Litecoin is confidently recovering after the drop in October. The coin’s price rose above $100 following news of the approval of the first spot ETF based on LTC, which could become a turning point for the asset. At the same time, the network is showing record levels of hashrate and activity, and the development of MWEB strengthens Litecoin’s position as a leading solution supporting private transactions.

Growth after the drop and expectations around the ETF

After falling to $51 in October, Litecoin managed to double in price, consolidating in the $100–105 range. The main reason for the growth was reports about the launch of a Litecoin ETF, which was approved by the American regulator and, according to Bloomberg, will be listed on NASDAQ as early as this week.

According to analysts, the fund from Canary Funds received automatic approval thanks to the accelerated application review mechanism. This step opens up institutional investors’ access to the asset and could become a catalyst for a new upward cycle.

Nevertheless, the market is reacting cautiously. The price of LTC is moving in a narrow range, indicating anticipation for confirmation of the ETF’s effectiveness, as was the case with Ethereum and Solana funds. The Polymarket platform estimates the probability of full ETF approval by the end of 2025 at 99%, which could become a fundamental driver for Litecoin’s long-term growth.

Strong on-chain metrics

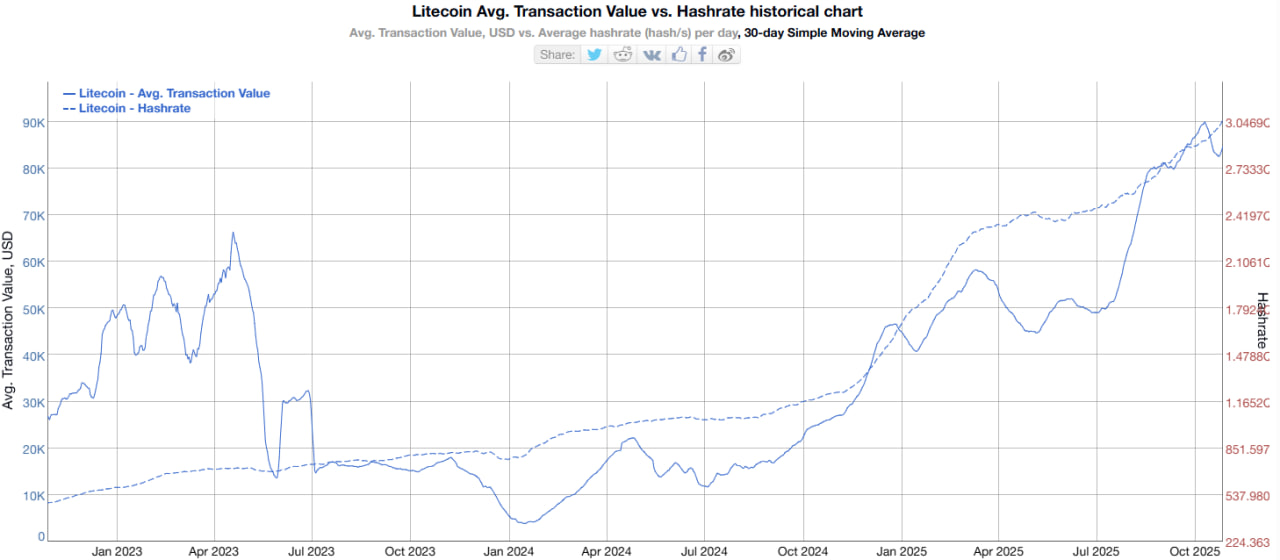

In addition to fund news, the network’s technical indicators show confident strengthening. The average transaction volume on the Litecoin network exceeded $80,000, a three-year high. This indicates growth in large transfers and interest from institutional users.

At the same time, the network hashrate reached a new all-time high. The growth in computing power makes the blockchain more resistant to attacks and indicates high miner engagement.

BitInfoCharts analysts note that the increase in hashrate with stable fees indicates healthy distribution of computing resources and the network’s readiness for increased load.

