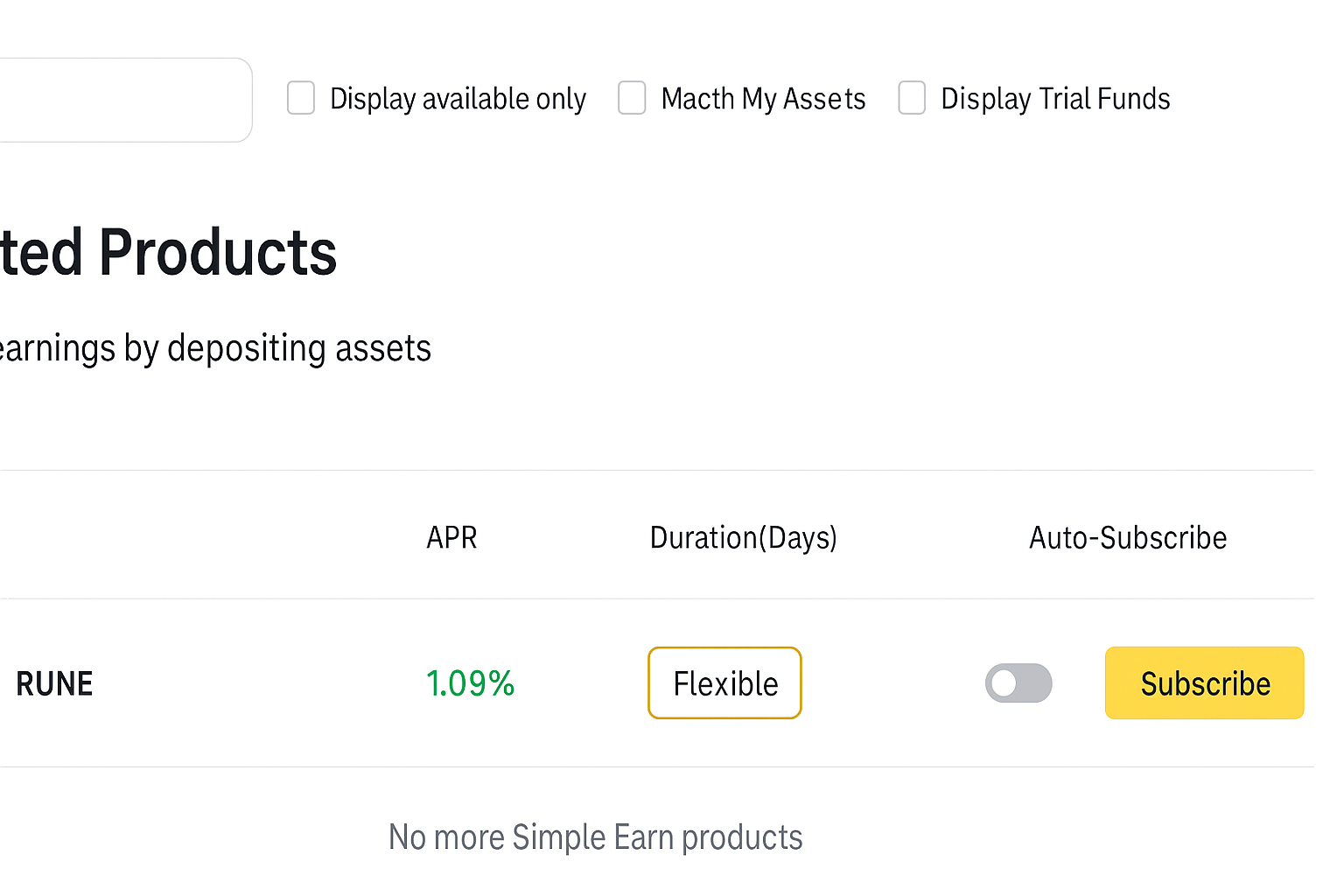

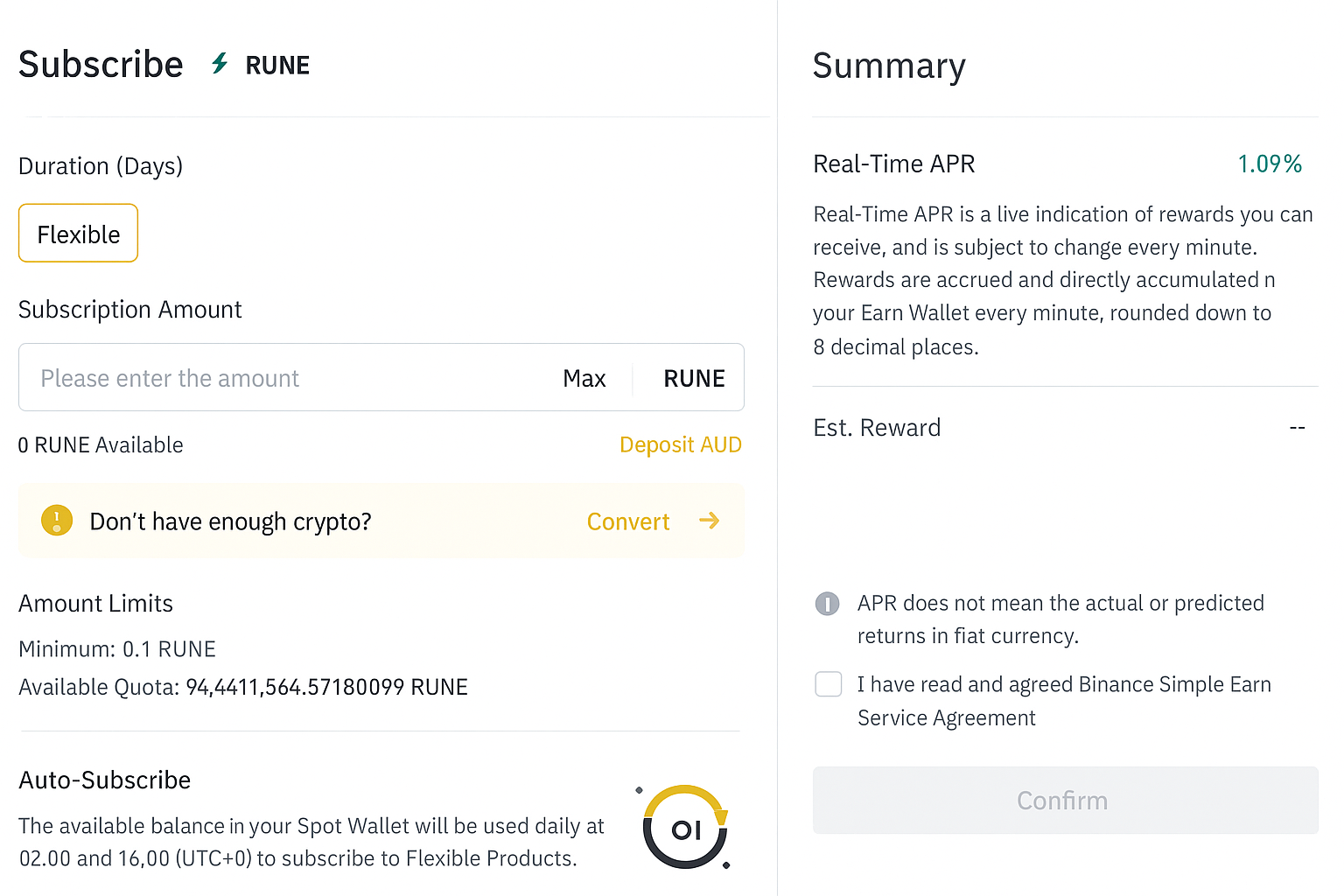

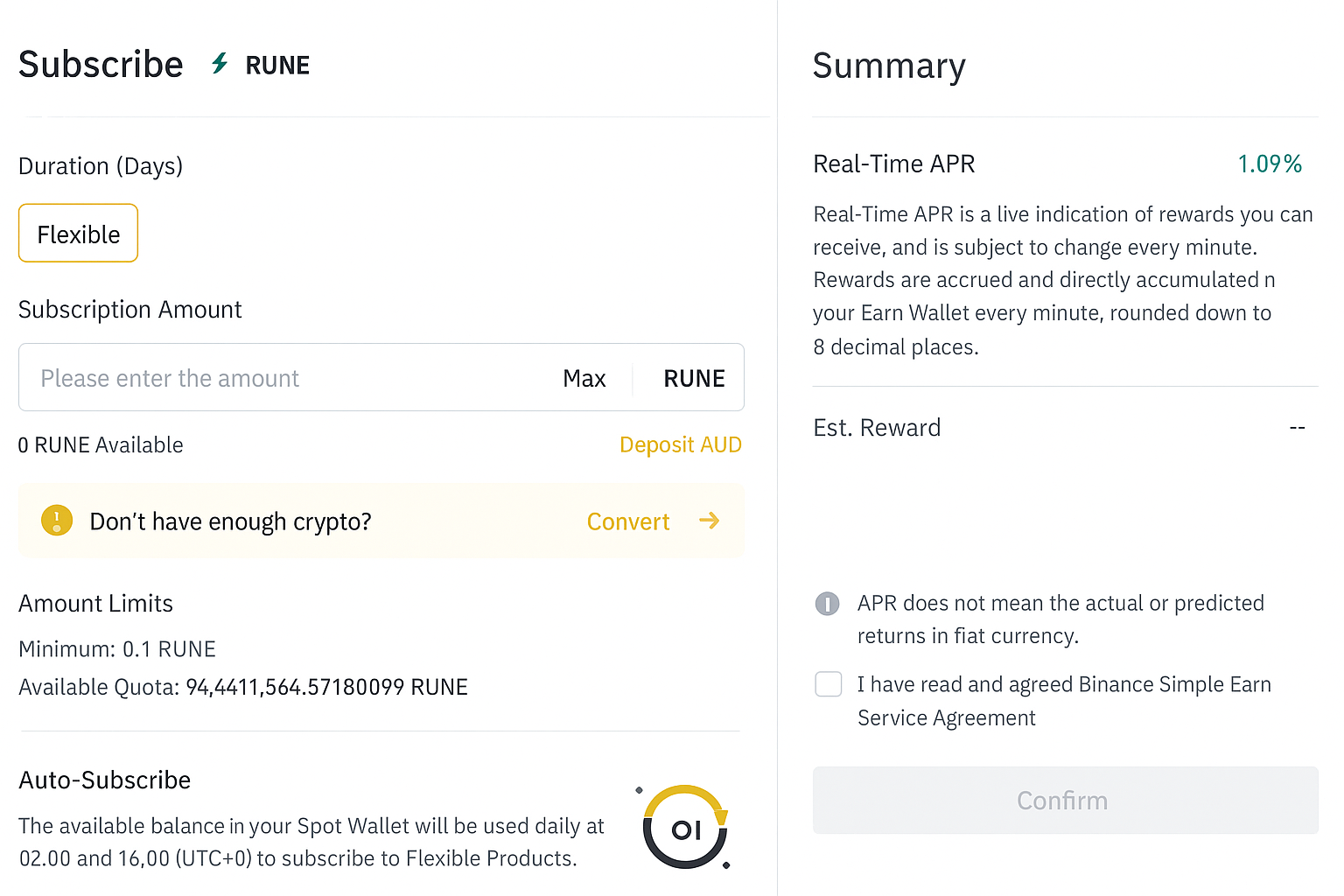

Binance is the world’s largest venue for staking-style earning, featuring a deep “Earn” catalog. Hundreds of assets have products there, including RUNE. Because RUNE isn’t a standard PoS delegation coin and demand is modest, the current offering sits at an APR of 1.09%. Rates can move quickly: this figure climbed from 0.5% to above 1% within two days as we drafted, so yields may swing higher or lower as supply changes.

On Binance, the term is flexible, so participants can add or redeem their RUNE any time with no lock penalty. The minimum entry is 0.1 RUNE, which at the time was worth well under twenty cents. These products are capacity-limited on a first-come basis; still, with a 10,000 RUNE cap and muted demand, availability usually isn’t an issue.

For large holders, the exchange rate may feel underwhelming. Parking $1,000,000 worth of RUNE would throw off about $11,000 per year at 1.1% APR. By contrast, a switch into THOR and staking on THORSwap could yield in the ballpark of $150,000 annually before gas and transaction costs. If you prefer to keep exposure in RUNE itself, Binance remains a straightforward, reputable place to capture a modest 1.1% rather than leaving coins idle.

