The token of the decentralized exchange Aster surged following a high-profile purchase by Binance founder Changpeng Zhao (CZ). After the announcement of the 2 million token purchase, the asset rose from $0.91 to a peak of $1.26, becoming one of the most discussed in the DeFi market.

CZ back in the spotlight

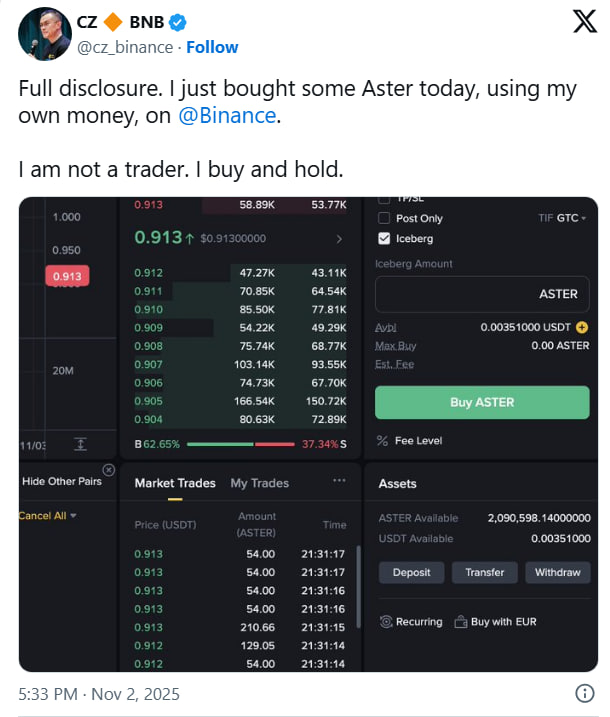

On Sunday, Zhao announced on X (formerly Twitter) that he had purchased the ASTER token ‘with his own funds’ via Binance. He emphasized:

‘I am not a trader. I buy and hold.’

Following his post, interest in the token surged sharply. According to CoinMarketCap, ASTER quotes gained about 20%, and trading volume increased several times over.

According to LookOnChain, the ASTER wallet received large USDT transfers, becoming one of the largest on the BNB Chain network. However, counter-positions also appeared on the market—two ‘whales’ opened shorts on the asset and are already in profit: one earned $5.9 million, the other $1.4 million.

Large withdrawals and volatility

Separately, Onchain Lens reported that one of the major holders withdrew $5.58 million in ASTER tokens from Binance. Over the past six days, he has withdrawn a total of 6.8 million tokens worth $6.66 million.

The price increase looks especially striking against the backdrop of previous losses. In October, the Aster token fell by 11%, and the total value locked (TVL) decreased by 25%.

The role of Aster in Web3

Aster is a fast-growing DEX platform offering spot and futures trading with leverage up to 1001x and a hidden orders feature. Its success is largely attributed to the support of Changpeng Zhao, who back in October posted a tweet with the phrase ‘keep building’ and a screenshot of the Aster interface.

Experts note that CZ’s endorsement sharply increased interest in the protocol, and the latest purchase became a catalyst for speculative demand.

Political context

Zhao’s purchase came shortly after US President Donald Trump pardoned him, closing a months-long legal saga.

Recall that in November 2023, Zhao pleaded guilty to violating anti-money laundering regulations at Binance. After a deal with authorities, he temporarily stepped back from business, but according to recent reports, he is actively returning to investment activities.

What’s next?

The rise of ASTER is an example of how strong Changpeng Zhao’s influence on the market remains. Despite controversies around Binance, any of his actions—from a tweet to a token purchase—continues to cause sharp price swings.

If interest in Aster persists, the project may secure its position among the leaders of DeFi platforms. But high volatility and large shorts in the market create the risk of a new pullback.

Read more: Polymarket set a new record for trader activity, Kalshi maintains leadership in volumes