New exchange-traded funds based on Solana (ETF) are gaining momentum — investors have shown strong interest from the very first days. After the launch of Bitwise BSOL and Grayscale GSOL this week, initial inflows show that interest in Solana-based instruments is only growing. Analysts believe that Solana-ETF could repeat the success of spot funds for BTC and Ethereum, which have already gathered billions of dollars under management.

Interest in Solana is growing

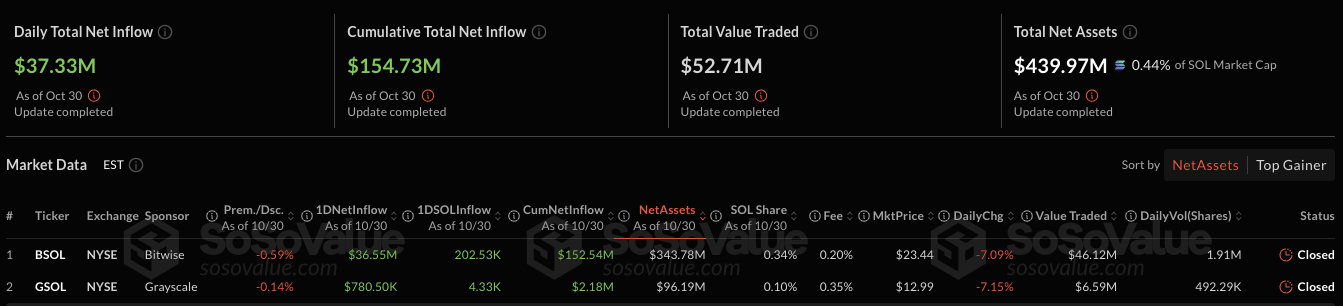

As of October 30, the total inflow into Solana-ETF reached $154.73 million, and the total assets under management — $439.97 million. The leading fund is Bitwise BSOL with a daily inflow of $36.55 million and assets totaling $343.78 million.

Solana-ETF data as of October 30. Source: SoSoValue

Next is GSOL from Grayscale: $780,500 inflow per day and $96.19 million under management. Both funds showed a slight decrease — about 7% per day, reflecting the overall weakness in Solana’s price dynamics.

According to Grayscale top manager Zac Pandl, Solana-ETF could well grow into multibillion-dollar products, especially as institutional investors start to enter crypto more broadly. He believes that the appearance of Solana in regulated instruments opens access for those who prefer traditional financial platforms. This could attract fresh capital into the ecosystem and secure Solana a place alongside BTC and Ethereum.

Institutional demand and diversification

American ETFs already manage assets worth over $10 trillion — and for traditional investors, this is one of the most convenient ways to enter the market. Against this backdrop, the launch of funds based on Solana fits perfectly into the overall trend: institutions continue to show increasing interest in digital assets. Yes, some classic managers are still cautious about crypto, but the demand remains, especially from those looking for new tools to diversify their portfolios.

See also: Grayscale launched a Solana ETF with staking income on NYSE Arca

At the same time, the market itself is growing — new funds focused on other altcoins are appearing. This week, for example, products for Hedera and Litecoin were added to the list. Competition is intensifying, but analysts note that many investors still prefer to work with broad, balanced portfolios to avoid dependence on the fluctuations of individual tokens.

The advantage of staking and long-term potential

Solana-ETF has an important difference from bitcoin funds — the ability to participate in staking. This opens up an additional source of income for investors. According to Solana Compass, the average staking yield this week was about 5.73% per year. Grayscale passes on about 77% of these rewards to its holders, turning tokens into a tool not only for growth but also for regular earnings.

See also: Bitcoin ends October with a drop for the first time in seven years: investors await what November will bring

This could be a serious factor for long-term investors: staking makes Solana-ETF especially attractive as part of a diversified crypto portfolio. As the market matures, analysts expect that staking yields and increased network activity will drive institutional interest and lead to inflows of up to $5 billion.