See our full Binance review for a complete breakdown.

2. THORSwap Staking

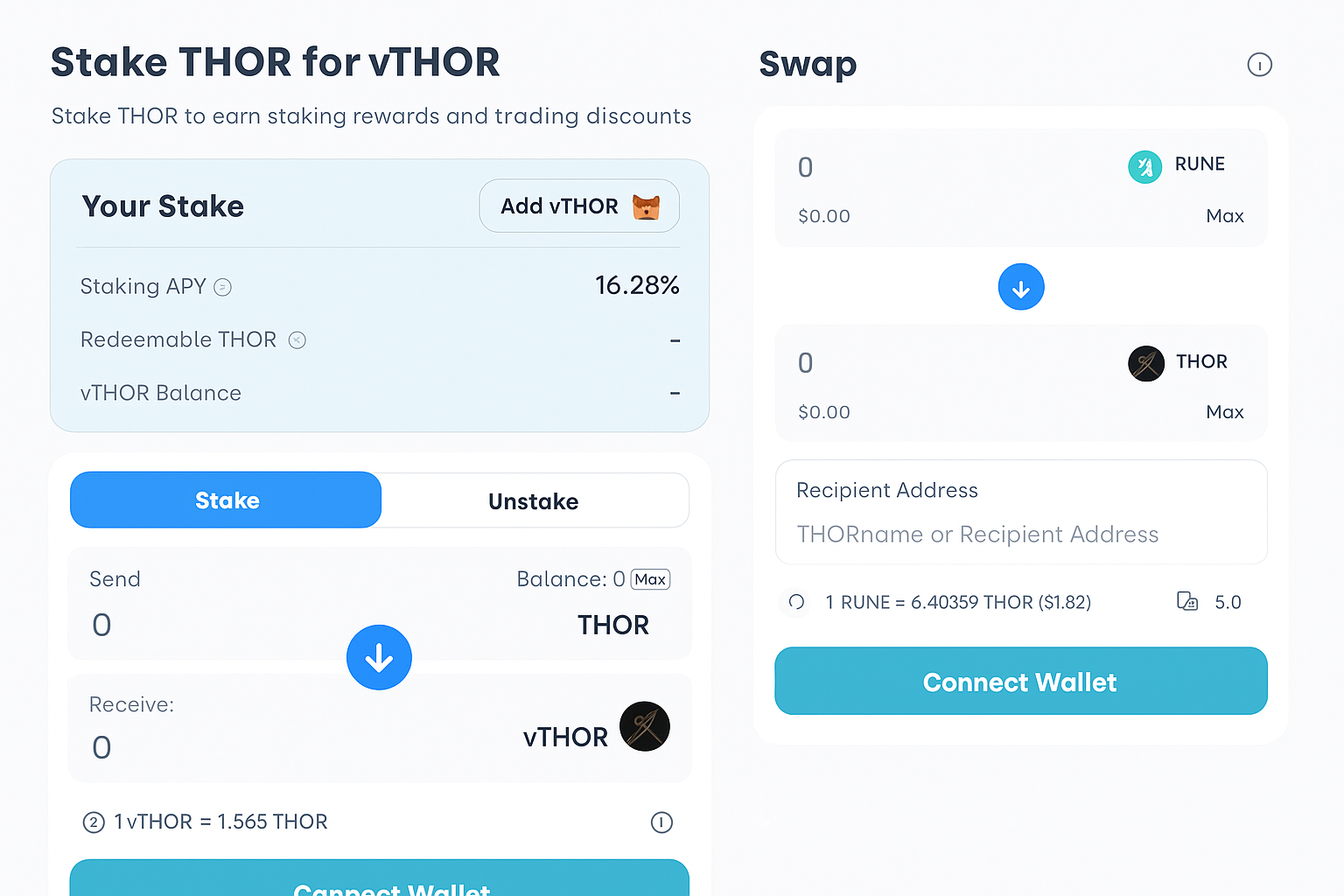

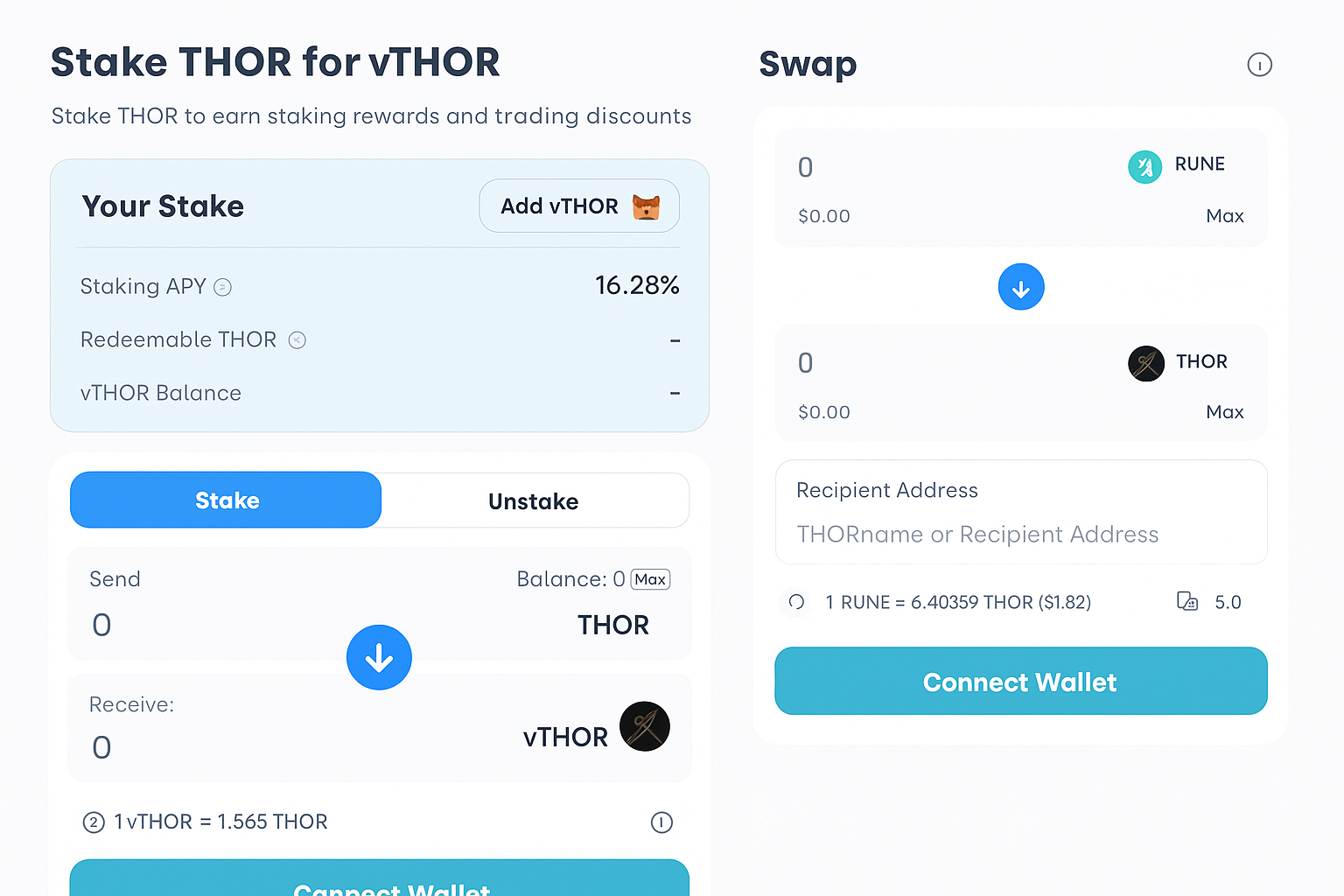

Back in March 2022, THORChain rolled out single-sided staking contracts so users could stake via chain mechanics similar to other PoS assets. THORSwap is the flagship app on THORChain, a permissionless exchange that uses the THOR token to power several functions. Since RUNE and THOR coexist on the same underlying chain, moving between them on THORSwap is seamless.

Stakers who lock THOR help the network and receive a share of swap fees, creating a variable yet frequently strong APY. At the time of writing, the staking return showed 16.28% with daily auto-compounding, making it an appealing passive income stream for on-chain participants.