MWEB enhances privacy and scalability

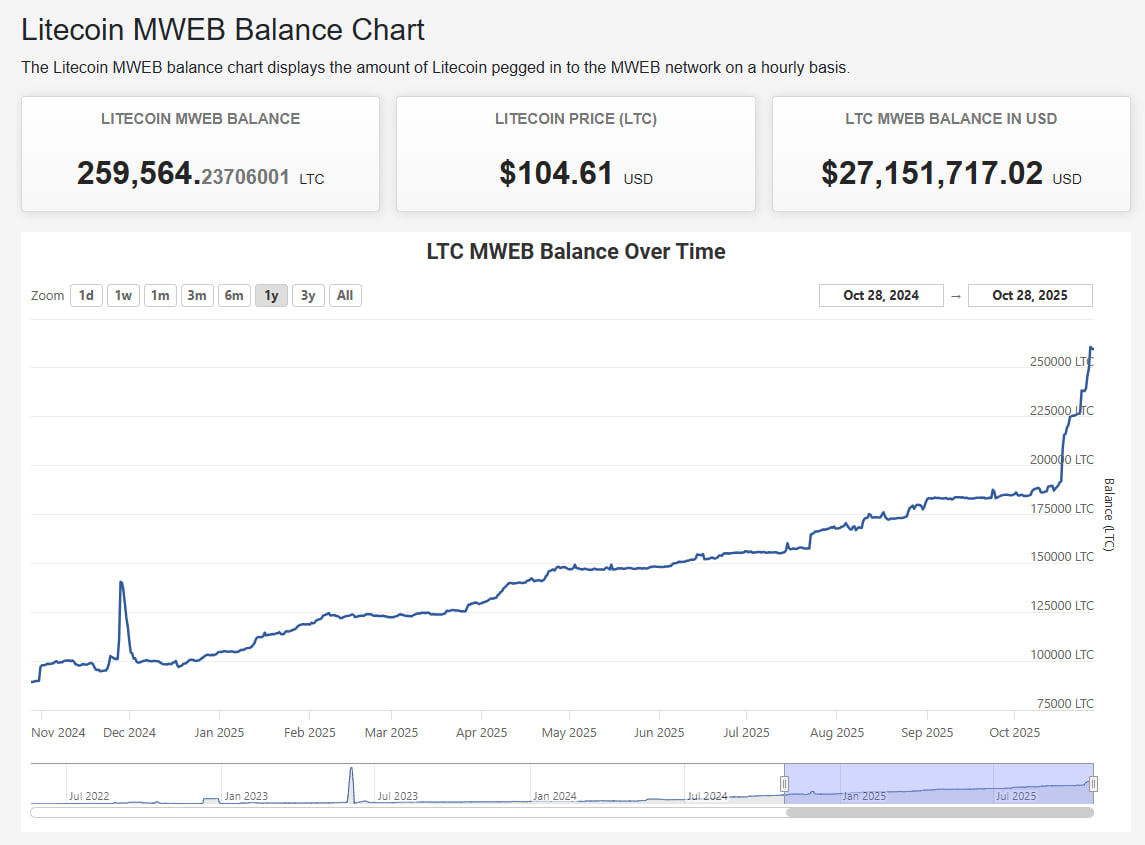

Another reason for interest in Litecoin was the active integration of MWEB — a technology that allows confidential transactions without loss of speed and with low fees. According to MWEB Explorer, the total balance of private transactions reached 260,000 LTC, and this figure continues to grow.

Experts believe that MWEB makes Litecoin one of the few major cryptocurrencies combining transparent infrastructure with optional privacy. This could become an important advantage in the context of developing regulated funds focused on confidential assets.

Possible growth scenario and analogy with Zcash

The combination of growing interest in ETFs and an increase in the share of private operations is creating a new support point for Litecoin. Analysts compare the situation to the dynamics of Zcash (ZEC), which showed strong moves amid interest in privacy technologies.

Some experts believe that Litecoin is capable of repeating this scenario, becoming the first major cryptocurrency with the possibility of integrating private ETFs.

From ‘silver’ to an independent asset

Litecoin was once called ‘silver to Bitcoin’s gold’, but over time its role in the market diminished. Now the coin is getting a second wind thanks to a combination of technological upgrades and institutional drivers.

The growth of hashrate, active development of MWEB, and the launch of the ETF are laying the foundation for a new bull cycle by 2026.

What’s next?

If interest in staking and privacy products continues to grow, Litecoin could become a bridge between traditional funds and confidential blockchain technologies. Analysts expect that in the coming quarters, LTC will be able to strengthen as one of the key Layer-1 assets with institutional support.

Read more: Grayscale launched the largest staking investment fund on Solana in the US