To participate, users swap ERC-20 THOR to vTHOR, a transferable token that represents the staking position. Holding vTHOR also unlocks THORSwap trading discounts in addition to yield, reducing costs when swapping between THOR and RUNE. When you exit, unstaking vTHOR converts it back to standard THOR, which can then be traded for RUNE again.

Plan for Ethereum gas costs, which can spike during busy periods such as popular NFT mints or heavy trading. Keep some ETH handy to cover network charges for staking and unstaking operations to avoid failed transactions.

THORSwap connects with trusted non-custodial wallets such as:

- Trust Wallet

- MetaMask

- Ledger

- Keplr wallet

For most RUNE holders seeking strong returns, staking THOR through the THORSwap dApp is the most attractive path. While it involves a few extra clicks compared with a centralized exchange, an APY north of 15% can justify the added steps. Because THOR and RUNE share the same chain, swapping is straightforward—and there’s no enforced lock-up period.

3. THORSwap

Supplying assets on THORSwap is the only native, on-chain way to earn with RUNE outside of running a node, which can take $2M+ up front. The permissionless swap platform uses an AMM engine that needs capital in pools; contributors receive a portion of the pool’s swap fees in return for providing depth.

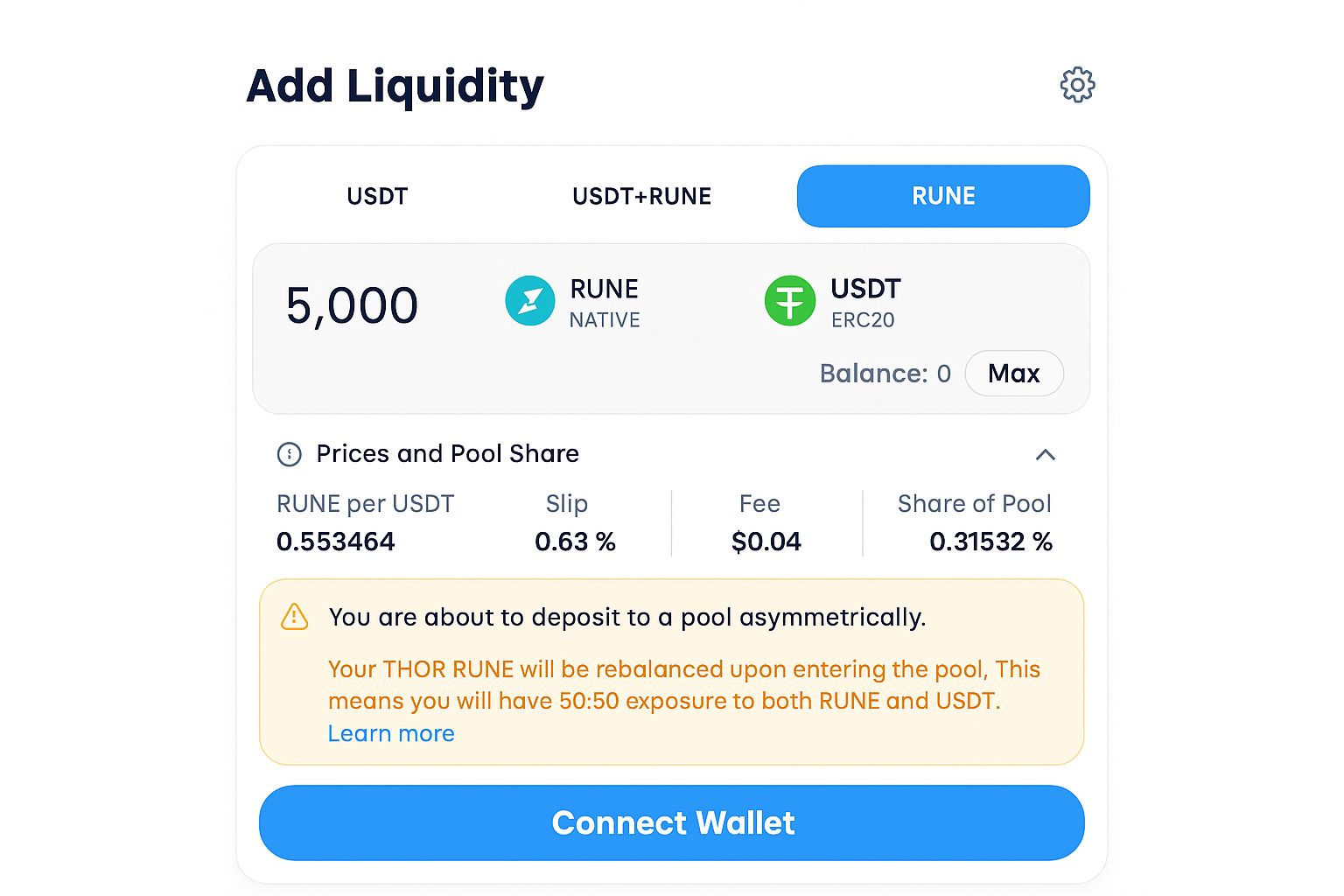

When deploying RUNE as liquidity on THORSwap, there are two main choices:

- Deposit only RUNE into a single-sided pool entry

- Supply RUNE alongside the paired asset in equal value

As a quick illustration, imagine adding 5,000 RUNE into the RUNE–USDT pool using only the RUNE side. The protocol will balance it into an even split between USDT and RUNE. In that scenario, you might hold about 0.31% of the pool, and you’d earn that corresponding percentage of the trading fees.

Alternatively, someone could add equal values of RUNE and USDT into the same pool. Payouts change with THORSwap volumes. The typical APY hovers around 13–14%, and at the time of writing, providers could capture more than 22% annually in certain pools.

Although providing depth often delivers the richest returns for RUNE, it’s more involved and may expose you to higher gas costs and price impact. This tactic suits experienced yield farmers and liquidity miners, while beginners who only want to hold RUNE might prefer a simpler staking wallet or exchange product.

RUNE token essentials

RUNE powers THORChain, a decentralized protocol in the “liquidity protocol” category that relies on AMMs to enable permissionless asset swaps. RUNE is used for governance voting and to cover fees across the network’s tooling. The proof-of-stake security model currently relies on around 120 node operators, each bonding over one million RUNE to help secure the chain’s validator set.

Yes, you can stake RUNE

Running a node is the way to stake RUNE directly, but the buy-in is steep—more than $1.5M USD—and there is no mainstream delegation mechanism for smaller holders. You can check average bond sizes and any open operator slots on the THORChain explorer. In addition, only a handful of platforms offer interest-bearing or staking products for RUNE, which keeps direct earning options limited.

Workarounds exist: convert RUNE into the ERC-20 token THOR and stake it via the THORSwap app for competitive returns. Another route is to add RUNE to a pool to share swap fees, which tends to be riskier and more complex than delegating but often pays more. Lastly, Binance lists a RUNE staking product with comparatively low rewards.

How much can you earn staking RUNE

Operators bonding millions of RUNE can see more than $40,000 per month in rewards—about 12% APY. The lowest-friction option, Binance, yields around 1.1% annually. For perspective, staking 1,000 RUNE there would produce about 0.91 RUNE each month—roughly a dollar’s worth at recent prices.

Advanced strategies typically pay better. Swapping to THOR and staking on THORSwap can push returns toward 16% yearly, and contributing RUNE to a THORSwap pool can sometimes exceed 20% p.a. These methods require extra steps and know-how, but the uplift in earnings can make the effort worthwhile for many investors.

How to stake RUNE on Binance

If ease of use matters most and yield size is secondary, Binance is effectively the go-to. At times, the APY has been about 0.5% for RUNE, although that figure can change frequently with market conditions.

To use an exchange for staking RUNE, follow the steps below:

1. Create and verify a Binance account

Head to Binance and sign up if you don’t already have access. To unlock all features, you’ll need to pass identity checks by uploading a government-issued document such as a passport or a driver’s license.

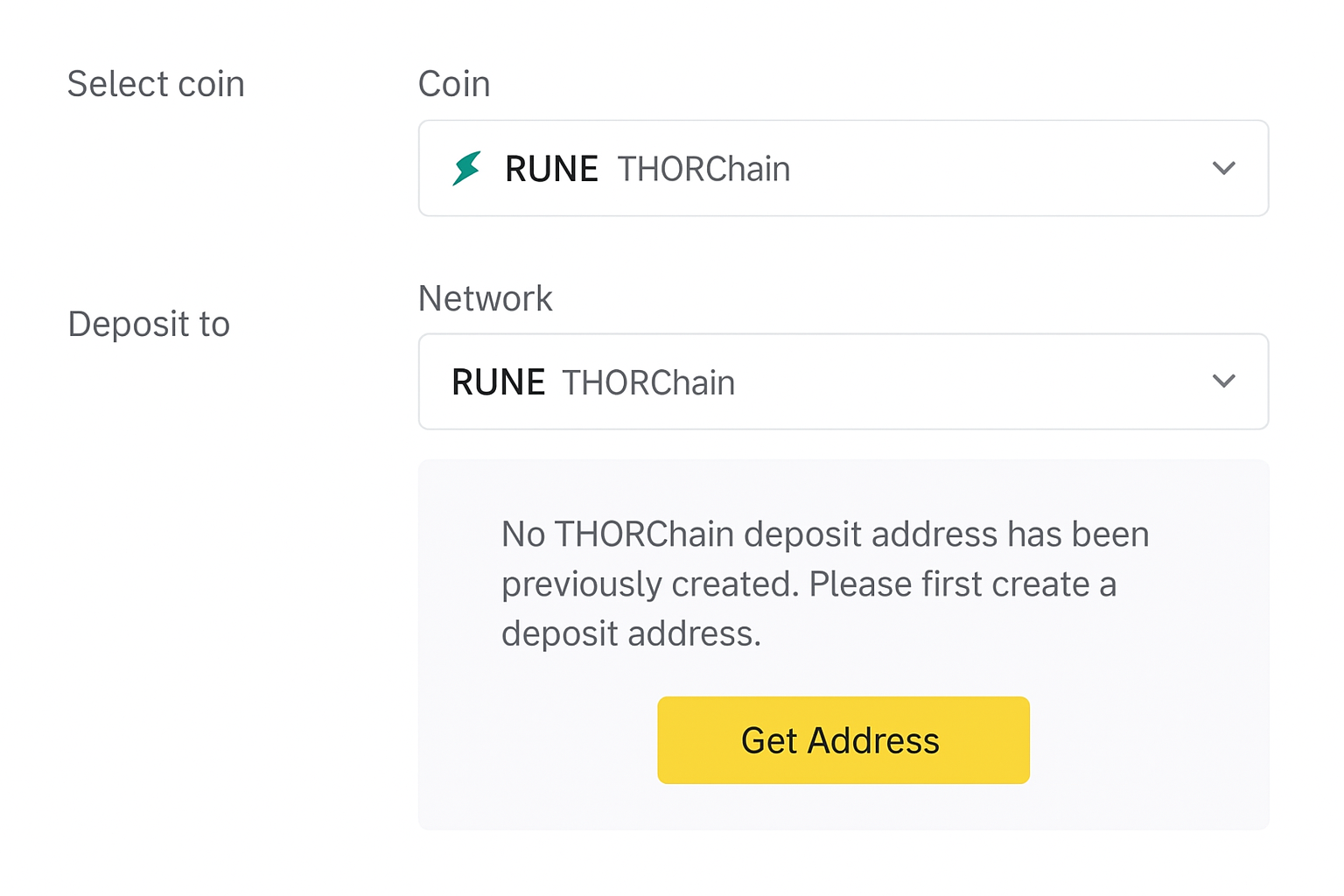

2. Transfer RUNE to your Binance wallet

If you already hold RUNE, send it to your Binance deposit address. Go to Wallet, then Fiat & Spot, find RUNE, and choose Deposit. Binance will provide a THORChain address for the transfer. You can also purchase RUNE on the platform, with trading costs starting from 0.1%.

3. Open Binance Earn

Navigate to Binance Earn and pick Simple Earn. A catalog of earning products will load. Type RUNE into the search to locate available options. At the time of writing there was a single product—click Subscribe to proceed.

4. Stake RUNE

Review the product terms and input the amount of RUNE to allocate. Currently, only a flexible term is offered for RUNE, so you won’t need to select a duration, though that could change. Accept the service terms and confirm to start earning on your RUNE.